by Calculated Risk on 7/22/2016 10:13:00 AM

Friday, July 22, 2016

BLS: Unemployment Rates stable in 43 states in June

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were significantly higher in June in 6 states, lower in 1 state, and stable in 43 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today.

...

South Dakota and New Hampshire had the lowest jobless rates in June, 2.7 percent and 2.8 percent, respectively. Alaska had the highest unemployment rate, 6.7 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.7%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only seven states and D.C are at or above 6% (dark blue). The states at or above 6% are Alaska, Nevada, Illinois, Louisiana, New Mexico, Alabama and West Virginia.

Thursday, July 21, 2016

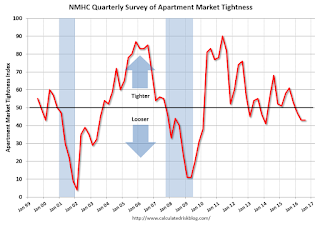

NMHC: Apartment Market Tightness Index remained negative in July Survey

by Calculated Risk on 7/21/2016 05:44:00 PM

From the National Multifamily Housing Council (NMHC): Apartment Markets Remain Mixed According to the Latest NMHC Quarterly Survey

Apartment markets continued to show mixed conditions in the July 2016 National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. For the third quarter in a row, the Market Tightness (43) and Equity Financing (44) Indexes remained below the breakeven level of 50. Conversely, the Debt Financing Index came in at 62 and the Sales Volume Index landed right at 50.

“Apartment markets remain strong, but the surge of new apartment construction is starting to shift the supply-demand balance, particularly in the market for upscale apartments,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Given that most new supply is class A, we’re not seeing the same shift in class B and C apartments. In addition, some weakness in the Market Tightness Index may be just seasonality.”

For the third quarter in a row, the Market Tightness Index, which was unchanged at 43, showed supply a bit stronger than demand. Almost one-third of respondents (31 percent) reported looser conditions than three months ago. At the other end, 18 percent noted tighter conditions, while over half (51 percent) reported no change.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the third consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to slow (the vacancy rate is generally rising too).

A Few Comments on June Existing Home Sales

by Calculated Risk on 7/21/2016 03:35:00 PM

Earlier: Existing Home Sales increased in June to 5.57 million SAAR

For existing homes, inventory is still key. I expected some increase in inventory last year, but that didn't happened. Inventory is still very low and falling year-over-year (down 5.8% year-over-year in June). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

Also, the NAR reported total sales were up 3.0% from June 2015, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales — foreclosures and short sales — were 6 percent of sales in June, unchanged from May and down from 8 percent a year ago. Four percent of June sales were foreclosures (lowest since NAR began tracking in October 2008) and 2 percent were short sales.Last year in June the NAR reported that 8% of sales were distressed sales.

A rough estimate: Sales in June 2015 were reported at 5.41 million SAAR with 8% distressed. That gives 430 thousand distressed (annual rate), and 4.98 million equity / non-distressed. In June 2016, sales were 5.57 million SAAR, with 6% distressed. That gives 330 thousand distressed - a decline of about 23% from June 2015 - and 5.24 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 5%.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in June (red column) were the highest for June since 2006 (NSA).

This is a solid first half for 2016.

Earlier: Philly Fed Manufacturing Survey showed Contraction in July

by Calculated Risk on 7/21/2016 12:57:00 PM

From the Philly Fed: July 2016 Manufacturing Business Outlook Survey

Manufacturing activity in the region fell slightly in July, according to firms responding to this month’s Manufacturing Business Outlook Survey. Although the indicator for current general activity turned negative, indicators for new orders and shipments were positive. Employment was flat at the reporting firms this month.This was below the consensus forecast of a reading of 5.0 for July.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, fell from 4.7 in June to -2.9 this month. For nine of the past 11 months, this diffusion index has been negative ...

...

The survey’s broad indicator of future growth moved slightly higher this month: The diffusion index for future general activity increased 4 points to 33.7, which is close to its average of 35.9 during the past five years

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys was slightly negative in July (yellow). This suggests the ISM survey will probably indicate slower expansion this month.

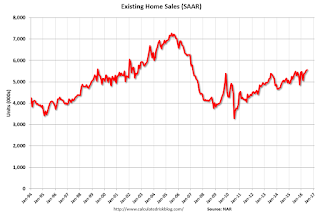

Existing Home Sales increased in June to 5.57 million SAAR

by Calculated Risk on 7/21/2016 10:11:00 AM

From the NAR: Existing-Home Sales Ascend Again in June, First-time Buyers Provide Spark

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, climbed 1.1 percent to a seasonally adjusted annual rate of 5.57 million in June from a downwardly revised 5.51 million in May. After last month's gain, sales are now up 3.0 percent from June 2015 (5.41 million) and remain at their highest annual pace since February 2007 (5.79 million). ...

Total housing inventory at the end of June dipped 0.9 percent to 2.12 million existing homes available for sale, and is now 5.8 percent lower than a year ago (2.25 million). Unsold inventory is at a 4.6-month supply at the current sales pace, which is down from 4.7 months in May.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.57 million SAAR) were 1.1% higher than last month, and were 3.0% above the June 2015 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.12 million in June from 2.14 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.12 million in June from 2.14 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 5.8% year-over-year in June compared to June 2015.

Inventory decreased 5.8% year-over-year in June compared to June 2015. Months of supply was at 4.6 months in June.

This was above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims declined to 253,000

by Calculated Risk on 7/21/2016 08:33:00 AM

The DOL reported:

In the week ending July 16, the advance figure for seasonally adjusted initial claims was 253,000, a decrease of 1,000 from the previous week's unrevised level of 254,000. The 4-week moving average was 257,750, a decrease of 1,250 from the previous week's unrevised average of 259,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 72 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 257,750.

This was lower than the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, July 20, 2016

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg Survey, FHFA House Price Index

by Calculated Risk on 7/20/2016 07:16:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 254 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 5.0, up from 4.7.

• Also at 8:30 AM, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 9:00 AM, FHFA House Price Index for May 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.48 million SAAR, down from 5.53 million in May. Housing economist Tom Lawler estimates the National Association of Realtors will report sales at 5.62 million SAAR in June.

CoreLogic: Orange County Median Home Prices Hit New Record

by Calculated Risk on 7/20/2016 12:47:00 PM

From Jeff Collins at the O.C. Register: $657,500: O.C. median home price hits record

The median price of an Orange County home – or the price at the midpoint of all sales – was $657,500, real estate data firm CoreLogic reported Tuesday. That’s up $29,000, or 4.6 percent, in a year and $6,000 in a month.This brings up a few important points that I've mentioned before ...

...

The previous peak of $645,000, reached in June 2007, is equivalent to $750,000 in today’s dollars – or $92,000 higher than June’s median.

1. This is the median price - not a repeat sales index - and the median price can be impacted by the mix of homes sold (not as useful as a repeat sales index).

2. As Collins notes in the article, these are nominal prices. When adjusted for inflation (real prices), prices are still 14% below the bubble peak.

3. This is not a bubble. A bubble requires both excess appreciation and speculation, and there is a little evidence of speculation - these are qualified buyers who will not default if prices decline (unlike many buyers during the bubble).

4. Note that the central / coastal areas are closer to the previous peak than the outlying areas. This is the typical pattern; the price increases start in the central / coastal areas, and then move inland as the cycle matures. Plus the inland areas saw the most speculation during the bubble - especially using subprime loans - and it will take longer for prices to reach a new peak.

AIA: Architecture Billings Index "remains on solid footing" in June

by Calculated Risk on 7/20/2016 09:55:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index remains on solid footing

Buoyed by increasing levels of demand across all project types, the Architecture Billings Index (ABI) was positive in June for the fifth consecutive month. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 52.6, down from the mark of 53.1 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.6, down from a reading of 60.1 the previous month.Note that multi-family has picked up again, so we might see another pickup in multi-family starts.

“Demand for residential projects has surged this year, greatly exceeding the pace set in 2015. This suggests strong future growth for housing in the coming year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While we expect to see momentum continue for the overall design and construction industry in the months ahead, the fact that the value of design contracts dipped into negative territory in June for the first time in more than two years is something of a concern.”

...

• Regional averages: South (55.5), West (54.1), Northeast (51.8), Midwest (48.2)

• Sector index breakdown: multi-family residential (57.9), institutional (52.7), mixed practice (51.0), commercial / industrial (50.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.6 in June, down from 53.1 in May. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 7/20/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 15, 2016. The prior week’s results included an adjustment for the July 4th holiday.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 23 percent compared with the previous week and was 16 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.65 percent from 3.60 percent, with points unchanged at 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

If refinance mortgage rates fell a little further, we might see a significant pickup in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "16 percent higher than the same week one year ago".