by Calculated Risk on 3/03/2017 01:03:00 PM

Friday, March 03, 2017

Yellen: "a further adjustment of the federal funds rate would likely be appropriate" at March Meeting

From Fed Chair Janet Yellen: From Adding Accommodation to Scaling It Back Excerpt:

[W]e currently judge that it will be appropriate to gradually increase the federal funds rate if the economic data continue to come in about as we expect. Indeed, at our meeting later this month, the Committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate.A rate hike is very likely at the March FOMC meeting.

ISM Non-Manufacturing Index increased to 57.6% in February

by Calculated Risk on 3/03/2017 10:05:00 AM

The February ISM Non-manufacturing index was at 57.6%, up from 56.5% in January. The employment index increased in February to 55.2%, from 54.7%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:February 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 86th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 57.6 percent, which is 1.1 percentage points higher than the January reading of 56.5 percent. This is the highest reading since October 2015 and represents continued growth in the non-manufacturing sector at a slightly faster rate. The Non-Manufacturing Business Activity Index increased to 63.6 percent, 3.3 percentage points higher than the January reading of 60.3 percent, which is the highest reading since February 2011, when the index registered 63.8 percent, reflecting growth for the 91st consecutive month, at a faster rate in February. The New Orders Index registered 61.2 percent, 2.6 percentage points higher than the reading of 58.6 percent in January. This is the highest reading since August 2015, when the index registered 62.7 percent. The Employment Index increased 0.5 percentage point in February to 55.2 percent from the January reading of 54.7 percent. The Prices Index decreased 1.3 percentage points from the January reading of 59 percent to 57.7 percent, indicating prices increased for the 11th consecutive month, at a slower rate in February. According to the NMI®, 16 non-manufacturing industries reported growth in February. The non-manufacturing sector reflected strong growth in February after cooling off in January. Respondents’ comments continue to be mixed, with some uncertainty; however, the majority indicate a positive outlook on business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests faster expansion in February than in January. A strong report.

Thursday, March 02, 2017

Friday: Yellen, ISM Non-Mfg Index

by Calculated Risk on 3/02/2017 09:32:00 PM

This will be a closely watched speech by Fed Chair Janet Yellen. It appears that the FOMC is leaning towards raising rates this month.

Friday:

• At 10:00 AM, the ISM non-Manufacturing Index for February. The consensus is for index to increase to 57.2 from 57.1 in December.

• At 12:30 PM, Speech by Fed Vice Chairman Stanley Fischer, Fed Monetary Policy Decisionmaking, At the 2017 U.S. Monetary Policy Forum, New York, N.Y.

• At 1:00 PM, Speech by Fed Chair Janet Yellen, Economic Outlook, At the Executives Club of Chicago, Chicago, Ill.

Fannie Mae: Mortgage Serious Delinquency rate unchanged in January

by Calculated Risk on 3/02/2017 06:31:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 1.20% in January, from 1.20% in December. The serious delinquency rate is down from 1.55% in January 2016.

This ties last month as the lowest serious delinquency rate since March 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.35 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until later this year.

Note: Freddie Mac reported earlier.

Demographics: Renting vs. Owning

by Calculated Risk on 3/02/2017 02:53:00 PM

Note; This is an update to a post I wrote in 2015.

It was almost 7 years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers in 2011 were 1) very low new supply for apartments, and 2) strong demand (both favorable demographics, and people moving from owning to renting).

The move "from owning to renting" is mostly over, and demographics for apartments are much less favorable than 6 years ago. Also much more supply has come online. Slowing demand and more supply for apartments is why I think growth in multi-family starts will be flat or slow further this year (multi-family starts probably peaked in 2015).

| Multi-family Starts by Year | |

|---|---|

| Year | 5+ Units (000s) |

| 2005 | 311.4 |

| 2006 | 292.8 |

| 2007 | 277.3 |

| 2008 | 266.0 |

| 2009 | 97.3 |

| 2010 | 104.3 |

| 2011 | 167.3 |

| 2012 | 233.9 |

| 2013 | 293.7 |

| 2014 | 341.7 |

| 2015 | 385.8 |

| 2016 | 381.0 |

On demographics, a large cohort had been moving into the 20 to 29 year old age group (a key age group for renters). Going forward, a large cohort will be moving into the 30 to 39 age group (a key for ownership).

Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften in a few years.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

Merrill on Possible March Fed Hike

by Calculated Risk on 3/02/2017 10:43:00 AM

Expectations of a March rate hike have increased significantly over the last few days. Some market based measures now show an 80%+ chance of a rate hike.

A few excerpts from Merrill Lynch research:

The market has moved dramatically in the past two days to price in a hike at the March meeting. This was partly triggered by hawkish commentary from regional Fed presidents, including NY Fed President Dudley yesterday. While we agree that the chances of a hike in March have increased, given the Fed commentary, we are sticking with our baseline forecast for the Fed to stay on hold at the next meeting and hike in June. That said, it is a very close call ...The FOMC meeting will be on March 14th and 15th.

...

What to watch:

1. Fed speeches, with particular focus on Yellen and Fischer on Friday. Will they push back at all against market pricing for March? Or will they make comments similar to Dudley ...

2. Employment report on March 10th: While the Fed does not respond to just one report, they would like to see something trend-like to support a hike. This means close to 175K on NFP, a 0.2/0.3% mom rebound in wages and the unemployment rate slipping/holding steady.

Weekly Initial Unemployment Claims decrease to 223,000

by Calculated Risk on 3/02/2017 09:18:00 AM

The DOL reported:

In the week ending February 25, the advance figure for seasonally adjusted initial claims was 223,000, a decrease of 19,000 from the previous week's revised level. This is the lowest level for initial claims since March 31, 1973 when it was 222,000. The previous week's level was revised down by 2,000 from 244,000 to 242,000. The 4-week moving average was 234,250, a decrease of 6,250 from the previous week's revised average. This is the lowest level for this average since April 14, 1973 when it was 232,750. The previous week's average was revised down by 500 from 241,000 to 240,500.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 234,250.

This was lower then the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, March 01, 2017

Duy: On the Fed, Possible March Rate Hike, and Dudley

by Calculated Risk on 3/01/2017 07:29:00 PM

From Tim Duy at Bloomberg: Timing of the Next Fed Rate Hike Is Now a Balancing Act

Will they or won’t they? Bond traders are now pricing in odds above 75 percent that Federal Reserve policy makers will raise interest rates when they meet in two weeks, but there is still plenty of data to chew on before then. ...And from Duy at Fed Watch: More on Dudley

The timing of the next hike is a balancing act between the need for preemptive policy to stave off inflationary pressure against the desire to let labor market strength continue to eat away at any residual underemployment. As of December, the median Federal Open Market Committee participant believed that balance was met with three 25 basis-point hikes in 2017.

...

That number, however, is somewhat deceptive as some of the more hawkish FOMC members, such as Richmond Federal Reserve President Jeffrey Lacker, aren’t voting members this year. The voters have tended to tilt dovish, which is why I describe the forecasts within the Fed’s Summary of Economic Projections as pointing toward two hikes with an option on a third. That speaks to moves in June and December and possibly September.

I think in this interview Dudley is doing a good job explaining policy in terms of the forecast. That is something the Fed needs to keep pushing. It doesn’t sound like the forecast or the risks have moved sufficiently to change the number of rate hikes expected this year. But he sure seems to be leaning toward pulling forward those hikes.CR Note: Just a reminder - for the last several years, every time it has been a close call whether the Fed will raise rates - the Fed has passed.

...

Bottom Line: When I read the interview, it is hard for me to see that he has a strong conviction for drawing forward the rate hike to March. It seems odd to do so if he sees no change in the forecast and downplays the impact of the upside risks. If he does want to move in March, it tells me then it has little to do with either factor and is entirely about staying ahead of the curve. It is about the need for a preemptive rate hike. If his forecast is for three hikes and he wants to hike in March, then his patience has ended and he wants those hikes frontloaded. If for FOMC participants as a whole the forecast has yet to change much, then it is possible that the even if they raise in March, the median projection of three rate hikes this year remains steady.

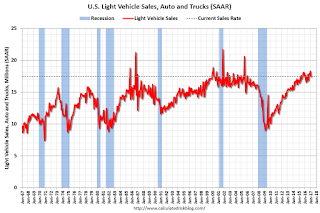

U.S. Light Vehicle Sales at 17.5 million annual rate in February

by Calculated Risk on 3/01/2017 03:10:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.47 million SAAR in February.

That is down about 1% from February 2016, and unchanged from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for February (red, light vehicle sales of 17.47 million SAAR from WardsAuto).

This was below the consensus forecast of 17.7 million for February.

After two consecutive years of record sales, it looks like sales will mostly move sideways in 2017.

Note: dashed line is current estimated sales rate.

Fed's Beige Book: Modest to Moderate expansion, Tight labor markets

by Calculated Risk on 3/01/2017 02:09:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of New York based on information collected on or before February 17, 2017."

Reports from all twelve Federal Reserve Districts indicated that the economy expanded at a modest to moderate pace from early January through mid-February. ... Labor markets remained tight in early 2017, with some Districts noting widening labor shortages. Employment grew moderately in most of the nation, though three Districts characterized growth as modest and two reported that it was little changed. A number of Districts noted that staffing firms were seeing brisk business for this time of year, and one noted more conversions from temporary to permanent workers. In general, wages in most Districts rose modestly or moderately, with a few reporting some pickup in the pace of wage growth. A number of Districts noted that shortages of skilled workers--particularly engineers and IT workers--were driving up their wages, and there were also some reports of labor shortages in the leisure and hospitality, construction and manufacturing industries.And on real estate:

emphasis added

Home construction and sales continued to expand modestly in most Districts, while residential rental markets were mixed. Home prices were steady to up modestly in most Districts, and a number of Districts noted low inventories of existing homes. Commercial real estate construction grew modestly, and sales and leasing activity grew moderately. Lending activity was steady to somewhat higher.Note that residential rental markets "were mixed".