by Calculated Risk on 5/02/2016 10:04:00 AM

Monday, May 02, 2016

ISM Manufacturing index decreased to 50.8 in April

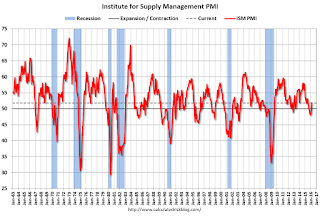

The ISM manufacturing index indicated expansion for the second consecutive month in April, following five months of contraction. The PMI was at 50.8% in April, down from 51.8% in March. The employment index was at 49.2%, up from 48.1% in March, and the new orders index was at 55.8%, down from 58.3% in March.

From the Institute for Supply Management: April 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in April for the second consecutive month, while the overall economy grew for the 83rd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The April PMI® registered 50.8 percent, a decrease of 1 percentage point from the March reading of 51.8 percent. The New Orders Index registered 55.8 percent, a decrease of 2.5 percentage points from the March reading of 58.3 percent. The Production Index registered 54.2 percent, 1.1 percentage points lower than the March reading of 55.3 percent. The Employment Index registered 49.2 percent, 1.1 percentage points above the March reading of 48.1 percent. Inventories of raw materials registered 45.5 percent, a decrease of 1.5 percentage points from the March reading of 47 percent. The Prices Index registered 59 percent, an increase of 7.5 percentage points from the March reading of 51.5 percent, indicating higher raw materials prices for the second consecutive month. Manufacturing registered growth in April for the second consecutive month, as 15 of our 18 industries reported an increase in new orders in April (up from 13 in March), and 15 of our 18 industries reported an increase in production in April (up from 12 in March)."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 51.5%, and suggests manufacturing expanded at a slower pace in April than in March.

Black Knight March Mortgage Monitor

by Calculated Risk on 5/02/2016 09:12:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for March today. According to BKFS, 4.08% of mortgages were delinquent in March, down from 4.66% in March 2015, and the lowest since March 2007. BKFS also reported that 1.25% of mortgages were in the foreclosure process, down from 1.68% a year ago.

This gives a total of 5.33% delinquent or in foreclosure.

Press Release: Black Knight's Mortgage Monitor: Home Price Increases Muting Affordability Gains from Low Interest Rates; Refinanceable Population Grows to 7.5 Million

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of March 2016. This month, in light of mortgage interest rates falling by approximately 35 basis points (BPS) since the start of 2016, Black Knight examined how these lower rates have impacted home affordability. Calculating principal and interest payments based on a fixed-rate mortgage with a 30-year term and 80 percent loan-to-value (LTV) ratio, Black Knight examined how much per month it would cost a borrower to purchase the median-priced home at the national and state levels. All else being equal, interest rate declines would save borrowers significant money on such a purchase, but as Black Knight Data & Analytics Senior Vice President Ben Graboske explained, rising home prices are muting – and in some areas, completely cancelling out – the positive impact declining rates would have on home affordability.

"Excluding home price movement, the interest rate decline since the start of the year would save borrowers approximately $44 a month when purchasing the median-priced home nationally," said Graboske. "However, when you factor in estimated home price appreciation (HPA) – the most recent Black Knight Home Price Index Report for February showed annual HPA at 5.3 percent – those monthly savings fall to just $18. ”

emphasis added

Click on graph for larger image.

Click on graph for larger image.These graphs from Black Knight show measures of mortgage performance

From Black Knight:

• Overall delinquencies continue to improve, falling 8 percent month-over-month, 12 percent year-over-year, and – as mentioned on the previous page – are now at their lowest point since March 2007There is much more in the mortgage monitor.

• 30-day delinquencies continue to drop as well, and are currently sitting at 1.95 percent, the lowest level seen in well over 15 years, driven by pristine performance in recent vintages

• Severely delinquent loan populations (90 or more days delinquent or in active foreclosure) continue to linger in the market; 90+ is 45 percent above and the foreclosure rate is more than 2x above normal levels

• In a “normal” market, 30-day delinquent loans would account for roughly 55 percent of non-current loans; in today’s overly “back heavy” market, they only make up about 37 percent

• As additional severely delinquent loans are removed from the market, delinquency rates will likely continue to dip below “normal” levels in an overcorrection of the market

Sunday, May 01, 2016

Monday: ISM Manufacturing, Construction Spending

by Calculated Risk on 5/01/2016 08:21:00 PM

Weekend:

• Schedule for Week of May 1, 2016

• Energy expenditures as a percentage of PCE hit another All Time Low in March

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for April. The consensus is for the ISM to be at 51.5, down from 51.8 in March. The ISM manufacturing index indicated expansion at 51.8% in March. The employment index was at 48.1%, and the new orders index was at 58.3%.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

• At 2:00 PM, the April 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $45.62 per barrel and Brent at $47.05 per barrel. A year ago, WTI was at $59, and Brent was at $64 - so prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.22 per gallon (down about $0.35 per gallon from a year ago).

Energy expenditures as a percentage of PCE hit another All Time Low in March

by Calculated Risk on 5/01/2016 10:35:00 AM

Note: Last month I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the March 2016 PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through March 2016.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In March 2016, energy expenditures as a percentage of PCE declined to another all time low of just under 3.7%.

However, WTI oil prices increased from $30.32 per barrel in February to $37.55 in March - so energy as a percentage of PCE will probably increase a little over the next few months.

Saturday, April 30, 2016

Schedule for Week of May 1, 2016

by Calculated Risk on 4/30/2016 11:21:00 AM

The key report this week is the April employment report on Friday.

Other key indicators include April vehicle sales, the April ISM manufacturing and non-manufacturing indexes, and the March trade deficit.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 51.5, down from 51.8 in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 51.5, down from 51.8 in March.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.8% in March. The employment index was at 48.1%, and the new orders index was at 58.3%.

10:00 AM: Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

2:00 PM ET: the April 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.3 million SAAR in April from 16.6 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.3 million SAAR in April from 16.6 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the March sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 193,000 payroll jobs added in April, down from 200,000 added in March.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through February. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.4 billion in March from $47.1 billion in February.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to increase to 54.7 from 54.5 in March.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is a 0.6% increase in orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, up from 257 thousand the previous week.

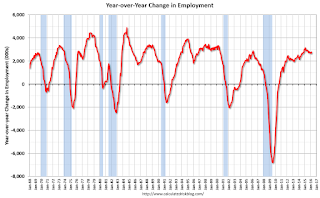

8:30 AM: Employment Report for April. The consensus is for an increase of 200,000 non-farm payroll jobs added in April, down from the 215,000 non-farm payroll jobs added in March.

The consensus is for the unemployment rate to decline to 4.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In March, the year-over-year change was 2.80 million jobs.

A key will be the change in real wages.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.8 billion increase in credit.

April 2016: Unofficial Problem Bank list declines to 214 Institutions

by Calculated Risk on 4/30/2016 08:09:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2016. During the month, the list fell from 222 institutions to 214 after nine removals and one addition. Assets dropped by $2.2 billion to an aggregate $62.4 billion. A year ago, the list held 342 institutions with assets of $105.1 billion.

Actions have been terminated against U.S. Century Bank, Doral, FL ($910 million); Community Bank of Florida, Inc., Homestead, FL ($485 million); Florida Capital Bank, National Association, Jacksonville, FL ($341 million); Advantage Bank, Loveland, CO ($265 million); Transcapital Bank, Sunrise, FL ($169 million); Mountain Valley Bank, Dunlap, TN ($96 million); Bank of Newington, Newington, GA ($87 million); and Rocky Mountain Bank & Trust, Florence, CO ($65 million).

Trust Company Bank, Memphis, TN ($21 million) exited the list via failure becoming the second bank to fail in 2016.

Added this month was First Community National Bank, Cuba, MO ($207 million). Also, the FDIC issued a Prompt Corrective Action order against Proficio Bank, Cottonwood Heights, UT ($110 million), which has been on the list since March 2014.

Friday, April 29, 2016

Fannie Mae: Mortgage Serious Delinquency rate declined in March, Lowest since June 2008

by Calculated Risk on 4/29/2016 04:07:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in March to 1.44%, down from 1.52% in February. The serious delinquency rate is down from 1.78% in March 2015.

This is the lowest rate since June 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Freddie Mac has not reported for March yet.

The Fannie Mae serious delinquency rate has only fallen 0.34 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe Fannie Mae serious delinquencies will be close to normal some time in late 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Lawler:Updated Table of Distressed Sales and All Cash Sales for Selected Cities in March

by Calculated Risk on 4/29/2016 12:26:00 PM

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and all cash sales for selected cities in March.

On distressed: Total "distressed" share is down in all of these markets.

Short sales and foreclosures are down in all of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Mar- 2016 | Mar- 2015 | Mar- 2016 | Mar- 2015 | Mar- 2016 | Mar- 2015 | Mar- 2016 | Mar- 2015 | |

| Las Vegas | 5.9% | 8.3% | 7.1% | 9.3% | 13.0% | 17.6% | 27.7% | 32.4% |

| Reno** | 3.0% | 5.0% | 3.0% | 8.0% | 6.0% | 13.0% | ||

| Phoenix | 2.1% | 3.2% | 2.3% | 4.2% | 4.5% | 7.4% | 24.6% | 27.5% |

| Sacramento | 4.5% | 5.4% | 5.5% | 6.9% | 10.0% | 12.4% | 17.3% | 19.3% |

| Minneapolis | 2.5% | 3.0% | 10.9% | 12.4% | 13.4% | 15.4% | ||

| Mid-Atlantic | 4.4% | 4.7% | 13.6% | 14.0% | 18.0% | 18.8% | 18.3% | 18.2% |

| So. California* | 3.1% | 4.0% | 3.9% | 5.1% | 7.0% | 9.1% | 22.7% | 25.2% |

| Bay Area CA* | 2.2% | 2.8% | 2.5% | 2.9% | 4.7% | 5.7% | 24.0% | 24.3% |

| Riverside | 2.4% | 3.5% | 3.2% | 5.0% | 5.6% | 8.5% | 18.2% | 19.2% |

| San Bernardino | 2.4% | 4.1% | 3.2% | 5.2% | 5.6% | 9.3% | 20.7% | 21.8% |

| Florida SF | 2.7% | 3.9% | 12.0% | 21.0% | 14.7% | 25.0% | 32.0% | 38.8% |

| Florida C/TH | 1.6% | 2.5% | 9.5% | 15.3% | 11.1% | 17.8% | 62.0% | 66.2% |

| Miami MSA SF | 3.9% | 6.6% | 13.9% | 19.6% | 17.7% | 26.2% | 32.9% | 40.0% |

| Miami MSA C/TH | 1.9% | 3.0% | 12.6% | 19.1% | 14.5% | 22.1% | 64.2% | 69.6% |

| Spokane | 11.5% | 18.1% | ||||||

| Chicago (city) | 19.6% | 21.9% | ||||||

| Hampton Roads | 18.2% | 22.7% | ||||||

| Spokane | 11.5% | 18.1% | ||||||

| Northeast Florida | 19.9% | 30.9% | ||||||

| Spokane | 11.5% | 18.1% | ||||||

| Rhode Island | 14.0% | 17.3% | ||||||

| Toledo | 30.6% | 32.7% | ||||||

| Tucson | 25.8% | 32.0% | ||||||

| Knoxville | 22.1% | 22.9% | ||||||

| Peoria | 21.6% | 23.7% | ||||||

| Georgia*** | 21.0% | 23.2% | ||||||

| Omaha | 16.3% | 16.1% | ||||||

| Pensacola | 17.0% | 28.0% | 28.3% | 33.4% | ||||

| Richmond VA MSA | 9.8% | 11.9% | 17.3% | 18.0% | ||||

| Memphis**** | 15.0% | 15.3% | 32.3% | 37.6% | ||||

| Springfield IL** | 11.2% | 12.1% | 18.1% | N.A. | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Chicago PMI declines in April, Final April Consumer Sentiment at 89.0

by Calculated Risk on 4/29/2016 10:08:00 AM

Chicago PMI: April Chicago Business Barometer Down 3.2 Points to 50.4

The Chicago Business Barometer decreased 3.2 points to 50.4 in April from 53.6 in March led by a fall in New Orders and a sharp drop in Order Backlogs. It marks a slow start to the second quarter, with most measures down from levels seen a year earlier.This was below the consensus forecast of 53.4.

...

The decline in the Barometer was led by a fall in New Orders, leaving it at the lowest level since December 2015.

...

Chief Economist of MNI Indicators Philip Uglow said, “This was a disappointing start to the second quarter, with the Barometer barely above the neutral 50 mark in April. Against a backdrop of softer domestic demand and the slowdown abroad, panellists are now more worried about the impact a rate hike might have on business than they were at the same time last year.”

emphasis added

Click on graph for larger image.

The final University of Michigan consumer sentiment index for April was at 89.0, down from 91.0 in March:

"Consumer sentiment continued its slow decline in late April due to weakening expectations for future growth, although their views of current economic conditions remained positive. All of the April decline was in the Expectations component, which fell by 4.8% from one month ago and by 12.6% from a year ago and by 14.7% from its January 2015 peak. The retreat from the 2015 peaks was evident across a wide range of expectations about prospects for the national economy. The size of the decline, while troublesome, is still far short of indicating an impending recession. The decline is all the more remarkable given that consumers' assessments of current economic conditions, including their personal finance, have remained largely unchanged at very positive levels during the past year."

emphasis added

Personal Income increased 0.4% in March, Spending increased 0.1%

by Calculated Risk on 4/29/2016 08:33:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $57.4 billion, or 0.4 percent, ... according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $12.8 billion, or 0.1 percent.On inflation: The PCE price index increased 0.8 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in March (slightly lower than in February).

...

Real PCE -- PCE adjusted to remove price changes -- increased less than 0.1 percent in March, compared with an increase of 0.3 percent in February. ... The price index for PCE increased 0.1 percent in March, in contrast to a decrease of 0.1 percent in February. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

The March PCE price index increased 0.8 percent from March a year ago. The March PCE price index, excluding food and energy, increased 1.6 percent from March a year ago.