by Calculated Risk on 4/28/2016 01:45:00 PM

Thursday, April 28, 2016

Q1 GDP: Investment

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased at a 14.8% annual rate in Q1. Equipment investment decreased at a 8.6% annual rate, and investment in non-residential structures decreased at a 10.7% annual rate. On a 3 quarter trailing average basis, RI (red) is positive, equipment (green) is close to zero, and nonresidential structures (blue) is negative.

Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a decline. Other areas of nonresidential are now increasing significantly. I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward (except for energy and power), and for the economy to continue to grow at a steady pace.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Kansas City Fed: Regional Manufacturing Activity "declined modestly" in April

by Calculated Risk on 4/28/2016 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined Modestly

The Federal Reserve Bank of Kansas City released the April Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined modestly.The Kansas City region was hit hard by lower oil prices and the stronger dollar, but the impact is fading.

“Factories reported a modest decline in activity in April, but expectations for future activity increased to their highest reading of the year”, said Wilkerson.

...

Tenth District manufacturing activity continued to decline modestly, while producers’ expectations for future activity improved considerably. Most price indexes moved slightly higher in April, but remained at low levels.

The month-over-month composite index was -4 in April, up from -6 in March and -12 in February ...

emphasis added

This was the last of the regional Fed surveys for April.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

It seems likely the ISM manufacturing index will show slow expansion again in April.

Weekly Initial Unemployment Claims increase to 257,000, Lowest 4-Week Average since 1973

by Calculated Risk on 4/28/2016 08:45:00 AM

The DOL reported:

In the week ending April 23, the advance figure for seasonally adjusted initial claims was 257,000, an increase of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 247,000 to 248,000. The 4-week moving average was 256,000, a decrease of 4,750 from the previous week's revised average. This is the lowest level for this average since December 8, 1973 when it was 252,250. The previous week's average was revised up by 250 from 260,500 to 260,750.The previous week was revised up by 1,000.

There were no special factors impacting this week's initial claims. This marks 60 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

Note: The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 256,000.

This is the lowest level for the four-week average since 1973.

This was below the consensus forecast of 260,000. The low level of the 4-week average suggests few layoffs.

BEA: Real GDP increased at 0.5% Annualized Rate in Q1

by Calculated Risk on 4/28/2016 08:36:00 AM

From the BEA: Gross Domestic Product: First Quarter 2016 (Advance Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 0.5 percent in the first quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 1.4 percent.The advance Q1 GDP report, with 0.5% annualized growth, was below expectations of a 0.7% increase.

...

The increase in real GDP in the first quarter reflected positive contributions from personal consumption expenditures (PCE), residential fixed investment, and state and local government spending that were partly offset by negative contributions from nonresidential fixed investment, private inventory investment, exports, and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the first quarter reflected a larger decrease in nonresidential fixed investment, a deceleration in PCE, a downturn in federal government spending, an upturn in imports, and larger decreases in private inventory investment and in exports that were partly offset by an upturn in state and local government spending and an acceleration in residential fixed investment.

emphasis added

Personal consumption expenditures (PCE) increased at a 1.9% annualized rate in Q1, down from 2.4% in Q4. Residential investment (RI) increased at a 14.8% pace. However equipment investment decreased at a 8.6% annualized rate, and investment in non-residential structures decreased at a 10.7% pace (due to the decline in oil prices).

The key negatives were investment in inventories (subtracted 0.33 percentage point), trade (subtracted 0.34 percentage point), nonresidential investment (subtracted 0.76 percentage points) and Federal government spending (subtracted 0.11 percentage points).

I'll have more later ...

Wednesday, April 27, 2016

Thursday: GDP, Unemployment Claims

by Calculated Risk on 4/27/2016 07:49:00 PM

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2016 is 0.6 percent on April 27, up from 0.4 percent on April 26.New York Fed Nowcasting:

GDP growth prospects remain moderate for the first half of the year: the nowcasts stand at 0.8% for 2016:Q1 and 1.2% for 2016:Q2.Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, up from 247 thousand the previous week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2016 (Advance estimate). The consensus is that real GDP increased 0.7% annualized in Q1.

• At 11:00 AM, Kansas City Fed Survey of Manufacturing Activity for April. This is the last of the regional Fed manufacturing surveys for April.

Analysis: Rate Hike in June depends mostly on Inflation

by Calculated Risk on 4/27/2016 05:07:00 PM

The April FOMC statement was very similar to the March statement. There was less emphasis on "global" risks in the April statement, and there was more emphasis on low inflation. Here are excepts from the April and March statements on inflation:

From the April FOMC statement:

Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and falling prices of non-energy imports.This was changed from the March FOMC statement:

emphasis added

Inflation picked up in recent months; however, it continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports.Note: I was expecting a change in the statement characterizing risks as "nearly balanced", but that wasn't included (I think that would have suggested a rate hike in June was more likely).

To hike in June, it seems the FOMC will be looking for decent employment reports for April and May, and for inflation to pickup (especially core PCE).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for four key measures of inflation: Core PCE, core CPI, trimmed-mean CPI and median CPI (the last two from the Cleveland Fed).

On a year-over-year basis in March, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy rose 2.2%.

Core PCE (green) is for February and increased 1.7% year-over-year.

Using these measures, inflation has been moving up, and most measures are close to the Fed's target - only core PCE is still below.

Core PCE for March will be released this Friday, and core PCE for April will be released on May 31st. If core PCE moves up further, a rate hike in June would be more likely.

FOMC Statement: No Change to Policy, Less Global Concern

by Calculated Risk on 4/27/2016 02:03:00 PM

Not much change. Less mention of "global" risks.

FOMC Statement:

Information received since the Federal Open Market Committee met in March indicates that labor market conditions have improved further even as growth in economic activity appears to have slowed. Growth in household spending has moderated, although households' real income has risen at a solid rate and consumer sentiment remains high. Since the beginning of the year, the housing sector has improved further but business fixed investment and net exports have been soft. A range of recent indicators, including strong job gains, points to additional strengthening of the labor market. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and falling prices of non-energy imports. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo. Voting against the action was Esther L. George, who preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent.

emphasis added

Zillow Forecast: Expect Slower Growth in March for the Case-Shiller Indexes

by Calculated Risk on 4/27/2016 11:50:00 AM

The Case-Shiller house price indexes for February were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: March Case-Shiller Forecast: Expect the Slowdown to Continue

All three headline S&P/Case-Shiller Home Price Indices grew at a slightly slower pace in February compared to January, and the slowdown should extend into March, according to Zillow’s March Case-Shiller forecast.The year-over-year change for the 10-city and 20-city indexes will probably be lower in the March report than in the February report. The change for the National Index will probably be about the same.

The March Case-Shiller National Index is expected to gain another 0.3 percent in March from February, down from 0.4 percent growth in February from January. We expect the 10-City Index to grow 4.3 percent year-over-year in March, and the 20-City Index to grow 5 percent over the same period, down from annual growth of 4.6 percent and 5.4 percent in February, respectively. The National Index looks set to rise 5.3 percent year-over-year in March, equal to February’s annual growth.

Zillow’s March Case-Shiller forecast is shown in the table below. These forecasts are based on today’s February Case-Shiller data release and the March 2016 Zillow Home Value Index (ZHVI). The March Case-Shiller Composite Home Price Indices will not be officially released until Tuesday, May 31.

NAR: Pending Home Sales Index increased 1.4% in March, up 1.4% year-over-year

by Calculated Risk on 4/27/2016 10:03:00 AM

From the NAR: Pending Home Sales Maintain Momentum in March

The Pending Home Sales Index, a forward-looking indicator based on contract signings, climbed 1.4 percent to 110.5 in March from an downwardly revised 109.0 in February and is now 1.4 percent above March 2015 (109.0). After last month’s slight gain, the index has increased year-over-year for 19 consecutive months and is at its highest reading since May 2015 (111.0).This was above expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May.

...

The PHSI in the Northeast increased 3.2 percent to 97.0 in March, and is now 18.4 percent above a year ago. In the Midwest the index inched up 0.2 percent to 112.8 in March, and is now 4.0 percent above March 2015.

Pending home sales in the South rose 3.0 percent to an index of 125.4 in March but are still 0.6 percent lower than last March. The index in the West declined 1.8 percent in March to 95.3, and is now 7.9 percent below a year ago.

emphasis added

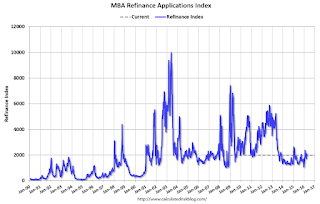

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

by Calculated Risk on 4/27/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

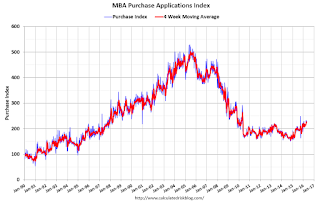

Mortgage applications decreased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 22, 2016.

...

The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 14 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.85 percent from 3.83 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity has increased a little with lower rates.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 14% higher than a year ago.