by Calculated Risk on 5/16/2017 09:23:00 AM

Tuesday, May 16, 2017

Industrial Production increased 1.0% in April

From the Fed: Industrial production and Capacity Utilization

Industrial production advanced 1.0 percent in April for its third consecutive monthly increase and its largest gain since February 2014. Manufacturing output rose 1.0 percent as a result of widespread increases among its major industries. The indexes for mining and utilities posted gains of 1.2 percent and 0.7 percent, respectively. At 105.1 percent of its 2012 average, total industrial production in April was 2.2 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.6 percentage point in April to 76.7 percent, a rate that is 3.2 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.0 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is 3.2% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

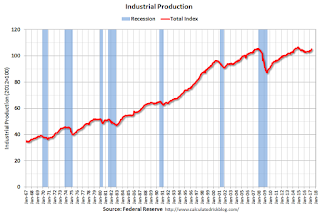

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 105.1. This is 20.7% above the recession low, and is close to the pre-recession peak.

This was above expectations.

Housing Starts decreased to 1.172 Million Annual Rate in April

by Calculated Risk on 5/16/2017 08:42:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,172,000. This is 2.6 percent below the revised March estimate of 1,203,000, but is 0.7 percent above the April 2016 rate of 1,164,000. Single-family housing starts in April were at a rate of 835,000; this is 0.4 percent above the revised March figure of 832,000. The April rate for units in buildings with five units or more was 328,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,229,000. This is 2.5 percent below the revised March rate of 1,260,000, but is 5.7 percent above the April 2016 rate of 1,163,000. Single-family authorizations in April were at a rate of 789,000; this is 4.5 percent below the revised March figure of 826,000. Authorizations of units in buildings with five units or more were at a rate of 403,000 in April.

emphasis added

Click on graph for larger image.

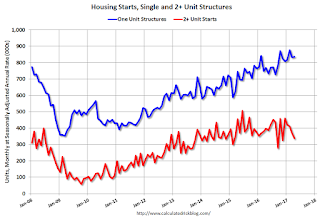

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in April compared to March. Multi-family starts are down year-over-year.

Multi-family is volatile.

Single-family starts (blue) increased in April, and are up 8.8% year-over-year.

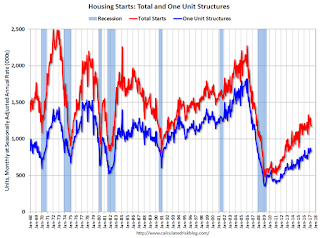

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in April were below expectations. This decline was due to a sharp decline in multi-family. Still a decent report. I'll have more later ...

Monday, May 15, 2017

Tuesday: Housing Starts, Industrial Production

by Calculated Risk on 5/15/2017 08:03:00 PM

Tuesday:

• At 8:30 AM ET, Housing Starts for April. The consensus is for 1.256 million, up from the March rate of 1.215 million.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for April.The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 76.3%.

Early Q2 GDP Forecasts

by Calculated Risk on 5/15/2017 01:05:00 PM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 3.6 percent on May 12, unchanged from May 9. The forecast for second-quarter real consumer spending inched up from 2.7 percent to 2.8 percent after [last week's] retail sales release from the U.S. Census Bureau and [last week's] Consumer Price Index report from the U.S. Bureau of Labor Statistics.From the NY Fed Nowcasting Report

emphasis added

The FRBNY Staff Nowcast stands at 1.9% for 2017:Q2.

NAHB: Builder Confidence increased to 70 in May

by Calculated Risk on 5/15/2017 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 70 in May, up from 68 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Continues on Upward Trend

In a further sign that the housing market continues to strengthen, builder confidence in the market for newly-built single-family homes rose two points in May to a level of 70 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the second highest HMI reading since the downturn.

“This report shows that builders’ optimism in the housing market is solidifying, even as they deal with higher building material costs and shortages of lots and labor,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas.

“The HMI measure of future sales conditions reached its highest level since June 2005, a sign of growing consumer confidence in the new home market,” said NAHB Chief Economist Robert Dietz. “Especially as existing home inventory remains tight, we can expect increased demand for new construction moving forward.”

...

Two of the three HMI components registered gains in May. The index charting sales expectations in the next six months jumped four points to 79 while the index gauging current sales conditions increased two points to 76. Meanwhile, the component measuring buyer traffic edged one point down to 51.

The three-month moving averages for HMI scores posted gains in three out of the four regions. The Northeast and South each registered three-point gains to 49 and 71, respectively, while the West rose one point to 78. The Midwest was unchanged at 68.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast and another solid reading.

NY Fed: Manufacturing Activity "leveled off" in May

by Calculated Risk on 5/15/2017 08:37:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity leveled off in New York State, according to firms responding to the May 2017 Empire State Manufacturing Survey. The headline general business conditions index fell six points to -1.0. The new orders index dropped to -4.4, suggesting a small decline in orders, and the shipments index edged down to 10.6, indicating that shipments increased at a slightly slower pace than in April. ...The slight contraction in May (-1.0) was below the consensus forecast of a reading of 7.0.

...

Employment indexes remained positive, pointing to continued improvement in labor market conditions. The index for number of employees edged down to 11.9, and the average workweek index was little changed at 7.5. ...

Indexes assessing the six-month outlook suggested that firms remained optimistic about future conditions. The index for future business conditions held steady at 39.3, and indexes for future new orders and shipments were somewhat higher. Employment was expected to increase in the months ahead.

emphasis added

Sunday, May 14, 2017

Monday: NY Fed Mfg Survey, Homebuilder Survey

by Calculated Risk on 5/14/2017 08:38:00 PM

Weekend:

• Schedule for Week of May 14, 2017

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 7.0, up from 5.2.

• At 10:00 AM, The May NAHB homebuilder survey. The consensus is for a reading of 68, unchanged from 68 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $47.82 per barrel and Brent at $50.81 per barrel. A year ago, WTI was at $47, and Brent was at $48 - so oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.33 per gallon - a year ago prices were at $2.23 per gallon - so gasoline prices are up about 10 cents a gallon year-over-year.

Update: "Scariest jobs chart ever"

by Calculated Risk on 5/14/2017 03:30:00 PM

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I keep getting asked if I could post an update to the graph, and here it is through the April 2017 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 5.5% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Saturday, May 13, 2017

Schedule for Week of May 14, 2017

by Calculated Risk on 5/13/2017 08:11:00 AM

The key economic report this week is April Housing Starts.

For manufacturing, April industrial production, and the May New York, and Philly Fed manufacturing surveys, will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 7.0, up from 5.2.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 68, unchanged from 68 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for April.

8:30 AM: Housing Starts for April. This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low).

The consensus is for 1.256 million, up from the March rate of 1.215 million.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 76.3%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

11:00 AM: The New York Fed will release their Q1 2017 Household Debt and Credit Report

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 236 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 19.6, down from 22.0.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for April 2017

Friday, May 12, 2017

Oil: "Price weakness failed to dent enthusiasm for rig additions this week"

by Calculated Risk on 5/12/2017 04:22:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on May 12, 2017:

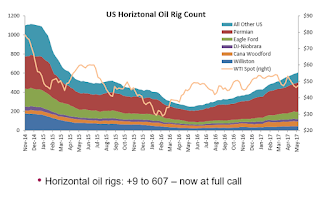

• Total US oil rigs added 9 to 712

• US horizontal oil rigs were up 9 to 607, breaking through the total ‘call’ for the cycle

• Once again, all the action was in the Permian, taking 8 of 9 horizontal rig additions

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.