by Calculated Risk on 4/27/2015 09:04:00 AM

Monday, April 27, 2015

Black Knight: House Price Index up 0.7% in February, 4.6% year-over-year

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: February Transactions – U.S. Home Prices Up 0.7 Percent for the Month; Up 4.6 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on February 2015 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI increased 0.7% percent in February, and is off 9.5% from the peak in June 2006 (not adjusted for inflation).

For a more in-depth review of this month’s home price trends, including detailed looks at the 20 largest states and 40 largest metros, please download the full Black Knight HPI Report at http://www.bkfs.com/Data/DataReports/BKFS_HPI_Feb2015_Report.pdf

The year-over-year increase in the index has been about the same for the last six months.

The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 40.7% from the peak in Las Vegas, off 34.8% in Orlando, and 31.7% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado, New York and Texas (Denver, Austin, Dallas, Houston) and several other cities around the country.

Note: Case-Shiller for February will be released tomorrow.

Sunday, April 26, 2015

Sunday Night Futures

by Calculated Risk on 4/26/2015 08:45:00 PM

From the Financial Times: Eurozone officials seek to bypass Varoufakis to spur Greek talks

A fraught eurozone meeting in Riga at the weekend has left Yanis Varoufakis, the Greek finance minister, increasingly isolated both in Brussels and in Athens as officials seek to bypass him in an effort to jump-start bailout talks.Time is getting short.

Excerpt with permission

Monday:

• 10:30 AM ET: Dallas Fed Manufacturing Survey for April.

Weekend:

• Schedule for Week of April 26, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $57.36 per barrel and Brent at $65.28 per barrel. A year ago, WTI was at $102, and Brent was at $109 - so, even with the recent increases, prices are down over 40% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.54 per gallon (down about $1.15 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

ATA Trucking Index increased in March

by Calculated Risk on 4/26/2015 09:20:00 AM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Gained 1.1% in March

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1.1% in March, following a revised drop of 2.8% during the previous month. In March, the index equaled 133.5 (2000=100). The all-time high is 135.8, reached in January 2015.

Compared with March 2014, the SA index increased 5%, which was above the 3.3% gain in February but below January’s 6.7% year-over-year increase. During the first quarter, tonnage was unchanged from the previous quarter while increasing 5% from the same period in 2014. ...

“While tonnage did not fully recoup the loss from February, it increased nicely in March,” said ATA Chief Economist Bob Costello. “I’d say that tonnage was one of the better indicators for the month, which is a positive sign for the broader economy.”

Costello added that truck tonnage has increased in five of the last six months, but is off 1.7% from the high in January.

“The next couple of months will be telling for truck freight volumes as we enter the spring freight season,” he said.

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 5.0% year-over-year.

Saturday, April 25, 2015

Schedule for Week of April 26, 2015

by Calculated Risk on 4/25/2015 01:15:00 PM

The key report this is week is Q1 GDP on Wednesday. Also the FOMC will meet on Tuesday and Wednesday, and release a statement on Wednesday.

Other key reports include the March Personal Income and Outlays report on Thursday, April ISM manufacturing index on Friday, April vehicle sales on Friday, and the Case-Shiller house prices on Tuesday.

10:30 AM: Dallas Fed Manufacturing Survey for April.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the National Index for February. The Zillow forecast is for the National Index to increase 4.5% year-over-year in February, and for prices to increase 0.5% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

10:00 AM: Conference Board's consumer confidence index for April. The consensus is for the index to increase to 102.5 from 101.3.

10:00 AM: Q1 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 1st quarter 2015 (advance estimate). The consensus is that real GDP increased 1.0% annualized in Q1.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

2:00 PM: FOMC Meeting Statement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 290 thousand from 295 thousand.

8:30 AM ET: Personal Income and Outlays for March. The consensus is for a 0.2% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 50.0, up from 46.3 in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for an increase to 52.0 from 51.5 in March.

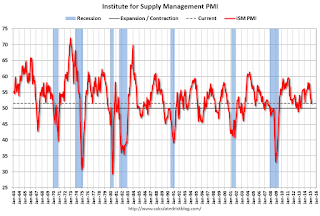

10:00 AM: ISM Manufacturing Index for April. The consensus is for an increase to 52.0 from 51.5 in March.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.5% in March. The employment index was at 50.0%, and the new orders index was at 51.8%.

10:00 AM: Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to decrease to 16.9 million SAAR in April from 17.05 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The consensus is for light vehicle sales to decrease to 16.9 million SAAR in April from 17.05 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the March sales rate.

10:00 AM: University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 96.0, up from the preliminary reading of 95.9, and up from the March reading of 93.0.

April 2015: Unofficial Problem Bank list declines to 342 Institutions

by Calculated Risk on 4/25/2015 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2015. During the month, the list fell from 349 institutions to 342 after nine removals and two additions. Assets dropped by $1.2 billion to an aggregate $105.1 billion. A year ago, the list held 513 institutions with assets of $167.3 billion.

Actions were terminated against Orrstown Bank, Shippensburg, PA ($1.2 billion Ticker: ORRF); Atlantic Coast Bank, Jacksonville, FL ($709 million Ticker: ACFC); The Leaders Bank, Oak Brook, IL ($353 million); PrimeSouth Bank, Blackshear, GA ($326 million); The Exchange Bank, Skiatook, OK ($87 million); and Community Savings, Caldwell, OH ($68 billion). Finding their way off the list through merger were Colonial Bank, FSB, Vineland, NJ ($542 million Ticker: COBK); Baytree National Bank & Trust Company, Lake Forest, IL ($77 million); and Bank Reale, Pasco, WA ($38 million Ticker: BKRL).

The two additions this month were Lone Star National Bank, Pharr, TX ($2.2 billion) and Covenant Bank, Leeds, AL ($76 million).