by Calculated Risk on 4/21/2015 10:54:00 AM

Tuesday, April 21, 2015

BLS: Twenty-Three States had Unemployment Rate Decreases in March

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in March. Twenty-three states and the District of Columbia had unemployment rate decreases from February, 12 states had increases, and 15 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

The largest over-the-month decrease in employment occurred in Texas (-25,400), followed by Oklahoma (-12,900) and Pennsylvania (-12,700). The largest over-the-month increases in employment occurred in California (+39,800), Florida (+30,600), and Massachusetts and Washington (+10,500 each).

...

Nebraska had the lowest jobless rate in March, 2.6 percent. Nevada had the highest rate among the states, 7.1 percent. The District of Columbia had a rate of 7.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Nevada, at 7.1%, had the highest state unemployment rate although D.C was higher.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Only one state and D.C. are still at or above 7% (dark blue).

Goldman on Inflation: Pass-Through Disinflation: Not Over Yet

by Calculated Risk on 4/21/2015 09:25:00 AM

A few excerpts from a note by Goldman Sachs economist David Mericle:

How much should we make of the firmer [inflation] recent prints? In our view, not much. The new car and apparel categories are the largest core goods categories, and are also the most sensitive to import prices. Auto import prices have begun to fall over the last few months, and we expect a decline in consumer prices to follow. Apparel import prices, in contrast, only flattened recently and remain up roughly 1% over the past year. This is not so surprising: the dollar's recent appreciation has not been primarily against the currencies of countries from which the US imports clothing, such as China. But the roughly one-third decline in cotton prices since mid-2014 is likely to result in a larger decline in apparel prices, and we expect that the full impact has yet to be felt. Our equity analysts expect apparel prices to fall for the remainder of 2015, and the 12% drop in raw cotton prices in the March PPI suggests further declines could come soon. ...This is an argument for the Fed raising rates in September (as opposed to June) or even later.

What about services, which account for three-quarters of the core? Soft health care inflation has been a key contributor to lower core inflation. Slower growth of public payments for health care services and likely spillovers to private insurers suggest that health care inflation is unlikely to exceed core inflation going forward. While health care inflation should normalize from the current sub-1% rate eventually, soft wage growth in the health care industry suggests little immediate upward pressure. Shelter inflation has been among the firmest components of the core, and the low rental vacancy rate suggests this trend is likely to continue in the near term. But we see limited further upside: the National Multi Housing Council's Market Tightness Index is less elevated, and data from REIS indicate that new construction should raise the vacancy rate.

More broadly, we do not view the recent data as a sign that pass-through is now behind us. Pass-through is a two-stage process. Dollar appreciation should result first in lower import prices, and then in gradually lower consumer prices. Similarly, while commodity prices are reflected in consumer energy goods and services prices fairly quickly, core prices then respond to energy costs with a lag. ... [W]hile the first stage of oil price pass-through appears largely complete, import prices likely have further to fall. ...

Overall, we expect that further pass-through will cause year-on-year core PCE inflation to fall by another 0.1-0.2 percentage points by the September FOMC meeting (at which point the July data will be available).

...

Does pass-through disinflation matter for liftoff? ... It appears that Fed officials increasingly view pass-through disinflation as something to be waited out, rather than as something to be ignored.

Monday, April 20, 2015

CoreLogic (formerly DataQuick data): SoCal sales up 5.0% Year-over-year

by Calculated Risk on 4/20/2015 08:19:00 PM

CoreLogic released the Southern California report today for March (CoreLogic acquired DataQuick).

The data shows 18,156 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in March.

That was up 35.6% from 13,650 sales in February, and up 5.0% from 17,638 sales in March last year.

Note: Currently CoreLogic hasn't released the short sales and foreclosure data that DataQuick used to release.

Mortgage News Daily: Mortgage Rates Slide Sideways Again

by Calculated Risk on 4/20/2015 05:03:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slide Sideways Again

Mortgage rates figure if they can't be pushing down to new record lows, they might as well pass the time by shooting for different records. This time around, it's the record for FLATNESS! We calculate an average 30yr fixed conventional rate every day based on the sweet-spots on multiple lender rate sheets. This gives us an 'effective rate' to track that typically falls between the two most common rate quotes in the market. For instance, the current computed rate is 3.66% and the two most common quotes are 3.625% and 3.75%. On 9 out of the past 10 days, that effective rate has moved an average of 0.01% per day. In terms of day-to-day rate movement over time, this is about as flat as it gets!Here is a table from Mortgage News Daily:

LA area Port Traffic Increased Sharply in March following resolution of Labor Issues

by Calculated Risk on 4/20/2015 11:01:00 AM

Note: LA area ports were impacted by labor negotiations that were settled on February 21st.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report for February since LA area ports handle about 40% of the nation's container port traffic.

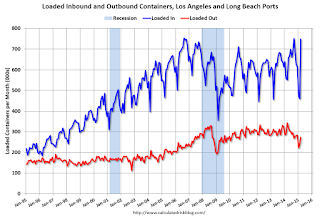

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.6% compared to the rolling 12 months ending in February. Outbound traffic was down 2.0% compared to 12 months ending in February.

Inbound traffic had been increasing, and outbound traffic had been mostly moving sideways or slightly down. The recent downturn in exports might be more than just the labor issues (strong dollar, weakness in China).

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 36% year-over-year in March, exports were down 20% year-over-year.

The labor issues are now resolved - the ships have disappearing from the outer harbor - and the distortions from the labor issues will mostly be behind us in April.