by Calculated Risk on 2/15/2017 12:22:00 PM

Wednesday, February 15, 2017

Key Measures Show Inflation close to 2% in January

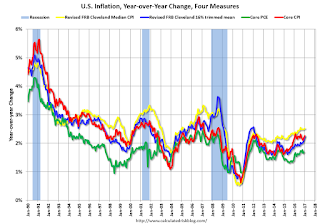

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.3% annualized rate) in January. The 16% trimmed-mean Consumer Price Index also rose 0.3% (3.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for January here. Motor fuel was up 149% annualized in January!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.6% (6.8% annualized rate) in January. The CPI less food and energy rose 0.3% (3.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.3%. Core PCE is for December and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 3.3% annualized, trimmed-mean CPI was at 3.7% annualized, and core CPI was at 3.8% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are above the Fed's 2% target (Core PCE is still below).

NAHB: Builder Confidence decreased to 65 in February

by Calculated Risk on 2/15/2017 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 65 in February, down from 67 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Continues to Settle Back to Sustainable Levels in February

Builder confidence in the market for newly-built single-family homes declined two points in February to a level of 65 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

...

“With much of the decline this month resulting from a decrease in buyer traffic, builders continue to struggle to minimize costs while dealing with supply side challenges such as a lack of developed lots and labor shortages,” said NAHB Chief Economist Robert Dietz. “Despite these constraints, the overall housing market fundamentals remain strong and we expect to see continued growth this year as some of these concerns are addressed.”

All three HMI components fell in February. The component gauging current sales conditions dipped one point to 71, and the index charting sales expectations in the next six months registered a three-point decline to 73. The component measuring buyer traffic dropped five points to 46.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell two points to 50 and the Midwest rose one point to 65. The South dipped one point to 67 and the West held steady at 79 for the third month in a row.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 68, but still another solid reading.

Industrial Production decreased 0.3% in January

by Calculated Risk on 2/15/2017 09:22:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.3 percent in January following a 0.6 percent increase in December. In January, manufacturing output moved up 0.2 percent, and mining output jumped 2.8 percent. The index for utilities fell 5.7 percent, largely because unseasonably warm weather reduced the demand for heating. At 104.6 percent of its 2012 average, total industrial production in January was at about the same level as it was a year earlier. Capacity utilization for the industrial sector fell 0.3 percentage point in January to 75.3 percent, a rate that is 4.6 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.3% is 4.6% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in January to 104.6. This is 19.7% above the recession low, and is close to the pre-recession peak.

This was below expectations of no change, but December was revised up.

Retail Sales increased 0.4% in January

by Calculated Risk on 2/15/2017 08:39:00 AM

On a monthly basis, retail sales increased 0.4 percent from December to January (seasonally adjusted), and sales were up 5.6 percent from January 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for January 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $472.1 billion, an increase of 0.4 percent from the previous month, and 5.6 percent above January 2016. ... The November 2016 to December 2016 percent change was revised from up 0.6 percent to up 1.0 percent.

Click on graph for larger image.

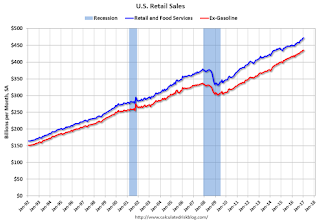

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.2% in January.

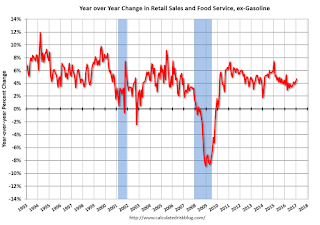

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.7% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.7% on a YoY basis.The increase in January was above expectations, and sales for December were revised up. A solid report.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/15/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 10, 2017.

... The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 3 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.32 percent from 4.35 percent, with points remaining unchanged at 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

It would take a substantial decrease in mortgage rates to see a significant increase in refinance activity - although we might see more cash-out refis.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the recent increase in mortgage rates, purchase activity is still holding up - and up 3 percent from the same week one year ago.

However refinance activity has declined significantly.

Tuesday, February 14, 2017

Wednesday: Yellen, Retail Sales, CPI, Industrial Production, Homebuilder Confidence, Empire State Mfg

by Calculated Risk on 2/14/2017 07:30:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for January will be released. The consensus is for 0.1% increase in retail sales in January.

• Also at 8:30 AM, The Consumer Price Index for January from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 7.5, up from 6.5.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for no change in Industrial Production, and for Capacity Utilization to be unchanged at 75.5%.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C.

• Also at 10:00 AM, The February NAHB homebuilder survey. The consensus is for a reading of 68, up from 67 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.4% increase in inventories.

LA area Port Traffic "Surges" in January

by Calculated Risk on 2/14/2017 02:19:00 PM

From the Port of Long Beach: Port Traffic Surges In January

Renewed activity at the Port of Long Beach’s largest terminal and extra ships calling ahead of the Lunar New Year pushed cargo 8.7 percent higher in January compared to the same month a year ago.From the Port of Los Angeles: Port of Los Angeles Records Busiest January in Port's 110-Year History

...

The month’s total container traffic growth was notable since TEU traffic in January 2016 jumped 25 percent from the same month in 2015.

“It was a tough benchmark, so we’re very happy with the way the new year is starting in Long Beach,” said Board of Harbor Commissioners President Lori Ann Guzmán.

The Port of Los Angeles handled 826,640 Twenty-Foot Equivalent Units (TEUs) in January 2017, an increase of 17.4 percent compared to January 2016. It was the busiest January in the port’s 110-year history, outpacing last January, which was the previous record for the first month of the year. It was also the second-best month overall for the Port, eclipsed only by last November’s 877,564 TEUs.Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

"Coming off our best year ever in 2016, it’s very encouraging to keep the momentum going into 2017,” said Port of Los Angeles Executive Director Gene Seroka. ...

The January surge is due in part to retail stores replenishing inventories after the holidays, a trend of increased U.S. exports and cargo ships calling ahead of the Lunar New Year, when goods from Asia slow down considerably.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.9% compared to the rolling 12 months ending in December. Outbound traffic was up 1.4% compared to 12 months ending in December.

The downturn in exports in 2015 was probably due to the slowdown in China and the stronger dollar. Now exports are picking up again,

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). In general exports have started increasing, and imports have been gradually increasing.

Yellen: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 2/14/2017 10:10:00 AM

Federal Reserve Chair Janet Yellen testimony "Semiannual Monetary Policy Report to the Congress" Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.. A few excepts:

Since my appearance before this Committee last June, the economy has continued to make progress toward our dual-mandate objectives of maximum employment and price stability. In the labor market, job gains averaged 190,000 per month over the second half of 2016, and the number of jobs rose an additional 227,000 in January. Those gains bring the total increase in employment since its trough in early 2010 to nearly 16 million. In addition, the unemployment rate, which stood at 4.8 percent in January, is more than 5 percentage points lower than where it stood at its peak in 2010 and is now in line with the median of the Federal Open Market Committee (FOMC) participants' estimates of its longer-run normal level. A broader measure of labor underutilization, which includes those marginally attached to the labor force and people who are working part time but would like a full-time job, has also continued to improve over the past year. In addition, the pace of wage growth has picked up relative to its pace of a few years ago, a further indication that the job market is tightening. Importantly, improvements in the labor market in recent years have been widespread, with large declines in the unemployment rates for all major demographic groups, including African Americans and Hispanics. Even so, it is discouraging that jobless rates for those minorities remain significantly higher than the rate for the nation overall.Here is the C-Span Link

Ongoing gains in the labor market have been accompanied by a further moderate expansion in economic activity. U.S. real gross domestic product is estimated to have risen 1.9 percent last year, the same as in 2015. Consumer spending has continued to rise at a healthy pace, supported by steady income gains, increases in the value of households' financial assets and homes, favorable levels of consumer sentiment, and low interest rates. Last year's sales of automobiles and light trucks were the highest annual total on record. In contrast, business investment was relatively soft for much of last year, though it posted some larger gains toward the end of the year in part reflecting an apparent end to the sharp declines in spending on drilling and mining structures; moreover, business sentiment has noticeably improved in the past few months. In addition, weak foreign growth and the appreciation of the dollar over the past two years have restrained manufacturing output. Meanwhile, housing construction has continued to trend up at only a modest pace in recent quarters. And, while the lean stock of homes for sale and ongoing labor market gains should provide some support to housing construction going forward, the recent increases in mortgage rates may impart some restraint.

Inflation moved up over the past year, mainly because of the diminishing effects of the earlier declines in energy prices and import prices. Total consumer prices as measured by the personal consumption expenditures (PCE) index rose 1.6 percent in the 12 months ending in December, still below the FOMC's 2 percent objective but up 1 percentage point from its pace in 2015. Core PCE inflation, which excludes the volatile energy and food prices, moved up to about 1-3/4 percent.

My colleagues on the FOMC and I expect the economy to continue to expand at a moderate pace, with the job market strengthening somewhat further and inflation gradually rising to 2 percent.

emphasis added

NFIB: Small Business Optimism Index increased slightly in January

by Calculated Risk on 2/14/2017 10:05:00 AM

Earlier from the National Federation of Independent Business (NFIB): National Federation of Independent Business Monthly Survey Shows Another Gain in Small Business Optimism

Small business optimism rose again in January to its highest level since December 2004, suggesting that the post-election surge has staying power, according to the monthly National Federation of Independent Business (NFIB) Index of Small Business Optimism, released today.

...

The Index reached 105.9 in January, an increase of 0.1 points. The uptick follows the largest month-over-month increase in the survey’s history. Five of the Index components increased and five decreased, but many held near their record high.

...

[T]he seasonally adjusted average employment change per firm posting a gain of 0.15 workers per firm, the best reading since September 2015 and historically, a strong showing. ... Fifty-three percent reported hiring or trying to hire (up 2 points), but 47 percent reported few or no qualified applicants for the positions they were trying to fill. Fifteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 3 points).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 105.9 in January.

This is the highest level since 2004.

Monday, February 13, 2017

Tuesday: Yellen, PPI

by Calculated Risk on 2/13/2017 07:00:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 8:30 AM, The Producer Price Index for January from the BLS. The consensus is for 0.3% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.