by Calculated Risk on 10/12/2015 04:33:00 PM

Monday, October 12, 2015

CBO: Fiscal 2015 Budget deficit decline to 2.4% of GDP

Note: Fiscal 2015 ended on September 30, 2015.

From CBO: Monthly Budget Review for September 2015

The federal government ran a budget deficit of $435 billion fiscal year 2015, the Congressional Budget Office estimates—$48 billion less than the shortfall recorded in fiscal year 2014, and the smallest deficit recorded since 2007. Relative to the size of the economy, that deficit—at an estimated 2.4 percent of gross domestic product (GDP)—was slightly below the average experienced over the past 50 years, and 2015 was the sixth consecutive year in which the deficit declined as a percentage of GDP since peaking at 9.8 percent in 2009. By CBO’s estimate, revenues were about 8 percent higher and outlays were about 5 percent higher in 2015 than they were in the previous fiscal year.And on September:

emphasis added

The federal government realized a surplus of $95 billion in September 2015, CBO estimates—$11 billion smaller than the surplus in September 2014. Because September 1, 2014, was the Labor Day holiday, certain payments that ordinarily would have been made in September were instead made in August. Without those shifts in the timing of payments, the surplus for September 2015 would have been $8 billion larger than last September’s.As former Fed Chairman Ben Bernanke noted in February 2013, the deficit as a percent of GDP would actually be smaller now without the "sequester":

The CBO estimates that deficit-reduction policies in current law will slow the pace of real GDP growth by about 1-1/2 percentage points this year, relative to what it would have been otherwise.The "know-nothings" in Congress didn't listen then, and they are not listening now.

A significant portion of this effect is related to the automatic spending sequestration that is scheduled to begin on March 1, which, according to the CBO's estimates, will contribute about 0.6 percentage point to the fiscal drag on economic growth this year. Given the still-moderate underlying pace of economic growth, this additional near-term burden on the recovery is significant.

Moreover, besides having adverse effects on jobs and incomes, a slower recovery would lead to less actual deficit reduction in the short run for any given set of fiscal actions.

The Treasury will report the actual figures tomorrow.

Lehner: "Is 2015 Peak Renter?"

by Calculated Risk on 10/12/2015 01:38:00 PM

Here is an article today from economist Josh Lehner: Is 2015 Peak Renter?

There have been at least three primary drivers of the massive shift toward renting in the past decade: finances, demographics, and taste and preferences. Much of the discussion surrounding this overall shift has focuses on the finance issues — foreclosures, credit availability, ability to afford, lack of down payment, etc — and with good reason as this is the most visible aspect of the housing bust and impact of the Great Recession. However given the ongoing strength in multifamily housing today, key questions are being asked. Among them: how long can it last and how much, if at all, will ownership rebound in the future? In other words, when will the housing market hit peak renter? To answer, let’s examine those three underlying drivers.Thanks for the nice mention! There is much much more in the article.

...

All that said, our office remains skeptical that all of the shift into rental is permanent, even from a taste or preference stand point. When the Millennials do settle down, get married, have a couple of kids — at a later age than previous generations — we know single family with good schools looks a lot more attractive. Even so, it does look like most of the increase in rentals is likely to be permanent, particularly in light of the fact that no economist or housing expect I know is predicting a return to the pattern of development and growth seen during much of the past few decades. Even within the renter/owner calculus, as Bill talked about on TV, condos are likely to grow, which are, obviously, both owner and multifamily. Combine this with the possibility that retiring Boomers will actually want to downsize and live in the urban core (I think this is still an open question, not a done deal) and the outlook for multifamily remains strong.

Overall, the biggest takeaway I have from this work, is that in growing, popular areas like Portland, even if the market shifts back toward ownership somewhat, overall demand will increase for both. This is simply due to overall population growth. There will be more of all ages, and preferences a decade from now, look back at those first two graphs.

Update: Framing Lumber Prices down Sharply Year-over-year

by Calculated Risk on 10/12/2015 11:28:00 AM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices are down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts.

Overall the decline in prices is probably due to more supply, and less demand from China.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early October 2015 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down about 22% from a year ago, and CME futures are down around 35% year-over-year.

Headlines from Columbus Day 2008

by Calculated Risk on 10/12/2015 09:27:00 AM

Columbus Day 2008 was a crazy time ... A few headlines on my blog from Monday, October 13, 2008:

• Paulson to Meet with Bank CEOs Today

The 3 p.m. meeting is being called while most of the banking chiefs are in Washington for meetings of the World Bank and the International Monetary Fund. Invited to attend were banking executives including Ken Lewis, CEO of Bank of America, Jamie Dimon, CEO of J.P. Morgan Chase, Lloyd Blankfein, CEO of Goldman Sachs Group; John Mack, CEO of Morgan Stanley; and Vikram Pandit, CEO of Citigroup.• Federal Reserve and other central banks announce unlimited liquidity

... one person familiar with the matter said Secretary Paulson is expected to discuss details of his new plan to take equity stakes in financial firms ...

In order to provide broad access to liquidity and funding to financial institutions, the Bank of England (BoE), the European Central Bank (ECB), the Federal Reserve, the Bank of Japan, and the Swiss National Bank (SNB) are jointly announcing further measures to improve liquidity in short-term U.S. dollar funding markets.• Foreclosures in Orange County

MDA DataQuick, in a special report prepared for the Orange County Register, found that as of early September there were more than 3,300 unsold foreclosures in the county. DataQuick looked at all foreclosures for the year ended in June, and checked to see how many had resold. It found 40 percent were unsold.• Paul Krugman Wins Nobel Economics Prize

Sunday, October 11, 2015

Sunday Night Futures

by Calculated Risk on 10/11/2015 07:29:00 PM

The Bond Market and Banks will be closed Monday in observance of the Columbus Day Holiday. The stock market will be open.

An excerpt from an article by Tim Duy: Fed Struggles With The High Water Mark

So where does all of this leave Fed policy? Confused, I think, like September when economists saw the outcome of that meeting as a coin toss. Don't expect communications to become much clearer. October is off the table (despite what Lacker might believe). They first need to decide if the last two months of jobs data were aberrations or signals of slowing job growth. They can't do that before October. And I am not confident they can do so by December. If we get two more reports hovering around 200k a month between now and December, matched with generally consistent data across other indicators, then December is on the table. That would indicate the economy is not coming off its high water mark without some help from the Fed. If jobs growth slows to 100k a month, again with a broad swath of generally consistent data, then we are looking at deep into 2016 before any hike. Around 150k is the gray area. They won't know if the economy is poised to head lower on its own, or if that is sufficient to contain inflationary pressures. They don't know if they should be tapping on the breaks or not. Risk management under the assumption of constrained inflation suggests they push off action until January or March. But they would not send such a clear message. Indeed, I suspect that more numbers like the last two will make the December meeting much like September's. That I fear is my current baseline - another close call in which the Fed concludes to take a pass.Weekend:

• Schedule for Week of October 11, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are flat and DOW futures are down 10 (fair value).

Oil prices were up over the last week with WTI futures at $49.84 per barrel and Brent at $52.65 per barrel. A year ago, WTI was at $86, and Brent was at $89 - so prices are down more than 40% year-over-year (a year ago that prices were falling).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.31 per gallon (down about $0.90 per gallon from a year ago).

Goldman: Expects Participation Rate to decline 0.25% per year, Unemployment Rate to below 4.5%

by Calculated Risk on 10/11/2015 11:36:00 AM

A few excerpts from a research piece by Goldman Sachs economist David Mericle: What We Have Here Is a Failure to Participate

[W] now expect the participation rate to fall by about 0.2-0.25pp per year. The main reasons for the forecast change are that we have flattened the slope of the upward trend in participation rates for older workers and will see a smaller boost from declines in the now-lower stock of discouraged workers in the future. This implies that a given amount of GDP growth will put more downward pressure on the unemployment rate than we previously estimated, and we now expect the rate to fall below 4½% in coming years even as growth slows toward a trend rate. Exhibit 10 shows our new forecast paths.

Click on graph for larger image.

Click on graph for larger image.This graph from Goldman Sachs shows their projection for the labor force participation rate on the left. Goldman expects the participation rate to decline from the current 62.4% to around 61.8% in 2018. Most of the expected decline over the next few years will be from retirement.

Note: Economist at the BLS expect the participation rate to continue to decline for the next couple of decades due to demographics.

The right side of the graph shows Goldman's forecast for the unemployment rate (previous forecast and revision).

Goldman expects the unemployment rate to decline to around 4.6% at the end of 2016, and to see further decline in 2017 and 2018.

Saturday, October 10, 2015

Schedule for Week of October 11, 2015

by Calculated Risk on 10/10/2015 08:15:00 AM

The key economic reports this week is September retail sales on Tuesday.

For manufacturing, September Industrial Production will be released on Friday, and the October NY and Philly Fed manufacturing surveys will be released this week.

For prices, CPI will be released on Thursday.

The Bond Market and Banks will be closed in observance of the Columbus Day Holiday. The stock market will be open.

9:00 AM ET: NFIB Small Business Optimism Index for September.

2:00 PM: The Monthly Treasury Budget Statement for September (end of fiscal 2015).

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is for a 0.2% decrease in prices, and a 0.1% increase in core PPI.

8:30 AM ET: Retail sales for September will be released.

8:30 AM ET: Retail sales for September will be released.This graph shows retail sales since 1992 through August 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were up 0.2% from July to August (seasonally adjusted), and sales were up 2.2% from August 2014.

The consensus is for retail sales to increase 0.1% in September, and to decrease 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for no change in inventories.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 263 thousand the previous week.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.2% decrease in CPI, and a 0.1% increase in core CPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for October. The consensus is for a reading of -7.0, up from -14.7.

10:00 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of -1.0, up from -6.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.3% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.4%.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in July to 5.753 million from 5.323 million in June

The number of job openings (yellow) were up 22% year-over-year, and Quits were up 6% year-over-year.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 89.5, up from 87.2 in September.

Friday, October 09, 2015

Sacramento Housing in September: Sales up 13%, Inventory down 19% YoY

by Calculated Risk on 10/09/2015 07:10:00 PM

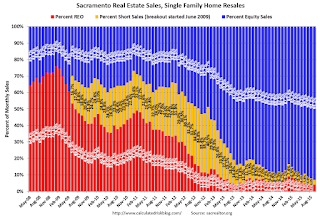

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In September, total sales were up 13.1% from September 2014, and conventional equity sales were up 18.5% compared to the same month last year.

In September, 6.9% of all resales were distressed sales. This was down from 7.8% last month, and down from 11.1% in September 2014. This is the lowest percentage of distressed sales since they started breaking out distressed sales).

The percentage of REOs was at 4.1% in September, and the percentage of short sales was 2.7.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales. Distressed sales are so small, the font doesn't fit.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 18.5% year-over-year (YoY) in September. This was the fifth consecutive monthly YoY decrease in inventory in Sacramento (a big recent change).

Cash buyers accounted for 15.6% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying.

Nomura on September CPI

by Calculated Risk on 10/09/2015 06:11:00 PM

Yesterday I posted some comments by Merrill Lynch economists on September CPI. Here is the take of economists at Nomura:

"Given the recent tightening in labor markets, higher wages in the health care sector and continued declines in the vacancy rate of rental houses, we think that the slowdown in core service inflation in August was temporary and still expect a gradual pick up in core inflation in the medium term. We expect a 0.17% m-o-m (1.8% y-o-y) gain in core CPI in September. We expect the continued decline in energy prices in September to weigh on the overall price index. As such, we expect headline prices to decline by 0.20% m-o-m (-0.1% y-o-y)."CPI for September will be released next Thursday.

"Is 2015 Peak Renter?" @TheStalwart @adsteel

by Calculated Risk on 10/09/2015 04:35:00 PM

Joe Weisenthal and Alix Steel have invited me to be on Bloomberg's 'What'd You Miss?' today. We are going to discuss demographics and the impact on renting.

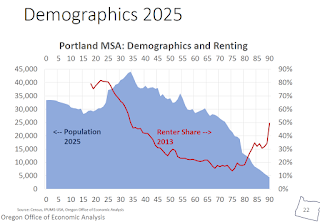

The title of this post is from a report by Oregon Office of Economic Analysis economist Josh Lehner on the Portland housing market. Josh was kind enough to allow me to use a couple of his graphs for my appearance on Bloomberg.

Here are the three graphs I'm planning on discussing:

The first graph is from my post yesterday: Demographic Impacts: Renting vs. Owning, Labor Force Participation, GDP

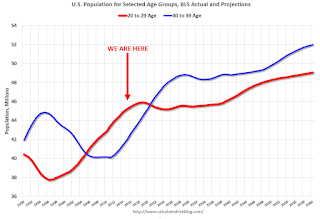

This graph shows the long term trend for two key age groups: 20 to 29, and 30 to 39.

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

Note: I used a similar graph five years ago to argue there would be a surge in rentals from both demographics, and also from people losing their homes to foreclosure.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

Renting peaks when people are in their 20s, and then steadily falls off (behavior may change a little going forward).

The second graph from Lehner shows population projections for 2025.

This doesn't mean 2015 is "peak renter". But this does suggest growth will slow for multi-family, but not a sharp decline.

The recent Reis survey on apartment vacancies and rents also suggests some slowdown, but overall the rental market is still very tight.