by Calculated Risk on 5/05/2016 07:07:00 PM

Thursday, May 05, 2016

Friday: Jobs and Wages

Earlier on the payroll report:

From CR: Preview of April Employment Report

And Goldman's April NFP Preview

"We expect a 240k gain in nonfarm payroll employment in April [and] the unemployment rate to fall to 4.9% [and] Average hourly earnings for all workers are likely to rise 0.3% in AprilFriday:

• At 8:30 AM ET, the Employment Report for April. The consensus is for an increase of 200,000 non-farm payroll jobs added in April, down from the 215,000 non-farm payroll jobs added in March. The consensus is for the unemployment rate to decline to 4.9%.

• At 3:00 PM, Consumer credit from the Federal Reserve. The consensus is for a $15.8 billion increase in credit.

Fannie and Freddie: REO inventory declined in Q1, Down 34% Year-over-year

by Calculated Risk on 5/05/2016 03:45:00 PM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

From Fannie Mae: Fannie Mae Reports Net Income of $1.1 Billion and Comprehensive Income of $936 Million for First Quarter 2016

Fannie Mae reported net income of $1.1 billion and comprehensive income of $936 million for the first quarter of 2016. The company reported a positive net worth of $2.1 billion as of March 31, 2016, which the company expects will result in its paying Treasury a $919 million dividend in June 2016.Fannie Mae reported the number of REO declined to 52,289 at the end of Q1 2016 compared to 79,319 at the end of Q1 2015.

Freddie Mac reported the number of REO (Real Estate Owned) declined to 15,409 at the end of Q1 2106 compared to 22,738 at the end of Q1 2015.

Click on graph for larger image.

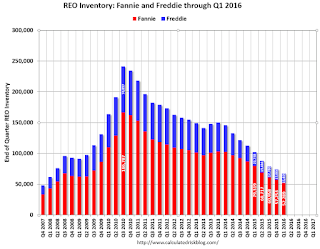

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q1 for both Fannie and Freddie, and combined inventory is down 34% year-over-year. For Freddie, this is the lowest level of REO since Q4 2007. For Fannie, this is the lowest level since Q1 2008.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

Goldman's April NFP Preview

by Calculated Risk on 5/05/2016 12:51:00 PM

A few excerpts from Goldman Sachs' April Payroll Preview by economist David Mericle:

We expect a 240k gain in nonfarm payroll employment in April. We increased our forecast from an initial estimate of 225k published last Friday as a result of the improvement in the employment component of the ISM non-manufacturing survey released this week. Our revised estimate is above consensus expectations for a 200k increase. ...

We expect the unemployment rate to fall to 4.9% in April from an unrounded 5.00% in March, but see the risks as tilted to the upside. ...

Average hourly earnings for all workers are likely to rise 0.3% in April, following a similar gain in March. ... A 0.3% increase would result in a 0.1pp increase in the year-on-year rate to 2.4% ... Looking further ahead, we expect wages to continue to accelerate as the labor market tightens ...

Las Vegas Real Estate in April: Sales Increased 4% YoY, Inventory Declines Slightly

by Calculated Risk on 5/05/2016 10:41:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada Home Prices Holding Steady with Increasing Sales and Tight Supply

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in April was 3,518, up from 3,379 in April of 2015. Compared to the same month one year ago, 2.4 percent more homes, but 0.7 percent fewer condos and townhomes, sold in April.1) Overall sales were up 4.1% year-over-year.

...

By the end of April, GLVAR reported 7,357 single-family homes listed without any sort of offer. That’s up 0.8 percent from one year ago. For condos and townhomes, the 2,231 properties listed without offers in April represented an 8.5 percent decrease from one year ago.

GLVAR continued to report declines in distressed sales and a corresponding increase in traditional home sales, where lenders are not controlling the transaction. In April, 4.5 percent of all local sales were short sales – when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 7.2 percent of all sales one year ago. Another 7.1 percent of all April sales were bank-owned, the same as in March and down from 8.3 percent one year ago.

emphasis added

2) The percent of cash sales decreased year-over-year from 30.4% in April 2015 to 28.1% in April 2016. Cash buying peaked in February 2013 at 59.5%. This has been trending down.

3) Non-contingent inventory for single-family homes was up 0.8% year-over-year. Inventory for condos was down 8.5%. Inventory is important to watch - and inventory is still tight.

Weekly Initial Unemployment Claims increase to 274,000

by Calculated Risk on 5/05/2016 08:33:00 AM

The DOL reported:

In the week ending April 30, the advance figure for seasonally adjusted initial claims was 274,000, an increase of 17,000 from the previous week's unrevised level of 257,000. The 4-week moving average was 258,000, an increase of 2,000 from the previous week's unrevised average of 256,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 61 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 258,000.

This is the lowest level for the four-week average since 1973.

This was above the consensus forecast of 262,000. The low level of the 4-week average suggests few layoffs.

Wednesday, May 04, 2016

Freddie Mac: Mortgage Serious Delinquency rate decreased in March, Lowest since Aug 2008

by Calculated Risk on 5/04/2016 05:17:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate decreased in March to 1.20% from 1.26% in February. Freddie's rate is down from 1.73% in March 2015. This is the lowest rate since August 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae reported last week.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.53 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of this year.

I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Preview of April Employment Report

by Calculated Risk on 5/04/2016 01:21:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus, according to Bloomberg, is for an increase of 200,000 non-farm payroll jobs in April (with a range of estimates between 175,000 to 245,000, and for the unemployment rate to decline to 4.9%.

The BLS reported 215,000 jobs added in March.

Here is a summary of recent data:

• The ADP employment report showed an increase of 156,000 private sector payroll jobs in April. This was below expectations of 193,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

However, the ADP report tends to be too low in April. In 2015, the ADP report showed an increase of 169,000 jobs, and the BLS report showed 223,000. And in 2014, the ADP report showed 220,000 private sector jobs added, and the BLS report showed 288,000 jobs added.

• The ISM manufacturing employment index increased in April to 49.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 25,000 in April. The ADP report indicated 13,000 fewer manufacturing jobs. Note: Recently the ADP has been a better predictor for BLS reported manufacturing employment than the ISM survey.

The ISM non-manufacturing employment index increased in April to 53.0%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 155,000 in April.

Combined, the ISM indexes suggests employment gains of 130,000. This suggests employment growth below expectations.

• Initial weekly unemployment claims averaged 256,000 in April, down from 263,000 in March, and the lowest 4-week average since 1973. For the BLS reference week (includes the 12th of the month), initial claims were at 247,000, down from 259,000 during the reference week in March.

The decrease during the reference suggests fewer layoffs in April as compared to March.

• The final April University of Michigan consumer sentiment index decreased to 89.0 from the March reading of 91.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. The ADP and ISM reports suggest a weaker than consensus report, although unemployment claims suggest stronger job growth. However, as I noted above, the ADP report tends to be low in April.

My guess the employment report will be below consensus in April.

ISM Non-Manufacturing Index increased to 55.7% in April

by Calculated Risk on 5/04/2016 10:05:00 AM

The April ISM Non-manufacturing index was at 55.7%, up from 54.5% in March. The employment index increased in April to 53.0%, up from 50.3% in March. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:April 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the 75th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.7 percent in April, 1.2 percentage points higher than the March reading of 54.5 percent. This represents continued growth in the non-manufacturing sector at a slightly faster rate. The Non-Manufacturing Business Activity Index decreased to 58.8 percent, 1 percentage point lower than the March reading of 59.8 percent, reflecting growth for the 81st consecutive month, at a slower rate in April. The New Orders Index registered 59.9 percent, 3.2 percentage points higher than the reading of 56.7 percent in March. The Employment Index increased 2.7 percentage points to 53 percent from the March reading of 50.3 percent and indicates growth for the second consecutive month. The Prices Index increased 4.3 percentage points from the March reading of 49.1 percent to 53.4 percent, indicating prices increased in April for the first time in three months. According to the NMI®, 13 non-manufacturing industries reported growth in April. The majority of the respondents’ comments reflect optimism about the business climate and the direction of the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.7, and suggests faster expansion in April than in March.

Trade Deficit decreased in March to $40.4 Billion

by Calculated Risk on 5/04/2016 08:42:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $40.4 billion in March, down $6.5 billion from $47.0 billion in February, revised. March exports were $176.6 billion, $1.5 billion less than February exports. March imports were $217.1 billion, $8.1 billion less than February imports.The trade deficit was smaller than the consensus forecast of $41.4 billion.

The first graph shows the monthly U.S. exports and imports in dollars through March 2016.

Click on graph for larger image.

Click on graph for larger image.Both imports and exports decreased in March.

Exports are 6% above the pre-recession peak and down 5% compared to March 2015; imports are 6% below the pre-recession peak, and down 9% compared to March 2015.

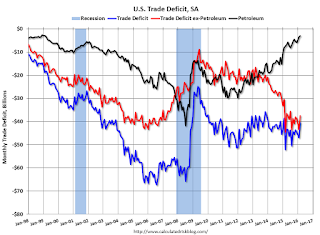

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $27.68 in March, up from $27.48 in February, and down from $46.47 in March 2015. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined a little since early 2012.

The trade deficit with China decreased to $20.9 billion in March, from $31.2 billion in March 2015 (there was a surge in imports last year in March -as ships were unloaded - following the West Coast port slowdown). The deficit with China is a substantial portion of the overall deficit.

ADP: Private Employment increased 156,000 in April

by Calculated Risk on 5/04/2016 08:19:00 AM

Private sector employment increased by 156,000 jobs from March to April according to the April ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 193,000 private sector jobs added in the ADP report.

...

Goods-producing employment dropped by 11,000 jobs in April, down from a downwardly revised 5,000 in March. The construction industry added 14,000 jobs, which was down from March’s 18,000. Meanwhile, manufacturing lost 13,000 jobs after being revised down to -3,000 the previous month.

Service-providing employment rose by 166,000 jobs in April, down from 189,000 in March.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market appears to have stumbled in April. Job growth noticeably slowed, with some weakness across most sectors. One month does not make a trend, but this bears close watching as the financial market turmoil earlier in the year may have done some damage to business hiring.”

The BLS report for April will be released Friday, and the consensus is for 200,000 non-farm payroll jobs added in April.