by Calculated Risk on 7/27/2016 10:04:00 AM

Wednesday, July 27, 2016

NAR: Pending Home Sales Index increased Slightly in June, up 1.0% year-over-year

From the NAR: Pending Home Sales Marginally Rise in June

Pending home sales were mostly unmoved in June, but did creep slightly higher as supply and affordability constraints prevented a bigger boost in activity from mortgage rates that lingered near all-time lows through most of the month, according to the National Association of Realtors®. Increases in the Northeast and Midwest were offset by declines in the South and West.This was below expectations of a 1.3% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched 0.2 percent to 111.0 in June from 110.8 in May and is now 1.0 percent higher than June 2015 (109.9). With last month's minor improvement, the index is now at its second highest reading over the past 12 months, but is noticeably down from this year's peak level in April (115.0).

...

The PHSI in the Northeast advanced 3.2 percent to 96.0 in June, and is now 1.7 percent above a year ago. In the Midwest the index increased 0.8 percent to 108.9 in June, and is now 1.6 percent higher than June 2015.

Pending home sales in the South decreased modestly (0.6 percent) to an index of 125.9 in June but are still 1.8 percent higher than last June. The index in the West declined 1.3 percent in June to 101.3, and is now 1.8 percent below a year ago.

emphasis added

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 7/27/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 11.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 22, 2016.

... The Refinance Index decreased 15 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier to the lowest level since February 2016. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.69 percent from 3.65 percent, with points unchanged at 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "12 percent higher than the same week one year ago".

Tuesday, July 26, 2016

Wednesday: FOMC Announcement, Pending Home Sales, Durable Goods

by Calculated Risk on 7/26/2016 06:47:00 PM

Here was my FOMC preview: FOMC Preview: No Rate Hike, Possibly Preparing for September Rate Hike

From Merrill Lynch on the FOMC:

The July meeting of the Federal Open Market Committee (FOMC) is unlikely to result in any policy changes by the Fed, in our view. In fact, we do not expect the Fed to give any signals about September or subsequent meetings, maintaining its data dependent approach to a gradual hiking cycle. Markets will likely be looking for any clues of how this week's meeting will set up Fed policy decisions at subsequent meetings this year. Our base case remains that the Fed will next hike in December, but a September move cannot be completely ruled out. We believe the bar to hike then, however, is relatively high: the US activity data would need to remain solid, inflation indicators generally would need to point higher, and global risks would have to settle down to a dull rumble.Wednesday:

Our base case of a more optimistic tone to the July statement, given better data on net, should lead at most to a modest increase in market-implied probabilities of hikes this year. More substantive language changes are unlikely, in our view, but would be more market moving if they occur. Perhaps the biggest risk to market pricing will come not from this week's statement, but from the minutes in three weeks' time. Recall the sharp market reaction when the April minutes revealed significant support on the FOMC for a possible June rate hike. There is the potential for a similarly surprising amount of FOMC interest in a September hike this time around.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 1.3% decrease in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 1.3% increase in the index.

• At 2:00 PM, FOMC Meeting Announcement. No change in policy is expected at this meeting.

Real Prices and Price-to-Rent Ratio in May

by Calculated Risk on 7/26/2016 03:25:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.0% year-over-year in May

The year-over-year increase in prices is mostly moving sideways now around 5%. In May, the index was up 5.0% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 2.8% below the bubble peak. However, in real terms, the National index is still about 17.1% below the bubble peak.

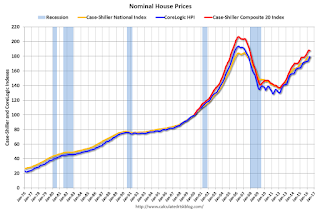

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to November 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

CPI less Shelter has declined over the last two years pushing up real house prices.

In real terms, the National index is back to January 2004 levels, the Composite 20 index is back to October 2003, and the CoreLogic index back to November 2003.

In real terms, house prices are back to late 2003 levels.

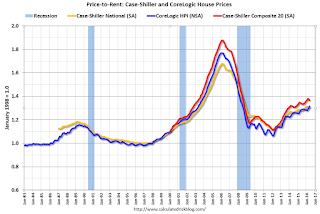

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to July 2003 levels, the Composite 20 index is back to June 2003 levels, and the CoreLogic index is back toMay 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

A few Comments on June New Home Sales

by Calculated Risk on 7/26/2016 11:52:00 AM

The new home sales report for June was strong at 592,000 on a seasonally adjusted annual rate basis (SAAR) - the highest since early 2008 - and combined sales for March, April and May were revised up by 22 thousand SAAR.

Sales were up 25.4% year-over-year (YoY) compared to June 2015. And sales are up 10.1% year-to-date compared to the same period in 2015.

Earlier: New Home Sales increased to 592,000 Annual Rate in June, Highest since 2008.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 10.1% year-over-year, mostly because of the solid growth in Q2.

There will probably be solid year-over-year growth in Q3 this year too.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 592,000 Annual Rate in June, Highest since 2008

by Calculated Risk on 7/26/2016 10:00:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 592 thousand.

The previous three months were revised up by a total of 22 thousand (SAAR).

"Sales of new single-family houses in June 2016 were at a seasonally adjusted annual rate of 592,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.5 percent above the revised May rate of 572,000 and is 25.4 percent above the June 2015 estimate of 472,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in June to 4.9 months.

The months of supply decreased in June to 4.9 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of June was 244,000. This represents a supply of 4.9 months at the current sales rate."

On inventory, according to the Census Bureau:

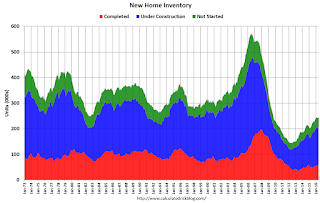

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2016 (red column), 54 thousand new homes were sold (NSA). Last year 44 thousand homes were sold in June.

The all time high for June was 115 thousand in 2005, and the all time low for May was 28 thousand in June 2010 and June 2011.

This was above expectations of 562,000 sales SAAR in June, and prior months were revised up. A solid report. I'll have more later today.

Case-Shiller: National House Price Index increased 5.0% year-over-year in May

by Calculated Risk on 7/26/2016 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Increases Ease in May According to the S&P Corelogic Case-Shiller Indices

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.0% annual gain in May, the same as the prior month. The 10-City Composite posted a 4.4% annual increase, down from 4.7% the previous month. The 20-City Composite reported a year-over-year gain of 5.2%, down from 5.4% in April.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 1.2% in May. The 10-City Composite recorded a 0.8% month-over-month increase, while the 20-City Composite posted a 0.9% increase in May. After seasonal adjustment, the National Index recorded a 0.2% month-over month increase, the 10-City Composite posted a 0.2% decrease, and the 20-City Composite reported a 0.1% month-over-month decrease. After seasonal adjustment, 12 cities saw prices rise, two cities were unchanged, and six cities experienced negative monthly prices changes.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.9% from the peak, and down 0.2% in May (SA).

The Composite 20 index is off 9.0% from the peak, and down 0.1% (SA) in May.

The National index is off 2.8% from the peak, and up 0.2% (SA) in May. The National index is up 31.3% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.4% compared to May 2015.

The Composite 20 SA is up 5.2% year-over-year..

The National index SA is up 5.0% year-over-year.

Note: According to the data, prices increased in 12 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Black Knight's First Look at June Mortgage Data

by Calculated Risk on 7/26/2016 08:21:00 AM

From Black Knight: Black Knight Financial Services’ First Look at June Mortgage Data: Foreclosure Starts Up for Second Consecutive Month; Prepays Rise on Historically Low Rates

• Despite June’s increase, first-time foreclosure starts in Q2 2016 were at their lowest level in over 16 yearsAccording to Black Knight's First Look report for June, the percent of loans delinquent increased 1.3% in June compared to May, and declined 10.0% year-over-year.

• Prepayment speeds (historically a good indicator of refinance activity) jumped to a 12-month high, mirroring an overall rise in refinance activity driven by historically low interest rates

• Early-stage delinquencies saw a seasonal increase in June, while 90-day delinquencies and foreclosure inventories continued to decline

The percent of loans in the foreclosure process declined 2.6% in June and were down 29.4% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.31% in June, up from 4.25% in May.

The percent of loans in the foreclosure process declined in June to 1.10%.

The number of delinquent properties, but not in foreclosure, is down 237,000 properties year-over-year, and the number of properties in the foreclosure process is down 231,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for June in early August.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2016 | May 2016 | June 2015 | June 2014 | |

| Delinquent | 4.31% | 4.25% | 4.79% | 5.71% |

| In Foreclosure | 1.10% | 1.13% | 1.56% | 2.00% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,178,000 | 2,153,000 | 2,415,000 | 2,876,000 |

| Number of properties in foreclosure pre-sale inventory: | 558,000 | 574,000 | 789,000 | 1,006,000 |

| Total Properties | 2,736,000 | 2,727,000 | 3,204,000 | 3,882,000 |

Monday, July 25, 2016

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 7/25/2016 08:54:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices. The consensus is for a 5.6% year-over-year increase in the Comp 20 index for May. The Zillow forecast is for the National Index to increase 5.0% year-over-year in May.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for an increase in sales to 562 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 551 thousand in May.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for July.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Sideways Slide Ahead of Fed

Mortgage rates were unchanged again today, making three out of the past 4 days where rates haven't budged and 6 out of the past 7 days where rates moved by 0.01% or less, on average. That's an exceptionally narrow range, and it speaks to indecision in financial markets ahead of this week's major central bank announcements. That's where the Fed and the Bank of Japan give the official word on their monetary policy, which includes setting short term rates and spelling out various stimulus efforts.Here is a table from Mortgage News Daily:

The Fed isn't expected to hike rates this week, but chances increase as the year progresses. As such, it wouldn't be a surprise to see this week's announcement telegraph their intentions for the coming announcements. Although the Fed's policy rate does not directly control mortgage rates, there is typically upward pressure on all interest rates if Fed rate hike expectations increase.

In terms of specific levels, the average conventional 30yr fixed quote moved up to 3.5% for top tier scenarios late last week. Quite a few lenders are still quoting 3.375%, while just a few are up to 3.625%. Keep in mind, "top tier" means there are absolutely no "hits" to loan pricing (i.e. 25% equity, 760+ credit score, etc). Most loans in the real world have some hits (or adjustments to the 'perfect' pricing), meaning that a lot of 3.625-3.75% rates are being quoted. We track the top tier rate because that's the easiest way to capture the true day-over-day movement (especially considering the effect of certain adjustments has varied over time, and to some extent, between lenders).

emphasis added

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in June

by Calculated Risk on 7/25/2016 02:50:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in June.

On distressed: Total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are down in all of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| June- 2016 | June- 2015 | June- 2016 | June- 2015 | June- 2016 | June- 2015 | June- 2016 | June- 2015 | |

| Las Vegas | 4.4% | 6.7% | 5.9% | 7.6% | 10.3% | 14.3% | 27.0% | 28.4% |

| Reno** | 3.0% | 5.0% | 2.0% | 3.0% | 5.0% | 8.0% | ||

| Phoenix | 1.6% | 2.8% | 1.9% | 3.6% | 3.4% | 6.4% | 20.9% | 23.1% |

| Sacramento | 2.8% | 5.8% | 2.6% | 4.6% | 5.4% | 10.4% | 16.1% | 17.8% |

| Minneapolis | 1.2% | 2.0% | 3.8% | 5.7% | 5.0% | 7.7% | 10.9% | 12.1% |

| Mid-Atlantic | 2.7% | 3.1% | 8.1% | 8.7% | 10.8% | 11.7% | 14.4% | 15.2% |

| Florida SF | 2.2% | 3.5% | 8.0% | 16.6% | 10.2% | 20.1% | 27.2% | 33.3% |

| Florida C/TH | 1.4% | 2.4% | 7.1% | 14.8% | 8.6% | 17.2% | 54.5% | 60.9% |

| Miami MSA SF | 3.2% | 6.0% | 9.5% | 17.2% | 12.7% | 23.3% | 28.8% | 34.8% |

| Miami MSA C/TH | 1.8% | 2.9% | 10.3% | 19.3% | 12.1% | 22.2% | 58.8% | 62.9% |

| So. California* | 5.3% | 6.9% | ||||||

| Bay Area CA* | 2.2% | 4.3% | ||||||

| Chicago (city) | 9.8% | 12.4% | ||||||

| Spokane | 7.6% | 10.8% | ||||||

| Rhode Island | 9.2% | 10.4% | ||||||

| Northeast Florida | 15.1% | 25.4% | ||||||

| Orlando | 27.9% | 35.8% | ||||||

| Tucson | 23.1% | 26.5% | ||||||

| Toledo | 23.2% | 27.0% | ||||||

| S.C. Wisconsin | 14.1% | 14.3% | ||||||

| Knoxville | 18.9% | 18.9% | ||||||

| Peoria | 15.6% | 16.1% | ||||||

| Georgia*** | 18.1% | 20.3% | ||||||

| Omaha | 15.1% | 14.6% | ||||||

| Pensacola | 25.3% | 31.6% | ||||||

| Richmond VA | 5.6% | 7.6% | 13.5% | 13.8% | ||||

| Memphis | 9.0% | 11.4% | ||||||

| Springfield IL** | 4.7% | 5.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||