by Calculated Risk on 7/08/2015 07:00:00 AM

Wednesday, July 08, 2015

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Index up Sharply YoY

Note: Results for holiday weeks can be very volatile.

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 3, 2015. This week’s results included an adjustment for the July 4th holiday. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 7 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 32 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.23 percent from 4.26 percent, with points increasing to 0.37 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 32% higher than a year ago (probably distorted by holiday week).

Tuesday, July 07, 2015

Phoenix Real Estate in June: Sales Up 20.5%, Inventory DOWN 16% Year-over-year

by Calculated Risk on 7/07/2015 05:51:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the seventh consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in June were up 20.5% year-over-year.

2) Cash Sales (frequently investors) were down to 23.0% of total sales.

3) Active inventory is now down 16.4% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 1.8% through April (increasing faster than in 2014).

| June Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| June 2008 | 5,748 | --- | 1,093 | 19.0% | 53,8262 | --- |

| June 2009 | 9,325 | 62.2% | 3,443 | 36.9% | 38,358 | ---2 |

| June 2010 | 9,278 | -0.5% | 3,498 | 37.7% | 41,869 | 9.2% |

| June 2011 | 11,134 | 20.0% | 5,001 | 44.9% | 29,203 | -30.3% |

| June 2012 | 9,133 | -18.0% | 4,272 | 46.8% | 19,857 | -32.0% |

| June 2013 | 8,150 | -10.8% | 3,055 | 37.5% | 19,541 | -1.6% |

| June 2014 | 7,239 | -11.2% | 1,854 | 25.6% | 27,954 | 43.1% |

| June 2015 | 8,273 | 20.5% | 2,005 | 23.0% | 23,377 | -16.4% |

| 1 June 2008 does not include manufactured homes, ~100 more 2 June 2008 Inventory includes pending | ||||||

Reis: Mall Vacancy Rate unchanged in Q2

by Calculated Risk on 7/07/2015 02:58:00 PM

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q2 2015. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged at 10.1% in Q2. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

[Strip Mall] After three consecutive quarters of slightly declining vacancy, the national vacancy rate for neighborhood and community centers was unchanged this quarter at 10.1%. Although net absorption exceeded new supply growth, it was insufficient to cause a decline in vacancy. Nonetheless, rent growth continued to slightly accelerate this quarter, though it is barely running ahead of core inflation. [Regional] The vacancy rate for malls also was unchanged at 7.9% while asking rents grew by 0.6%, the seventeenth consecutive quarter of growth. Improvement in the two major subsectors continues, and at an accelerating pace, but their recoveries remain far slower than those of past cycles.

So what’s holding the market back? While ecommerce is not helping, it is not the death knell for bricksand‐ mortar retail that some perceive it to be. In reality, a bigger challenge comes from the proliferation of different retail subtypes over the last two decades. For example, power space inventory has more than doubled since 1998 as demand for this space has increased dramatically. Meanwhile, to put that into context, neighborhood and community center and mall inventory has only increased by roughly 15% over the same time period. The rise of power centers, lifestyle centers, town centers, and even outlet centers has siphoned demand away from traditional retail subtypes.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

CoreLogic: House Prices up 6.3% Year-over-year in May

by Calculated Risk on 7/07/2015 11:59:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

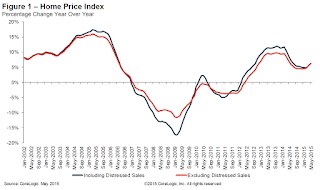

From CoreLogic: CoreLogic Reports National Homes Prices Rose by 6.3 Percent Year Over Year in May 2015

CoreLogic® ... today released its May 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 6.3 percent in May 2015 compared with May 2014. This change represents 39 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 1.7 percent in May 2015 compared with April 2015.

Including distressed sales, 33 states and the District of Columbia were at or within 10 percent of their peak prices in May 2015. Ten states and the District of Columbia reached new price peaks not experienced since January 1976 when the CoreLogic HPI started. These states include Alaska, Colorado, Iowa, Nebraska, New York, North Carolina, Oklahoma, Tennessee, Texas and Vermont.

Excluding distressed sales, home prices increased by 6.3 percent in May 2015 compared with May 2014 and increased by 1.4 percent month over month compared with April 2015. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.7% in May (NSA), and is up 6.3% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase had been moving sideways over most of the last year, but has picked up a little recently.

BLS: Jobs Openings increased to 5.4 million in May, Highest on Record

by Calculated Risk on 7/07/2015 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.4 million on the last business day of May, the highest since the series began in December 2000, the U.S. Bureau of Labor Statistics reported today. The number of hires was unchanged at 5.0 million in May and the number of separations was little changed at 4.7 million. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in May, unchanged from April.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in May to 5.363 million from 5.334 million in April.

The number of job openings (yellow) are up 16% year-over-year compared to May 2014.

Quits are up 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report. It is a good sign that job openings are over 5 million - and at an all time high - and that quits are increasing solidly year-over-year.

Trade Deficit increased in May to $41.9 Billion

by Calculated Risk on 7/07/2015 08:41:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.9 billion in May, up $1.2 billion from $40.7 billion in April, revised. May exports were $188.6 billion, $1.5 billion less than April exports. May imports were $230.5 billion, $0.3 billion less than April imports.The trade deficit was close to the consensus forecast of $42.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through May 2015.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports also decreased in May.

Exports are 14% above the pre-recession peak and down 4% compared to May 2014; imports are at the pre-recession peak, and down 4% compared to May 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings over earlier this year were due to port slowdown.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings over earlier this year were due to port slowdown.Oil imports averaged $50.76 in May, up from $46.52 in April, and down from $96.12 in May 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $28.8 billion in May, from $30.4 billion in May 2014. The deficit with China is a large portion of the overall deficit.

Monday, July 06, 2015

Tuesday: Trade Deficit, Job Openings

by Calculated Risk on 7/06/2015 07:31:00 PM

A sharp decline in oil prices, from the WSJ: Oil Prices Tumble Nearly 8%

Oil prices on Monday skidded to their biggest single-day declines in more than three months, as gyrations in Chinese stocks and the prospect of more crude from the U.S. and Iran revived worries about the global supply glut.Tuesday:

...

The U.S. benchmark oil price slid for the third session in a row, closing down $4.38, or 7.7%, to $52.53 a barrel on the New York Mercantile Exchange. ...

...

Brent crude, the global benchmark, closed down $3.78, or 6.3%, to $56.54 a barrel on ICE Futures Europe.

• Early: Reis Q2 2015 Mall Survey of rents and vacancy rates.

• At 8:30 AM ET, the Trade Balance report for May from the Census Bureau. The consensus is for the U.S. trade deficit to be at $42.0 billion in May from $40.9 billion in April.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS. Jobs openings increased in April to 5.376 million from 5.109 million in March. The number of job openings were up 22% year-over-year compared to April 2014, and Quits were up 11% year-over-year.

• At 3:00 PM, Consumer Credit for May from the Federal Reserve. The consensus is for an increase of $18.5 billion in credit.

Q2 Review: Ten Economic Questions for 2015

by Calculated Risk on 7/06/2015 02:38:00 PM

At the end of each year, I post Ten Economic Questions for the coming year. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2015 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q2 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2015: How much will housing inventory increase in 2015?

Right now my guess is active inventory will increase further in 2015 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2015). I expect active inventory to move closer to 6 months supply this summer.According to the May NAR report on existing home sales, inventory was up 1.8% year-over-year in May, and the months-of-supply was at 5.1 months. I still expect inventory to increase in 2015, and for supply to be close to 6 months sometime this summer.

9) Question #9 for 2015: What will happen with house prices in 2015?

In 2015, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. Low inventories, and a better economy (with more consumer confidence) suggests further price increases in 2015. I expect we will see prices up mid single digits (percentage) in 2015 as measured by these house price indexes.If is still early, but the Case Shiller data for April showed prices up 4.2% year-over-year. The year-over-year change seems to be moving mostly sideways recently.

8) Question #8 for 2015: How much will Residential Investment increase?

My guess is growth of around 8% to 12% for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts might shift a little more towards single family in 2015.Through May, even with a weak start to the year, starts were up 6% year-over-year compared to the same period in 2014. As expected, multi-family has been weaker than single family this year. New home sales were up 24% year-over-year in May, but that was an easy comparison.

7) Question #7 for 2015: What about oil prices in 2015?

It is impossible to predict an international supply disruption - if a significant disruption happens, then prices will obviously move higher. Continued weakness in Europe and China does seem likely - and I expect the frackers to slow down with exploration and drilling, but to continue to produce at most existing wells at current prices (WTI at $55 per barrel). This suggests in the short run (2015) that prices will stay well below $100 per barrel (perhaps in the $50 to $75 range) - and that is a positive for the US economy.As of this morning, WTI futures are just over $53 per barrel.

6) Question #6 for 2015: Will real wages increase in 2015?

As the labor market tightens, we should start seeing some wage pressure as companies have to compete more for employees. Whether real wages start to pickup in 2015 - or not until 2016 or later - is a key question. I expect to see some increase in both real and nominal wage increases this year. I doubt we will see a significant pickup, but maybe another 0.5 percentage points for both, year-over-year.Through June, nominal hourly wages were up 2.0 year-over-year. I still expect a little pick up later this year.

5) Question #5 for 2015: Will the Fed raise rates in 2015? If so, when?

The FOMC will not want to immediately reverse course, so the might wait a little longer than expected. Right now my guess is the first rate hike will happen at either the June, July or September meetings.June didn't happen, but September still seems possible. It could even be later in the year, or even next year.

4) Question #4 for 2015: Will too much inflation be a concern in 2015?

Due to the slack in the labor market (elevated unemployment rate, part time workers for economic reasons), and even with some real wage growth in 2015, I expect these measures of inflation will stay mostly at or below the Fed's target in 2015. If the unemployment rate continues to decline - and wage growth picks up - maybe inflation will be an issue in 2016.It is still early, but inflation was still low through May.

So currently I think core inflation (year-over-year) will increase in 2015, but too much inflation will not be a serious concern this year.

3) Question #3 for 2015: What will the unemployment rate be in December 2015?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to close to 5% by December 2015. My guess is based on the participation rate staying relatively steady in 2015 - before declining again over the next decade. If the participation rate increases a little, then I'd expect unemployment in the low-to-mid 5% range.The participation rate has mostly moved sideways this year, and the unemployment rate was 5.3% in June. This is on track for close to 5% in December.

2) Question #2 for 2015: How many payroll jobs will be added in 2015?

Energy related construction hiring will decline in 2015, but I expect other areas of construction to be solid.Through June 2015, the economy has added 1,250,000 jobs, or 208,000 per month. I still expect employment gains to average 200,000 to 225,000 per month in 2015 (lower than 2014, but still solid).

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - and more companies will have difficulty finding qualified candidates. Even with the overall boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2015 than in 2014.

So my forecast is for gains of about 200,000 to 225,000 payroll jobs per month in 2015. Lower than 2014, but another solid year for employment gains given current demographics.

1) Question #1 for 2015: How much will the economy grow in 2015?

Lower gasoline prices suggest an increase in personal consumption expenditures (PCE) excluding gasoline. And it seems likely PCE growth will be above 3% in 2015. Add in some more business investment, the ongoing housing recovery, some further increase in state and local government spending, and 2015 should be the best year of the recovery with GDP growth at or above 3%.Once again the first quarter was disappointing due to the weather, cutbacks in the oil sector, the West Coast port slowdown and the strong dollar, but there was some bounce back in Q2. It looks like GDP will be in the 2s again this year.

Overall, so far, 2015 is unfolding about as expected.

Black Knight May Mortgage Monitor

by Calculated Risk on 7/06/2015 11:55:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for May today. According to BKFS, 4.96% of mortgages were delinquent in May, up from 4.77% in April. BKFS reported that 1.49% of mortgages were in the foreclosure process, down from 1.91% in May 2014.

This gives a total of 6.45% delinquent or in foreclosure. It breaks down as:

• 1,591,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 922,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 754,000 loans in foreclosure process.

For a total of 3,268,000 loans delinquent or in foreclosure in May. This is down from 3,805,000 in May 2014.

And here is a look at homeowners who could still refinance.

From Black Knight:

Looking at current interest rates on existing 30-year mortgages and applying broad-based underwriting criteria, we see approximately 6.1 million potential refinance candidates – borrowers that likely could qualify for and benefit from refinancingThere is much more in the mortgage monitor.

Given that HARP has been extended through 2016, we find there are an additional 450K borrowers that meet HARP eligibility guidelines and could benefit from refinancing through the program

There are 1.6 million more refinanceable borrowers today than one year ago, due in part to home price appreciation, but primarily due to interest rate reductions

This is down by 1 million borrowers from just last month, due to minor fluctuations in interest rates, illustrating just how rate sensitive a population this is

If rates were to rise by just half a percentage point, 42 percent of borrowers (2.6 million people) fall out of that refinanceable population

ISM Non-Manufacturing Index increased to 56.0% in June

by Calculated Risk on 7/06/2015 10:04:00 AM

The June ISM Non-manufacturing index was at 56.0%, up from 55.7% in May. The employment index decreased in June to 52.7%, down from 55.3% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 65th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56 percent in June, 0.3 percentage point higher than the May reading of 55.7 percent. This represents continued growth in the non-manufacturing sector at a slightly faster rate. The Non-Manufacturing Business Activity Index increased to 61.5 percent, which is 2 percentage points higher than the May reading of 59.5 percent, reflecting growth for the 71st consecutive month at a faster rate. The New Orders Index registered 58.3 percent, 0.4 percentage point higher than the reading of 57.9 percent registered in May. The Employment Index decreased 2.6 percentage points to 52.7 percent from the May reading of 55.3 percent and indicates growth for the 16th consecutive month. The Prices Index decreased 2.9 percentage points from the May reading of 55.9 percent to 53 percent, indicating prices increased in June for the fourth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in June. The majority of respondents’ comments are positive about business conditions and the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Update: Graph corrected.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was at the consensus forecast of 56.0% and suggests slightly faster expansion in June than in May.