by Calculated Risk on 11/05/2015 08:34:00 AM

Thursday, November 05, 2015

Weekly Initial Unemployment Claims increased to 276,000

The DOL reported:

In the week ending October 31, the advance figure for seasonally adjusted initial claims was 276,000, an increase of 16,000 from the previous week's unrevised level of 260,000. The 4-week moving average was 262,750, an increase of 3,500 from the previous week's unrevised average of 259,250.The previous week was unrevised at 260,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 262,750.

This was above the consensus forecast of 262,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, November 04, 2015

FOMC's Yellen, Dudley: December Meeting is "Live"

by Calculated Risk on 11/04/2015 08:13:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, up from 260 thousand the previous week.

From Binyamin Appelbaum at the NY Times: Yellen Signals a Fed Tilt Toward December Rate Increase

“At this point, I see the U.S. economy as performing well,” [Fed Chair Janet Yellen] said, noting the strength of domestic spending. Volatility in global financial markets has also diminished, and the recent deal to raise the federal debt ceiling averted a fiscal showdown, removing two threats to continued growth. If the good news continues, she said, “December would be a live possibility.”From Reuters: Dudley,Yellen concur: December in play for rate hike

New York Fed President William Dudley, addressing reporters, said he would "completely agree" with Fed Chair Janet Yellen who had earlier said December is in play for a policy tightening if the economic data points to further improvement in the labor market and to a rebound in inflation.

Mortgage News Daily: Mortgage Rates up to 4%

by Calculated Risk on 11/04/2015 06:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back to 4 Percent After Yellen

Mortgage rates maintained their upward momentum today, rising to the highest levels since late September after Janet Yellen confirmed the Fed's rate hike outlook. Bond markets (which include the mortgage-backed securities that most directly affect mortgage rates) began adjusting for that outlook last week after the Fed announcement. Markets saw a roughly 1 in 3 chance of a December rate hike before that announcement, and better than 50 percent afterward.Here is a table from Mortgage News Daily:

[In testimony today] Yellen confirmed the shift in tone represented by last week's official announcement. Bottom line: the Fed looks pretty serious about hiking in December. That confirmation was worth a bit of extra pain for bond markets, hence the move higher in mortgage rates. The average lender is now back to 4.0% on conventional 30yr fixed quotes, with only the aggressive few offering anything in the high 3's.

Preview: Employment Report for October

by Calculated Risk on 11/04/2015 02:01:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus, according to Bloomberg, is for an increase of 190,000 non-farm payroll jobs in October (with a range of estimates between 150,000 to 240,000), and for the unemployment rate to decline to 5.0%.

The BLS reported 142,000 jobs added in September.

Here is a summary of recent data:

• The ADP employment report showed an increase of 182,000 private sector payroll jobs in October. This was close to expectations of 185,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index decreased in October to 47.6%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 30,000 in October. The ADP report indicated a 2,000 decrease for manufacturing jobs.

The ISM non-manufacturing employment index increased in September to 59.2%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 320,000 in September. However, the correlation is weaker when the index is this strong!

Combined, the ISM indexes suggests employment gains of 290,000. This suggests employment well above expectations.

• Initial weekly unemployment claims averaged close to 260,000 in October, down from 271,000 in September. This is the lowest since 1973. For the BLS reference week (includes the 12th of the month), initial claims were at 259,000, down from 264,000 during the reference week in September.

The decrease during the reference suggests a lower level of layoffs in October (or easier to find jobs, so some people don't file for unemployment claims).

• The final October University of Michigan consumer sentiment index increased to 90.0 from the September reading of 87.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a small increase in small business employment in October. From Intuit: Small Business Employment Remained Stagnant in October

In October, although the overall small business hiring rate increased to 5.3 percent – the highest level since the recession recovery began – net hiring remained stagnant.• Trim Tabs reported that the U.S. economy added 178,000 jobs in October, up from their estimate of 149,000 jobs in September. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

“The employment decline in the recent months adds up to a jobs loss of 4,000 since July 2015, a small number compared to the 20.6 million people employed by small businesses, “said Susan Woodward the economist who works with Intuit to produce the indexes. “With a high hiring rate but no net hires, the hiring rate of 5.3 percent is all turnover – firms replacing people who quit or were fired.”

The monthly hours worked by small business employees increased significantly – a total of 45 minutes, to 113.1 hours.

“Hours worked is at the highest level we’ve seen since we began reporting this data in 2004, far outside of normal. I expect that businesses will soon hire new people and reduce hours for existing employees, pushing ‘hours worked’ back to its normal level,” Woodward said.

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. The ISM non-manufacturing index and unemployment claims suggest an above consensus report. However Trim Tabs, ADP and Intuit suggests at an or below consensus report.

My guess is the consensus will be close.

ISM Non-Manufacturing Index increased to 59.1% in October

by Calculated Risk on 11/04/2015 10:05:00 AM

The October ISM Non-manufacturing index was at 59.1%, up from 56.9% in September. The employment index increased in October to 59.2%, up from 58.3% in September. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: October 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 69th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 59.1 percent in October, 2.2 percentage points higher than the September reading of 56.9 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 63 percent, which is 2.8 percentage points higher than the September reading of 60.2 percent, reflecting growth for the 75th consecutive month at a faster rate. The New Orders Index registered 62 percent, 5.3 percentage points higher than the reading of 56.7 percent in September. The Employment Index increased 0.9 percentage point to 59.2 percent from the September reading of 58.3 percent and indicates growth for the 20th consecutive month. The Prices Index increased 0.7 percentage point from the September reading of 48.4 percent to 49.1 percent, indicating prices decreased in October for the second consecutive month. According to the NMI®, 14 non-manufacturing industries reported growth in October. After the slight cooling off in September, the non-manufacturing sector reflected growth across most of the indexes. Respondents remain mostly positive about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well above the consensus forecast of 56.7% and suggests faster expansion in October than in September. A strong report.

Trade Deficit decreased in September to $40.8 Billion

by Calculated Risk on 11/04/2015 08:46:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was was $40.8 billion in September, down $7.2 billion from $48.0 billion in August, revised. September exports were $187.9 billion, $3.0 billion more than August exports. September imports were $228.7 billion, $4.2 billion less than August imports.The trade deficit was close to the consensus forecast of $41.1 billion.

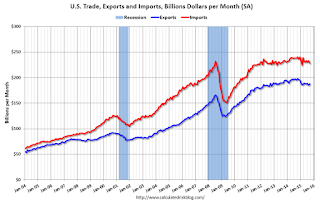

The first graph shows the monthly U.S. exports and imports in dollars through September 2015.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in September.

Exports are 13% above the pre-recession peak and down 4% compared to September 2014; imports are 1% below the pre-recession peak, and down 4% compared to September 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).Oil imports averaged $42.72 in September, down from $49.33 in August, and down from $92.52 in September 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $36.3 billion in September, from $35.6 billion in August 2014. The deficit with China is a substantial portion of the overall deficit.

ADP: Private Employment increased 182,000 in October

by Calculated Risk on 11/04/2015 08:20:00 AM

Private sector employment increased by 182,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was close to the consensus forecast for 185,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 24,000 jobs in October, representing the best month in this sector since January of this year. The construction industry added 35,000 jobs in October, roughly matching September’s gain. Meanwhile, manufacturing remained in negative territory losing 2,000 jobs in October after shrinking by 17,000 in September.

Service-providing employment rose by 158,000 jobs in October, down from a downwardly revised 182,000 in September. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth as measured by the ADP Research Institute is not slowing meaningfully in contrast with the recent slowdown in the government’s data. The economy is creating close to 200,000 jobs per month. Job gains are broad based with energy and manufacturing alone subtracting from the top line. Small businesses, in particular, are contributing to the labor market’s solid performance.”

The BLS report for October will be released Friday, and the consensus is for 190,000 non-farm payroll jobs added in October.

MBA: Mortgage Applications Decrease Slightly in Latest Weekly Survey, Purchase Applications up 20% YoY

by Calculated Risk on 11/04/2015 07:01:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 30, 2015

...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 20 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.01 percent from 3.98 percent, with points increasing to 0.47 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 20% higher than a year ago.

Tuesday, November 03, 2015

Wednesday: Trade Deficit, ADP Employment, ISM Non-Mfg Index

by Calculated Risk on 11/03/2015 08:22:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in October, down from 200,000 in September.

• At 8:30 AM, the Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.1 billion in September from $48.3 billion in August.

• At 10:00 AM, the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 56.7 from 56.9 in September.

Some interesting data released last week from Freddie Mac: Insight & Outlook The following text and graphs are from Fannie Mae:

Click on graph for larger image.

The recent trend of lender de-concentration in the mortgage industry continues. For example, in 2014 large lenders – those who originated at least $10 billion – represented about 30 percent of all conventional originations versus 41 percent in 2013. Virtually all of the de-concentration has come from the very largest lenders. According to data from Inside Mortgage Finance, the top 5 originators accounted for about 34 percent of all originations in 2014, down from 62 percent in 2009. The gain in share has been spread across a broad range of smaller lenders; the share of originations from lenders ranked 21 or higher increased from about 14 percent in 2009 to over 42 percent in 2014 (Exhibit 3).

The market share of non-depository, independent mortgage companies increased sharply in 2014. With the collapse of the housing and secondary mortgage market during the Great Recession, many independent mortgage companies went out of business, especially those focused on subprime lending, and the market share of this group dropped sharply. Since then, the industry has more than recovered its former market share with independent mortgage companies accounting for about 47 percent of home-purchase loans and 42 percent of refinance loans in 2014 (Exhibit 4). These shares are higher than at any point in the past 20 yearsCR Comment: This is a significant shift in lending, especially for purchase lending. If these smaller, independent lenders are not fully represented in the MBA purchase index, then the index would understate the growth in the housing market (something I wondered about a few years ago). At that time, MBA's chief economist Mike Fratantoni told me:

Despite some reports attributing this rise to nonconventional lending and a willingness to originate riskier loans, the HMDA data indicate this rise has been broad-based across different types of loans and demographic groups. However, the increase in lending by independent mortgage companies has been concentrated in states in the West and Southwest, where they focus mostly on originating home purchase loans.

Nonbanks have less stable sources of financing and less financial oversight than banks. Some experts have expressed concern that these lenders are more likely to fail in an economic downturn and thus expose the GSEs and Ginnie Mae to losses.

[I]n the last couple of years ... independent mortgage bankers have accounted for a fast growing share of the purchase market ... We have actively recruited independents and smaller banks to get better coverage of the purchase market. ... It is likely that many of the lenders not in the survey have a higher purchase share and lower refi share.The index is very useful, but it has probably been difficult to keep up with this shift in lending.

U.S. Light Vehicle Sales at 18.1 million annual rate in October

by Calculated Risk on 11/03/2015 03:14:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 18.13 million SAAR in October. That is up almost 10% from October 2014, and up slightly from the 18.1 million annual sales rate last month.

This was the second consecutive month over 18 million.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 18.13 million SAAR from WardsAuto).

This was above the consensus forecast of 17.7 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was another very strong month for auto sales and it appears 2015 will be the best year for light vehicle sales since 2001.