by Calculated Risk on 2/05/2016 02:00:00 PM

Friday, February 05, 2016

Comments: A Solid Employment Report

My initial reaction was this was a "decent" employment report. However, with some further analysis, I think this should be characterized as a "solid" report.

The unemployment rate declined to 4.9% even as the participation rate increased (a strong household survey). Sure the headline number was below the consensus forecast, but this follows several months of above trend job gains (job gains averaged 279 thousand over the previous three months).

With current demographics, the unemployment rate would decline with job gains under 100 thousand, so 151 thousand is still solid.

And another positive sign is that wage growth picked up and was above the consensus forecast. From the BLS: "In January, average hourly earnings for all employees on private nonfarm payrolls increased by 12 cents to $25.39. Over the year, average hourly earnings have risen by 2.5 percent."

Earlier: January Employment Report: 151,000 Jobs, 4.9% Unemployment Rate (Graphs Included)

A few more numbers: Total employment is now 4.9 million above the previous peak. Total employment is up 13.6 million from the employment recession low.

Private payroll employment increased 158,000 in December, and private employment is now 5.2 million above the previous peak. Private employment is up 14.0 million from the recession low.

In January, the year-over-year change was 2.67 million jobs.

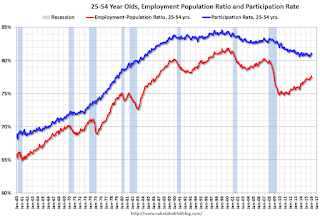

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in January to 81.1%, and the 25 to 54 employment population ratio increased to 77.7%. The participation rate for this group might increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in January - and although the series is noisy - wage growth is trending up.

This was stronger than most forecasts and is a sign the labor market is tightening.

Note: CPI has been running under 2%, so there has been real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 6.0 million in January but was down by 796,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find full-time jobs.The number of persons working part time for economic reasons was little changed in January. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 9.9% in January.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.09 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 2.08 million in December.

This is generally trending down, but is still high.

There are still signs of slack (as example, part time workers for economic reasons and elevated U-6), but there also signs the labor market is tightening (wages and U-3). Overall this was a solid employment report.

Trade Deficit Increased in December to $43.4 Billion

by Calculated Risk on 2/05/2016 11:58:00 AM

Earlier the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.4 billion in December, up $1.1 billion from $42.2 billion in November, revised. December exports were $181.5 billion, $0.5 billion less than November exports. December imports were $224.9 billion, up $0.6 billion from November.The trade deficit was slightly larger than the consensus forecast of $43.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through December 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in December.

Exports are 9% above the pre-recession peak and down 7% compared to December 2014; imports are 3% below the pre-recession peak, and down 7% compared to December 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $36.60 in December, down from $39.24 in November, and down from $82.92 in December 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $27.9 billion in December, from $28.1 billion in December 2014. The deficit with China is a substantial portion of the overall deficit.

January Employment Report: 151,000 Jobs, 4.9% Unemployment Rate (Graphs Included)

by Calculated Risk on 2/05/2016 09:05:00 AM

From the BLS:

Total nonfarm payroll employment rose by 151,000 in January, and the unemployment rate was little changed at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in several industries, led by retail trade, food services and drinking places, health care, and manufacturing. Employment declined in private educational services, transportation and warehousing, and mining.

...

The change in total nonfarm payroll employment for November was revised from +252,000 to +280,000, and the change for December was revised from +292,000 to +262,000. With these revisions, employment gains in November and December combined were 2,000 lower than previously reported.

...

In January, average hourly earnings for all employees on private nonfarm payrolls increased by 12 cents to $25.39. Over the year, average hourly earnings have risen by 2.5 percent.

...

[Annual Benchmark Revision] The total nonfarm employment level for March 2015 was revised downward by 206,000 ... The effect of these revisions on the underlying trend in nonfarm payroll employment was minor. For example, the over-the-year change in total nonfarm employment for 2015 was revised from 2,650,000 to 2,735,000,

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 151 thousand in January (private payrolls increased 158 thousand).

Payrolls for November and December were revised down by a combined 2 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In January, the year-over-year change was 2.67 million jobs. A solid gain.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in January to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate increased in January to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio increased to 59.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was declined in January to 4.9%.

This was below expectations of 188,000 jobs ... but overall still a decent report.

I'll have much more later ...

January Employment Report: 151,000 Jobs, 4.9% Unemployment Rate

by Calculated Risk on 2/05/2016 08:37:00 AM

From the BLS:

Total nonfarm payroll employment rose by 151,000 in January, and the unemployment rate was little changed at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in several industries, led by retail trade, food services and drinking places, health care, and manufacturing. Employment declined in private educational services, transportation and warehousing, and mining.Note: I'll post graphs soon - the data is being updated due to the annual benchmark revision.

...

The change in total nonfarm payroll employment for November was revised from +252,000 to +280,000, and the change for December was revised from +292,000 to +262,000. With these revisions, employment gains in November and December combined were 2,000 lower than previously reported.

...

In January, average hourly earnings for all employees on private nonfarm payrolls increased by 12 cents to $25.39. Over the year, average hourly earnings have risen by 2.5 percent.

...

[Annual Benchmark Revision] The total nonfarm employment level for March 2015 was revised downward by 206,000 ... The effect of these revisions on the underlying trend in nonfarm payroll employment was minor. For example, the over-the-year change in total nonfarm employment for 2015 was revised from 2,650,000 to 2,735,000,

emphasis added

Thursday, February 04, 2016

Friday: Employment Report, Trade Deficit

by Calculated Risk on 2/04/2016 07:02:00 PM

Employment previews:

CR: Preview: Employment Report for January

Goldman Payroll Preview: 170K Forecast

Tim Duy: Jobs Day

Friday:

• At 8:30 AM ET, Employment Report for January. The consensus is for an increase of 188,000 non-farm payroll jobs added in January, down from the 292,000 non-farm payroll jobs added in December. The consensus is for the unemployment rate to be unchanged at 5.0%.

• Also at 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is for the U.S. trade deficit to be at $43.0 billion in December from $42.4 billion in November.

• At 3:00 PM, Consumer Credit for December from the Federal Reserve. The consensus is for an increase of $16.5 billion in credit.

U.S. Courts: "Bankruptcy Filings Drop 10 Percent in Calendar Year 2015"

by Calculated Risk on 2/04/2016 04:44:00 PM

From the U.S. Courts: Bankruptcy Filings Drop 10 Percent in Calendar Year 2015

During the 12-month period ending December 31, 2015, 844,495 cases were filed in federal bankruptcy courts, down from the 936,795 bankruptcy cases filed in calendar year 2014—a 9.9 percent drop in filings. This is the lowest number of bankruptcy filings for any 12-month period since 2007, and the fifth consecutive calendar year that filings have fallen.CR Note: For Q4, bankruptcy filings were down about 8% compared to Q4 2014. At that pace of improvement, fiscal 2016 for the Court system (ends Sept 30th) will see the fewest bankruptcy filings since fiscal 1990.

Lawler: Home Builder Results: Net Orders Decent, Deliveries Lag a Bit, Order Backlog Jumps

by Calculated Risk on 2/04/2016 12:38:00 PM

From housing economist Tom Lawler:

Below is a table showing some selected operating statistics from large, publicly-traded home builders for the quarter ending December 31, 2015.

Combined net home orders for these seven home builders last quarter were up 11.7% from the comparable quarter of 2014, while home deliveries were up 6.3% YOY. For the group as a whole deliveries were a bit lower (as were revenues and earnings) than one would have expected based on order backlogs, which mainly reflected longer-than-normal construction timelines in several markets (as opposed to sales cancellations, which in aggregate were down slightly from a year ago). The combined order backlog for these builders at the end of last year was up 18.3% from a year earlier. Net orders per active community for the group were up 8.7% YOY.

| Net Orders | Settlements | Average Closing Price ($000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/15 | 12/14 | % Chg | 12/15 | 12/14 | % Chg | 12/15 | 12/14 | % Chg |

| D.R. Horton | 8,064 | 7,370 | 9.4% | 8,061 | 7,973 | 1.1% | 290 | 281 | 3.3% |

| PulteGroup | 3,659 | 3,232 | 13.2% | 5,662 | 5,316 | 6.5% | 353 | 334 | 5.7% |

| NVR | 3,100 | 2,713 | 14.3% | 4,010 | 3,469 | 15.6% | 382 | 376 | 1.6% |

| Beazer Homes | 923 | 966 | -4.5% | 1,049 | 885 | 18.5% | 321 | 296 | 8.6% |

| Meritage Homes | 1,568 | 1,272 | 23.3% | 1,919 | 1,863 | 3.0% | 397 | 369 | 7.6% |

| MDC Holdings | 1,020 | 887 | 15.0% | 1,275 | 1,242 | 2.7% | 435 | 397 | 9.5% |

| M/I Homes | 897 | 773 | 16.0% | 1,253 | 1,105 | 13.4% | 360 | 322 | 11.8% |

| Total | 19,231 | 17,213 | 11.7% | 23,229 | 21,853 | 6.3% | 343 | 326 | 5.4% |

D.R. Horton reported that net orders for its “Express” brand, targeted for the “entry-level” home buyer, represented 25% of its total orders (in units) last quarter, compared to 13% in the comparable quarter of 2014, while the Express share of deliveries increased to 22% from 10%. The average selling price for Express deliveries last quarter was $199,400, compared to $168,900 a year earlier. A major reason for the sharp jump in the average Express selling price was an increase in the share of deliveries in higher-priced markets (including California).

While LGI Homes has not yet released its earnings report for last quarter, the company does release monthly home closings (in units). For the quarter ended December 31, 2015 LGI Home delivered 946 homes, up 45.1% from the comparable quarter of 2014. LGI had 54 active communities in December, up from 39 a year earlier. LGI focuses heavily (though not exclusively) on entry-level/first-time home buyers, and its average sales price in the quarter ended September 30, 2015 was about $186,000. LGI also reported that its home closings totaled 232 in January, up 51.6% from the previous January, and that it had 54 active communities in January compared to 42 a year ago.

Earlier this month the Commerce Department estimated that new single-family home sales last quarter totaled 112,000, up 7.7% from the comparable quarter of 2014.

Goldman Payroll Preview: 170K Forecast

by Calculated Risk on 2/04/2016 11:03:00 AM

Note: Yesterday I wrote: Preview: Employment Report for January

A few excerpts from a research piece by Goldman Sachs economist Daan Struyven:

January Payrolls Preview We expect a 170k gain in nonfarm payroll employment in January, below consensus expectations of 190k. ... We expect the unemployment rate to remain unchanged at 5.0% in January on a rounded basis ... However, we see some risk that the unemployment rate will round down to 4.9% given our expectation for a strong employment gain and the possibility of a slight decline in participation ...Struyven also mentions that the annual benchmark revision will be released tomorrow, and the revision will probably show about 200 thousand fewer jobs added over the last year than previously estimated. As I noted yesterday, the preliminary annual benchmark revision showed a downward adjustment of 208,000 jobs, and the preliminary estimate is usually pretty close to final revision.

We expect average hourly earnings for all workers to rise 0.4% (mom) in January following a 0.04% decline in December. Our expectation for a firmer than usual rise in average hourly earnings growth is primarily due to favorable calendar effects. In addition, we estimate that minimum wage increases in about a dozen states could boost aggregate average hourly earnings by about 0.05%. However, even a 0.4% increase in January would result in a decline in the year-on-year rate to 2.3% due to unfavorable base effects.

Weekly Initial Unemployment Claims increase to 285,000

by Calculated Risk on 2/04/2016 08:33:00 AM

The DOL reported:

In the week ending January 30, the advance figure for seasonally adjusted initial claims was 285,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 278,000 to 277,000. The 4-week moving average was 284,750, an increase of 2,000 from the previous week's revised average. The previous week's average was revised down by 250 from 283,000 to 282,750.The previous week was revised down to 277,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 284,750.

This was above the consensus forecast of 275,000. Although initial claims have increased recently, this is still a very low level and the 4-week average suggests few layoffs.

Wednesday, February 03, 2016

Tim Duy's Fed Watch: "Resisting Change?"

by Calculated Risk on 2/03/2016 06:36:00 PM

From Tim Duy: Resisting Change?

Bottom Line: Fischer is clearly less confident than earlier this month when he claimed that market participants were underestimating the pace of rate hikes. The baseline of four hikes is clearly is doubt; see here for my five potential scenarios. Financial market participants have almost completely discounted any rate hikes this year. This is a recession scenario that I am not enamored with. That said, I suspect market volatility and lack of inflation data keep them on hold in March and maybe April even if the recession does not come to pass. However (although not my baseline), I can tell a story where they feel like the employment data forces their hand. Especially so if they continue to downplay the inflation numbers. A substantial part of their policy still appears directed by a pre-conceived notion of "normal" policy. This I think is the Fed's largest error; the fact that the yield curve stubbornly resists being pushed higher suggests that the Fed's estimates of the terminal fed funds rates is wildly optimistic. There appear to be limits to which the Fed can resist the global pull of zero (or lower) rates.Thursday:

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 280 thousand initial claims, up from 278 thousand the previous week.

• 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is a 2.8% decrease in orders.