by Calculated Risk on 10/20/2016 03:39:00 PM

Thursday, October 20, 2016

NMHC: Apartment Market Tightness Index remained negative in October Survey

From the National Multifamily Housing Council (NMHC): Apartment Markets Retreat in the October NMHC Quarterly Survey

Apartment markets softened across all four indexes in the October 2016 National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. The Market Tightness (28), Sales Volume (42), Equity Financing (33) and Debt Financing (38) Indexes all landed below the breakeven level of 50 – showing weaker conditions from the previous quarter.

“The growing supply of new apartments, primarily in the Class A space, appears to have finally reached a level to slow the historically high rent growth. Additionally, debt and equity markets are more discerning in terms of what deals they are ready to take on, including the continued slowing of available construction loans,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Despite the softening due to the new development focus on Class A apartments, the overall fundamentals for apartments remain stable, indicated by the strong demand for Class B and C properties.”

The Market Tightness Index fell to 28, the lowest since July 2009 and the fourth quarter in a row showing declining conditions. Almost half of respondents (49 percent) reported looser conditions than three months ago. Likewise, only six percent noted tighter conditions. The remaining 45 percent reported no change at all.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the fourth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to slow (the vacancy rate is generally creeping up too).

A Few Comments on September Existing Home Sales

by Calculated Risk on 10/20/2016 12:12:00 PM

Earlier: Existing Home Sales increased in September to 5.47 million SAAR

Inventory remains a key issue. Here is a repeat of two paragraphs I wrote about inventory a few months ago:

I expected some increase in inventory last year, but that didn't happened. Inventory is still very low and falling year-over-year (down 6.8% year-over-year in September). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

A key point: Some areas are seeing more inventory. For example, there is more inventory in some coastal areas of California, in New York city and for high rise condos in Miami.

I'd consider any existing home sales rate in the 5 to 5.5 million range solid based on the normal historical turnover of the existing stock. As always, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale.

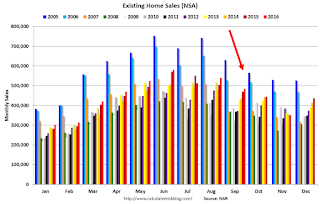

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in September (red column) were the highest for September since 2006 (NSA).

Note that sales NSA are in the slower Fall period, and will really slow seasonally in January and February.

Existing Home Sales increased in September to 5.47 million SAAR

by Calculated Risk on 10/20/2016 10:12:00 AM

From the NAR: First-time Buyers Steer Existing-Home Sales Higher in September

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, hiked 3.2 percent to a seasonally adjusted annual rate of 5.47 million in September from a downwardly revised 5.30 million in August. After last month's gain, sales are at their highest pace since June (5.57 million) and are 0.6 percent above a year ago (5.44 million)....

Total housing inventory at the end of September rose 1.5 percent to 2.04 million existing homes available for sale, but is still 6.8 percent lower than a year ago (2.19 million) and has now fallen year-over-year for 16 straight months. Unsold inventory is at a 4.5-month supply at the current sales pace, which is down from 4.6 months in August.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (5.47 million SAAR) were 3.2% higher than last month, and were 0.6% above the September 2015 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.04 million in September from 2.01 million in August. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.04 million in September from 2.01 million in August. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.8% year-over-year in September compared to September 2015.

Inventory decreased 6.8% year-over-year in September compared to September 2015. Months of supply was at 4.5 months in September.

This was above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increase to 260,000

by Calculated Risk on 10/20/2016 08:35:00 AM

Note: I expected some increase this week due to Hurricane Matthew.

The DOL reported:

In the week ending October 15, the advance figure for seasonally adjusted initial claims was 260,000, an increase of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 246,000 to 247,000. The 4-week moving average was 251,750, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 249,250 to 249,500.The previous week was revised up.

There were no special factors impacting this week's initial claims. This marks 85 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 251,750.

This was above than the consensus forecast of 250,000. The low level of claims suggests relatively few layoffs.

Wednesday, October 19, 2016

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 10/19/2016 06:11:00 PM

Tonight (Wednesday) from 9:00 PM to 10:30 PM ET: the Third Presidential Debate, at University of Nevada, Las Vegas, Las Vegas, NV

From Politifact PolitiFact’s guide to the third presidential debate

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 246 thousand the previous week. Note: I expect a larger increase in claims than the consensus due to Hurricane Matthew - maybe closer to 300 thousand.

• Also at 8:30 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of 7.0, down from 12.8.

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.35 million SAAR, up from 5.33 million in August. Housing economist Tom Lawler expects the NAR to report sales of 5.55 million SAAR.

Fed's Beige Book: "Most Districts indicated a modest or moderate pace of expansion"

by Calculated Risk on 10/19/2016 02:15:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Dallas based on information collected on or before October 7, 2016. "

Reports from the twelve Federal Reserve Districts suggest national economic activity continued to expand during the reporting period from late August to early October. Most Districts indicated a modest or moderate pace of expansion; however, the New York District reported no change in overall activity. Compared with the previous report, the pace of growth improved in the St. Louis, Kansas City, and Dallas Districts. Outlooks were mostly positive, with growth expected to continue at a slight to moderate pace in several Districts.And on real estate:

Labor market conditions remained tight, with modest employment and wage growth noted over the reporting period. Most Districts characterized input costs and/or output prices as fairly flat, but prices increased slightly on net.

emphasis added

Residential real estate activity expanded in most Districts since the prior report, and contacts in a few Districts expressed optimism about future growth. Homes sales fell markedly in the Kansas City District, while slight to moderate gains were reported by most of the other Districts. Demand for lower-priced homes was solid in Districts that commented on it, while sales of higher-priced homes slowed in the New York, Chicago, and Dallas Districts, and in Alaska according to San Francisco's report. Home inventories were generally reported to be low or declining and were restraining sales growth according to the Boston, Philadelphia, and Minneapolis Districts. Home prices continued to rise at a modest pace across much of the country, which contacts in some Districts attributed to tight inventories and labor constraints. Growth in residential construction was generally flat to up during the reporting period, with particular strength noted in the San Francisco District. However, construction activity dipped slightly in the Richmond District partly due to lot shortages.Real estate is decent.

Reports on multifamily activity varied but were positive on net. Strength in the apartment market was noted by the Dallas District (excluding the Houston metro area), while activity was mixed in the New York District. Growth in multifamily construction was positive in the Boston and Atlanta Districts but was mixed in the Richmond District and slowed further according to New York's report.

Commercial real estate leasing activity generally improved, and outlooks were mostly optimistic, although contacts in a few Districts expressed concern about economic uncertainty surrounding the upcoming presidential elections. Commercial rents were flat to up, and vacancy rates were generally low and/or declined in reporting Districts, except in the Houston metro area where office vacancies increased further. Sales of commercial properties were characterized as robust in the Chicago, Minneapolis, and San Francisco Districts but softened in the greater Boston area. Commercial construction increased on net, with contacts in the Cleveland and Atlanta Districts reporting increased or high backlogs. Shortages of skilled labor remained a constraint on construction activity in some Districts, such as Cleveland and San Francisco.

AIA: Architecture Billings Index declines in September

by Calculated Risk on 10/19/2016 12:11:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Further Contraction in Architecture Billings Index

For the first time since the summer of 2012, the Architecture Billings Index (ABI) posted consecutive months of a decline in demand for design services. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI score was 48.4, down from the mark of 49.7 in the previous month. This score reflects a decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.4, down from a reading of 61.8 the previous month.

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “But this drop-off in demand could be continued hesitancy in the marketplace to move forward on projects until the presidential election is decided. The fact that new work coming into architecture continues to slowly increase suggests that billings will resume their growth in the coming months”

...

• Regional averages: South (53.4), Midwest (50.1), West (49.5), Northeast (44.0)

• Sector index breakdown:commercial/industrial (50.4), mixed practice (49.8), institutional (49.0), multi-family residential (48.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.4 in September, down from 49.7 in August. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 8 of the last 12 months, suggesting a further increase in CRE investment through mid-2017. However if this drop-off continues, CRE investment could slow in the 2nd half of 2017.

Comments on September Housing Starts

by Calculated Risk on 10/19/2016 09:55:00 AM

Earlier: Housing Starts decreased to 1.047 Million Annual Rate in September

The housing starts report this morning was unusual because of the sharp decline in multi-family starts. However multi-family permits were solid in September, so multi-family starts will probably rebound in October.

Meanwhile single family starts were up, and there were upward revisions to the prior two months. No worries!

This first graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 3.7% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that still looks about right.

Multi-family starts are down 5.6% year-to-date, and single-family starts are up 8.6% year-to-date.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries, although this has dipped lately). Completions lag starts by about 12 months.

Both multi-family starts and completions declined in September, but both will probably bounce back in October.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Housing Starts decreased to 1.047 Million Annual Rate in September

by Calculated Risk on 10/19/2016 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,047,000. This is 9.0 percent below the revised August estimate of 1,150,000 and is 11.9 percent (±11.9%) below the September 2015 rate of 1,189,000.

Single-family housing starts in September were at a rate of 783,000; this is 8.1 percent above the revised August figure of 724,000. The September rate for units in buildings with five units or more was 250,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,225,000. This is 6.3 percent above the revised August rate of 1,152,000 and is 8.5 percent above the September 2015 estimate of 1,129,000.

Single-family authorizations in September were at a rate of 739,000; this is 0.4 percent above the revised August figure of 736,000. Authorizations of units in buildings with five units or more were at a rate of 449,000 in September.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased significantly in September compared to August. Multi-family starts are down sharply year-over-year.

Multi-family is volatile, and permits are up - so I expect multi-family starts to bounce back in October.

Single-family starts (blue) increased in September, and are up 5.4% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in September were below expectations - due to the decline in multi-family starts - however combined starts for July and August were revised up. I'll have more later ...

MBA: "Mortgage Applications Slightly Increase in Latest Weekly Survey"

by Calculated Risk on 10/19/2016 07:00:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 14, 2016. This week’s results included an adjustment for the Columbus Day holiday.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 13 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since June 2016, 3.73 percent, from 3.68 percent, with points increasing to 0.36 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined. Since rates are up a little recently, refinance activity has declined a little.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "13 percent higher than the same week one year ago".