by Calculated Risk on 10/07/2015 10:43:00 AM

Wednesday, October 07, 2015

"Labor Market Gains Not Sparking a Single-Family Housing Recovery"

From Adam Ozimek at Moody's Analytics: Labor Market Gains Not Sparking a Single-Family Housing Recovery

The unemployment rate is marching ever lower, and the economy is approaching full employment, but still single-family housing is lagging. This is prompting some to wonder, what will it take to turn things around?CR Note: I think single family is lagging for several reasons:

One suggestion is that once unemployment falls low enough we’ll see the long-awaited single-family housing recovery. If this were true, one would expect that metro areas with already-lower unemployment would be seeing a single-family turnaround.

To test this theory, metro areas were ranked by their August unemployment rate compared with their historical average. Around 43% of metro areas have an unemployment rate lower than the 2000 to 2004 average. The 25 that are doing the best are concentrated in Texas, California, and states in the Northwest. Austin TX has the lowest relative unemployment rate. In August, the unemployment rate there reached 3%, which is 62.3% of the 2000 to 2004 average of 4.8%.

The average unemployment rate in these 25 metro areas is 3.9%, compared with 5.6% for these same areas in 2000 to 2004, and 5.1% for the total U.S. today. In other words, employment is looking healthy in these metro areas compared with historical averages and the U.S. overall.

...

However, even in these 25 metro areas, single-family housing permits remain significantly below historical levels. This suggests that even where unemployment has fallen to historically low levels, it has not been enough to boost single-family permits.

1) the builders had limited entitled land following the bust, so they built fewer but higher priced homes. The data on New Home prices supports this.

2) in some areas, there is still competition from foreclosures (Judicial foreclosure areas like Florida). However Ozimek focused on areas that have recovered, so this doesn't explain his findings.

3) and there used to be quite a bit of financing available for first time homebuyers - many of these programs are gone.

There is much more in Ozimek's article.

MBA: Mortgage Applications "Up Sharply", Purchase Applications up 49% YoY

by Calculated Risk on 10/07/2015 07:04:00 AM

From the MBA: Mortgage Applications Up Sharply in Latest MBA Weekly Survey

Mortgage applications increased 25.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 2, 2015.

...

The Refinance Index increased 24 percent from the previous week. The seasonally adjusted Purchase Index increased 27 percent from one week earlier. The unadjusted Purchase Index increased 27 percent compared with the previous week and was 49 percent higher than the same week one year ago.

“The number of applications for purchase and refinance mortgages soared last week due both to renewed rate volatility and as many applications were filed prior to the TILA-RESPA regulatory change. The average loan size of applications in the weekly survey increased by 6.9 percent, driven by a 12.1 percent increase in the average size of refinances,” said Lynn Fisher, MBA’s Vice President of Research and Economics.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.99 percent, the lowest level since May 2015, from 4.08 percent, with points increasing to 0.46 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 49% higher than a year ago.

This surge was partially related to applications being filed before the TILA-RESPA regulatory change, so I expect applications to decline significant in the next survey.

Tuesday, October 06, 2015

Mortgage News Daily: Mortgage Rates holding 3 7/8%

by Calculated Risk on 10/06/2015 07:35:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Sideways to Slightly Higher

Most lenders are right in line with yesterday's latest levels though there are a few who marginally increased costs. That means that borrowers would still likely be seeing the same note rates as yesterday, with Conventional 30yr fixed loans being quoted in a range from 3.75 - 3.875%.Here is a table from Mortgage News Daily:

To reiterate a point made yesterday, with the exception of last Friday, rates are as low as they've been since late April. Rates spent plenty of time dipping their toes in the water of "high 3's" over the past few months, but this is the best sustained run we've had with 3.75% being available at more than a few lenders. And again, keep in mind that almost any rate that's available at one lender would be available at other lenders as well, but the costs to obtain that rate could vary greatly between lenders on opposite ends of the spectrum.

Fed: Q2 Household Debt Service Ratio Very Low

by Calculated Risk on 10/06/2015 02:48:00 PM

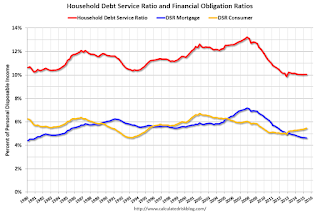

The Fed's Household Debt Service ratio through Q2 2015 was released yesterday: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio increased in Q2 has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) has been increasing for the last two years.

This data suggests aggregate household cash flow has improved.

CoreLogic: House Prices up 6.9% Year-over-year in August

by Calculated Risk on 10/06/2015 11:32:00 AM

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Home Prices Up Almost 7 Percent Year Over Year

According to the CoreLogic HPI, home prices nationwide, including distressed sales, increased by 6.9 percent in August 2015 compared with August 2014 and increased by 1.2 percent in August 2015 compared with July 2015.

“Economic forecasts generally project higher mortgage rates and more single-family housing starts for 2016. These forces should dampen demand and augment supply, leading to a moderation in home price growth,” said Frank Nothaft, chief economist for CoreLogic. “Over the next 12 months through August 2016, CoreLogic projects its national HPI to rise 4.3 percent, less than the 6.9 percent gain over the 12 months through August 2015.”

“Home price appreciation in cities like New York, Los Angeles, Dallas, Atlanta and San Francisco remain very strong reflecting higher demand and constrained supplies,” said Anand Nallathambi, president and CEO of CoreLogic. “Continued gains in employment, wage growth and historically low mortgage rates are bolstering home sales and home price gains. In addition, an increasing number of major metropolitan areas are experiencing ever-more severe shortfalls in affordable housing due to supply constraints and higher rental costs. These factors will likely support continued home price appreciation in 2016 and possibly beyond.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.2% in August (NSA), and is up 6.9% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The year-over-year comparison has been positive for forty two consecutive months.

The YoY increase had been moving sideways over most of the last year, but has picked up recently.

Trade Deficit increased in August to $48.3 Billion

by Calculated Risk on 10/06/2015 08:42:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $48.3 billion in August, up $6.5 billion from $41.8 billion in July, revised. August exports were $185.1 billion, $3.7 billion less than July exports. August imports were $233.4 billion, $2.8 billion more than July imports.The trade deficit close to the consensus forecast of $48.6 billion.

The first graph shows the monthly U.S. exports and imports in dollars through August 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in August.

Exports are 12% above the pre-recession peak and down 6% compared to August 2014; imports are 1% above the pre-recession peak, and down 2% compared to August 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).Oil imports averaged $49.33 in August, down from $54.20 in July, and down from $96.34 in August 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $35.0 billion in August, from $30.3 billion in August 2014. The deficit with China is a large portion of the overall deficit.

Monday, October 05, 2015

Tuesday: Trade Deficit

by Calculated Risk on 10/05/2015 08:16:00 PM

Tuesday:

• At 8:30 AM ET, Trade Balance report for August from the Census Bureau. The consensus is for the U.S. trade deficit to be at $48.6 billion in August from $41.9 billion in July.

From Binyamin Appelbaum at the NY Times: Ben Bernanke, in Book, Blames Congress for Lagging Fiscal Recovery

Congress is largely responsible for the incomplete recovery from the 2008 financial crisis, Ben S. Bernanke, the former Federal Reserve chairman, says in a memoir published on Monday.I agree.

Mr. Bernanke, who left the Fed in January 2014 after eight years as chairman, writes that the Fed’s response to the crisis was bold and effective but insufficient.

“I often said that monetary policy was not a panacea — we needed Congress to do its part,” he says. “After the crisis calmed, that help was not forthcoming.”

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 10/05/2015 04:44:00 PM

An update: Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through August 2015.

The prime working age population peaked in 2007, and bottomed at the end of 2012. The prime working age population is almost back to the previous peak (this is population and has nothing to do cyclical weakness - this is just demographics).

The good news is the prime working age group is now growing at 0.5% per year - and this should boost economic activity a little going forward.

Note: There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s! So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

Black Knight August Mortgage Monitor

by Calculated Risk on 10/05/2015 02:36:00 PM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for August today. According to BKFS, 4.83% of mortgages were delinquent in August, down from 4.71% in July. BKFS reported that 1.37% of mortgages were in the foreclosure process, down from 1.80% in August 2014.

This gives a total of 6.20% delinquent or in foreclosure. It breaks down as:

• 1,582,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 865,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 696,000 loans in foreclosure process.

For a total of 3,142,000 loans delinquent or in foreclosure in August. This is down from 3,908,000 in August 2014.

Press Release: Black Knight’s August Mortgage Monitor: Cash-Out Refinances Up 68 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of August 2015. ... As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, borrowers have been capitalizing on increased equity available in their homes and still historically low rates.

“In the second quarter of 2015, we saw cash-out refinance volumes rise almost 70 percent from the same period last year,” said Graboske. “While this is the highest volume in cash-out refinances we’ve seen in five years, it’s still nearly 80 percent below the peak in Q3 2005. Even so, it’s clear that borrowers have been capitalizing on the increased equity available to them. As we reported in last month’s Mortgage Monitor, total equity of mortgage holders has risen by about $1 trillion over the last year, and ‘tappable’ equity stands at $4.5 trillion. Borrowers today are pulling out an average of $67,000 of equity through cash-out refis, nearly the levels we saw back in 2006. What’s really interesting though, is that even after pulling out that equity, resulting average LTVs are at 68 percent, the lowest level we’ve seen in over 10 years. During this same time span, we’ve seen second lien HELOC lending rise, albeit at a lesser rate; that volume is up 40 percent from last year. However, as interest rates rise, we could see an increase in HELOC lending and corresponding slowing in first lien cash-out refis, as borrowers will likely want to hang on to lower rates for their first mortgage while still being able to tap available equity.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows average cash out and the resulting LTV. Cash outs are up, but the LTVs are still very low.

From Black Knight:

Borrowers today are pulling out an average of $67,000 of equity through cash-out refinances, nearly at the levels seen back in 2006There is much more in the mortgage monitor.

Even after pulling out equity, resulting average LTVs are at 68 percent, the lowest level in over 10 years

Less than 10 percent of all cash-out refinances have LTVs above 80 percent, also at the lowest level in over 10 years.

Nearly 60 percent of cash-out refinance volume is coming from borrowers with UPBs below $200K

Reis: Mall Vacancy Rate unchanged in Q3

by Calculated Risk on 10/05/2015 11:36:00 AM

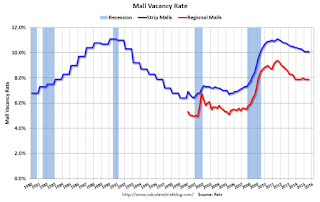

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q3 2015. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged at 10.1% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

The national vacancy rate for neighborhood and community shopping centers was unchanged during the third quarter at 10.1%. The market is mired in this incredibly slow recovery whereby net absorption exceeds new supply, but not by a wide enough margin to cause vacancy to decline in a meaningful fashion. The vacancy rate for malls also was unchanged again at 7.9%, indicating that this issue is not just confined to one retail subsector.

So where is the demand? To be sure, the market is absorbing space, but not at the pace one would have hoped at this juncture in the cycle. A few things have transpired. First, space in the best centers leased up relatively quickly during this recovery and is largely gone. What remains to be leased is space that is a bit more challenging. Second, ecommerce, though not the leviathan that it is often portrayed to be, is not helping. Many services that people purchase online, such as apps, simply are not available for purchase in a physical store. Ecommerce slowly takes market share away from bricks‐and‐mortar buildings with every passing quarter. Third, the rise of different retail subtypes such as town centers, lifestyle centers, and power centers has given consumers options that they previously did not have. Does that mean we should expect structurally higher vacancy rates for the traditional retail subtypes? Likely yes. Those property subtypes are not likely to reach the same low vacancy rates during this cycle that they have attained in previous cycles. Although retail sales and demand for goods and services continues to increase, it is now spread through many more distribution channels than in the past.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.