by Calculated Risk on 5/19/2016 08:33:00 AM

Thursday, May 19, 2016

Weekly Initial Unemployment Claims decrease to 278,000

The DOL reported:

In the week ending May 14, the advance figure for seasonally adjusted initial claims was 278,000, a decrease of 16,000 from the previous week's unrevised level of 294,000. The 4-week moving average was 275,750, an increase of 7,500 from the previous week's unrevised average of 268,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 63 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 275,750.

This was close to the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, May 18, 2016

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 5/18/2016 05:30:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 294 thousand the previous week.

• Also at 8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 3.0, up from -1.6.

• Also at 8:30 AM, Chicago Fed National Activity Index for April. This is a composite index of other data.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Spike to 6-Week Highs After Fed Minutes

Mortgage rates skyrocketed today, relative to their recent average daily movement, following the release of the Minutes from the most recent Fed meeting. At the time of the Fed's last policy announcement at the end of April, financial markets were nervous that the Fed would more firmly indicate their intention to hike at the June meeting. When that announcement had no such clues, markets breathed a sigh of relief and rates moved steadily lower in the following weeks

...

Long story short, the Fed is leaving it's June rate hike options open. The Fed rate doesn't directly dictate mortgage rates, but mortgage rates do tend to reflect future expectations of the Fed's rate hike path. Today ended up being the biggest single day jump in rates since early February. Almost any lender will be quoting conventional 30yr fixed rates an eighth of a point higher than they were yesterday, with the most prevalent quote moving back up to 3.75% for the first time this month.

emphasis added

FOMC Minutes: "Most participants judged" that June rate hike "appropriate" based on data

by Calculated Risk on 5/18/2016 02:00:00 PM

The FOMC believes that market participants are underestimating the likelihood of a rate hike in June.

From the Fed: Minutes of the Federal Open Market Committee, April 26-27, 2016 . Excerpts:

Participants discussed whether their current assessments of economic conditions and the medium-term outlook warranted increasing the target range for the federal funds rate at this meeting. Participants agreed that incoming indicators regarding labor market developments continued to be encouraging. They generally concurred that data releases during the intermeeting period on components of private domestic demand had been disappointing, but most participants judged that the slowdown in growth of domestic spending would be temporary, citing possible measurement problems and other transitory factors. Financial market conditions continued to improve, providing support to aggregate demand and suggesting that market participants saw some reduction in downside risks to the outlook: Equity prices rose further, credit spreads declined somewhat, and the dollar depreciated over the intermeeting period. Taking these developments into account, participants generally judged that the medium-term outlook for economic activity and the labor market had not changed appreciably since the previous meeting. Furthermore, most participants continued to expect that, with labor markets continuing to strengthen, the dollar no longer appreciating, and energy prices apparently having bottomed out, inflation would move up to the Committee's 2 percent objective in the medium run.

Still, with 12-month PCE inflation continuing to run below the Committee's 2 percent objective, a number of participants judged that it would be appropriate to proceed cautiously in removing policy accommodation. Some participants pointed to the risk that the recent weak data on domestic spending could reflect a loss of momentum in the economy that might hinder further gains in the labor market and raise the likelihood that inflation could fail to increase as expected. Accordingly, these participants believed that it would be important to evaluate whether incoming information was consistent with their expectation that economic growth would pick up and thus support continued improvement in the labor market. In addition, a number of participants judged that the risks to the outlook for inflation remained tilted to the downside in light of low readings on measures of inflation compensation and the fall over the past year in some survey measures of longer-term inflation expectations. Also, many participants noted that downside risks emanating from developments abroad, while reduced, still warranted close monitoring. For these reasons, participants generally saw maintaining the target range for the federal funds rate at 1/4 to 1/2 percent at this meeting and continuing to assess developments carefully as consistent with setting policy in a data-dependent manner and as leaving open the possibility of an increase in the federal funds rate at the June FOMC meeting.

Some participants saw limited costs to maintaining a patient posture at this meeting but noted the risks--including potential risks to financial stability--of waiting too long to resume the process of removing policy accommodation, especially given the lags with which monetary policy affects the economy. A couple of participants were concerned that further postponement of action to raise the federal funds rate might confuse the public about the economic considerations that influence the Committee's policy decisions and potentially erode the Committee's credibility.

A few participants judged it appropriate to increase the target range for the federal funds rate at this meeting, citing their assessments that downside risks associated with global economic and financial developments had diminished substantially since early this year, that labor market conditions were consistent with the Committee's maximum-employment objective, and that inflation was likely to rise this year toward the Committee's 2 percent objective. Two participants noted that several standard policy benchmarks, such as a number of interest rate rules and some measures of the equilibrium real interest rate, continued to imply values for the federal funds rate well above the current target range. Such large and persistent deviations of the federal funds rate from these benchmarks, in their view, posed a risk that the removal of policy accommodation was proceeding too slowly and that the Committee might, in the future, find it necessary to raise the federal funds rate quickly to combat inflation pressures, potentially unduly disrupting economic or financial activity. Overly accommodative policy could also induce imprudent risk-taking in financial markets, posing additional risks to achieving the Committee's goals in the future.

Participants agreed that their ongoing assessments of the data and other incoming information, as well as the implications for the outlook, would determine the timing and pace of future adjustments to the stance of monetary policy. Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labor market conditions continuing to strengthen, and inflation making progress toward the Committee's 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June. Participants expressed a range of views about the likelihood that incoming information would make it appropriate to adjust the stance of policy at the time of the next meeting. Several participants were concerned that the incoming information might not provide sufficiently clear signals to determine by mid-June whether an increase in the target range for the federal funds rate would be warranted. Some participants expressed more confidence that incoming data would prove broadly consistent with economic conditions that would make an increase in the target range in June appropriate. Some participants were concerned that market participants may not have properly assessed the likelihood of an increase in the target range at the June meeting, and they emphasized the importance of communicating clearly over the intermeeting period how the Committee intends to respond to economic and financial developments.

emphasis added

AIA: "Architecture Billings Index Shows Continued Modest Growth"

by Calculated Risk on 5/18/2016 09:39:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Shows Continued Modest Growth

After beginning the year with a decline, the Architecture Billings Index has posted three consecutive months of increasing demand for design activity at architecture firms. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.9, down from a reading of 58.1 the previous month.

“Architects continue to report a wide range of business conditions, with unusually high variation in design activity across the major building categories,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “The strong growth in design contracts – the strongest score for this indicator since last summer -- certainly suggests that firms will be reporting growth in billings over the next several months.”

...

• Regional averages: South (52.2), Northeast (51.5), West (50.8), Midwest (50.8)

• Sector index breakdown: multi-family residential (53.7), commercial / industrial (52.0), mixed practice (50.0), institutional (49.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.6 in April, down from 51.9 in March. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for most of 2015 - suggesting a slowdown or less growth for apartments - but has turned around and been positive for the last seven months - so there might be another pickup in multi-family starts.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2016.

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

by Calculated Risk on 5/18/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 13, 2016.

...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier to the lowest level since February 2016. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 3.82 percent, with points unchanged at 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate was unchanged from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity increased a little this year when rates declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 12% higher than a year ago.

Tuesday, May 17, 2016

Wednesday: FOMC Minutes

by Calculated Risk on 5/17/2016 06:54:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, the Fed will release the FOMC Minutes for the meeting of April 26-27, 2016

From Tim Duy: Fed Officials Come Looking For A Fight

[A] non-trivial contingent of the Fed does not want to leave June off the table. That is a message that came thorough loud and clear today. ... there is a message here - many FOMC participants want to go into the June meeting with a reasonable chance that they will hike rates. They don't want the outcome of this meeting to be a foregone conclusion.

...

The more hawkish Fedspeak could be foreshadowing that the minutes of the April FOMC meeting will have a hawkish tilt.

...

Bottom Line: Today's Fed speakers came looking for a fight with financial market participants. They don't like the low odds assigned to the June meeting. I don't think June is a go; the data isn't quite there yet. But odds are greater than 15%, in my opinion.

emphasis added

Comments on April Housing Starts

by Calculated Risk on 5/17/2016 04:11:00 PM

Earlier: Housing Starts increased to 1.172 Million Annual Rate in April

The housing starts report this morning was above consensus, and there were upward revisions to the prior three months. However starts were down 1.7% from April 2015, but April was strong last year (see the first graph).

The key take away from the report is that multi-family is slowing, and single family growth is ongoing year-over-year.

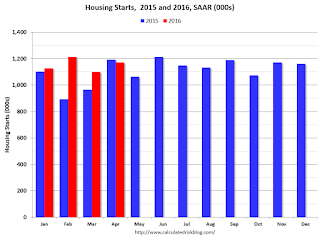

This graph shows the month to month comparison between 2015 (blue) and 2016 (red).

The comparison for April was more difficult than in February and March.

Year-to-date starts are up 10.2% compared to the same period in 2015, but that will slow further with the more difficult comparisons for the remainder of the year.

Multi-family starts are down 2.3% year-to-date, and single-family starts are up 16.8% year-to-date.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply year-over-year.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, but I expect most of the growth will be from single family going forward.

Lawler: Early Look at Existing Home Sales in April

by Calculated Risk on 5/17/2016 01:21:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.44 million in April, up 2.1% from March’s preliminary pace, and up 5.8% from last April’s seasonally adjusted pace. On the inventory front, national home listings typically show a sizable seasonal increase from March to April, and local realtor/MLS data suggest that was the case last month. However, these data suggest that this April’s increase was noticeable smaller than last April’s gain, and I project that the NAR’s estimate for the number of existing homes for sale at the end of April will be 2.10 million, up 6.1% from March’s preliminary estimate but down 5.4% from last April.

Finally, local/realtor/MLS data suggest that the NAR’s estimate of the median existing single-family home sales price in April will be up by about 6.0% from last April.

While home sales in most areas of the country last month were higher than last April, there were a few notable exceptions. For example, homes sales in both the Portland, Oregon area and in the Denver, Colorado area – which have been “hot” and where home prices have increased substantially over the past two years – were down from a year ago last month. In both areas the “months’ supply” of homes for sale has been incredibly low, and in both areas active listings increased sharply on the month, though from extremely low levels. Existing home sales were also down sharply from a year ago in the Bay Area of California, where prices have also increased sharply over the past few years and where the months’ supply of homes for sale has been extremely low. Realtors “blame” last month’s slow sales pace in these areas not simply to the low overall inventory of homes for sale, but mainly to the exceptionally low inventory levels of “affordable” homes for sale.

In Texas, the sizable divergence in sales trends by different areas continued, as residential sales in the “North Texas” area (which includes the Dallas-Fort Worth area) last month were up by over 14% YOY, while sales in the Houston area were down by almost 2% YOY.

CR Note: The NAR is scheduled to release April existing home sales on Friday, and the consensus is for 5.40 million SAAR.

Key Measures Show Inflation close to 2% in April

by Calculated Risk on 5/17/2016 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.4% annualized rate) in April. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.5% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here. Motor fuel was up 152% annualized in April!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (5.0% annualized rate) in April. The CPI less food and energy rose 0.2% (2.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy also rose 2.1%. Core PCE is for March and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 3.4% annualized, trimmed-mean CPI was at 2.5% annualized, and core CPI was at 2.4% annualized.

On a year-over-year basis, three of these measures are at or above 2%.

Using these measures, inflation has been moving up, and most are close to the Fed's target (Core PCE is still below).

Fed: Industrial Production increased 0.7% in April

by Calculated Risk on 5/17/2016 09:26:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.7 percent in April after decreasing in the previous two months. Manufacturing output rose 0.3 percent after declining the same amount in March. The index for utilities jumped 5.8 percent in April, as the demand for electricity and natural gas returned to a more normal level after being suppressed by warmer-than-usual weather in March. Mining production fell 2.3 percent in April, and it has decreased more than 1 1/2 percent per month, on average, over the past eight months. At 104.1 percent of its 2012 average, total industrial production in April was 1.1 percent below its year-earlier level. Capacity utilization for the industrial sector increased 0.5 percentage point in April to 75.4 percent, a rate that is 4.6 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

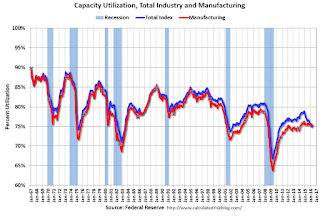

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.4% is 4.6% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

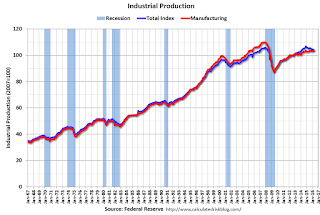

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.6% in April to 104.1. This is 19.1% above the recession low, and 1.5% below the pre-recession peak.

This was above expectations of a 0.2% increase.