by Calculated Risk on 2/24/2017 02:36:00 PM

Friday, February 24, 2017

A few Comments on January New Home Sales

New home sales for January were reported at 555,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months were all revised down. So overall this was a disappointing report.

Sales were up 5.5% year-over-year in January, However, January and February were the weakest months last year on a seasonally adjusted annual rate basis - so this was an easy comparison.

Note that these sales (for January) occurred after mortgage rates increased following the election. As I've noted before, interest rate changes impact new home sales before existing home sales because new home sales are counted when the contract is signed, and existing home sales at the close of escrow.

This is just the second month of data after the rate increase, and we might be seeing a small dip in sales due to higher interest rates. However, so far, we haven't seen any impact on existing home sales.

It will take several months of data to see the impact of higher mortgage rates - and this is the seasonally weak period - so we might have to wait for the March and April data.

Earlier: New Home Sales increase to 555,000 Annual Rate in January.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 5.5% year-over-year in January.

New home sales averaged 559 thousand per month (SAAR) in 2016, so January was about at the average rate for last year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier: February Consumer Sentiment at 96.3

by Calculated Risk on 2/24/2017 12:07:00 PM

The University of Michigan consumer sentiment index for February was at 96.3, down from 98.5 in January.

While consumer confidence edged upward in late February, it remained slightly below the decade peak recorded in January. Overall, the Sentiment Index has been higher during the past three months than anytime since March 2004. Normally, the implication would be that consumers expected Trump's election to have a positive economic impact. That is not the case since the gain represents the result of an unprecedented partisan divergence, with Democrats expecting recession and Republicans expecting robust growth. Indeed, the difference between these two parties is nearly identical to the difference between the all-time peak and trough values in the Expectations Index - 64.6 versus 64.4. While the expectations of Democrats and Republicans largely offset each other, the overall gain in the Expectations Index was due to self-identified Independents, who were much closer to the optimism of the Republicans than the pessimism of the Democrats. (Note: the February Expectations Index was 55.5 among Democrats, 120.1 among Republicans, and 89.2 among Independents.) Since neither recession nor robust growth is expected in 2017, both extremes must eventually converge

emphasis added

Click on graph for larger image.

Consumer sentiment is a concurrent indicator (not a leading indicator).

New Home Sales increase to 555,000 Annual Rate in January

by Calculated Risk on 2/24/2017 10:12:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 555 thousand.

The previous three months were revised down..

"Sales of new single-family houses in January 2017 were at a seasonally adjusted annual rate of 555,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.7 percent above the revised December rate of 535,000 and is 5.5 percent above the January 2016 estimate of 526,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in January at 5.7 months.

The months of supply was unchanged in January at 5.7 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of January was 265,000. This represents a supply of 5.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2017 (red column), 41 thousand new homes were sold (NSA). Last year, 39 thousand homes were sold in January.

The all time high for January was 92 thousand in 2005, and the all time low for January was 21 thousand in 2011.

This was below expectations of 573,000 sales SAAR. I'll have more later today.

Thursday, February 23, 2017

Friday: New Home Sales

by Calculated Risk on 2/23/2017 07:53:00 PM

From Tim Duy at Bloomberg Whom to Listen to in the Fed Minutes

When it comes to the meetings of the Federal Open Market Committee, not all central bank policy makers are created equally. There are “participants” -- all the policy makers in the room -- and there are “members,” those who have a vote. It is important to keep this distinction in mind when reading the minutes of the FOMC meetings -- especially because many of the more hawkish members of the Fed are participants, not members.Friday:

...

So even though "many" participants appeared interested in moving rate hikes forward, "many" members “many” were comfortable with the expected pace of tightening, “some” might be somewhat more cautious but as of now their concerns appear to remain unfounded, while only “one” is looking to hike soon.

...

Overall, the minutes leave my assessment of the upcoming meeting little changed. Odds favor that the Fed will hold rates steady in March – the data largely confirms the existing forecasts and seems consistent with views of much of the committee that there is no need to rush rates. To be sure, upcoming inflation and employment reports could alter that outlook and pull the next rate hike forward. But given the cautious approach of committee members, stronger data might be pulling a June hike to May rather than all the way to March.

• At 10:00 AM ET, New Home Sales for January from the Census Bureau. The consensus is for a increase in sales to 573 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 536 thousand in December.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 96.0, up from the preliminary reading 95.7.

Update on lack of Chinese Residential Real Estate Buyers

by Calculated Risk on 2/23/2017 03:47:00 PM

A few weeks ago I wrote Some Random Concerns and Observations .... One of my concerns was that stricter capital controls in China would negatively impact certain U.S. real estate markets. After that post, I spoke to an excellent source in San Marino (high end area of Los Angeles), and he told me that some Chinese owners were looking to sell (impacting prices).

Here is an article today from David Pierson at the LA Times: Mega-mansions in this L.A. suburb used to sell to Chinese buyers in days. Now they're sitting empty for months

The turnaround in activity, industry officials say, is directly linked to policies in China. ... To defend against capital flight, Chinese regulators allow citizens to take out only $50,000 a year. But that’s been largely ignored and circumvented, often by asking dozens of friends and family to exercise their quota on someone else’s behalf.If this continues, then this will impact certain areas - and have spillover effects to other areas.

... on Dec. 31, China’s State Administration of Foreign Exchange, which swaps Chinese yuan for dollars, issued some of its strictest guidelines yet. Customers now have to pledge not to invest in foreign property and provide a detailed account of how foreign funds will be used. They also prohibited customers from taking foreign currency out for someone else.

The rules could have broad implications around the world for any city exposed to Chinese real estate investment such as Vancouver, Sydney and more recently, Seattle.

Kansas City Fed: Regional Manufacturing Activity "Expanded Further" in February

by Calculated Risk on 2/23/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Further

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded further with continued strong expectations.The Kansas City region was hit hard by the decline in oil prices, but activity is expanding solidly again. The regional Fed surveys suggest a strong reading for the ISM manufacturing index for February.

“This was the highest reading for our month-over-month composite index since June 2011,” said Wilkerson. “In addition, the future composite index was the highest since our survey switched to a monthly frequency in 2001.”

...

The month-over-month composite index was 14 in February, its highest reading since June 2011, up from 9 in both January and December. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Activity in both durable and nondurable goods plants increased, particularly for metals, machinery, computer, and electronic products. Most month-over-month indexes improved moderately in February. The new orders, order backlog, and employment indexes all edged higher, and the new orders for exports index moved into positive territory for the first time in over a year. ... The future composite index moved higher from 27 to 29, its highest reading since the survey moved to a monthly frequency in 2001.

emphasis added

Weekly Initial Unemployment Claims increase to 244,000, 4-Week Average Lowest Since 1973

by Calculated Risk on 2/23/2017 08:38:00 AM

The DOL reported:

In the week ending February 18, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 6,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 239,000 to 238,000. The 4-week moving average was 241,000, a decrease of 4,000 from the previous week's revised average. This is the lowest level for this average since July 21, 1973 when it was 239,500. The previous week's average was revised down by 250 from 245,250 to 245,000.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,000.

This was close to the consensus forecast.

The low level of claims suggests relatively few layoffs.

Black Knight: Mortgage Delinquencies Declined in January

by Calculated Risk on 2/23/2017 07:00:00 AM

From Black Knight: Black Knight Financial Services’ First Look at January Mortgage Data: Impact of Rising Rates Felt as Prepayments Decline by 30 Percent in January

• Prepayment speeds (historically a good indicator of refinance activity) declined by 30 percent in January to the lowest level since February 2016According to Black Knight's First Look report for January, the percent of loans delinquent decreased 3.9% in January compared to December, and declined 16.6% year-over-year.

• Delinquencies improved by 3.9 percent from December and were down 17 percent from January 2016

• Foreclosure starts rose 18 percent for the month; January’s 70,400 starts were the most since March 2016

• 2.6 million borrowers are behind on mortgage payments, the lowest number since August 2006, immediately following the pre-crisis national peak in home prices

The percent of loans in the foreclosure process declined 0.5% in January and were down 27.6% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.25% in January, down from 4.42% in December.

The percent of loans in the foreclosure process declined in January to 0.94%.

The number of delinquent properties, but not in foreclosure, is down 413,000 properties year-over-year, and the number of properties in the foreclosure process is down 178,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2017 | Dec 2016 | Jan 2016 | Jan 2015 | |

| Delinquent | 4.25% | 4.42% | 5.09% | 5.48% |

| In Foreclosure | 0.94% | 0.95% | 1.30% | 1.76% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,162,000 | 2,248,000 | 2,575,000 | 2,764,000 |

| Number of properties in foreclosure pre-sale inventory: | 481,000 | 483,000 | 659,000 | 885,000 |

| Total Properties | 2,643,000 | 2,731,000 | 3,234,000 | 3,649,000 |

Wednesday, February 22, 2017

Thursday: Unemployment Claims

by Calculated Risk on 2/22/2017 07:23:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand the previous week.

• Also at 8:30 AM, Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 9:00 AM, FHFA House Price Index for December 2016. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for February.

A Few Comments on January Existing Home Sales

by Calculated Risk on 2/22/2017 05:35:00 PM

Earlier: NAR: "Existing-Home Sales Jump in January"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus.

2) The contracts for most of the January existing home sales were entered after the recent increase in mortgage rates (rates started increasing after the election).

With the recent increase in rates, I'd expect some decline in sales volume as happened following the "taper tantrum" in 2013. So far that hasn't happened.

3) Inventory is still very low and falling year-over-year (down 7.1% year-over-year in January). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

I expect inventory will be increasing year-over-year by the end of 2017.

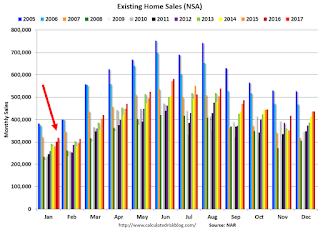

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in January (red column) were the highest for January since 2007 (NSA).

Note that sales NSA are in the slow seasonal period, and will increase sharply (NSA) in March.