by Calculated Risk on 10/07/2015 08:16:00 PM

Wednesday, October 07, 2015

Thursday: FOMC Minutes, Unemployment Claims

Some excerpts on the stock market from Aleksandar Timcenko and Noah Weisberger at Goldman Sachs (this is their view):

After hitting an all-time high in late July, the S&P 500 subsequently declined more than 12% over the following month. This type of price action qualifies as a ‘drawdown’, using the definition developed in this piece. We examine recent global equity price action in the context of past drawdowns, and look at why they occur and what accounts for their severity. Lastly, we discuss the post-drawdown environment.Thursday:

...

We find that the size and speed of the recent equity drawdowns are within historical norms; that they are more likely to occur (and more likely to be large) when economic growth is deteriorating, when multiples have increased and when returns have climbed above trend; and that markets tend to revert to their previous trends.

This suggests that, if – as we expect – the macroeconomic picture stabilises, recent equity downturns will slowly and steadily reverse course.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 271 thousand initial claims, down from 275 thousand the previous week.

• At 2:00 PM, the Fed will release the FOMC Minutes for the Meeting of September 16-17, 2015

Defeatists Policies #NothingCanBeDone

by Calculated Risk on 10/07/2015 05:01:00 PM

A personal comment ...

Over the last several years, I noted on several occasions that Congress has been a disaster. They've opposed economic policies normally supported by both parties - and by Milton Friedman and Ronald Reagan - and this has hurt the economy. Former Fed Chairman Ben Bernanke noted in his book: “I also felt frustrated that fiscal policy makers, far from helping the economy, appeared to be actively working to hinder it.”

emphasis added

I agree with Bernanke.

This seems to part of a defeatists theme of the current Congress - an overwhelming pessimism about several policies -"Nothing can be done" could be their slogan (or worse when they "actively work to hinder" the economy).

Former Fed Chairman Ben Bernanke also wrote in this book that he “lost patience with Republicans’ susceptibility to the know-nothing-ism of the far right." He went on to write: “I often said that monetary policy was not a panacea — we needed Congress to do its part. After the crisis calmed, that help was not forthcoming.”

emphasis added

And here is another excerpt from Bernanke's book via the WSJ, Bernanke on Congress:

"They blamed the crisis on the Fed and on Fannie (Mae) and Freddie (Mac), with little regard for the manifest failings of the private sector, other regulators, or, most especially, Congress itself. They condemned bailouts as giveaways of taxpayer money without considering the broader economic consequences of the collapse of systemically important firms. They saw inflation where it did not exist and, when the official data did not bear out their predictions, invoked conspiracy theories. They denied that monetary or fiscal policy could support job growth, while still working to direct federal spending to their own districts. They advocated discredited monetary systems, like the gold standards.This defeatist view - and pessimistic outlook - applies to other policies too. As an example, during the recent debate, GOP presidential hopefuls Marco Rubio and Carly Fiorina acknowledged the dangers of climate change (a positive step compared to the deniers), but both said Nothing Can be Done. How sadly pessimistic and contrary to the optimism of Presidents Kennedy and Reagan.

I believe steps can be taken to address climate change with minimal impact on the economy - people are resourceful. In the '70s, when it was discovered that chlorofluorocarbons were damaging the ozone, the "do nothing" crowd claimed action would damage the economy, and cars would no longer have air conditioning. Action was taken, and the economy was fine (and the AC in my car still works).

On a personal note, one of my college professors, Sherwood Rowland, won the Nobel prize for discovering the role of chlorofluorocarbons in ozone depletion. I chatted with Professor Rowland in 2008, and we discussed the science of climate change (My undergraduate degree is in Chemistry). Dr. Rowland was extremely concerned about the impacts of climate change, and clearly frustrated with the politics of the deniers.

And we also hear "nothing can be done" about the ongoing mass shooting in the U.S., even though most Americans support stricter background checks, longer waiting periods, and restricting certain types of weapons. Reagan supported gun control, but not this Congress. Something can be done - and will be done eventually. Hopefully "Before some ol' fool come around here, Wanna shoot either you or me".

I'm optimistic about the future and I share Bernanke's view that"the United States [is] one of the most attractive places to live, work and invest over the next few decades". But we need better policymakers in Congress.

Phoenix Real Estate in September: Sales up 12%, Inventory down 12%

by Calculated Risk on 10/07/2015 02:02:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

For the tenth consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in September were up 11.6% year-over-year.

2) Cash Sales (frequently investors) were down to 22.6% of total sales.

3) Active inventory is now down 11.7% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices are increasing a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 3.0% through July (prices increased more in 7 months in 2015, than all of 2014).

| September Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Sept-08 | 6,179 | --- | 1,041 | 16.8% | 54,4271 | --- |

| Sept-09 | 7,907 | 28.0% | 2,776 | 35.1% | 38,340 | -29.6% |

| Sept-10 | 6,762 | -14.5% | 2,904 | 42.9% | 45,202 | 17.9% |

| Sept-11 | 7,892 | 16.7% | 3,470 | 44.0% | 26,950 | -40.4% |

| Sept-12 | 6,478 | -17.9% | 2,849 | 44.0% | 21,703 | -19.5% |

| Sept-13 | 6,313 | -2.5% | 2,106 | 33.4% | 23,405 | 7.8% |

| Sept-14 | 6,252 | -1.0% | 1,609 | 25.7% | 26,492 | 13.2% |

| Sept-15 | 6,980 | 11.6% | 1,573 | 22.5% | 23,396 | -11.7% |

| 1 September 2008 probably includes pending listings | ||||||

"Labor Market Gains Not Sparking a Single-Family Housing Recovery"

by Calculated Risk on 10/07/2015 10:43:00 AM

From Adam Ozimek at Moody's Analytics: Labor Market Gains Not Sparking a Single-Family Housing Recovery

The unemployment rate is marching ever lower, and the economy is approaching full employment, but still single-family housing is lagging. This is prompting some to wonder, what will it take to turn things around?CR Note: I think single family is lagging for several reasons:

One suggestion is that once unemployment falls low enough we’ll see the long-awaited single-family housing recovery. If this were true, one would expect that metro areas with already-lower unemployment would be seeing a single-family turnaround.

To test this theory, metro areas were ranked by their August unemployment rate compared with their historical average. Around 43% of metro areas have an unemployment rate lower than the 2000 to 2004 average. The 25 that are doing the best are concentrated in Texas, California, and states in the Northwest. Austin TX has the lowest relative unemployment rate. In August, the unemployment rate there reached 3%, which is 62.3% of the 2000 to 2004 average of 4.8%.

The average unemployment rate in these 25 metro areas is 3.9%, compared with 5.6% for these same areas in 2000 to 2004, and 5.1% for the total U.S. today. In other words, employment is looking healthy in these metro areas compared with historical averages and the U.S. overall.

...

However, even in these 25 metro areas, single-family housing permits remain significantly below historical levels. This suggests that even where unemployment has fallen to historically low levels, it has not been enough to boost single-family permits.

1) the builders had limited entitled land following the bust, so they built fewer but higher priced homes. The data on New Home prices supports this.

2) in some areas, there is still competition from foreclosures (Judicial foreclosure areas like Florida). However Ozimek focused on areas that have recovered, so this doesn't explain his findings.

3) and there used to be quite a bit of financing available for first time homebuyers - many of these programs are gone.

There is much more in Ozimek's article.

MBA: Mortgage Applications "Up Sharply", Purchase Applications up 49% YoY

by Calculated Risk on 10/07/2015 07:04:00 AM

From the MBA: Mortgage Applications Up Sharply in Latest MBA Weekly Survey

Mortgage applications increased 25.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 2, 2015.

...

The Refinance Index increased 24 percent from the previous week. The seasonally adjusted Purchase Index increased 27 percent from one week earlier. The unadjusted Purchase Index increased 27 percent compared with the previous week and was 49 percent higher than the same week one year ago.

“The number of applications for purchase and refinance mortgages soared last week due both to renewed rate volatility and as many applications were filed prior to the TILA-RESPA regulatory change. The average loan size of applications in the weekly survey increased by 6.9 percent, driven by a 12.1 percent increase in the average size of refinances,” said Lynn Fisher, MBA’s Vice President of Research and Economics.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.99 percent, the lowest level since May 2015, from 4.08 percent, with points increasing to 0.46 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 49% higher than a year ago.

This surge was partially related to applications being filed before the TILA-RESPA regulatory change, so I expect applications to decline significant in the next survey.

Tuesday, October 06, 2015

Mortgage News Daily: Mortgage Rates holding 3 7/8%

by Calculated Risk on 10/06/2015 07:35:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Sideways to Slightly Higher

Most lenders are right in line with yesterday's latest levels though there are a few who marginally increased costs. That means that borrowers would still likely be seeing the same note rates as yesterday, with Conventional 30yr fixed loans being quoted in a range from 3.75 - 3.875%.Here is a table from Mortgage News Daily:

To reiterate a point made yesterday, with the exception of last Friday, rates are as low as they've been since late April. Rates spent plenty of time dipping their toes in the water of "high 3's" over the past few months, but this is the best sustained run we've had with 3.75% being available at more than a few lenders. And again, keep in mind that almost any rate that's available at one lender would be available at other lenders as well, but the costs to obtain that rate could vary greatly between lenders on opposite ends of the spectrum.

Fed: Q2 Household Debt Service Ratio Very Low

by Calculated Risk on 10/06/2015 02:48:00 PM

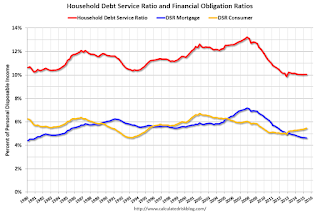

The Fed's Household Debt Service ratio through Q2 2015 was released yesterday: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio increased in Q2 has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) has been increasing for the last two years.

This data suggests aggregate household cash flow has improved.

CoreLogic: House Prices up 6.9% Year-over-year in August

by Calculated Risk on 10/06/2015 11:32:00 AM

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Home Prices Up Almost 7 Percent Year Over Year

According to the CoreLogic HPI, home prices nationwide, including distressed sales, increased by 6.9 percent in August 2015 compared with August 2014 and increased by 1.2 percent in August 2015 compared with July 2015.

“Economic forecasts generally project higher mortgage rates and more single-family housing starts for 2016. These forces should dampen demand and augment supply, leading to a moderation in home price growth,” said Frank Nothaft, chief economist for CoreLogic. “Over the next 12 months through August 2016, CoreLogic projects its national HPI to rise 4.3 percent, less than the 6.9 percent gain over the 12 months through August 2015.”

“Home price appreciation in cities like New York, Los Angeles, Dallas, Atlanta and San Francisco remain very strong reflecting higher demand and constrained supplies,” said Anand Nallathambi, president and CEO of CoreLogic. “Continued gains in employment, wage growth and historically low mortgage rates are bolstering home sales and home price gains. In addition, an increasing number of major metropolitan areas are experiencing ever-more severe shortfalls in affordable housing due to supply constraints and higher rental costs. These factors will likely support continued home price appreciation in 2016 and possibly beyond.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.2% in August (NSA), and is up 6.9% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The year-over-year comparison has been positive for forty two consecutive months.

The YoY increase had been moving sideways over most of the last year, but has picked up recently.

Trade Deficit increased in August to $48.3 Billion

by Calculated Risk on 10/06/2015 08:42:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $48.3 billion in August, up $6.5 billion from $41.8 billion in July, revised. August exports were $185.1 billion, $3.7 billion less than July exports. August imports were $233.4 billion, $2.8 billion more than July imports.The trade deficit close to the consensus forecast of $48.6 billion.

The first graph shows the monthly U.S. exports and imports in dollars through August 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in August.

Exports are 12% above the pre-recession peak and down 6% compared to August 2014; imports are 1% above the pre-recession peak, and down 2% compared to August 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).Oil imports averaged $49.33 in August, down from $54.20 in July, and down from $96.34 in August 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $35.0 billion in August, from $30.3 billion in August 2014. The deficit with China is a large portion of the overall deficit.

Monday, October 05, 2015

Tuesday: Trade Deficit

by Calculated Risk on 10/05/2015 08:16:00 PM

Tuesday:

• At 8:30 AM ET, Trade Balance report for August from the Census Bureau. The consensus is for the U.S. trade deficit to be at $48.6 billion in August from $41.9 billion in July.

From Binyamin Appelbaum at the NY Times: Ben Bernanke, in Book, Blames Congress for Lagging Fiscal Recovery

Congress is largely responsible for the incomplete recovery from the 2008 financial crisis, Ben S. Bernanke, the former Federal Reserve chairman, says in a memoir published on Monday.I agree.

Mr. Bernanke, who left the Fed in January 2014 after eight years as chairman, writes that the Fed’s response to the crisis was bold and effective but insufficient.

“I often said that monetary policy was not a panacea — we needed Congress to do its part,” he says. “After the crisis calmed, that help was not forthcoming.”