by Calculated Risk on 8/17/2016 02:08:00 PM

Wednesday, August 17, 2016

FOMC Minutes: "Near-term risks to the domestic outlook had diminished"

From the Fed: Minutes of the Federal Open Market Committee July 26-27, 2016. Excerpts:

With respect to the economic outlook and its implications for monetary policy, members continued to expect that, with gradual adjustments in the stance of monetary policy, economic activity would expand at a moderate pace and labor market indicators would strengthen. Members saw developments during the intermeeting period as reducing near-term uncertainty along two dimensions discussed at the June meeting. The first was about the outlook for the labor market. They agreed that the strong rebound in job gains in June--together with a rise in the labor force participation rate and a decline in the number of individuals who were working part time for economic reasons--suggested that, despite the very soft employment report for May, labor market conditions remained solid and slack had continued to diminish. Many members commented on the somewhat slower average pace of improvement in labor market conditions in recent months. Several of these members observed that the recent pace of job gains remained well above that consistent with stable rates of labor utilization. A couple of members indicated that, in light of their judgment that labor market conditions were at or close to the Committee's objectives, some moderation in employment gains was to be expected. In contrast, several other members expressed concern about the likelihood of a further reduction in the pace of job gains, and it was noted that if that slowing turned out to be persistent, the case for increasing the target range for the federal funds rate in the near term would be less compelling.

A second source of near-term uncertainty that members had discussed at the June meeting pertained to the potential economic and financial market consequences of the U.K. referendum on membership in the EU. At the current meeting, most members pointed to the quick recovery of financial market conditions since the "leave" vote as an encouraging sign of resilience in global financial markets that helped reduce near-term uncertainty about the outlook for the U.S. economy.

While members judged that near-term risks to the domestic outlook had diminished, some noted that the U.K. vote, along with other developments abroad, still imparted significant uncertainty to the medium- to longer-term outlook for foreign economies, with possible consequences for the U.S. outlook. As a result, members agreed to indicate that they would continue to closely monitor global economic and financial developments.

Members continued to expect inflation to remain low in the near term, in part because of earlier declines in energy prices, but most anticipated that inflation would rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipated and the labor market strengthened further. Nonetheless, in light of the current shortfall of inflation from 2 percent, members agreed that they would continue to carefully monitor actual and expected progress toward the Committee's inflation goal.

After assessing the outlook for economic activity, the labor market, and inflation, as well as the risks around that outlook, members decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent at this meeting. Members generally agreed that, before taking another step in removing monetary accommodation, it was prudent to accumulate more data in order to gauge the underlying momentum in the labor market and economic activity. A couple of members preferred also to wait for more evidence that inflation would rise to 2 percent on a sustained basis. Some other members anticipated that economic conditions would soon warrant taking another step in removing policy accommodation. One member preferred to raise the target range for the federal funds rate at the current meeting, citing the easing of financial conditions since the U.K. referendum, the return to trend economic growth, solid job growth, and inflation moving toward 2 percent.

Members again agreed that, in determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee would assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. They noted that this assessment would take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee expected that economic conditions would evolve in a manner that would warrant only gradual increases in the federal funds rate, and that the federal funds rate was likely to remain, for some time, below levels that are expected to prevail in the longer run. However, members emphasized that the actual path of the federal funds rate would depend on the economic outlook as informed by incoming data. In that regard, members judged it appropriate to continue to leave their policy options open and maintain the flexibility to adjust the stance of policy based on incoming information and its implications for the Committee's assessment of the outlook for economic activity, the labor market, and inflation, as well as the risks to the outlook. Most members noted that effective communications from the Committee would help the public understand how monetary policy might respond to incoming data and developments.

emphasis added

AIA: Architecture Billings Index "moderates slightly, remains positive" in July

by Calculated Risk on 8/17/2016 11:25:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index moderates slightly, remains positive

The Architecture Billings Index (ABI) was positive in July for the sixth consecutive month, and tenth out of the last twelve months as demand across all project types continued to increase. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI score was 51.5, down from the mark of 52.6 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.5, down from a reading of 58.6 the previous month.Note that multi-family has picked up again, so we might see another pickup in multi-family starts.

“The uncertainty surrounding the presidential election is causing some funding decisions regarding larger construction projects to be delayed or put on hold for the time being,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “It’s likely that these concerns will persist up until the election, and therefore we would expect higher levels of volatility in the design and construction sector in the months ahead.”

...

• Regional averages: South (56.9), Midwest (50.1), Northeast (49.3), West (49.2)

• Sector index breakdown: multi-family residential (55.2), institutional (50.7), mixed practice (50.5), commercial / industrial (50.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.5 in July, down from 52.6 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

Sacramento Housing in July: Sales down 7%, Active Inventory down 10% YoY

by Calculated Risk on 8/17/2016 09:25:00 AM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In July, total sales were down 6.7% from July 2015, and conventional equity sales were down 4.2% compared to the same month last year.

In July, 4.9% of all resales were distressed sales. This was down from 5.0% last month, and down from 9.1% in July 2015, and the lowest level since Sacramento started tracking distressed sales.

The percentage of REOs was at 2.2% in July, and the percentage of short sales was 2.7%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 9.8% year-over-year (YoY) in June. This was the fifteenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 12.3% of all sales (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 8/17/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 12, 2016.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier to the lowest level since February 2016, but remained 10 percent higher than the same week last year.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.64 percent from 3.65 percent, with points decreasing to 0.31 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "10 percent higher than the same week last year".

Tuesday, August 16, 2016

Comments on July Housing Starts

by Calculated Risk on 8/16/2016 08:59:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, the AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Minutes from the July 26-27, 2016 Meeting.

Earlier: Housing Starts increased to 1.211 Million Annual Rate in July

The housing starts report this morning was above consensus, however there were downward revisions to the prior two months. Still a solid report.

This first graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 6.7% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that still looks about right.

Multi-family starts are down 0.6% year-to-date, and single-family starts are up 10.6% year-to-date.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will probably catch up to starts soon (completions lag starts by about 12 months).

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues ...

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/16/2016 03:47:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.41 million in July, down 2.9% from June’s preliminary pace and down 1.3% from last July’s seasonally-adjusted pace. Unadjusted sales last month should register a significantly steeper YOY decline than seasonally adjusted sales, as there were two fewer business days this July than last July.

Local realtor/MLS data also suggest that existing home listings in aggregate increased modestly last month, and I project that the inventory of existing homes for sale as estimated by the NAR for the end of July will be 2.14 million, up 0.9% from June’s preliminary estimate and down 5.3% from last July. Finally, I project that the NAR’s estimate of the median existing single-family home sales price for July will be up 5.3% from last July’s estimate.

Compared to last July unadjusted home sales last month were down in a wide range of markets across the country, but that is less surprising when one takes into account the significantly lower business day count (two!) this July relative to last July. There were, however, a few notable markets where unadjusted sales last month were sharply lower than a year earlier.

Last month residential home sales in the Portland, Oregon metro area were down 19.6% YOY. While residential listings in July were still slightly down from a year earlier, the increase in listings since February has substantially exceeded the typical seasonal norm.

In the Denver, Colorado metro area residential home sales last month were down 17.6% YOY. And while residential listings remained historically low, listings how increased considerably faster than the seasonal norm since February.

Finally, existing single-family home sales nine-county San Francisco, California Bay area last month were down 16.1% YOY. The California Association of Realtor’s “Unsold Inventory Index” for the SF Bay Area was 2.8 months in July, up from 1.8 months last July.

All three of these markets have seen substantial home prices increases over the past years, as well as historically very low inventory levels. All three markets have also, however, seen YOY declines in sales for at least four straight months.

Key Measures Show Inflation close to 2% in July

by Calculated Risk on 8/16/2016 01:36:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.7% annualized rate) in July. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for July here. Motor fuel was down 43% annualized in July.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was unchanged (-0.5% annualized rate) in July. The CPI less food and energy rose 0.1% (1.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.6%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy also rose 2.2%. Core PCE is for June and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.7% annualized, trimmed-mean CPI was at 1.8% annualized, and core CPI was at 1.1% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are at or above the Fed's target (Core PCE is still below).

Early Look at 2017 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 8/16/2016 10:36:00 AM

The BLS reported this morning:

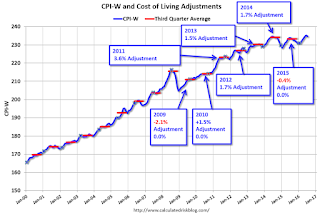

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 0.4 percent over the last 12 months to an index level of 234.789 (1982-84=100).CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2014, the Q3 average of CPI-W was 234.242. In the previous year, 2013, the average in Q3 of CPI-W was 230.327. That gave an increase of 1.7% for COLA for 2015.

• In 2015, the Q3 average of CPI-W was 233.278. That was a decline of 0.4% from 2014, however, by law, the adjustment is never negative so the benefits remained the same this year (in 2016).

Since the previous highest Q3 average was in 2014 (not 2015), at 234.242, we have to compare Q3 this year to two years ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 0.4% year-over-year in July, and although this is very early - we need the data for July, August and September - my current guess is COLA will be slightly positive this year - but COLA could be zero again.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero, so there was no change in the contribution and benefit base for 2016. However if the there is even a small increase in COLA (it will be close this year), the contribution base will be adjusted using the National Average Wage Index (and catch up for last year).

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2015 yet, but wages probably increased again in 2015. If wages increased the same as last year, then the contribution base next year will increase to around $127,000 from the current $118,500.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

Fed: Industrial Production increased 0.7% in July

by Calculated Risk on 8/16/2016 09:22:00 AM

From the Fed: Industrial production and Capacity Utilization

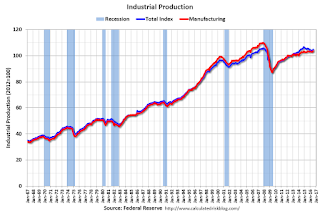

Industrial production rose 0.7 percent in July after moving up 0.4 percent in June. The advance in July was the largest for the index since November 2014. Manufacturing output increased 0.5 percent in July for its largest gain since July 2015. The index for utilities rose 2.1 percent as a result of warmer-than-usual weather in July boosting demand for air conditioning. The output of mining moved up 0.7 percent; the index has increased modestly, on net, over the past three months after having fallen about 17 percent between December 2014 and April 2016. At 104.9 percent of its 2012 average, total industrial production in July was 0.5 percent lower than its year-earlier level. Capacity utilization for the industrial sector increased 0.5 percentage point in July to 75.9 percent, a rate that is 4.1 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.9% is 4.1% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.7% in July to 104.1. This is 20.0% above the recession low, and is at the pre-recession peak.

This was above expectations of a 0.3% increase.

Housing Starts increased to 1.211 Million Annual Rate in July

by Calculated Risk on 8/16/2016 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

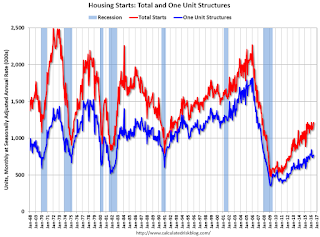

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,211,000. This is 2.1 percent above the revised June estimate of 1,186,000 and is 5.6 percent above the July 2015 rate of 1,147,000.

Single-family housing starts in July were at a rate of 770,000; this is 0.5 percent above the revised June figure of 766,000. The July rate for units in buildings with five units or more was 433,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,152,000. This is 0.1 percent below the revised June rate of 1,153,000, but is 0.9 percent above the July 2015 estimate of 1,142,000.

Single-family authorizations in July were at a rate of 711,000; this is 3.7 percent below the revised June figure of 738,000. Authorizations of units in buildings with five units or more were at a rate of 411,000 in July

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in July compared to June. Multi-family starts are up 13% year-over-year.

Single-family starts (blue) increased in July, and are up 1.3% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in July were above expectations, however combined starts for May and June were revised down. I'll have more later ...