by Calculated Risk on 12/25/2016 08:19:00 AM

Sunday, December 25, 2016

Happy Holidays!

Happy Holidays and Merry Christmas to All!

Whose woods these are I think I know."Stopping by Woods on a Snowy Evening" by Robert Frost

His house is in the village though;

He will not see me stopping here

To watch his woods fill up with snow.

My little horse must think it queer

To stop without a farmhouse near

Between the woods and frozen lake

The darkest evening of the year.

He gives his harness bells a shake

To ask if there is some mistake.

The only other sound’s the sweep

Of easy wind and downy flake.

The woods are lovely, dark and deep,

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Enjoy the season!

Saturday, December 24, 2016

Schedule for Week of Dec 25, 2016

by Calculated Risk on 12/24/2016 08:09:00 AM

This will be a light week for economic data.

Happy Holidays and Merry Christmas!

All US markets will be closed in observance of the Christmas Holiday.

9:00 AM ET: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the September 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.1% year-over-year increase in the Comp 20 index for October. The Zillow forecast is for the National Index to increase 5.7% year-over-year in October.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.5% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, down from 275 thousand the previous week.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for a reading of 57.0, down from 57.6 in November.

Friday, December 23, 2016

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in November

by Calculated Risk on 12/23/2016 05:26:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in November.

On distressed: The total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are mostly down in these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | |

| Las Vegas | 4.0% | 7.1% | 6.5% | 6.2% | 10.5% | 13.3% | 26.9% | 33.2% |

| Reno** | 2.0% | 4.0% | 3.0% | 4.0% | 5.0% | 8.0% | ||

| Phoenix | 1.5% | 2.9% | 2.2% | 3.8% | 3.7% | 6.7% | 23.4% | 29.1% |

| Sacramento | 2.6% | 4.4% | 2.4% | 3.6% | 5.0% | 8.0% | 12.9% | 22.9% |

| Minneapolis | 1.8% | 2.6% | 4.8% | 9.6% | 6.6% | 12.2% | 12.7% | 16.6% |

| Mid-Atlantic | 3.1% | 3.9% | 9.4% | 11.9% | 12.6% | 15.8% | 17.5% | 20.9% |

| Florida SF | 2.2% | 3.7% | 8.1% | 15.3% | 10.3% | 19.0% | 29.5% | 37.7% |

| Florida C/TH | 1.3% | 2.4% | 6.1% | 13.4% | 7.4% | 15.7% | 57.2% | 65.4% |

| Chicago (city) | 15.5% | 18.6% | ||||||

| Spokane | 6.7% | 9.8% | ||||||

| Northeast Florida | 13.7% | 26.2% | ||||||

| Rhode Island | 9.2% | 11.2% | ||||||

| Tucson | 23.1% | 32.2% | ||||||

| Knoxville | 21.3% | 26.0% | ||||||

| Peoria | 23.2% | 27.2% | ||||||

| Georgia*** | 19.7% | 25.2% | ||||||

| Omaha | 18.1% | 20.6% | ||||||

| Richmond VA | 8.8% | 10.2% | 17.2% | 21.0% | ||||

| Memphis | 10.9% | 15.3% | ||||||

| Springfield IL** | 5.6% | 8.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Review: Ten Economic Questions for 2016

by Calculated Risk on 12/23/2016 02:31:00 PM

At the end of each year, I post Ten Economic Questions for the coming year. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2016 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is a review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2016: How much will housing inventory increase in 2016?

Right now my guess is active inventory will increase in 2016 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2016). I don't expect a double digit surge in inventory, but maybe a mid-single digit increase year-over-year. If correct, this will keep house price increases down in 2015 (probably lower than the 5% or so gains in 2014 and 2015).According to the November NAR report on existing home sales, inventory was down 9.3% year-over-year in August, and the months-of-supply was at 4.0 months. It is clear inventory will decrease in 2016. Note: I changed my view on inventory early this year (one of the key reasons for writing down expectations - so we can change our views when the data is different than expected).

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

9) Question #9 for 2016: What will happen with house prices in 2016?

Low inventories, and a decent economy suggests further price increases in 2016. However I expect we will see prices up less in 2016, than in 2015, as measured by these house price indexes - mostly because I expect more inventory.It is early, but the recently released Case-Shiller data showed prices up 5.5% year-over-year in September. The price increase is slightly higher than in 2015 (prices were up 5.25% nationally in 2015), probably due to less inventory.

8) Question #8 for 2016: How much will Residential Investment increase?

My guess is growth of around 4% to 8% in 2016 for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts will shift a little more towards single family in 2016.Through November, starts were up 4.8% year-over-year compared to the same period in 2015. New home sales were up 12.7% year-over-year. Starts will increase as expected; new home sales will be higher than I expected.

7) Question #7 for 2016: What about oil prices in 2016?

It is impossible to predict an international supply disruption, however if a significant disruption happens, then prices will move higher. Continued weakness in Europe and China seems likely, however sluggish demand will be somewhat offset by less tight oil production. It seems like the key oil producers (Saudi, etc) will continue production at current levels. This suggests in the short run (2016) that prices will stay low, but probably move up a little in 2016. I'll guess WTI will be up from the current price [WTI at $38 per barrel] by December 2016 (but still under $50 per barrel).As of this morning, WTI futures are at $52.85 per barrel. Prices moved up as expected, but are a little above $50.

6) Question #6 for 2016: Will real wages increase in 2016?

For this post the key point is that nominal wages have been only increasing about 2% per year with some pickup in 2015. As the labor market continues to tighten, we should start see more wage pressure as companies have to compete more for employees. I expect to see some further increase in nominal wage increases in 2016 (perhaps over 3% later in the year). The year-over-year change in real wages will depend on inflation, and I expect headline CPI to pickup some this year as the impact on headline inflation of declining oil prices fades.Through November, nominal hourly wages were up 2.5% year-over-year. This is a pickup from last year - and wage growth appears to be trending up. Wages will increase at a faster rate in 2016 than in 2015.

5) Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

I've seen several people arguing the Fed will be cutting rates by the end of 2016 - I think that is unlikely. Instead I think the Fed will be cautious - and they will not want to reverse course. Right now I think something around three rate hikes in 2016 is likely.Events have pushed the Fed to delay rate increases, and the Fed only hiked once in 2016.

4) Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

Due to some remaining slack in the labor market (example: elevated level of part time workers for economic reasons), I expect these measures of inflation will be close to the Fed's target in 2016.It is early, but inflation has moved up close to the Fed target through November.

So currently I think core inflation (year-over-year) will increase further in 2016, but too much inflation will not be a serious concern in 2016.

3) Question #3 for 2016: What will the unemployment rate be in December 2016?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to around 4.5% by December 2016. My guess is based on the participation rate declining slightly in 2016 and for decent job growth in 2016 (however less in 2016 than in 2015).The unemployment rate was 4.6% in November, down from 5.0% in December 2015.

2) Question #2 for 2016: How many payroll jobs will be added in 2016?

Energy related construction hiring will decline in 2016, but I expect other areas of construction to be solid. For manufacturing, growth in the auto sector will probably slow this year, but the drag on manufacturing employment from the strong dollar should be less in 2016.Through November 2016, the economy has added almost 2 million jobs; or 180,000 per month. It now appears employment gains will be lower than in 2015 (as expected).200,000 per month in 2016.

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - but probably not the severe contraction as in 2015, and more companies will have difficulty finding qualified candidates. Even with some boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2016 than in 2015.

So my forecast is for gains of around 200,000 payroll jobs per month in 2015. Lower than in 2015, but another solid year for employment gains given current demographics.

1) Question #1 for 2016: How much will the economy grow in 2016?

In addition, the sharp decline in oil prices should be a net positive for the US economy in 2016. And, hopefully, the negative impact from the strong dollar will fade in 2016.GDP growth was sluggish again in the first half (just up 1.1% annualized), and solid in Q3. GDP is now tracking 2.5% in Q4. This would be GDP growth just over 2% from Q4 2015 to Q4 2016.

The most likely growth rate is in the mid-2% range again ...

In general, 2016 unfolded as expected with some key exceptions (one of the reasons I write down what I think will happen). I changed my view on Fed rate hikes earlier this year to just one hike. And existing home inventory is declined again this year.

Residential investment, oil prices, inflation, wage growth and employment were about as I expected.

A few Comments on November New Home Sales

by Calculated Risk on 12/23/2016 11:41:00 AM

New home sales for November were reported at 592,000 on a seasonally adjusted annual rate basis (SAAR). This was above the consensus forecast, however the previous months combined were revised down slightly.

Sales were up 16.5% year-over-year in November, and this is the best month for November (NSA) since 2007. And sales are up 12.7% year-to-date compared to the same period in 2015.

This is very solid year-over-year growth.

Note that these sales (for November) mostly happened while mortgage rates were increasing (but still below the current level). So far the increase in rates hasn't impacted sales, but we need to wait a few months to see the impact.

Earlier: New Home Sales increase to 592,000 Annual Rate in November.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 12.7% year-over-year, because of very strong year-over-year growth over the last seven months.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year. I was too pessimistic on new home sales this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 592,000 Annual Rate in November

by Calculated Risk on 12/23/2016 10:09:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 592 thousand.

The previous three months were revised down slightly.

"Sales of new single-family houses in November 2016 were at a seasonally adjusted annual rate of 592,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.2 percent above the revised October rate of 563,000 and is 16.5 percent above the November 2015 estimate of 508,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still fairly low historically.

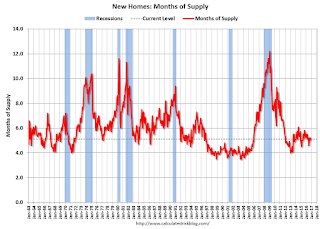

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 5.1 months.

The months of supply decreased in November to 5.1 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of November was 250,000. This represents a supply of 5.1 months at the current sales rate"

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2016 (red column), 41 thousand new homes were sold (NSA). Last year, 36 thousand homes were sold in November. This was the highest sales for November since 2007.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was above expectations of 580,000 sales SAAR in November. I'll have more later today.

Thursday, December 22, 2016

Friday: New Home Sales

by Calculated Risk on 12/22/2016 07:17:00 PM

A couple of Q4 GDP tracking estimates ...

From Merrill Lynch updated today: "our 4Q GDP tracking estimate [is] 1.8% qoq saar"

And from the Atlanta Fed GDPNow:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2016 is 2.5 percent on December 22, down from 2.6 percent on December 16. The forecasts of fourth-quarter real personal consumption expenditures and real intellectual property products investment growth increased modestly after this morning's GDP and personal income outlays reports from the U.S. Bureau of Economic Analysis (BEA). These were offset by modest declines in the forecasted contributions to growth from residential, nonresidential equipment and inventory investment after the aforementioned BEA releases, this morning's advance manufacturing report from the U.S. Census Bureau, and yesterday's existing-home sales release from the National Association of Realtors.Friday:

• At 10:00 AM ET, New Home Sales for November from the Census Bureau. The consensus is for an increase in sales to 580 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 563 thousand in October.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 98.0, unchanged from the preliminary reading 98.0.

Black Knight: Annual improvement in mortgage delinquency rates is beginning to slow as market "normalizes"

by Calculated Risk on 12/22/2016 02:11:00 PM

From Black Knight: Black Knight Financial Services’ First Look at November Mortgage Data: Foreclosure Starts Up from October, But Still Near 10-Year Lows

• Delinquency rate up by 2.5 percent, a relatively mild seasonal increase by historical standardsAccording to Black Knight's First Look report for November, the percent of loans delinquent increased 2.5% in November compared to October, and declined 9.4% year-over-year.

• Annual improvement in mortgage delinquency rates is beginning to slow as market "normalizes"

• Number of loans in active foreclosure drops below 500K for the first time in nearly 10 years

• Pre-payment activity remains strong, for now, as applications made prior to the rise in interest rates continue to close

The percent of loans in the foreclosure process declined 1% in November and were down 29% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.46% in November, up from 4.35% in October.

The percent of loans in the foreclosure process declined in November to 0.98%.

The number of delinquent properties, but not in foreclosure, is down 228,000 properties year-over-year, and the number of properties in the foreclosure process is down 200,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for November on January 9th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2016 | Oct 2016 | Nov 2015 | Nov 2014 | |

| Delinquent | 4.46% | 4.35% | 4.92% | 6.03% |

| In Foreclosure | 0.98% | 0.99% | 1.38% | 1.75% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,263,000 | 2,202,000 | 2,491,000 | 3,037,000 |

| Number of properties in foreclosure pre-sale inventory: | 498,000 | 504,000 | 698,000 | 883,000 |

| Total Properties | 2,761,000 | 2,706,000 | 3,189,000 | 3,921,000 |

Kansas City Fed: Regional Manufacturing Activity "Improved Considerably" in December

by Calculated Risk on 12/22/2016 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Improved Considerably

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity improved considerably to its highest growth rate in over two years.The Kansas City region was hit hard by the decline in oil prices, but activity is expanding again.

“This was the highest composite reading in our survey since May 2014,” said Wilkerson. “This is now four straight months of factory expansion in our region, following a difficult time for many plants in 2015 and much of 2016.”

...

The month-over-month composite index was 11 in December, up from 1 in November and 6 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Activity in nondurable goods plants increased markedly, particularly for food and plastics, while durable goods plants expanded at a slower pace. Most month-over-month indexes improved in December. The production index jumped from 9 to 24, and the shipments, new orders, and order backlog indexes also rose. The employment index increased from 1 to 10, its highest level since May 2014. ...

emphasis added

Personal Income increased slightly in November, Spending increased 0.2%

by Calculated Risk on 12/22/2016 10:07:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $1.6 billion (less than 0.1 percent) in November according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $24.0 billion (0.2 percent).The November PCE price index increased 1.4 percent year-over-year and the November PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

...

Real PCE increased 0.1 percent. The PCE price index increased less than 0.1 percent. Excluding food and energy, the PCE price index increased less than 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through November 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income and the increase in PCE were below expectations.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 2.7% annual rate in Q4 2016. (using the mid-month method, PCE was increasing 3.2%). This suggests decent PCE growth in Q4.