by Calculated Risk on 6/28/2015 09:15:00 PM

Sunday, June 28, 2015

Sunday Night Futures: Greece and Puerto Rico

From the NY Times: Puerto Rico’s Governor Says Island’s Debts Are ‘Not Payable’

Puerto Rico’s governor, saying he needs to pull the island out of a “death spiral,” has concluded that the commonwealth cannot pay its roughly $72 billion in debts, an admission that will probably have wide-reaching financial repercussions.And from the WSJ: Greece Orders Banks Closed, Imposes Capital Controls to Stem Deposit Flight

Greece shut down its banking system, ordering lenders to stay closed for six days starting Monday, and its central bank moved to impose controls to prevent money from flooding out of the country.I hope Greece is ready with the Drachma (It seemed there was no way out four months ago).

Monday:

• At 10:00 AM ET, Pending Home Sales Index for May. The consensus is for a 0.6% increase in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for June.

Weekend:

• Schedule for Week of June 28, 2015

• June 2015: Unofficial Problem Bank list declines to 309 Institutions, Q2 2015 Transition Matrix

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 29 and DOW futures are down 217 (fair value).

Oil prices were down over the last week with WTI futures at $58.80 per barrel and Brent at $62.55 per barrel. A year ago, WTI was at $106, and Brent was at $112 - so prices are down 40%+ year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.78 per gallon (down about $0.90 per gallon from a year ago).

Greece: ECB Freezes Level of Emergency Loans

by Calculated Risk on 6/28/2015 11:00:00 AM

Some comments from analysts at the Financial Times Alphaville: Greece: bank analysts and eurowatchers on what to expect on Monday

The analysts make good point on Greek banks, and also on the odds of the Greeks voting for more austerity, an excerpt:

"according to recent polls there may be a majority in the Greek population supporting the creditor-proposed package. Hence if the vote was a ‘yes’ then the creditor side will likely work hard at keeping Greece within the Eurozone. We may thus not see full-blown risk off sentiment tomorrow as there is still a fair chance of Grexit being avoided in the end."However no analyst mentions that the austerity program failed miserably (see: Did Germany Fulfill their Promises? Did Austerity in Greece Deliver?). The definition of insanity is repeating the same thing (austerity) and expecting different results. More austerity means more depression. Europe has been Schauble'd!

And from the WSJ: ECB to Keep Level of Emergency Loans for Greek Banks Unchanged

The European Central Bank said Sunday it will freeze for now the level of emergency loans for Greek banks at Friday’s level, a step that could push the country closer to having to impose capital controls to halt a deposit flight that appeared to have accelerated over the weekend.And from the NY Times: European Central Bank Limits Aid to Greek Banks Amid Debt Crisis

Saturday, June 27, 2015

June 2015: Unofficial Problem Bank list declines to 309 Institutions, Q2 2015 Transition Matrix

by Calculated Risk on 6/27/2015 09:54:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for June 2015. During the month, the list fell from 324 institutions to 309 after 16 removals and one addition. Assets dropped by $1.4 billion to an aggregate $89.8 billion. A year ago, the list held 468 institutions with assets of $149.2 billion.

Actions have been terminated against North American Savings Bank, F.S.B., Grandview, MO ($1.3 billion); American Bank, Rockville, MD ($416 million); First Utah Bank, Salt Lake City, UT ($354 million); Regent Bank, Davie, FL ($349 million Ticker: PZBW); Grayson National Bank, Independence, VA ($332 million); Oregon Pacific Banking Company dba Oregon Pacific Bank, Florence, OR ($187 million); Cornerstone National Bank, Easley, SC ($144 million Ticker: CTOT); Independent Banker's Bank of Florida, Lake Mary, FL ($143 million); First National Bank of Crossett, Crossett, AR ($143 million Ticker: GSON); Boundary Waters Bank, Ely, MN ($112 million Ticker: NASB); The First National Bank of Le Center, Le Center, MN ($81 million); Plaza Bank, Seattle, WA ($75 million Ticker: ABKH); Heritage Bank, Topeka, KS ($49 million); First State Bank of Swanville, Swanville, MN ($28 million Ticker: ORBP); and Commonwealth Bank, FSB, Mount Sterling, KY ($19 million).

Prime Pacific Bank, National Association, Lynnwood, WA ($123 million) found its way off the list by merging with Town Square Bank, Ashland, KY.

The addition this month was Harvard Savings Bank, Harvard, IL ($161 million).

With it being the end of the second quarter, we bring an update on the transition matrix. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,694 institutions have appeared on the list at some point. There have been 1,385 institutions have come and gone on the list. Departure methods include 760 action terminations, 392 failures, 219 mergers, and 14 voluntary liquidations. The second quarter of 2015 started with 349 institutions on the list, so the 36 action terminations during the quarter reduced the list by 10.3 percent. Although it is easier to achieve a high removal percentage given the smaller overall list count, the 10.3 percent quarterly removal rate is the third fastest since the list has been published. Of the 389 institutions on the first published list, 40 still remain nearly six years later. The 392 failures are 23.1 percent of the 1,694 institutions that have appeared on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 153 | (58,436,369) | |

| Unassisted Merger | 38 | (9,059,178) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (3,635,297) | ||

| Still on List at 6/30/2015 | 40 | 10,328,893 | |

| Additions after 8/7/2009 | 269 | 77,127,497 | |

| End (6/30/2015) | 309 | 87,456,390 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 607 | 256,624,516 | |

| Unassisted Merger | 181 | 76,391,195 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 238 | 119,574,853 | |

| Total | 1,030 | 452,733,558 | |

| 1Institution not on 8/7/2009 or 6/30/2015 list but appeared on a weekly list. | |||

Schedule for Week of June 28, 2015

by Calculated Risk on 6/27/2015 08:51:00 AM

The key report this week is the June employment report on Thursday.

Other key indicators include the June ISM manufacturing index on Wednesday, June vehicle sales on June, and the April Case-Shiller house price index on Tuesday.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.6% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for June.

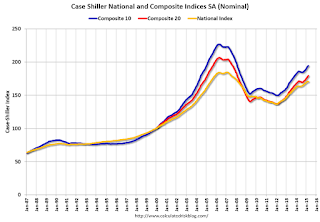

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the March 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.4% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in April, and for prices to be unchanged month-to-month seasonally adjusted.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a reading of 50.6, up from 46.2 in May.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in June, up from 200,000 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 53.2 from 52.8 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 53.2 from 52.8 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 52.8% in May. The employment index was at 51.7%, and the new orders index was at 55.8%.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.2 million SAAR in June from 17.7 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.2 million SAAR in June from 17.7 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

8:30 AM: Employment Report for June. The consensus is for an increase of 228,000 non-farm payroll jobs added in June, down from the 280,000 non-farm payroll jobs added in May.

The consensus is for the unemployment rate to decrease to 5.4%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In May, the year-over-year change was almost 3.1 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 271 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is a 0.3% decrease in orders.

All US markets will be closed in observance of the Independence Day weekend.

Friday, June 26, 2015

June NFP: Merrill and Nomura Forecasts

by Calculated Risk on 6/26/2015 05:56:00 PM

The June employment report will be released on Thursday, July 2nd. Here are a couple of forecasts:

From Nomura:

[W]e forecast a 230k increase in private payrolls, with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 235k. We forecast that manufacturing employment increased by 5k in June. We forecast that average hourly earnings for private employees rose by 0.17% m-o-m in June, a slower pace than trend due to a calendar quirk. Last, we expect the household survey to show that the unemployment rate ticked down to 5.4% from 5.5%, previously.From Merrill:

We look for job growth of 220,000, a slowdown from the 280,000 pace in May but consistent with the recent trend. As a result, the unemployment rate will likely lower to 5.4% from 5.5%. With the continued tightening in the labor market, we think average hourly earnings (AHE) will increase a “strong” 0.2%, allowing the yoy rate to hold at 2.3%.

Vehicle Sales Forecasts for June: Over 17 Million Annual Rate Again, Best June in a Decade

by Calculated Risk on 6/26/2015 03:41:00 PM

The automakers will report June vehicle sales on Wednesday, July 1st. Sales in May were at 17.7 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales will in June will be over 17 million SAAR again.

Note: There were 26 selling days in June, one less than in June 2014. Here are a few forecasts:

From Edmunds.com: Auto Industry Poised for Best June Sales in a Decade, Forecasts Edmunds.com

Edmunds.com ... forecasts that 1,484,487 new cars and trucks will be sold in the U.S. in June for an estimated Seasonally Adjusted Annual Rate (SAAR) of 17.3 million. The projected sales will be a 9.0 percent decrease from May 2015, but a 4.7 percent increase from June 2014. If the sales volume holds, it will mark the best-selling month of June since 2006, and the biggest June SAAR since 2005.From J.D. Power: June New-Vehicle Retail Sales Strongest For the Month in a Decade

emphasis added

The forecast for new-vehicle retail sales in June 2015 is 1,169,600 units, a 1 percent increase on a selling-day adjusted basis compared with June 2014 and the highest retail sales volume for the month since June 2005, when sales hit 1,350,004. Retail transactions are the most accurate measure of consumer demand for new vehicles. [Total forecast 17.2 million SAAR]From Kelley Blue Book: New-Car Sales To Rise Nearly 6 Percent In June 2015, According To Kelley Blue Book

New-vehicle sales are expected to increase 5.8 percent year-over-year to a total of 1.5 million units in June 2015, resulting in an estimated 17.4 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...Another strong month for auto sales. Let the good times roll!

...

"With another month of new-car sales growth in June 2015, the sixteenth in a row, the auto industry continues its incredibly strong momentum. With a 17.4 million projected SAAR for June, it would mark the third month above 17 million out of the past four months," said Alec Gutierrez, senior analyst for Kelley Blue Book. "However, heading into the summer months, sales should flatten out at a more sustainable pace."

Are Multi-Family Housing Starts near a peak?

by Calculated Risk on 6/26/2015 12:37:00 PM

I'm wondering if multi-family housing starts are near a peak. The architecture billings index for multi-family residential market was negative for the fourth consecutive month, and that suggests a slowdown for new apartment construction later this year.

That doesn't mean apartment construction will slow sharply, especially since demographics are still favorable for apartments (as discussed below). But multi-family construction might move sideways.

However the NMHC Market Tightness Index was still favorable for apartments in Q1, but not as favorable as a few years ago.

Note: Parts of this post are from previous posts.

The first graph shows single (blue) and multi-family (red) housing starts for the last several years.

Multi-family is volatile month-to-month, but it does appear that growth is slowing. Of course multi-family permits were very high last month, so we might see another pickup in starts.

This has been quite a boom for apartments. It was five years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

Demographics are still favorable, but my sense is the move "from owning to renting" has slowed. And more supply has been coming online.

On demographics, a large cohort has been moving into the 20 to 34 year old age group (a key age group for renters). Also, in 2015, based on Census Bureau projections, the two largest 5 year cohorts are 20 to 24 years old, and 25 to 29 years old (the largest cohorts are no longer be the "boomers"). Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in the 20 to 34 year age group has been increasing. This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

The circled area shows the recent and projected increase for this group.

From 2020 to 2030, the population for this key rental age group is expected to remain mostly unchanged.

This favorable demographic is a key reason I've been positive on the apartment sector for the last five years - and I expect new apartment construction to stay relatively strong for a few more years.

And on supply, here is the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

Whereas multi-family starts were only up slightly in May (NSA), mutli-family completions were up 60%!

Completions will continue to rise - with more supply coming on the market - even if starts do move sideways.

And looking forward on demographics ...

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

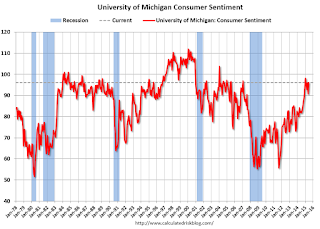

Final June Consumer Sentiment increases to 96.1

by Calculated Risk on 6/26/2015 10:03:00 AM

Thursday, June 25, 2015

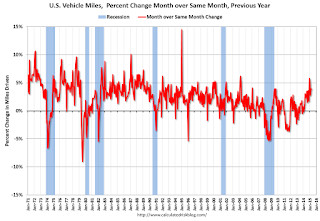

DOT: Vehicle Miles Driven increased 3.9% year-over-year in April, Rolling 12 Months at All Time High

by Calculated Risk on 6/25/2015 08:35:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 3.9% (10.2 billion vehicle miles) for April 2015 as compared with April 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 267.9 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for April 2015 is 262.4 billion miles, a 3.7% (9.5 billion vehicle miles) increase over April 2014.

The rolling 12 month total is moving up, after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

The second graph shows the year-over-year change from the same month in the previous year.

In April 2015, gasoline averaged of $2.56 per gallon according to the EIA. That was down significantly from April 2014 when prices averaged $3.74 per gallon.

In April 2015, gasoline averaged of $2.56 per gallon according to the EIA. That was down significantly from April 2014 when prices averaged $3.74 per gallon. Gasoline prices aren't the only factor - demographics is also key. However, with lower gasoline prices, miles driven - on a rolling 12 month basis - is at a new high.

Update: "Scariest jobs chart ever"

by Calculated Risk on 6/25/2015 04:18:00 PM

During the recent recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever".

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak (now April 2014 with revisions).

I was asked if I could post an update to the graph, and here it is.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in April 2014, employment is now 2.4% above the previous peak.

Note: most previous recessions end on the graph when employment reached a new peak, although I continued the 2001 recession too. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).