by Calculated Risk on 1/20/2016 07:01:00 AM

Wednesday, January 20, 2016

MBA: Mortgage Applications Increased in Latest Weekly Survey, Purchase Applications up 17% YoY

From the MBA: Refinance Mortgage Applications Increase as Rates Fall in Latest MBA Weekly Survey

Mortgage applications increased 9.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 15, 2016.

...

The Refinance Index increased 19 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 17 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since October 2015, 4.06 percent, from 4.12 percent, with points increasing to 0.41 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 17% higher than a year ago.

Tuesday, January 19, 2016

Wednesday: CPI, Housing Starts

by Calculated Risk on 1/19/2016 08:04:00 PM

An update on the rain in California ... from the LA Times: What happened to El Niño? Be patient, L.A., it'll come, expert says

[M]uch of the rain Northern California has received in recent months is not significantly related to El Niño. Most of that precipitation — including this week's storms hitting San Francisco — is coming from the typical winter weather pattern in California: cold storms from the northern Pacific Ocean, coming northwest of the state.Wednesday:

...

Experts say it's possible that the classic El Niño-influenced pattern could emerge by late January or early February. That would put it more in line with how the most punishing series of storms arrived in February 1998 and March of 1983.

"As we look back, the big show is usually in February, March — even into April and May," [NASA Jet Propulsion Laboratory climatologist] Patzert said. "So, in many ways, this is on schedule."

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Consumer Price Index for December from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, Housing Starts for December. The consensus is for 1.198 million SAAR, up from 1.173 million in November.

• During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

Mortgage News Daily: "Lenders quoting 30yr fixed rates of 3.875% on top tier scenarios"

by Calculated Risk on 1/19/2016 05:37:00 PM

Mortgage rates are nears the lows of the last two months ...

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Away From Long Term Lows

Mortgage rates moved higher today, but remained near the lowest levels in more than 2 months. Friday's drop was uncharacteristically sharp and put rates in a position to break 7 month lows had today gone the other direction. Most lenders are quoting conventional 30yr fixed rates of 3.875% on top tier scenarios. 4.0% is the next most prevalent quote with only a select few of the most aggressive lenders down at 3.75%. All of these assume top tier scenarios.Here is a table from Mortgage News Daily:

emphasis added

ATA Trucking Index increased 1% in December

by Calculated Risk on 1/19/2016 02:31:00 PM

From the ATA: ATA Truck Tonnage Index Increased 1% in December

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1% in December, following a decrease of 0.9% during November. In December, the index equaled 135.6 (2000=100), up from 134.3 in November, and 0.1% below the all-time high of 135.8 reached in January 2015.

Compared with December 2014, the SA index increased 1.1%, which was better than November’s 0.2% year-over-year gain. For all of 2015, compared with 2014, tonnage was up 2.6%.

...

“Tonnage ended 2015 on a strong note, but it was not strong for the year as a whole,” said ATA Chief Economist Bob Costello. “With year-over-year gains averaging just 1.2% over the last four months, there was a clear deceleration in truck tonnage.

“At the expense of sounding like a broken record, I remain concerned about the high level of inventories throughout the supply chain. The total business inventory-to-sales record is at the highest level in over a decade, excluding the Great Recession period. This will have a negative impact on truck freight volumes over the next few months at least. And, this inventory cycle is overriding any strength from consumer spending and housing at the moment” he said.

Trucking serves as a barometer of the U.S. economy, representing 68.8% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled just under 10 billion tons of freight in 2014. Motor carriers collected $700.4 billion, or 80.3% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 1.1% year-over-year.

Existing Home Sales: Take the Over

by Calculated Risk on 1/19/2016 11:52:00 AM

A short note: The NAR will report December Existing Home Sales on Friday, January 22nd at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.19 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.36 million on a seasonally adjusted annual rate (SAAR) basis, up from 4.76 million SAAR in November.

Based on Lawler's estimate, I'd take the "over" on Friday.

Note: Lawler is not always right on, but he is usually pretty close. See this post for a review of Lawler's track record.

NAHB: Builder Confidence unchanged at 60 in January

by Calculated Risk on 1/19/2016 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 60 in January, unchanged from December (revised). Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Holds Firm in January

Builder confidence in the market for newly-built single-family homes held steady at 60 in January from a downwardly revised December reading of 60 on the National Association of Home Builders/Wells Fargo Housing Market Index.

“After eight months hovering in the low 60s, builder sentiment is reflecting that many markets continue to show a gradual improvement, which should bode well for future home sales in the year ahead,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo.

“January’s HMI reading is right in line with our forecast of modest growth for housing,” said NAHB Chief Economist David Crowe. “The economic outlook remains promising, as consumers regain confidence and home values increase, which will help the housing market move forward.”

...

The HMI component gauging current sales condition rose two points 67 in January. The index measuring sales expectations in the next six months fell three points to 63, and the component charting buyer traffic dropped two points to 44.

Looking at the three-month moving averages for regional HMI scores, all four regions registered slight declines. The Northeast, Midwest and West each posted a one-point decline to 49, 57 and 75, respectively, while the South fell two points to 61.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 62, but still a strong reading.

Monday, January 18, 2016

Monday Night Futures

by Calculated Risk on 1/18/2016 09:03:00 PM

Note: China's GDP was reported at 6.9% year-over-year, at expectations.

Weekend:

• Schedule for Week of January 17, 2016

• Lawler: Early Read on Existing Home Sales in December and Post-Mortem on November

• Update: Predicting the Next Recession

Monday:

• At 10:00 AM ET, the January NAHB homebuilder survey. The consensus is for a reading of 62, up from 61 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 12 and DOW futures are up 120 (fair value).

Oil prices were down sharply over the last week with WTI futures at $29.20 per barrel (lowest since 2003) and Brent at $28.83 per barrel (lowest since 2003). A year ago, WTI was at $47, and Brent was at $48 - so prices are down about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.89 per gallon (down about $0.20 per gallon from a year ago). Gasoline prices should decline over the next few weeks based on the sharp decline in oil prices.

Lawler: Early Read on Existing Home Sales in December and Post-Mortem on November

by Calculated Risk on 1/18/2016 03:35:00 PM

From housing economist Tim Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.36 million in December, up 12.6% from November’s preliminary pace and up 5.7% from last Decembers seasonally adjusted pace. The bounce back in sales from November’s “shockingly” low pace – which occurred in many but by no means all markets across the country – strongly suggests that the new “TRID” disclosure rules and/or documents artificially depressed the pace of home sales in November – though by the same token they may have artificially inflated slightly the pace of sales in December.

As noted above, the bounce-back in sales last month was not only uneven across the country, but uneven even across different markets in the same state. Here are a few examples (the YOY increase in sales are based on preliminary reports).

| YOY % Change, Home Sales | ||

|---|---|---|

| Nov-15 | Dec-15 | |

| North Texas | 8.7% | 20.1% |

| Houston | -10.5% | -9.3% |

| Triangle Region | -1.0% | 13.1% |

| Charlotte | -3.3% | -2.6% |

| Toledo | -7.0% | 16.0% |

| Columbus | 4.0% | 6.0% |

| Tucson | 3.5% | 15.9% |

| Phoenix | 6.5% | 3.8% |

On the inventory front, I forecast that the inventory of existing home sales at the end of December as estimated by the National Association of Realtors will be 1.81 million, down 11.3% from November’s preliminary level and down 2.7% from last December. Finally I expect that the NAR’s estimate of the median existing SF home sales price for December will be up 6.7% from last December.

CR Note: Existing home sales for December will be released on Friday, and the consensus is for sales of 5.19 million SAAR.

And from Lawler: Post-Mortem on November Existing Home Sales ...

In its report on November home sales released on December 22nd, the National Association of Realtors estimated that US existing home sales ran at a seasonally adjusted annual rate of 4.76 million, down 10.5% from October’s downwardly-revised (to 5.32 million from 5.36 million) pace and down 3.8% from last November’s seasonally adjusted pace. The NAR estimated that unadjusted sales in November were unchanged from a year earlier. The NAR’s estimate was massively lower than the “consensus” forecast (5.32 million SAAR), but was also below my projection (4.97 million SAAR) from December 15th based on publicly-available realtor/MLS reports released through that date. My projection for unadjusted November sales based on regional tracking through December 15th was for a YOY gain of 2.4% (so obviously I underestimated the YOY increase in the November seasonal factor).

There have been numerous local realtor/MLS reports for November released since mid-December, and based on these reports (which comprise over 230,000 sales), I would estimate that “national” existing home sales in November on an unadjusted basis were up by just 1.3% from last November’s surprisingly slow pace, and just a bit higher than the NAR’s estimate. Any way you slice it, then, the pace of existing home sales in November was, on a seasonally adjusted basis, massively slower than in the Spring and Summer.

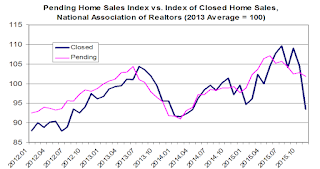

There is a pretty broad consensus that implementation of new mortgage disclosure rules and closing documents, which went into effect in early October, delayed some home closings in November and as such were behind some of the steep drop-off in sales, though it is difficult to quantify this impact (though any impact appears to have varied considerably across various markets). One reason for this consensus is that there was no plunge in various measures of pending home sales – though the NAR’s Pending Home Sales Index has been trending downward since May.

It is worth noting, of course, that the NAR’s Pending Home Sales Index has not been a great predictor of monthly home sales of late. These are several reasons for the “imperfect” linkage: first, of course, monthly data don’t give any indication of the intra-monthly pattern of signed contracts; second, contract “fallout” rates can vary; third, the NAR’s “sample size” for pending home sales is only half as large as that for closed sales; and finally, “data quality” issues are more significant in the pending home sales statistics than in the closed home sales statistics1.

Nevertheless, if in fact the new disclosure/closing rules and documents were behind much of the plunge in November home sales, then one would expect to see a sharp snap back in sales in December.

1This was especially apparent in the NAR’s Pending Home Sales Index in the West, which I noted in 2014 looked “just plain wrong.” Early last year the NAR made massive revisions in it Pending Home Sales Index for the West that now look more reasonable.

Update: Predicting the Next Recession

by Calculated Risk on 1/18/2016 10:49:00 AM

CR 2016 Update: In 2013, I wrote a post "Predicting the Next Recession". I repeated the post in January 2015 (and last summer) because of all the recession calls. Now, once again, the recession callers are out in force - this time arguing the problems in China, combined with the impact on oil producers of lower oil prices (and defaults by energy companies) - will lead to a global recession and drag the US into recession. I don't think so.

I've added a few updates in italics by year (some updates are from 2015). Most of the text is from January 2013.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR 2015 Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

[CR 2016 Update: Now it has been three years! And yes, ECRI has admitted their recession calls were incorrect. Not sure about the rest of the recession callers.]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

[CR 2016 Update: 2013 was a little better than I expected, but still sluggish. 2014 and 2015 saw some pickup in growth.]

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

[CR 2016 Update: The current recession calls are mostly based on exogenous events: the problems in China and in commodity based economies (especially oil based). There will be some spillover to the US such as fewer exports (and an impact on oil producing regions in the US), but unless there is a related financial crisis, I think the spillover will be insufficient to cause a recession in the US.]

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR 2016 Update: Most of the poor policy choices in the U.S. are behind us. Austerity hurt the recovery, but austerity appears over at the state, local and Federal levels. It is possible the Fed could tighten too quickly. ]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR 2016 Update: This was written in 2013 - and my prediction for no "recession for a few years" was correct. This still seems correct today, so no recession this year.]

Sunday, January 17, 2016

Hamilton: "World oil supply and demand"

by Calculated Risk on 1/17/2016 08:40:00 PM

Oil prices are still declining with Brent falling below $28 today.

Here a few excerpts from an article by Professor James Hamilton: World oil supply and demand

According to the Energy Information Administration’s Monthly Energy Review database, world field production of crude oil in September was up 1.5 million barrels a day over the previous year. More than all of that came from a 440,000 b/d increase in the U.S., 550,000 b/d from Saudi Arabia, and 900,000 b/d from Iraq. If it had not been for the increased oil production from these three countries, world oil production would actually have been down almost 400,000 b/d over the last year.

...

Since I last updated these calculations in September, the dollar has appreciated 3% against our major trading partners, and the price of copper has fallen 16%. Based on a weekly historical regression of oil prices on these variables along with the 10-year Treasury yield, we would have predicted a 10% drop in the price of WTI from $46/barrel in $41.50 today on the basis of changes in the exchange rate, copper price, and interest rates since September, explaining about a third of the drop in oil prices since September from international factors that are not unique to oil markets.

Bob Barbera discussed the role of slowing world GDP growth as one of those factors. His graph below shows that the observed slowdown in world GDP since 2010 ... could easily account for much of the drop in commodity prices through 2014. Barbera speculates on the basis of the numbers for Chinese rail shipments and electricity production that the true Chinese GDP growth for 2015 may have been significantly below the country’s official target of 7%. ...

...

If Iranian production is about to surge, Iraqi production remains high, and the Chinese economy is stumbling, that can only mean that even bigger drops in U.S. oil production are inevitable.