by Calculated Risk on 5/27/2017 08:11:00 AM

Saturday, May 27, 2017

Schedule for Week of May 28, 2017

The key report this week is the May employment report on Friday.

Other key indicators include Personal Income and Outlays for April, the May ISM manufacturing index, May auto sales, and the April Trade Deficit.

All US markets will be closed in observance of Memorial Day.

8:30 AM: Personal Income and Outlays for April. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to be up 0.1%.

9:00 AM ET: S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the February 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the Comp 20 index for March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 57.5, down from 58.3 in April.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in May, down from 177,000 added in April.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 234 thousand the previous week.

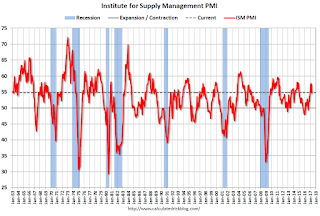

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 54.8% in April. The employment index was at 52.0%, and the new orders index was at 54.8%.

10:00 AM: Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, down from the 211,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate to be unchanged at 4.4%.

The consensus is for the unemployment rate to be unchanged at 4.4%.This graph shows the year-over-year change in total non-farm employment since 1968.

In April, the year-over-year change was 2.24 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $46.1 billion in April from $43.7 billion in March.

Friday, May 26, 2017

Vehicle Sales Forecast: Sales below 17 Million SAAR in May

by Calculated Risk on 5/26/2017 07:02:00 PM

The automakers will report May vehicle sales on Thursday, June 1st.

Note: There were 25 selling days in May 2017, up from 24 in May 2016.

From Reuters: U.S. auto sales seen up 0.5 percent in May: JD Power and LMC

U.S. auto sales in May will edge up 0.5 percent from a year earlier, despite consumer discounts remaining at record levels, industry consultants J.D. Power and LMC Automotive said on Thursday.Overall sales are mostly moving sideways (and down a little from the record in 2016).

...

The seasonally adjusted annual rate for the month will be 16.9 million vehicles, down from 17.3 million last year. ...

The consultancies cut new vehicle sales forecast for 2017 to 17.2 million units from 17.5 million units. U.S. sales of new cars and trucks hit a record high of 17.55 million units in 2016. But as the market has begun to saturate, automakers have been hiking incentives to entice consumers to buy.

emphasis added

Freddie Mac: Mortgage Serious Delinquency rate unchanged in April

by Calculated Risk on 5/26/2017 02:44:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in April was at 0.92%, unchanged from 0.92% in March. Freddie's rate is down from 1.15% in April 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This matches last month as the lowest serious delinquency rate since May 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.4 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for April soon.

Q2 GDP Forecasts

by Calculated Risk on 5/26/2017 11:54:00 AM

From Merrill Lynch:

[T]he data [today] pushed down 2Q GDP tracking by a tenth to 2.5% qoq saar. The main drag was from the weak durables report, while revisions to 1Q GDP caused some modest shifts in the 2Q components.From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 3.7 percent on May 26, down from 4.1 percent on May 16. The forecast for second-quarter real residential investment growth fell from 8.3 percent to 3.1 percent after Tuesday's housing related releases from the U.S. Census Bureau and Wednesday's existing-home sales release from the National Association of Realtors.From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.2% for 2017:Q2.

News from this week’s data releases reduced the nowcast for 2017:Q2 by 0.1 percentage point as the positive impact from wholesale inventories data was more than offset by the negative impact from the advance durable goods report and new home sales data.

Q1 GDP Revised up to 1.2% Annual Rate

by Calculated Risk on 5/26/2017 09:48:00 AM

From the BEA: Gross Domestic Product: First Quarter 2017 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 1.2 percent in the first quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.1 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 0.3% to 0.6%. (weak PCE). Residential investment was revised up slightly from 13.7% to +13.8%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 0.7 percent. With this second estimate for the first quarter, the general picture of economic growth remains the same; increases in nonresidential fixed investment and in personal consumption expenditures (PCE) were larger and the decrease in state and local government spending was smaller than previously estimated. These revisions were partly offset by a larger decrease in private inventory investment ...

emphasis added

Thursday, May 25, 2017

Friday: GDP

by Calculated Risk on 5/25/2017 09:56:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.9% decrease in durable goods orders.

• Also at 8:30 AM ET, Gross Domestic Product, 1st quarter 2017 (Second estimate). The consensus is that real GDP increased 0.8% annualized in Q1, up from the advance estimate of 0.7%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 97.6, down from the preliminary reading 97.7.

Philly Fed: State Coincident Indexes increased in 41 states in April

by Calculated Risk on 5/25/2017 01:48:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2017. Over the past three months, the indexes increased in 46 states and decreased in four, for a three-month diffusion index of 84. In the past month, the indexes increased in 41 states and decreased in nine, for a one-month diffusion index of 64.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In April, 41 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices. The reason for the recent decrease in the number of states with increasing activity is unclear - and might be revised away.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

Kansas City Fed: Regional Manufacturing Activity "Expanded Modestly" in May

by Calculated Risk on 5/25/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Modestly

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded moderately with strong expectations for future activity.The Kansas City region was hit hard by the decline in oil prices, but activity is expanding again.

“After slowing from a rapid rate of growth in February and March, we’ve seen more moderate growth the past two months,” said Wilkerson. “But firms are about as optimistic about future growth as they’ve ever been.”

...

The month-over-month composite index was 8 in May, up from 7 in April but down from 20 in March. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Activity at durable manufacturing plants eased slightly but remained positive, while nondurable activity improved, particularly for plastics and chemicals. Month-over-month indexes were mixed with little change overall. The production and shipments indexes edged slightly lower, while the employment and order backlog indexes inched higher. The new orders and new orders for exports indexes were both basically unchanged. The finished goods inventory index fell from 8 to 0, while the raw materials inventory index was stable.

emphasis added

Weekly Initial Unemployment Claims increase to 234,000

by Calculated Risk on 5/25/2017 08:34:00 AM

The DOL reported:

In the week ending May 20, the advance figure for seasonally adjusted initial claims was 234,000, an increase of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 232,000 to 233,000. The 4-week moving average was 235,250, a decrease of 5,750 from the previous week's revised average. This is the lowest level for this average since April 14, 1973 when it was 232,750. The previous week's average was revised up by 250 from 240,750 to 241,000.The previous week was revised up by 1,000.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 235,250 - the lowest since 1973.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, May 24, 2017

Thursday: Unemployment Claims

by Calculated Risk on 5/24/2017 07:14:00 PM

Some interesting analysis from Josh Lehner at the Oregon Office of Economic Analysis: States at Full Employment, A Prime-Age EPOP Story

The key economic question economists are trying to answer today is whether or not the U.S. economy is at full employment. Given it is more a concept then a hard calculation, you look for signs in the data that suggest the economy is there. In terms of jobs and the unemployment rate, there is no question the data do suggest this. However, at least nationally, wage growth is still relatively slow, albeit picking up some, and inflation remains consistently below target.The decline in the prime working age EPOP is a long term trend, and I suspect that after adjusted for the long term trend, and maybe a little for population (the 50 to 54 age cohort has a lower participation rate than most other prime cohorts), more states would be back to the levels of a decade ago.

Here in Oregon we’re checking more of the boxes than the U.S. overall. Not only have we seen stronger wage gains, but we got the labor force response in terms of rising participation rates. Furthermore, now that the labor market is tight, we are seeing slower job growth which is also expected. Again, I don’t think we’re quite there just yet, but in looking across the nation it’s clear that Oregon is closer than most states.

...

Specifically, when it comes the share of the prime working-age population that actually has a job, those between 25 and 54 years old, just two — two! — states are back to where they were last decade, let alone the late 1990s.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 237 thousand initial claims, up from 232 thousand the previous week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.