by Calculated Risk on 8/15/2016 08:27:00 PM

Monday, August 15, 2016

Tuesday: Housing Starts, CPI, Industrial Production

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2016 is 3.5 percent on August 12, down from 3.7 percent on August 9.From the NY Fed Nowcasting Report

The FRBNY Staff Nowcast stands at 2.4% for 2016:Q3Tuesday:

• At 8:30 AM ET, Housing Starts for July. Total housing starts increased to 1.189 million (SAAR) in June. Single family starts increased to 778 thousand SAAR in June. The consensus for 1.180 million, down from the June rate.

• Also at 8:30 AM, The Consumer Price Index for July from the BLS. The consensus is for a no change in CPI, and a 0.2% increase in core CPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 75.5%.

Update: Predicting the Next Recession

by Calculated Risk on 8/15/2016 04:12:00 PM

CR August 2016 Update: In 2013, I wrote a post "Predicting the Next Recession". I repeated the post in January 2015 (and last summer and early this year) because of all the recession calls. Late last year, the recession callers were out in force - arguing the problems in China, combined with the impact on oil producers of lower oil prices (and defaults by energy companies) - would lead to a global recession and drag the US into recession. I didn't think so - and I was correct.

I've added a few updates in italics by year. Most of the text is from January 2013.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR 2015 Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

[CR August 2016 Update: Now it has been three and a half years! And yes, ECRI has admitted their recession calls were incorrect. Not sure about the rest of the recession callers.]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

[CR August 2016 Update: 2013 was a little better than I expected, but still sluggish. 2014 and 2015 saw some pickup in growth, but 2016 was sluggish in the first half.]

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

[CR 2016 Update: The recent recession calls are mostly based on exogenous events: the problems in China and in commodity based economies (especially oil based). There will be some spillover to the US such as fewer exports (and an impact on oil producing regions in the US), but unless there is a related financial crisis, I think the spillover will be insufficient to cause a recession in the US.]

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR 2016 Update: Most of the poor policy choices in the U.S. are behind us. Austerity hurt the recovery, but austerity appears over at the state, local and Federal levels. It is possible the Fed could tighten too quickly. ]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR 2016 Update: This was written in 2013 - and my prediction for no "recession for a few years" was correct. This still seems correct today, so no recession in the immediate future (not in 2016 or the first half of 2017). Note that all 2017 forecasts assume Ms. Clinton will be the next President.]

FNC: Residential Property Values increased 4.8% year-over-year in June

by Calculated Risk on 8/15/2016 12:41:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their June 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 1.1% from May to June (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 1.3% (NSA), the 20-MSA RPI increased 1.2%, and the 30-MSA RPI increased 1.1% in June. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 10.7% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through June 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The June Case-Shiller index will be released on Tuesday, August 30th.

NAHB: Builder Confidence increases to 60 in August

by Calculated Risk on 8/15/2016 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 60 in August, up from 58 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Two Points in August

Builder confidence in the market for newly constructed single-family homes in August rose two points to 60 from a downwardly revised reading of 58 in July on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“New construction and new home sales are on the rise in most areas of the country, and this is helping to boost builder sentiment,” said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill.

“Builder confidence remains solid in the aftermath of weak GDP reports that were offset by positive job growth in July,” said NAHB Chief Economist Robert Dietz. “Historically low mortgage rates, increased household formations and a firming labor market will help keep housing on an upward path during the rest of the year.”

...

Two of the three HMI components posted gains in August. The component gauging current sales conditions rose two points to 65, while the index charting sales expectations in the next six months increased one point to 67. The component measuring buyer traffic fell one point to 44.

Looking at the three-month moving averages for regional HMI scores, the South registered a two-point uptick to 63, the Northeast rose two points to 41 while the West was unchanged at 69. The Midwest dropped two points to 55.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast of 60, And this is another solid reading.

NY Fed: August "General business conditions index fell five points to -4.2"

by Calculated Risk on 8/15/2016 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity in New York State declined slightly this month, according to firms responding to the August 2016 Empire State Manufacturing Survey. The headline general business conditions index fell five points to -4.2.This was below the consensus forecast of 2.5, and suggests manufacturing contracted in the NY region in August.

...

The employment index climbed three points to -1.0, indicating that employment levels were little changed, and the average workweek index rose to 2.1, pointing to a slight increase in hours worked.

...

Indexes for the six-month outlook revealed that respondents remained optimistic about future conditions, though to a lesser extent than in July. The index for future business conditions fell for a second consecutive month, dropping six points to 23.7.

Sunday, August 14, 2016

WTI Oil Prices UP Year-over-year

by Calculated Risk on 8/14/2016 06:47:00 PM

Weekend:

• Schedule for Week of Aug 14, 2016

Monday:

• At 8:30 AM ET, the New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 2.5, up from 0.6.

• At 10:00 AM, the August NAHB homebuilder survey. The consensus is for a reading of 60, up from 59 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $44.57 per barrel and Brent at $46.97 per barrel. A year ago, WTI was at $42, and Brent was at $48 - so prices are mostly unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.12 per gallon (down about $0.55 per gallon from a year ago).

This graph shows the year-over-year change in WTI based on data from the EIA.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

WTI oil prices are now up YoY! (Brent is still down YoY)

According to Bloomberg, WTI is at $44.57 per barrel today, and Brent is at $46.97

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Unless prices fall sharply again, oil prices - and eventually gasoline prices - will be up year-over-year and no longer a drag on CPI.

Hotels: Occupancy Rate on Track to be 2nd Best Year

by Calculated Risk on 8/14/2016 10:55:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 6 August

The U.S. hotel industry reported mixed results in the three key performance metrics during the week of 31 July through 6 August 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy decreased 1.6% to 75.6%. However, average daily rate was up 2.7% to US$127.69, and revenue per available room increased 1.1% to US$96.59.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

Also 2016 is tracking just ahead of 2000 (the previous 2nd best year).

This is the peak of the Summer travel period, and the occupancy rate will decline seasonally over the next month.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, August 13, 2016

Schedule for Week of Aug 14, 2016

by Calculated Risk on 8/13/2016 08:09:00 AM

The key economic reports this week are July housing starts and the July Consumer Price Index (CPI).

For manufacturing, July industrial production, and the August New York and Philly Fed manufacturing surveys, will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 2.5, up from 0.6.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 60, up from 59 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts increased to 1.189 million (SAAR) in June. Single family starts increased to 778 thousand SAAR in June.

The consensus for 1.180 million, down from the June rate.

8:30 AM: The Consumer Price Index for July from the BLS. The consensus is for a no change in CPI, and a 0.2% increase in core CPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 75.5%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: the FOMC Minutes from the July 26-27, 2016 Meeting.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, down from 266 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 2.0, up from -2.9.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2016

Friday, August 12, 2016

"Mortgage Rates Drop Back to 1-Month Lows"

by Calculated Risk on 8/12/2016 06:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drop Back to 1-Month Lows

Just a day after bouncing firmly higher from the lowest levels in a month, mortgage rates are right back down to the bottom of the recent range. For some lenders, there have been one or two days with lower rates over the past, but for most, today is the best in exactly one month. Incidentally, that also puts rates fairly close to the lowest levels in 3 years seen in the immediate wake of the UK vote to leave the European Union (Brexit).Here is a table from Mortgage News Daily:

For flawless scenarios, 3.375% is now a more prevalent quote than 3.5% on conventional 30yr fixed loans. At current levels, the most aggressive fringe of the marketplace is beginning to offer 3.25% again--a rate that enjoyed a brief spat of popularity in early July. It should also be noted that government rates (FHA/VA/USDA) have been shining of late, with several lenders offering 30yr rates near or under 3.0%, and the vast majority able to do at least 3.25%. But again, don't expect to see these rates without a perfect scenario (in terms of credit score, property type, loan purpose, Loan-to-value, etc).

emphasis added

The Housing Bottom and Comparing Recoveries

by Calculated Risk on 8/12/2016 12:44:00 PM

In early 2012 I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Here is an update to that graph.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the most recent housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

In 2012, I argued that the current housing recovery would continue to be sluggish relative to previous housing recoveries. I suggested there were several reasons for this. From my 2012 post:

First, the causes of this downturn were different than in most cycles. Usually housing down cycles are related to the Fed fighting inflation, and then housing comes back strongly when the Fed starts to ease again. But in this cycle, the housing downturn was the result of the bursting of the housing bubble and the financial crisis.That was correct, and the recovery continued to be sluggish.

As everyone now knows (or should know by now), recoveries following a financial crisis are sluggish. This is especially true for housing as all the excesses have to be worked down before the recovery will become robust. In some areas of the country, housing is starting to recover, and in other areas there are still a large number of excess vacant houses (although the number is being reduced just about everywhere).

There are also a large number of houses in the foreclosure process, especially in certain states with a judicial foreclosure process (like New Jersey). This means there will be competition for homebuilders from foreclosures for an extended period in these areas.

Contrast this to a typical recovery were most areas recover at the same time.

There are other factors too. Employment gains are sluggish following a financial crisis, there is still quite a bit of consumer deleveraging ongoing, and lending standards are still tight (in a typical recovery, lending standards are loosened pretty quickly).

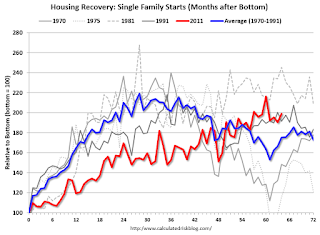

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.For the first several years, the current recovery (red) under performed previous recoveries.

Note: This doesn't even consider the depth of the current cycle (the deepest decline in housing starts since the Census Bureau started collecting data).

In 2012 I wrote:

With excess inventory, more foreclosures (especially in certain states), more consumer deleveraging, and tight lending standards, I expect this recovery to remains sluggish. The good news is - barring a significant policy mistake - this housing recovery will probably continue for several years (last for more years than usual).The current recovery (red) started slowly, but is still ongoing!