by Calculated Risk on 5/24/2017 03:07:00 PM

Wednesday, May 24, 2017

Black Knight: Mortgage Delinquencies Increased in April

From Black Knight: Black Knight Financial Services’ First Look at April 2017 Mortgage Data

• First-lien mortgage delinquencies rose by 13 percent, the largest monthly increase since November 2008According to Black Knight's First Look report for April, the percent of loans delinquent increased 12.9% in April compared to March, and declined 3.6% year-over-year.

• Month-over-month, the number of borrowers past due on mortgage payments increased by 241,000

• April’s delinquency rate increase was primarily calendar-driven (due to both the month ending on a Sunday and March being the typical calendar-year low) and largely isolated to early-stage delinquencies

• The inventory of loans in active foreclosure continues to decline, hitting a 10-year low in April

• At just 52,800, April saw the fewest monthly foreclosure starts since January 2005

The percent of loans in the foreclosure process declined 3.5% in April and were down 27.3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.08% in April, up from 3.62% in March.

The percent of loans in the foreclosure process declined in April to 0.85%.

The number of delinquent properties, but not in foreclosure, is down 74,000 properties year-over-year, and the number of properties in the foreclosure process is down 162,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2017 | Mar 2017 | Apr 2016 | Apr 2015 | |

| Delinquent | 4.08% | 3.62% | 4.24% | 4.72% |

| In Foreclosure | 0.85% | 0.88% | 1.17% | 1.63% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,072,000 | 1,831,000 | 2,146,000 | 2,381,000 |

| Number of properties in foreclosure pre-sale inventory: | 433,000 | 448,000 | 820,000 | 1,064,000 |

| Total Properties | 2,505,000 | 2,279,000 | 2,741,000 | 3,201,000 |

FOMC Minutes: More details on Balance Sheet Reduction

by Calculated Risk on 5/24/2017 02:05:00 PM

From the Fed: Minutes of the Federal Open Market Committee, May 2-3, 2017. Excerpts:

Participants continued their discussion of issues related to potential changes to the Committee's policy of reinvesting principal payments from securities held in the SOMA. The staff provided a briefing that summarized a possible operational approach to reducing the System's securities holdings in a gradual and predictable manner. Under the proposed approach, the Committee would announce a set of gradually increasing caps, or limits, on the dollar amounts of Treasury and agency securities that would be allowed to run off each month, and only the amounts of securities repayments that exceeded the caps would be reinvested each month. As the caps increased, reinvestments would decline, and the monthly reductions in the Federal Reserve's securities holdings would become larger. The caps would initially be set at low levels and then be raised every three months, over a set period of time, to their fully phased-in levels. The final values of the caps would then be maintained until the size of the balance sheet was normalized.

Nearly all policymakers expressed a favorable view of this general approach. Policymakers noted that preannouncing a schedule of gradually increasing caps to limit the amounts of securities that could run off in any given month was consistent with the Committee's intention to reduce the Federal Reserve's securities holdings in a gradual and predictable manner as stated in the Committee's Policy Normalization Principles and Plans. Limiting the magnitude of the monthly reductions in the Federal Reserve's securities holdings on an ongoing basis could help mitigate the risk of adverse effects on market functioning or outsized effects on interest rates. The approach would also likely be fairly straightforward to communicate. Moreover, under this approach, the process of reducing the Federal Reserve's securities holdings, once begun, could likely proceed without a need for the Committee to make adjustments as long as there was no material deterioration in the economic outlook.

Policymakers agreed that the Committee's Policy Normalization Principles and Plans should be augmented soon to provide additional details about the operational plan to reduce the Federal Reserve's securities holdings over time. Nearly all policymakers indicated that as long as the economy and the path of the federal funds rate evolved as currently expected, it likely would be appropriate to begin reducing the Federal Reserve's securities holdings this year. Policymakers agreed to continue in June their discussion of plans for a change to the Committee's reinvestment policy.

emphasis added

A Few Comments on April Existing Home Sales

by Calculated Risk on 5/24/2017 11:59:00 AM

Earlier: NAR: "Existing-Home Sales Slip 2.3 Percent in April"

Two key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. The NAR reported sales of 5.57 million SAAR, Lawler projected 5.56 million SAAR, and the consensus was 5.67 million SAAR. See: Lawler: Early Read on Existing Home Sales in April

"I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.56 million in April, down 2.6% from March’s preliminary pace and up 1.5% from last April’s seasonally adjusted pace."2) Inventory is still very low and falling year-over-year (down 9.0% year-over-year in April). More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

I started the year expecting inventory would be increasing year-over-year by the end of 2017. That still seems possible, but inventory will have to start increasing a little pretty soon.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in April (red column) were below April 2016. (NSA).

Note that sales NSA are now in the seasonally strong period (March through September).

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through April 2017. This graph starts in 1994, but the relationship had been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through April 2017. This graph starts in 1994, but the relationship had been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

AIA: Architecture Billings Index positive in April

by Calculated Risk on 5/24/2017 11:18:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Design billings increasing entering height of construction season

After beginning the year with a marginal decline, the Architecture Billings Index has posted three consecutive months of growth in design revenue at architecture firms. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI score was 50.9, down from a score of 54.3 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.2, up from a reading of 59.8 the previous month, while the new design contracts index increased from 52.3 to 53.2.

“Probably even better news for the construction outlook is that new project work coming into architecture firms has seen exceptionally strong growth so far this year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “In fact, new project activity has pushed up project backlogs at architecture firm to their highest level since the design market began its recovery earlier this decade.”

...

• Regional averages: South (55.3), Midwest (53.3), West (50.9), Northeast (50.7)

• Sector index breakdown: institutional (54.0), mixed practice (53.4), commercial / industrial (52.4), multi-family residential (49.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in April, down from 54.3 the previous month. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017 and early 2018.

NAR: "Existing-Home Sales Slip 2.3 Percent in April"

by Calculated Risk on 5/24/2017 10:13:00 AM

From the NAR: Existing-Home Sales Slip 2.3 Percent in April; Days on Market Falls to Under a Month

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, dipped 2.3 percent to a seasonally adjusted annual rate of 5.57 million in April from a downwardly revised 5.70 million in March. Despite last month's decline, sales are still 1.6 percent above a year ago and at the fourth highest pace over the past year.

...

Total housing inventory at the end of April climbed 7.2 percent to 1.93 million existing homes available for sale, but is still 9.0 percent lower than a year ago (2.12 million) and has fallen year-over-year for 23 consecutive months. Unsold inventory is at a 4.2-month supply at the current sales pace, which is down from 4.6 months a year ago.

emphasis added

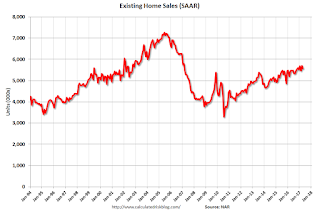

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.57 million SAAR) were 2.3% lower than last month, and were 1.6% above the April 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.93 million in April from 1.80 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.93 million in April from 1.80 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 9.0% year-over-year in April compared to April 2016.

Inventory decreased 9.0% year-over-year in April compared to April 2016. Months of supply was at 4.2 months in April.

This was below the consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 5/24/2017 07:00:00 AM

From the MBA: Refis Apps Up, Purchase Apps Slightly Down in Latest MBA Weekly Survey

Mortgage applications increased 4.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 19, 2017.

... The Refinance Index increased 11 percent from the previous week to its highest level since March 2017. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.17 percent, from 4.23 percent, with points increasing to 0.39 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity picked up a little as rates declined - but remains historically low - and will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up 3% year-over-year.

Tuesday, May 23, 2017

Wednesday: Existing Home Sales, FOMC Minutes and More

by Calculated Risk on 5/23/2017 08:18:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for March 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.67 million SAAR, down from 5.71 million in March. Housing economist Tom Lawler estimates the NAR will report sales of 5.56 million SAAR for April.

• During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes for the Meeting of May 2 - 3, 2017

Chemical Activity Barometer increases in May

by Calculated Risk on 5/23/2017 05:41:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Remains Strong but Hints at Slowing Pace of Economic Growth and Business Activity Into 2018

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), rose 0.4 percent in May, following a downward revision of 0.1 percent for April. Compared to a year earlier, the CAB is up 5.0 percent year-over-year, a modest slowing that still suggests continued growth through year-end 2017. All data is measured on a three-month moving average (3MMA).

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production in 2017.

Richmond Fed: Regional Manufacturing Activity Mostly Unchanged in May

by Calculated Risk on 5/23/2017 02:39:00 PM

Earlier from the Richmond Fed: Manufacturing Firms were Somewhat Less Upbeat about Activity in May Compared to Prior Months

Manufacturers in the Fifth District were somewhat less upbeat in May than in the prior three months, according to the latest survey by the Federal Reserve Bank of Richmond. The index for shipments and the index for new orders decreased notably, with the shipments index falling to slightly below 0. The index for employment was relatively flat, but the decline in the other two indexes resulted in a decline in the composite index from 20 in April to 1 in May. The majority of firms continued to report higher wages, but more firms reported a decline in the average workweek than reported an increase. ...Based on the regional surveys released so far, it appears manufacturing growth slowed in May. The ISM index will probably show slower growth this month.

emphasis added

A few Comments on April New Home Sales

by Calculated Risk on 5/23/2017 12:26:00 PM

New home sales for April were reported at 569,000 on a seasonally adjusted annual rate basis (SAAR). This was well below the consensus forecast, however the three previous months combined were revised up significantly. Overall this was a decent report.

Sales were only up 0.5% year-over-year in April.

Earlier: New Home Sales decrease to 569,000 Annual Rate in April.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 0.5% year-over-year in April.

For the first four months of 2017, new home sales are up 11.3% compared to the same period in 2016.

This was a strong year-over-year increase through April, however sales were weak in Q1 2016, so this was also an easy comparison.