by Calculated Risk on 10/27/2016 08:34:00 PM

Thursday, October 27, 2016

Friday: GDP

From Goldman Sachs economist Elad Pashtan

Our final Q3 GDP tracking estimate stands at +2.9% (qoq ar), roughly in line with the consensus of forecasts that were updated after the September trade report. We look for a strong boost from net exports, solid consumer spending, a small contribution from capital expenditures, and another (albeit smaller) drag from inventories.Friday:

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2016 (Advance estimate). The consensus is that real GDP increased 2.5% annualized in Q3.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 88.5, up from the preliminary reading 87.9.

Freddie Mac: Mortgage Serious Delinquency rate declined slightly in September, Lowest since July 2008

by Calculated Risk on 10/27/2016 02:50:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in September to 1.02%, down from 1.03% in August. Freddie's rate is down from 1.41% in September 2015.

This is the lowest rate since July 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.39 percentage points over the last year, and at that rate of improvement, the serious delinquency rate could be below 1% next month (October).

Note: Fannie Mae will report in the next few days.

HVS: Q3 2016 Homeownership and Vacancy Rates

by Calculated Risk on 10/27/2016 12:35:00 PM

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2016.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 63.5% in Q3, from 62.9% in Q2.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and the Reis survey is showing rental vacancy rates have started to increase slightly.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate is probably close to the bottom.

Kansas City Fed: Regional Manufacturing Activity "Expanded Moderately" in October

by Calculated Risk on 10/27/2016 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Moderately

The Federal Reserve Bank of Kansas City released the October Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded again at a moderate pace.The Kansas City region was hit hard by the decline in oil prices, and it appears activity is starting to expand again.

“This was the second consecutive month of rising factory activity in the Tenth District, the first time that has happened in nearly two years,” said Wilkerson. “Much of the improvement recently has been in machinery and fabricated metals manufacturing.”

...

The month-over-month composite index was 6 in October, equal to 6 in September and up from -4 in August ... Most month-over-month indexes improved further in October. The production index edged higher from 15 to 18, and the shipments, new orders, and order backlog also rose moderately. The employment index climbed from -3 to 7, its highest level in almost two years. ...

emphasis added

NAR: Pending Home Sales Index increased 1.5% in September, up 2.4% year-over-year

by Calculated Risk on 10/27/2016 10:03:00 AM

From the NAR: Pending Home Sales Edge Up in September

Pending home sales shifted higher in September following August's notable dip and are now at their fifth highest level over the past year, according to the National Association of Realtors®. Increases in the South and West outgained declines in the Northeast and Midwest.This was above expectations of a 1.0% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, grew 1.5 percent to 110.0 in September from a slight downward revision of 108.4 in August. With last month's gain, the index is now 2.4 percent higher than last September (107.4) and has now risen year-over-year for 22 of the last 25 months.

...

The PHSI in the Northeast fell 1.6 percent to 96.5 in September, but is still 7.7 percent above a year ago. In the Midwest the index declined modestly (0.2 percent) to 104.6 in September, and is now 1.0 percent lower than September 2015.

Pending home sales in the South rose 1.9 percent to an index of 122.1 in September and are now 1.7 percent higher than last September. The index in the West jumped 4.7 percent in September to 107.3, and is now 4.0 percent above a year ago.

emphasis added

Weekly Initial Unemployment Claims decrease to 258,000

by Calculated Risk on 10/27/2016 08:34:00 AM

The DOL reported:

In the week ending October 22, the advance figure for seasonally adjusted initial claims was 258,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 260,000 to 261,000. The 4-week moving average was 253,000, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 251,750 to 252,000.The previous week was revised up.

There were no special factors impacting this week's initial claims. This marks 86 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 253,000.

This was close to the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, October 26, 2016

Thursday: Durable Goods, Unemployment Claims, Pending Home Sales and More

by Calculated Risk on 10/26/2016 08:44:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 260 thousand the previous week. Note: I expect some further impact on claims due to Hurricane Matthew.

• Also at 8:30 AM, Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.2% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is for a 1.0% increase in the index.

• Also at 10:00 AM, the Q3 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for October.

Philly Fed: State Coincident Indexes increased in 36 states in September

by Calculated Risk on 10/26/2016 04:05:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2016. In the past month, the indexes increased in 36 states, decreased in 11, and remained stable in three, for a one-month diffusion index of 50. Over the past three months, the indexes increased in 40 states, decreased in nine, and remained stable in one, for a three-month diffusion index of 62.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.Philly Fed.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 39 states had increasing activity (including minor increases).

Eight states have seen declines over the last 6 months, in order the five worst are Wyoming (worst), Alaska, Louisiana, Kansas, Oklahoma - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

Zillow Forecast: Expect "Modest Acceleration" in YoY Growth in September for the Case-Shiller Indexes

by Calculated Risk on 10/26/2016 01:31:00 PM

The Case-Shiller house price indexes for August were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: September Case-Shiller Forecast: Modest Acceleration in Home Price Growth Will Continue

According to Zillow’s September Case-Shiller forecast, the national index and both smaller 10 and 20-city indices look set to continue the acceleration in home price growth they exhibited in August. And after more than two years of steady growth around 5 percent annually, the U.S. National Case-Shiller home price index is within striking distance of reaching its July 2006 peak levels, just 0.1 percent off those levels, according to today’s data.The year-over-year change for the 10-city and 20-city indexes will probably be about the same in the September report as in the August report. The change for the National index will probably be slightly higher.

The September Case-Shiller National Index is expected to grow 5.4 percent year-over-year and 0.7 percent month-to-month (seasonally adjusted). We expect the 10-City Index to grow 4.3 percent year-over-year and 0.3 percent (SA) from July. The 20-City Index is expected to grow 5.1 percent between September 2015 and September 2016, and rise 0.4 percent (SA) from August.

Zillow’s September Case-Shiller forecast is shown in the table below. These forecasts are based on today’s August Case-Shiller data release and the September 2016 Zillow Home Value Index (ZHVI). The September S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, November 29.

A few Comments on September New Home Sales

by Calculated Risk on 10/26/2016 11:23:00 AM

New home sales for September were reported below the consensus forecast at 593,000 on a seasonally adjusted annual rate basis (SAAR). And the three previous months were all revised down significantly.

However, sales were up 29.8% year-over-year in September, and this is the best month for September (NSA) since 2007. And sales are up 13.0% year-to-date compared to the same period in 2015.

The glass is more than half full. This is very solid year-over-year growth.

Earlier: New Home Sales at 593,000 Annual Rate in September.

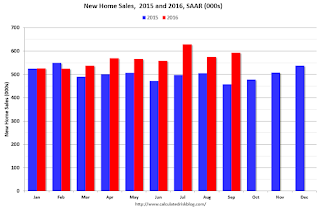

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 13.0% year-over-year, because of very strong year-over-year growth over the last six months.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year. It looks like I was too pessimistic on new home sales this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.