by Calculated Risk on 9/04/2015 07:22:00 PM

Friday, September 04, 2015

Will the Fed raise rates in September?

Economist are uncertain whether the Fed will increase the Fed Funds rate in September ...

From Neil Irwin at the NY Times The Upshot: A Positive Jobs Report Keeps the Fed in a Tricky Spot

Nothing about the latest numbers is likely to tip the balance for the Fed one way or the other. The unemployment rate is now down to 5.1 percent, its lowest since April 2008, when the Great Recession was a mere toddler. The 173,000 payroll jobs added in August were a little below analyst expectations, but revisions to earlier months were positive. Average hourly earnings rose a healthy 0.3 percent.From the WSJ: Blurry Job Picture Poses Test for Fed

Friday’s report, the last major gauge of job-market health before the Fed’s Sept. 16-17 meeting, leaves the central bank with a difficult decision as it ponders raising short-term interest rates this month for the first time since 2006: Has the U.S. economy improved enough to absorb higher rates, or does the fragile state of the world economy and the financial markets call for more patience?The key sentence in the July FOMC statement was

"The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term."Since that statement, the economy added 245 thousand jobs in July and 173 thousand jobs in August (and frequently August is revised up). The unemployment rate declined from 5.3% in June to 5.1% in August. My view is this is probably the "some further improvement" in the labor market that the FOMC mentioned in the July statement.

So the focus at the FOMC meeting will probably be on inflation. Is the FOMC "reasonably confident that inflation will move back to its 2 percent objective over the medium term" (emphasis added).

Fed Vice Chairman Stanley Fischer said last week:

As I have discussed, given the apparent stability of inflation expectations, there is good reason to believe that inflation will move higher as the forces holding down inflation dissipate further. While some effects of the rise in the dollar may be spread over time, some of the effects on inflation are likely already starting to fade. The same is true for last year's sharp fall in oil prices, though the further declines we have seen this summer have yet to fully show through to the consumer level. And slack in the labor market has continued to diminish, so the downward pressure on inflation from that channel should be diminishing as well.Although inflation may be low over the next few months (lower oil prices), it sounds like Fischer is "reasonably confident" that inflation will move higher in the "medium term". So my guess right now (with less than two weeks until the meeting) is the FOMC will raise rates at the September meeting.

emphasis added

Note: It is a different question if the Fed "should" raise rates in September. Clearly the risks are asymmetrical (hiking too soon poses much larger risks than waiting too long), and that argues for waiting a little longer. Also I've argued for some time (based partly on demographics) that the unemployment rate could fall further without inflation picking up.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 9/04/2015 02:02:00 PM

By request, here is another update of an earlier post through the August employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,073 |

| GW Bush 1 | -844 |

| GW Bush 2 | 381 |

| Obama 1 | 2,018 |

| Obama 2 | 6,8171 |

| 131 months into 2nd term: 10,648 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 844,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 463,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 2,018,000 more private sector jobs at the end of Mr. Obama's first term. Thirty one months into Mr. Obama's second term, there are now 8,895,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 584,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -702 |

| Obama 2 | 1181 |

| 131 months into 2nd term, 183 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

For the public sector, the cutbacks are clearly over at the state and local levels, and it appears cutbacks at the Federal level might also be over. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Below is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the third best for total job creation.

Note: Only 118 thousand public sector jobs have been added during the first thirty one months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is less than 10% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,073 | 1,242 | 11,315 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 6,817 | 118 | 6,995 | |

| Pace2 | 10,648 | 183 | 10,831 | |

| 131 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 236 | 269 | ||

| #2 | 188 | 254 | ||

| #3 | 146 | 224 | ||

August Employment Report Comments and more Graphs

by Calculated Risk on 9/04/2015 09:55:00 AM

Earlier: August Employment Report: 173,000 Jobs, 5.1% Unemployment Rate

This was a decent employment report with 173,000 jobs added, and employment gains for June and July were revised up.

There was even some wage growth, from the BLS: "In August, average hourly earnings for all employees on private nonfarm

payrolls rose by 8 cents to $25.09, following a 6-cent gain in July. Hourly

earnings have risen by 2.2 percent over the year."

A few more numbers: Total employment increased 173,000 from July to August and is now 3.9 million above the previous peak. Total employment is up 12.6 million from the employment recession low.

Private payroll employment increased 140,000 from July to August, and private employment is now 4.3 million above the previous peak. Private employment is up 13.1 million from the recession low.

In August, the year-over-year change was just over 2.9 million jobs.

Note: My view, partially based on demographics, has been that the unemployment rate could fall below 5% without a significant pickup in inflation. With the unemployment rate now at 5.1% - and still little inflation - this view appears to be correct (as opposed to those arguing, a year or two ago, that inflation would pick up at 6%).

Overall this was a decent report.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in August at 80.7%, and the 25 to 54 employment population ratio increased to 77.2%. The participation rate for this group might increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased 2.1% YoY - and although the series is noisy - it does appear wage growth is trending up a little. Wages will probably pick up a little more this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in August at 6.5 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons increased in August to 6.48 million from 6.32 million from in July. This suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 10.3% in August (lowest level since June 2008).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.19 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 2.18 million in July.

This is generally trending down, but is still high.

State and Local Government

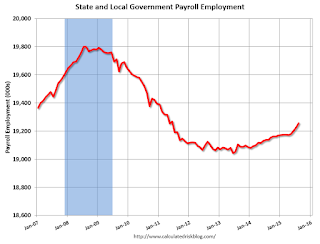

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.) In August 2015, state and local governments added 31 thousand jobs. State and local government employment is now up 214,000 from the bottom, but still 544,000 below the peak.

State and local employment is now increasing. And Federal government layoffs appear to have ended (Federal payrolls were unchanged in July, and Federal employment is up 6,000 year-to-date).

Overall this was a decent employment report for August and indicates further improvement in the labor market.

August Employment Report: 173,000 Jobs, 5.1% Unemployment Rate

by Calculated Risk on 9/04/2015 08:42:00 AM

From the BLS:

Total nonfarm payroll employment increased by 173,000 in August, and the unemployment rate edged down to 5.1 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care and social assistance and in financial activities. Manufacturing and mining lost jobs.

...

The change in total nonfarm payroll employment for June was revised from +231,000 to +245,000, and the change for July was revised from +215,000 to +245,000. With these revisions, employment gains in June and July combined were 44,000 more than previously reported.

...

In August, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $25.09, following a 6-cent gain in July. Hourly earnings have risen by 2.2 percent over the year.

emphasis added

Click on graph for larger image.

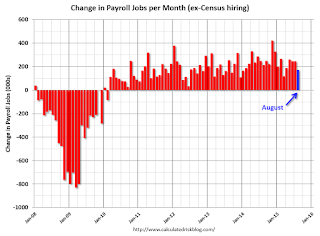

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 173 thousand in August (private payrolls increased 140 thousand).

Payrolls for June and July were revised up by a combined 44 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was over 2.9 million jobs.

That is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was unchanged in August at 62.6%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio increased to 59.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decline in August to 5.1%.

This was well below expectations of 223,000 jobs, however revisions were up, the unemployment rate declined significantly, and there was some wage growth ... overall a decent report.

I'll have much more later ...

Thursday, September 03, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 9/03/2015 08:03:00 PM

From Justin Lahart at the WSJ: Jobs Report Could Seal the Deal on Rates

J.P. Morgan economist Michael Feroli thinks the Fed will stand pat, leaving its target range on overnight rates at zero-to-0.25%. But an increase of 250,000 jobs coupled with a drop in the unemployment rate to 5.1% or 5% would represent a “pretty strong case” for a rate increase, he says. Bank of America Merrill Lynch economist Ethan Harris thinks the Fed will raise its rate range by a quarter point, but that a job gain of less than 150,000 would call that into question.As I noted in the earlier employment preview, most of the data was a little weaker in August than in July, and August tends to be revised up significantly - so I'm taking the "under" on the consensus forecast.

Friday:

• At 8:30 AM ET, the Employment Report for August. The consensus is for an increase of 223,000 non-farm payroll jobs added in August, up from the 215,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to decrease to 5.2%.

Goldman Employment Forecast: 190K Jobs

by Calculated Risk on 9/03/2015 04:34:00 PM

A brief excerpt from a research note by Goldman Sachs economist Chris Mischaikow August Payrolls Preview

We forecast nonfarm payroll growth of 190k in August, below the consensus forecast of 218k and down from July’s 215k gain. Labor market indicators were mixed last month. However, reported August payroll growth has tended to be relatively soft in the first release, with more frequent downside surprises and larger upward revisions compared to other months.

We expect the unemployment rate to decline to 5.2%, in line with consensus. Average hourly earnings for all employees are likely to increase 0.3% month-over-month in August.

Preview: Employment Report for August

by Calculated Risk on 9/03/2015 12:59:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus, according to Bloomberg, is for an increase of 223,000 non-farm payroll jobs in August (with a range of estimates between 173,000 to 257,000), and for the unemployment rate to decline to 5.2%.

The BLS reported 215,000 jobs added in July.

Here is a summary of recent data:

• The ADP employment report showed an increase of 190,000 private sector payroll jobs in August. This was below expectations of 210,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in August to 51.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 13,000 in August. The ADP report indicated a 7,000 increase for manufacturing jobs.

The ISM non-manufacturing employment index decreased in August to 56.0%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 234,000 in August.

Combined, the ISM indexes suggests employment gains of 221,000. This suggests employment at expectations.

• Initial weekly unemployment claims averaged close to 275,000 in August, about the same as in July. For the BLS reference week (includes the 12th of the month), initial claims were at 277,000; up from 255,000 during the reference week in July.

The increase during the reference suggests a slightly higher level of layoffs in August.

• The final July University of Michigan consumer sentiment index decreased to 91.9 from the July reading of 93.1. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a small decrease in small business employment in August. From Intuit: Small Business: Hours Worked, Compensation Rose in August; Jobs Declined

Small business employment fell by 5,000 jobs in August, an annual rate of 0.30 percent. However, Susan Woodward, the economist who works with Intuit to produce the indexes, said this change is very small.• Trim Tabs reported that the U.S. economy added 241,000 jobs in August. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

“July’s figure was revised up by 2,000 jobs. The level of small business employment is 20.7 million jobs, so the August decline doesn’t indicate a clear or major sign of softness in the labor force,” Woodward said.

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report.

There were several weaker indicators such the ADP report, ISM manufacturing, and small business hiring.

Historically the initial report for August tends to be revised up, so I'll take the under on the consensus this month.

ISM Non-Manufacturing Index decreased to 59.0% in August

by Calculated Risk on 9/03/2015 10:05:00 AM

The August ISM Non-manufacturing index was at 59.0%, down from 60.3% in July. The employment index decreased in August to 56.0%, down from 59.6% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 67th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 59 percent in August, 1.3 percentage points lower than the July reading of 60.3 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 63.9 percent, which is 1 percentage point lower than the July reading of 64.9 percent, reflecting growth for the 73rd consecutive month at a slower rate. The New Orders Index registered 63.4 percent, 0.4 percentage point lower than the reading of 63.8 percent in July. The Employment Index decreased 3.6 percentage points to 56 percent from the July reading of 59.6 percent and indicates growth for the 18th consecutive month. The Prices Index decreased 2.9 percentage points from the July reading of 53.7 percent to 50.8 percent, indicating prices increased in August for the sixth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in August. Overall, respondents continue to be optimistic about business conditions and the economy. This is reflected by indexes that are again strong; however, lower than what was seen in July."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 58.5% and suggests slightly slower expansion in August than in July. Another strong report.

Trade Deficit decreased in July to $41.8 Billion

by Calculated Risk on 9/03/2015 08:49:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.9 billion in July, down $3.3 billion from $45.2 billion in June, revised. July exports were $188.5 billion, $0.8 billion more than June exports. July imports were $230.4 billion, $2.5 billion less than June imports.The trade deficit was smaller than the consensus forecast of $42.9 billion.

The first graph shows the monthly U.S. exports and imports in dollars through June 2015.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports decreased in July.

Exports are 14% above the pre-recession peak and down 4% compared to July 2014; imports are close to the pre-recession peak, and down 3% compared to July 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).Oil imports averaged $54.20 in July, up from $53.76 in June, and down from $97.81 in July 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $31.6 billion in July, from $30.9 billion in July 2014. The deficit with China is a large portion of the overall deficit.

Weekly Initial Unemployment Claims increased to 282,000

by Calculated Risk on 9/03/2015 08:33:00 AM

The DOL reported:

In the week ending August 29, the advance figure for seasonally adjusted initial claims was 282,000, an increase of 12,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 271,000 to 270,000. The 4-week moving average was 275,500, an increase of 3,250 from the previous week's revised average. The previous week's average was revised down by 250 from 272,500 to 272,250.The previous week was revised down to 270,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 275,500.

This was higher than the consensus forecast of 273,000, however the low level of the 4-week average suggests few layoffs.