by Calculated Risk on 5/01/2017 10:04:00 AM

Monday, May 01, 2017

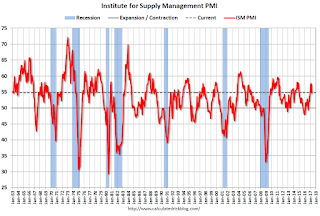

ISM Manufacturing index decreased to 54.8 in April

The ISM manufacturing index indicated expansion in April. The PMI was at 54.8% in April, down from 57.2% in March. The employment index was at 52.0%, down from 58.9% last month, and the new orders index was at 54.8%, down from 64.5%.

From the Institute for Supply Management: April 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in April, and the overall economy grew for the 95th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The April PMI® registered 54.8 percent, a decrease of 2.4 percentage points from the March reading of 57.2 percent. The New Orders Index registered 57.5 percent, a decrease of 7 percentage points from the March reading of 64.5 percent. The Production Index registered 58.6 percent, 1 percentage point higher than the March reading of 57.6 percent. The Employment Index registered 52 percent, a decrease of 6.9 percentage points from the March reading of 58.9 percent. Inventories of raw materials registered 51 percent, an increase of 2 percentage points from the March reading of 49 percent. The Prices Index registered 68.5 percent in April, a decrease of 2 percentage points from the March reading of 70.5 percent, indicating higher raw materials prices for the 14th consecutive month, but at a slower rate of increase in April compared with March. Comments from the panel generally reflect stable to growing business conditions; with new orders, production, employment and inventories of raw materials all growing in April over March."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 56.5%, and suggests manufacturing expanded at a slower pace in April than in March.

Still a decent report.

Personal Income increased 0.2% in March, Spending increased less than 0.1%

by Calculated Risk on 5/01/2017 08:36:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $40.0 billion (0.2 percent) in March according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $5.7 billion (less than 0.1 percent).The March PCE price index increased 1.8 percent year-over-year and the February PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

...

Real PCE increased 0.3 percent. The PCE price index decreased 0.2 percent. Excluding food and energy, the PCE price index decreased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through March 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was close to expectations.

Sunday, April 30, 2017

Monday: Personal Income and Outlays, ISM Mfg Survey, Construction Spending

by Calculated Risk on 4/30/2017 08:50:00 PM

Weekend:

• Schedule for Week of Apr 30, 2017

Monday:

• At 8:30 AM ET, Personal Income and Outlays for March. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to be unchanged.

• At 10:00 AM, ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March. The ISM manufacturing index indicated expansion at 57.2% in March. The employment index was at 58.9%, and the new orders index was at 64.5%.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $49.22 per barrel and Brent at $51.91 per barrel. A year ago, WTI was at $46, and Brent was at $46 - so oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.38 per gallon - a year ago prices were at $2.23 per gallon - so gasoline prices are up about 15 cents a gallon year-over-year.

April 2017: Unofficial Problem Bank list declines to 151 Institutions

by Calculated Risk on 4/30/2017 10:26:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2017. During the month, the list dropped from 151 to 148 institutions after four removals and one addition. Aggregate assets fell by $5.2 billion to $36.1 billion. A year ago, the list held 223 institutions with assets of $64.6 billion.

Actions were terminated against The Heritage Bank, Hinesville, GA ($542 million); The Bank of Commerce, Sarasota, FL ($183 million); and Peoples National Bank, Niceville, FL ($103 million).

This Friday, the FDIC closed a bank for the fourth time this year shuttering First NBC Bank, New Orleans, LA ($4.7 billion). This is the largest failure since the $5.9 billion Doral Bank, San Juan, PR on February 27, 2015. Since the on-set of the Great Recession in 2007, 525 insured institutions with assets of $749 billion have failed with resolution costs of $96.3 billion.

The addition this month was Admirals Bank, Boston, MA ($323 million). Also, the FDIC issued a deposit insurance termination action against Builders Bank, Chicago, IL ($41 million).

Saturday, April 29, 2017

Schedule for Week of Apr 30, 2017

by Calculated Risk on 4/29/2017 08:12:00 AM

The key report this week is the April employment report on Friday.

Other key indicators include the April ISM manufacturing and non-manufacturing indexes, April auto sales, and the March Trade Deficit.

8:30 AM: Personal Income and Outlays for March. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to be unchanged.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 57.2% in March. The employment index was at 58.9%, and the new orders index was at 64.5%.

10:00 AM: Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.2 million SAAR in April, from 16.6 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.2 million SAAR in April, from 16.6 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the March sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in April, down from 263,000 added in March.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to increase to 55.8 from 55.2 in March.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 246 thousand initial claims, down from 257 thousand the previous week.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $44.5 billion in March from $43.6 billion in February.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is a 0.4% increase in orders.

8:30 AM: Employment Report for April. The consensus is for an increase of 185,000 non-farm payroll jobs added in April, up from the 98,000 non-farm payroll jobs added in March.

The consensus is for the unemployment rate to increase to 4.6%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In March, the year-over-year change was 2.13 million jobs.

A key will be the change in wages.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.6 billion increase in credit.

Friday, April 28, 2017

Goldman: U.S. Economy "now at full employment"

by Calculated Risk on 4/28/2017 10:03:00 PM

A few excerpts from a note by Goldman Sachs economists Jan Hatzius and Daan Struyven:

On a broad range of measures, the US economy is now at full employment. Headline unemployment has fallen below most estimates of the structural rate, the discouraged worker share is back to pre-recession lows, and the still somewhat elevated share of involuntary part-timers is arguably structural.

And while the employment/population ratio remains well below its pre-recession level, the gap is fully explained by a combination of population aging and declining participation of prime-age men. This trend among prime-age men has continued for over six decades, has not stood in the way of a strong recent wage acceleration in that demographic, and therefore looks structural.

...

Job growth remains well above the pace needed to stabilize unemployment. The speed of the likely overshoot is comparable to the average postwar cycle, and we have lowered our end-2018 unemployment rate forecast to 4.1% from 4.3% prior.

emphasis added

Fannie Mae: Mortgage Serious Delinquency rate declined in March, Lowest since Feb 2008

by Calculated Risk on 4/28/2017 06:36:00 PM

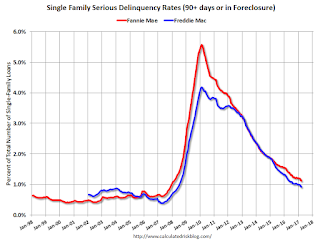

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 1.12% in March, from 1.19% in February. The serious delinquency rate is down from 1.44% in March 2016.

This is the lowest serious delinquency rate since February 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.32 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until this Summer.

Note: Freddie Mac reported earlier.

Oil: "Yet another strong week" for Rig Count

by Calculated Risk on 4/28/2017 03:26:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 28, 2017:

• Total US oil rigs were up 9 to 697

• US horizontal oil rigs surged at twice the ‘call’ pace, up 11 to 592

• Next week, horizontal oil rigs will reach the full ‘call’ analysts have penciled in for this cycle.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Chicago PMI increases in April

by Calculated Risk on 4/28/2017 01:33:00 PM

Earlier, the Chicago PMI: April Chicago Business Barometer at 58.3 vs 57.7 in March

The MNI Chicago Business Barometer increased to 58.3 in April from 57.7 in March, the highest level since January 2015.This was above the consensus forecast of 56.5.

“The April Chicago report showcased another impressive month, with firms reporting solid growth. Rising demand and firm production led to a pick-up in hiring by firms. Although the employment indicator has been bumpy, in and out of contraction, if the current month’s rise is sustained, it could provide a boost to the labor market,” said Shaily Mittal, senior economist at MNI Indicators.

emphasis added

Q1 GDP: Investment

by Calculated Risk on 4/28/2017 09:59:00 AM

First, the soft Q1 GDP data is part of a recent trend of weak first quarters, and was mostly due to weak PCE and inventory adjustment - no worries. It was pretty clear that PCE would be weak in Q1 (see two-month method). However investment was solid.

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased at a 13.7% annual rate in Q1. Equipment investment increased at a 9.1% annual rate, and investment in non-residential structures increased at a 22.1% annual rate.

On a 3 quarter trailing average basis, RI (red) is unchanged, equipment (green) is also unchanged, and nonresidential structures (blue) is slightly positive.

I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward, and for the economy to continue to grow.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has generally been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Still no worries.