by Calculated Risk on 11/21/2015 08:11:00 AM

Saturday, November 21, 2015

Schedule for Week of November 22nd

This will be a short, but busy holiday week.

The key reports this week are the second estimate of Q3 GDP, October New Home sales, October Existing Home Sales, October personal income and outlays, and September Case-Shiller house prices.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.41 million SAAR, down from 5.55 million in September.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.41 million SAAR, down from 5.55 million in September. Economist Tom Lawler estimates the NAR will report sales of 5.33 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

8:30 AM ET: Gross Domestic Product, 3rd quarter 2015 (Second estimate). The consensus is that real GDP increased 2.1% annualized in Q3, revised up from the advance estimate of 1.5%.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.3% year-over-year increase in the Comp 20 index for September. The Zillow forecast is for the National Index to increase 4.7% year-over-year in September.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 271 thousand the previous week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders.

8:30 AM ET: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:00 AM: FHFA House Price Index for September 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: New Home Sales for October from the Census Bureau.

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for a increase in sales to 499 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 468 thousand in September.

10:00 AM: University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 93.1, unchanged from the preliminary reading.

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close at 1:00 PM ET.

Friday, November 20, 2015

Goldman Sachs: Expect FOMC to Raise Fed Funds Rate 100bp in 2016

by Calculated Risk on 11/20/2015 08:37:00 PM

A few excerpts from a research piece by Goldman Sachs economists Zach Pandl and Jan Hatzius:

The US economy in 2016 is likely to be driven once again by domestic demand—particularly consumer spending. We forecast that GDP will increase by 2.25% Q4/Q4 next year, in line with our latest estimates for 2015. ... Both narrow and broad measures of unemployment have fallen significantly ...

The Federal Reserve looks likely to begin raising short-term interest rates next month, seven years after cutting them to zero. ... Based on our economic forecasts, we currently expect the committee to raise the funds rate by 100bp next year, or one hike per quarter—a fair amount above the 55-60bp pace priced into the bond market. Admittedly, we see the risks to this forecasts as skewed to the downside at the moment. The pace of rate hikes will depend on progress toward the FOMC’s employment and inflation goals, as well as evolving views on the level of equilibrium interest rates.

NY Fed: Household Debt increased $212 billion Q3 2015

by Calculated Risk on 11/20/2015 02:03:00 PM

The Q3 report was released yesterday: Household Debt and Credit Report.

From the NY Fed: Just Released: New and Improved Charts and Data on Auto Loans

Today, the New York Fed announced that household debt increased by a robust $212 billion in the third quarter of 2015. Both mortgage and auto loan originations increased, as auto originations reached a ten-year high and new mortgage lending appears to have finally recovered from the very low levels seen in the past year. This quarter, we’re introducing an improved estimate of auto loan originations, some new charts, and some fresh data on the auto loan market. The Quarterly Report on Household Debt and Credit and this analysis use our Consumer Credit Panel data, which is itself based on Equifax credit data.

...

The continued growth in auto lending, subprime lending in particular, is a topic that we’ve monitored closely over the past few years, and we’re just now seeing some increase in delinquency rates on loans made by auto finance companies. Because there are a large number of subprime borrowers in this sector, these borrowers may be more sensitive to developments in the labor market, and the increases in the outstanding balances of these borrowers may pose some risks. That said, any comparison with the subprime mortgage market of the 2000s that led to the crisis should note that the volume of subprime mortgages outstanding in 2007 was nearly four times the volume of subprime auto loans outstanding today ($250 billion).

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3. Household debt peaked in 2008, and bottomed in Q2 2013.

Even mortgage debt is increasing now, from the NY Fed:

Mortgage balances, the largest component of household debt, increased in the third quarter. Mortgage balances shown on consumer credit reports stood at $8.26 trillion, a $144 billion increase from the second quarter of 2015.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased slightly in Q3 to 5.6%. From the NY Fed:

Overall delinquency rates improved modestly in 2015Q3. As of September 30, 5.6% of outstanding debt was in some stage of delinquency. Of the $672 billion of debt that is delinquent, $455 billion is seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

Kansas City Fed: Regional Manufacturing Activity expanded slightly in October, First Time since February

by Calculated Risk on 11/20/2015 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity was Largely Flat

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity was largely flat, although expectations for future activity improved considerably.The declines for most of this year in manufacturing activity, in the Kansas City region, was probably mostly due to lower oil prices and weaker exports due to the strong dollar.

“We saw our composite index move just slightly into positive territory for the first time since February, as some segments of durable manufacturing improved even as activity in our energy states remained sluggish,” said Wilkerson.

...

Tenth District manufacturing activity was largely flat in November, although expectations for future activity improved considerably from the previous few months. Most price indexes edged back down after rising slightly last month.

The month-over-month composite index was 1 in November, up from -1 in October and -8 in September

...

Most future factory indexes continued to rise after falling markedly a few months ago. The future composite index jumped from -1 to 8, and the future production, shipments, and new orders indexes also increased. The future employment index rose from 6 to 13, its highest level in nine months.

emphasis added

BLS on State Unemployment Rates: No State at or above 7%, First Time since early 2007

by Calculated Risk on 11/20/2015 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in October. Thirty-two states and the District of Columbia had unemployment rate decreases from September, 3 states had increases, and 15 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

North Dakota had the lowest jobless rate in October, 2.8 percent, followed by Nebraska, 2.9 percent. West Virginia had the highest rate, 6.9 percent.

Click on graph for larger image.

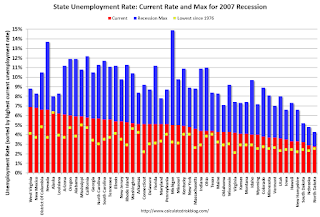

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. West Virginia, at 6.9%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only eight states are at or above 6% (dark blue).

Thursday, November 19, 2015

Merrill Lynch on economic impact of El Niño: Q1 "Risk" to Upside

by Calculated Risk on 11/19/2015 07:15:00 PM

Friday:

• At 10:00 AM ET, Regional and State Employment and Unemployment for October.

• At 11:00 AM, the Kansas City Fed manufacturing survey for November.

Merrill Lynch economists expect El Niño to boost economic activity a little in Q1. Here are a few excerpts from a research article by Michelle Meyer and Lisa Berlin of Merrill Lynch: Summer in Winter

While we are not complaining, it does not feel like we are in the middle of November, given the warm weather. ... According to the experts, this is partly a function of El Niño, which is a prolonged warming in Pacific Ocean surface temperatures. While we are not going to attempt to forecast the weather in the coming months (forecasting the economy is hard enough), it seems that there is a considerable risk of a warm winter. This would be a stark contrast to the last two years, with unusually harsh winter weather.

If we do enjoy a warm winter, the risk is that the 1Q economic data could surprise to the upside, particularly if expectations are for a slump akin to the last two years. We make the following arguments in this piece: 1) looking back at prior episodes of El Niño, GDP growth generally accelerated in 1Q. although the evidence is weak; 2) the seasonal adjustment process will be most sensitive to the most recent years, which suggests the seasonal factors will be looking for weakness, therefore, threatening to inflate the data; and 3) the BEA took steps to address the “residual seasonality” issue that has biased 1Q GDP lower over the prior few years, which may mitigate the negative effect.

...

[W]e think that if the winter ends up being warm, the risk is that the economic data look quite strong. This might just prompt the Fed to justify a second hike earlier than markets are expecting.

DOT: Vehicle Miles Driven increased 2.3% year-over-year in August, Rolling 12 Months at All Time High

by Calculated Risk on 11/19/2015 04:13:00 PM

The Department of Transportation (DOT) reported:

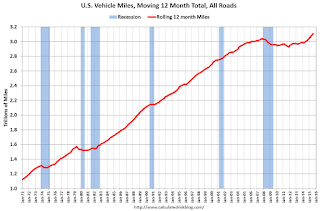

Travel on all roads and streets changed by 2.3% (6.3 billion vehicle miles) for August 2015 as compared with August 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 277.3 billion vehicle miles.

◦The seasonally adjusted vehicle miles traveled for August 2015 is 263.3 billion miles, a 3.6% (9.1 billion vehicle miles) increase over August 2014. It also represents a -0.4% change (-1.2 billion vehicle miles) compared with July 2015.

The rolling 12 month total is moving up - mostly due to lower gasoline prices - after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

The second graph shows the year-over-year change from the same month in the previous year.

In August 2015, gasoline averaged of $2.73 per gallon according to the EIA. That was down significantly from August 2014 when prices averaged $3.57 per gallon.

In August 2015, gasoline averaged of $2.73 per gallon according to the EIA. That was down significantly from August 2014 when prices averaged $3.57 per gallon. Gasoline prices aren't the only factor - demographics is also key. However, with lower gasoline prices, miles driven - on a rolling 12 month basis - is setting new highs each month.

Lawler: Preliminary Table of Distressed Sales and All Cash Sales for Selected Cities in October

by Calculated Risk on 11/19/2015 01:01:00 PM

Economist Tom Lawler sent me a preliminary table below of short sales, foreclosures and all cash sales for a few selected cities in October.

On distressed: Total "distressed" share is down in most of these markets. Distressed sales are up in the Mid-Atlantic due to an increase in foreclosures.

Short sales are down in all of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct- 2015 | Oct- 2014 | Oct- 2015 | Oct- 2014 | Oct- 2015 | Oct- 2014 | Oct- 2015 | Oct- 2014 | |

| Las Vegas | 6.7% | 10.6% | 7.3% | 8.9% | 14.0% | 19.5% | 30.9% | 35.1% |

| Reno** | 4.0% | 6.0% | 3.0% | 4.0% | 7.0% | 10.0% | ||

| Phoenix | 2.7% | 3.7% | 3.6% | 6.2% | 6.3% | 9.9% | 24.6% | 27.7% |

| Sacramento | 4.0% | 6.1% | 3.5% | 6.3% | 7.5% | 12.4% | 17.8% | 20.7% |

| Minneapolis | 2.3% | 2.7% | 7.7% | 9.9% | 10.0% | 12.6% | ||

| Mid-Atlantic | 3.7% | 4.8% | 11.9% | 10.0% | 15.6% | 14.9% | 19.3% | 19.2% |

| Baltimore **** | 3.0% | N/A | 18.6% | N/A | 21.6% | N/A | ||

| Orlando | 3.5% | 5.2% | 19.0% | 26.7% | 22.5% | 31.8% | 36.3% | 41.9% |

| Chicago (city) | 18.3% | 20.9% | ||||||

| Hampton Roads | 16.6% | 19.7% | ||||||

| Spokane | 12.3% | 13.8% | ||||||

| Colorado | 2.0% | 3.6% | ||||||

| Northeast Florida | 25.2% | 30.6% | ||||||

| Toledo | 30.4% | 38.2% | ||||||

| Tucson | 28.1% | 26.8% | ||||||

| Peoria | 20.8% | 22.8% | ||||||

| Georgia*** | 23.1% | 26.5% | ||||||

| Omaha | 16.4% | 18.5% | ||||||

| Pensacola | 31.1% | 33.5% | ||||||

| Richmond VA | 9.3% | 11.5% | 17.1% | 21.5% | ||||

| Memphis | 15.5% | 13.4% | ||||||

| Springfield IL** | 7.8% | 8.6% | 19.2% | 18.6% | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here | ||||||||

Philly Fed Manufacturing Survey showed slight expansion in November

by Calculated Risk on 11/19/2015 10:05:00 AM

From the Philly Fed: Manufacturing Conditions Showed Slight Improvement in November

Manufacturing conditions in the region showed slight improvement this month, according to firms responding to the November Manufacturing Business Outlook Survey. The indicator for general activity was slightly positive this month, following two months in negative territory.This was above the consensus forecast of a reading of 0.0 for November.

...

The diffusion index for current activity edged higher this month, from -4.5 to 1.9, its first positive reading in three months. ...

The survey’s indicators for labor market conditions were mixed this month. The percentage of firms reporting increases in employment (14 percent) was slightly greater than the percentage reporting decreases (11 percent). The employment index increased 4 points, from -1.7 to 2.6. Firms, however, reported overall declines in average work hours in November.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through November. The ISM and total Fed surveys are through October.

The average of the Empire State and Philly Fed surveys increased in November, but was still negative. This suggests another weak reading for the ISM survey.

Weekly Initial Unemployment Claims declined to 271,000

by Calculated Risk on 11/19/2015 08:34:00 AM

The DOL reported:

In the week ending November 14, the advance figure for seasonally adjusted initial claims was 271,000, a decrease of 5,000 from the previous week's unrevised level of 276,000. The 4-week moving average was 270,750, an increase of 3,000 from the previous week's unrevised average of 267,750.The previous week was unrevised at 276,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 270,750.

This was slightly above the consensus forecast of 270,000, however the low level of the 4-week average suggests few layoffs.