by Calculated Risk on 6/01/2015 08:38:00 AM

Monday, June 01, 2015

Personal Income increased 0.4% in April, Spending decreased slightly

The BEA released the Personal Income and Outlays report for April:

Personal income increased $59.4 billion, or 0.4 percent ... in April, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $2.6 billion, or less than 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased less than 0.1 percent in April, in contrast to an increase of 0.4 percent in March. ... The price index for PCE increased less than 0.1 percent in April, compared with an increase of 0.2 percent in March. The PCE price index, excluding food and energy, increased 0.1 percent in April, the same increase as in March.

The April price index for PCE increased 0.1 percent from April a year ago. The April PCE price index, excluding food and energy, increased 1.2 percent from April a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly higher than expected, The change in PCE was below the 0.2% increase consensus.

On inflation: The PCE price index increased 0.1 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.2 percent year-over-year in April.

For PCE, Q2 is off to a slow start.

Sunday, May 31, 2015

Monday: Personal Income and Outlays, ISM Mfg Index, Construction Spending

by Calculated Risk on 5/31/2015 08:27:00 PM

From Jim Hamilton at Econbrowser: Current economic conditions: not as bad as it sounds

The new BEA data also allow us to calculate an alternative estimate of GDP, building the estimate up from income data instead of expenditures. In terms of the underlying concepts, the income-based and expenditure-based calculations should produce the identical number for GDP. But because the data sources are different, in practice the two estimates differ, with the difference officially reported as a “statistical discrepancy.” While the expenditure-based GDP estimate showed a 0.7% decline at an annual rate, the income-based GDP estimate implied 1.4% growth for the first quarter. Moreover, using the statistical method for reconciling and combining the different estimates proposed by Aruoba, Diebold, Nalewaik, Schorfheide, and Song (ADNSS), the best estimate of first-quarter real GDP growth based on the existing data might be about 2%.No worries.

Monday:

• At 8:30 AM ET, Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April. The ISM manufacturing index indicated expansion at 51.5% in April. The employment index was at 48.3%, and the new orders index was at 53.5%.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.7% increase in construction spending.

Weekend:

• Schedule for Week of May 31, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 3 and DOW futures are up 36 (fair value).

Oil prices were down over the last week with WTI futures at $59.97 per barrel and Brent at $65.19 per barrel. A year ago, WTI was at $103, and Brent was at $108 - so, even with the recent increases, prices are down 40%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.75 per gallon (down about $0.90 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Hotels: Best April Ever

by Calculated Risk on 5/31/2015 09:54:00 AM

It looks like 2015 will be the best year ever for hotels (record occupancy and RevPAR).

It also looks like we are starting to see a pickup in supply growth (more rooms coming online). Most supply - in reaction to record demand - will eventually slow RevPAR growth, but will boost the economy by creating jobs.

Some interesting numbers from Jan Freitag at HotelNewsNow.com: Annualized occupancy at new high

1. A new number to report

April had the highest occupancy ever (66.8%) and the highest room demand (99.4 million rooms) ever.

This pushed annualized occupancy (measured as a 12-month moving average) up to 65%.

What does this mean? All key performance indicators (rooms available, rooms sold, revenue, average daily rate, occupancy and revenue per available room) are still at all-time highs.

...

Demand was 3 million rooms higher than last year, and supply was only 1.7 million roomnights higher. Ultimately that will change and the industry will sell less new rooms than build new rooms, but we do not expect that to happen until 2017.

3. This is the third consecutive month of +0.1% supply growth Supply growth hit 1.2% during the month. This is finally the acceleration of supply growth that we have been predicting after a slow 2014. Clearly there is momentum in the pipeline and the supply growth.

Saturday, May 30, 2015

May 2015: Unofficial Problem Bank list declines to 324 Institutions

by Calculated Risk on 5/30/2015 09:40:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for May 2015. During the month, the list fell from 342 institutions to 324 after 17 removals. Assets dropped by $13.9 billion to an aggregate $91.2 billion. Asset figures were updated during the month with the release of q1 financials, which added $2.2 billion. A year ago, the list held 496 institutions with assets of $154.1 billion.

Actions were terminated against FirstBank Puerto Rico, Santurce, PR ($12.4 billion Ticker: FBP); The Talbot Bank of Easton, Maryland, Easton, MD ($591 million Ticker: SHBI); Naugatuck Valley Savings and Loan, Naugatuck, CT ($497 million Ticker: NVSL); Suburban Bank & Trust Company, Elmhurst, IL ($488 million); Sterling Federal Bank, F.S.B., Sterling, IL ($458 million); Bloomfield State Bank, Bloomfield, IN ($383 million); Newton Federal Bank, Covington, GA ($229 million); United Midwest Savings Bank, De Graff, OH ($175 million); Greeneville Federal Bank, FSB, Greeneville, TN ($146 million); Marathon Savings Bank, Wausau, WI ($145 million); Home Federal Savings and Loan Association of Collinsville, Collinsville, IL ($96 million); Heritage Bank of St Tammany, Covington, LA ($90 million); Ozark Heritage Bank, National Association, Mountain View, AR ($85 million); Home Bank of Arkansas, Portland, AR ($75 million); and Eastside Commercial Bank, National Association, Bellevue, WA ($32 million).

Other removals include the failed Edgebrook Bank, Chicago, IL ($95 million) and two banks that found merger partners -- The West Michigan Savings Bank, Bangor, MI ($36 million) and Lake County Bank, Saint Ignatius, MT ($32 million).

The FDIC terminated a Prompt Corrective Action order against United American Bank, San Mateo, CA ($286 million).

This past Wednesday, the FDIC released industry results for the first quarter of 2015 and an update on the Official Problem Bank List. The FDIC said the official list had fallen from 291 to 253 institutions and that assets had dropped from $86.7 billion to $60.3 billion. Thus, the institutions count fell by 13.1 percent and assets declined by 30.4 percent. The official list peaked at 888 institutions with assets of $397 billion, so it is not surprising to see the official list continuing to decline. However, what is surprising is the pace of the decline this quarter in the institution count and assets, which are at their fastest quarterly rate since the official list peaked. It is a challenge to identify how problem bank assets declined by $26.4 billion during the first quarter. Perhaps the FDIC pre-maturely included the $12.4 billion from the action termination in May against FirstBank Puerto Rico.

Schedule for Week of May 31, 2015

by Calculated Risk on 5/30/2015 08:41:00 AM

The key report this week is the May employment report on Friday.

Other key indicators include the April Personal Income and Outlays report on Thursday, May ISM manufacturing index on Friday, May vehicle sales on Friday, April Trade Deficit on Tuesday, and the May ISM non-manufacturing index also on Tuesday.

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.5% in April. The employment index was at 48.3%, and the new orders index was at 53.5%.

10:00 AM: Construction Spending for April. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 17.0 million SAAR in May from 16.5 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 17.0 million SAAR in May from 16.5 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is a 0.1% decrease in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in May, up from 169,000 in April.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.9 billion in April from $51.4 billion in March. Note: The trade deficit increased sharply in March after the West Coast port slowdown was resolved in February. The deficit should decline significantly in April.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to decrease to 57.2 from 57.8 in April.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 276 thousand from 282 thousand.

8:30 AM: Productivity and Costs for Q1. The consensus is for a 6.0% increase in unit labor costs.

8:30 AM: Employment Report for May. The consensus is for an increase of 220,000 non-farm payroll jobs added in May, up from the 213,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate be unchanged at 5.4%.

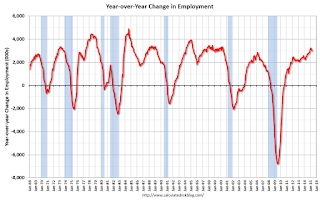

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was just under 3.0 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for March from the Federal Reserve. The consensus is for an increase of $16.0 billion in credit.