by Calculated Risk on 4/24/2017 02:28:00 PM

Monday, April 24, 2017

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2016

Three year ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

Last year I followed up with Largest 5-year Population Cohorts are now "20 to 24" and "25 to 29" and

U.S. Demographics: Ten most common ages in 2010, 2015, 2020, and 2030.

Note: For the impact on housing, also see: Demographics: Renting vs. Owning

Last week the Census Bureau released the population estimates for 2016, and I've updated the table from the previous post (replacing 2015 with 2016 data).

The table below shows the top 11 cohorts by size for 2010, 2016 (released this month), and Census Bureau projections for 2020 and 2030.

By the year 2020, 8 of the top 10 cohorts will be under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

There will be plenty of "gray hairs" walking around in 2020 and 2030, but the key for the economy is the population in the prime working age group is now increasing.

This is very positive for housing and the economy.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2016 | 2020 | 2030 |

| 1 | 45 to 49 years | 25 to 29 years | 25 to 29 years | 35 to 39 years |

| 2 | 50 to 54 years | 20 to 24 years | 30 to 34 years | 40 to 44 years |

| 3 | 15 to 19 years | 55 to 59 years | 35 to 39 years | 30 to 34 years |

| 4 | 20 to 24 years | 50 to 54 years | Under 5 years | 25 to 29 years |

| 5 | 25 to 29 years | 30 to 34 years | 55 to 59 years | 5 to 9 years |

| 6 | 40 to 44 years | 15 to 19 years | 20 to 24 years | 10 to 14 years |

| 7 | 10 to 14 years | 45 to 49 years | 5 to 9 years | Under 5 years |

| 8 | 5 to 9 years | 35 to 39 years | 60 to 64 years | 15 to 19 years |

| 9 | Under 5 years | 10 to 14 years | 15 to 19 years | 20 to 24 years |

| 10 | 35 to 39 years | 5 to 9 years | 10 to 14 years | 45 to 49 years |

| 11 | 30 to 34 years | Under 5 years | 50 to 54 years | 50 to 54 years |

Click on graph for larger image.

This graph, based on the 2016 population estimate, shows the U.S. population by age in July 2016 according to the Census Bureau.

Note that the largest age groups are all in their mid-20s.

And below is a table showing the ten most common ages in 2010, 2016, 2020, and 2030 (projections are from the Census Bureau).

Note the younger baby boom generation dominated in 2010. By 2016 the millennials are taking over. And by 2020, the boomers are off the list.

My view is this is positive for both housing and the economy, especially in the 2020s.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2016 | 2020 | 2030 | |

| 1 | 50 | 25 | 29 | 39 |

| 2 | 49 | 26 | 30 | 40 |

| 3 | 20 | 24 | 28 | 38 |

| 4 | 19 | 27 | 27 | 37 |

| 5 | 47 | 23 | 31 | 36 |

| 6 | 46 | 56 | 26 | 35 |

| 7 | 48 | 55 | 32 | 41 |

| 8 | 51 | 22 | 25 | 30 |

| 9 | 18 | 52 | 35 | 34 |

| 10 | 52 | 28 | 34 | 33 |

Merrill: "Fed to take a breather"

by Calculated Risk on 4/24/2017 12:54:00 PM

The consensus view is that the Fed will hike two more times this year (probably in June and September), and then announce a changed to the balance sheet policy at the December FOMC meeting (slow down reinvestment). Merrill Lynch economists think that the Fed will move slower.

A few excerpts from a Merrill Lynch note today: Fed to take a breather

Two more hikes ... then balance sheet

Fed officials have been preparing the market for a change to the balance sheet policy. This is consistent with the Fed’s larger communication strategy – slowly hint at policy changes and test the market reaction. ... In our view, the Fed is still prioritizing interest rate normalization over the balance sheet. Moreover, we think that the Fed would like to bring rates to at least a range of 1.25 – 1.50% (two more hikes) before shrinking the balance sheet. We believe it is a tall order for the Fed to deliver two more hikes and change the balance sheet policy before yearend, leaving us to argue that balance sheet reduction is a story for early 2018.

June is a close call

Our expectation has been for the Fed to skip the June meeting and hike in September and December ... our central scenario is as follows. June: the data are not quite strong enough to pull the trigger and the Fed hints at a later date for changing the balance sheet policy. September: the Fed hikes and offers more details on the reinvestment policy. December: another hike and a formal plan for the balance sheet is released. March: they announce the change to balance sheet policy in the statement, effective April [2018]

Dallas Fed: "Texas Manufacturing Expansion Continues" in April

by Calculated Risk on 4/24/2017 10:54:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity increased for the 10th consecutive month in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, moved down three points to 15.4, suggesting output growth continued but at a slightly slower pace this month.Based on the regional surveys released so far, it appears the ISM index will be solid again in April - but down from March.

Other measures of current manufacturing activity also indicated continued expansion in April. The survey’s demand indicators saw upward movement, with the new orders and growth rate of orders indexes edging up to 11.5 and 5.1, respectively. The shipments index also moved up, rising three points to 9.5. The capacity utilization index fell slightly but stayed positive for a 10th month in a row, coming in at 11.5.

Perceptions of broader business conditions improved again. The general business activity index held steady at 16.8, and the company outlook index inched down but remained positive at 15.1. Labor market measures indicated employment gains and longer workweeks in April. The employment index posted a fourth consecutive positive reading and remained unchanged at 8.5. Eighteen percent of firms noted net hiring, compared with 9 percent noting net layoffs. The hours worked index fell three points to 5.9.

Chicago Fed "Slower Economic Growth in March"

by Calculated Risk on 4/24/2017 09:42:00 AM

From the Chicago Fed: Chicago Fed National Activity Index Points to Slower Economic Growth in March

Led by slower growth in employment-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to +0.08 in March from +0.27 in February. Two of the four broad categories of indicators that make up the index decreased from February, and one category made a negative contribution to the index in March. The index’s three-month moving average, CFNAI-MA3, decreased to +0.03 in March from +0.16 in February, but remained positive for the fourth consecutive month.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat above the historical trend in March (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Black Knight: House Price Index up 0.8% in February, Up 5.7% year-over-year

by Calculated Risk on 4/24/2017 07:00:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: U.S. Home Prices Hit New Peak in February, Rising 0.8 Percent for the Month, Up 5.7 Percent Year-Over-Year

• Nationally, home prices rose 0.8% for the month and gained 5.7% on a year-over-year basisThe year-over-year increase in this index has been about the same for the last year.

• U.S. home prices hit a new, post-crisis high in February, with the national HPI hitting $268K, surpassing the previous peak set in June 2006

• February marked 58 consecutive months of annual national home price appreciation

• Home prices in six of the nation’s 20 largest states and 14 of the 40 largest metros hit new peaks in February

Note that house prices are just above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for February will be released tomorrow.

Sunday, April 23, 2017

Sunday Night Futures

by Calculated Risk on 4/23/2017 07:54:00 PM

Weekend:

• Schedule for Week of Apr 23, 2017

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 24 and DOW futures are up 187 (fair value) due to the outcome of the election in France (and early polls).

Oil prices were down over the last week with WTI futures at $49.83 per barrel and Brent at $52.27 per barrel. A year ago, WTI was at $43, and Brent was at $44 - so oil prices are up about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.42 per gallon - a year ago prices were at $2.14 per gallon - so gasoline prices are up about 28 cents a gallon year-over-year.

Vehicle Sales Forecast: Sales close to 17 Million SAAR in April

by Calculated Risk on 4/23/2017 01:01:00 PM

The automakers will report April vehicle sales on Tuesday, May 2nd.

Note: There were 26 selling days in April 2017, down from 27 in April 2016.

From WardsAuto: U.S. Forecast: Mild Sales, Growing Inventory

The report puts the seasonally adjusted annual rate of sales for the month at 17.1 million units, well above last month’s 16.5 million, but below year-ago’s 17.3 million.Looks like a decent month for vehicle sales, but overall sales are mostly moving sideways.

The monthly volume will be 3.1% below last year. Beyond one fewer selling day, Easter occurred in April this year, unlike 2016, possibly delaying sales for some shoppers in the second half of the month. ...

Sluggish sales in March left inventory levels high, with LV stock of 4.15 million units at month-end. The forecasted April inventory level sits at 4.16 million units, resulting in a fourth straight month above the 4 million mark. The only time this previously happened was in 2004, when five consecutive months surpassed that level. emphasis added

Saturday, April 22, 2017

Schedule for Week of Apr 23, 2017

by Calculated Risk on 4/22/2017 08:11:00 AM

The key economic reports this week are Q1 GDP and March New Home sales.

8:30 AM: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

9:00 AM: FHFA House Price Index for February 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the Comp 20 index for February.

10:00 AM ET: New Home Sales for March from the Census Bureau.

10:00 AM ET: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for a decrease in sales to 584 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 592 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 243 thousand initial claims, down from 244 thousand the previous week.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 0.4% decrease in the index.

10:00 AM: the Q1 2017 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for April. This is the last of the regional Fed surveys for April.

8:30 AM: Gross Domestic Product, 1st quarter 2017 (Advance estimate). The consensus is that real GDP increased 1.1% annualized in Q1.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 56.5, down from 57.7 in March.

10:00 AM: University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 98.0, unchanged from the preliminary reading 98.0.

Friday, April 21, 2017

OIl: Decent increase for Oil Rig Count

by Calculated Risk on 4/21/2017 05:34:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 21, 2017:

• Total US oil rigs were up 5 to 688

• US horizontal oil rigs added 9 to 581

...

• The US horizontal oil rig count is now within two weeks of the entire number necessary to cover the US contribution to incremental global oil supply.

• The market has clearly become jittery, and OPEC promises to extend production cuts are no longer comforting worried investors

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the evolution of the EIA's Short-Term Energy Outlook (STEO) production forecasts by month. The production outlook keeps increasing.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

BLS: March Unemployment Rates in Arkansas, Colorado, Maine and Oregon at New Series Lows

by Calculated Risk on 4/21/2017 03:05:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in March in 17 states and stable in 33 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eighteen states had jobless rate decreases from a year earlier, and 32 states and the District had little or no change. The national unemployment rate declined by 0.2 percentage point from February to 4.5 percent and was 0.5 point lower than in March 2016.

...

Colorado had the lowest unemployment rate in March, 2.6 percent, closely followed by Hawaii, 2.7 percent, and New Hampshire, North Dakota, and South Dakota, 2.8 percent each. The rates in Arkansas (3.6 percent), Colorado (2.6 percent), Maine (3.0 percent), and Oregon (3.8 percent) set new series lows. (All state series begin in 1976.) New Mexico had the highest jobless rate, 6.7 percent.

emphasis added

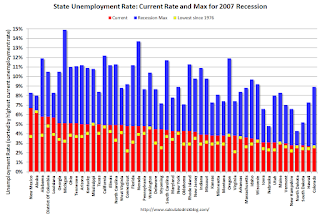

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. New Mexico, at 6.7%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only two states are at or above 6% (dark blue). The states are New Mexico (6.7%), and Alaska (6.4%).

Note: The series low for Alaska is 6.3% (almost a new low in Alaska too).