by Calculated Risk on 2/17/2015 11:51:00 AM

Tuesday, February 17, 2015

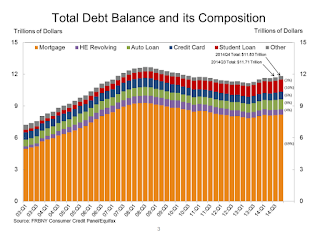

NY Fed: Household Debt increased in Q4 2014

Here is the Q4 report: Household Debt and Credit Report.

From the NY Fed: Household Debt Continues Upward Climb While Student Loan Delinquencies Worse

In its Q4 2014 Household Debt and Credit Report, the Federal Reserve Bank of New York announced that outstanding household debt increased $117 billion from the third quarter. The one percent increase puts total household indebtedness at $11.83 trillion as of December 31, 2014. Total debt has gone up $326 billion since the fourth quarter of 2013. The report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

Balances were largely up across the board, led by mortgages ($39 billion) and student loans ($31 billion). Auto loan debt and credit card debt increased by $21 billion and $20 billion, respectively. Outstanding student loan balances now stand at $1.16 trillion.

While overall delinquency rates were unchanged at 4.3 percent in the fourth quarter, delinquency rates for auto loans and student loans worsened. Our Liberty Street Economics blog post provides a further discussion of the delinquency picture.

“Although we’ve seen an overall improvement in delinquency rates since the Great Recession, the increasing trend in student loan balances and delinquencies is concerning,” said Donghoon Lee, research officer at the Federal Reserve Bank of New York. “Student loan delinquencies and repayment problems appear to be reducing borrowers’ ability to form their own households.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q4. Household debt peaked in 2008, and bottomed in Q2 2013.

The recent increase in debt suggests households (in the aggregate) deleveraging is over.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased to 6.0% in Q4, from 6.2% in Q3. Most of the improvement was in the less than 30 day category.

The Severely Derogatory (red) rate has fallen to 2.17%, the lowest since Q1 2008.

The 120+ days late (orange) rate has was unchanged at 1.82%, the lowest since Q2 2008.

In general, short term delinquencies are back to normal levels.

There are a number of credit graphs at the NY Fed site.

NAHB: Builder Confidence decreased to 55 in February

by Calculated Risk on 2/17/2015 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 55 in February, down from 57 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

From Reuters: Builder Confidence Slightly Lower in February on Harsh Weather Conditions

Builder confidence in the market for newly built, single-family homes in February fell two points to a level of 55 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

Overall, builder sentiment remains fairly solid, with this slight downturn largely attributable to the unusually high snow levels across much of the nation,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo.

“For the past eight months, confidence levels have held in the mid- to upper 50s range, which is consistent with a modest, ongoing recovery,” said NAHB Chief Economist David Crowe. “Solid job growth, affordable home prices and historically low mortgage rates should help unleash growing pent-up demand and keep the housing market moving forward in the year ahead.”

Two of the three HMI components posted losses in February. The component gauging current sales conditions edged one point lower to 61 while the component measuring buyer traffic fell five points to 39. The gauge charting sales expectations in the next six months held steady at 60.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 58.

NY Fed: Empire State Manufacturing Survey indicates "business activity continued to expand at a modest pace" in February

by Calculated Risk on 2/17/2015 08:45:00 AM

From the NY Fed: Empire State Manufacturing Survey

The February 2015 Empire State Manufacturing Survey indicates that business activity continued to expand at a modest pace for New York manufacturers. The headline general business conditions index edged down two points to 7.8. The new orders index fell five points to 1.2—evidence that orders were flat—while the shipments index climbed to 14.1. Employment indexes pointed to an increase in employment levels and little change in the average workweek. ...This is the first of the regional surveys for February. The general business conditions index was below the consensus forecast of a reading of 9.0, and indicates modest expansion in February.

...

Indexes assessing the six-month outlook, though generally positive, conveyed considerably less optimism about future business activity than in recent months. The index for future general business conditions plunged twenty-three points to 25.6, its lowest level in more than two years.

emphasis added

Monday, February 16, 2015

Tuesday: Empire State Mfg, Homebuilder Confidence

by Calculated Risk on 2/16/2015 07:11:00 PM

From the WSJ: Greek Financing Talks Break Down Amid Wide Gulf Over Bailout

“The general feeling [among ministers] is still that the best way forward would be for the Greek authorities to seek an extension of the current program,” said Jeroen Dijsselbloem, the Dutch minister who presides over the regular meetings with his counterparts. “We simply need more time,” he added.I've read the proposed draft statement for an extension - and it was absurd - there is no way the Greeks will sign it.

After the meeting, Mr. Varoufakis said he had been ready to request a four-month extension to the existing bailout, but not under the conditions that Mr. Dijsselbloem and the other ministers were offering. “Our only condition for doing this was that we should not be asked to impose measures that are clearly recessionary and clearly uncalled for in the state of humanitarian crisis we have in Greece,” he said.

Tuesday:

• At 8:30 AM ET, the NY Fed Empire State Manufacturing Survey for February. The consensus is for a reading of 9.0, down from 10.0 last month (above zero is expansion).

• At 10:00 AM, the February NAHB homebuilder survey. The consensus is for a reading of 58, up from 57 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekend:

• Schedule for Week of February 15, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 9 and DOW futures are down 65 (fair value).

Oil prices were up over the last week with WTI futures at $52.72 per barrel and Brent at $61.40 per barrel. A year ago, WTI was at $100, and Brent was at $109 - so prices are down about 45% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.25 per gallon (down about $1.10 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Ships, Ships, Everywhere Ships

by Calculated Risk on 2/16/2015 03:54:00 PM

From the LA Times: Line of ships waiting off coast grows as ports shut down for holiday

On Monday, there were 33 vessels anchored off the Los Angeles and Long Beach ports, unable to dock, according to the Marine Exchange of Southern California. That was three more than Sunday.

...

The White House is sending Labor Secretary Tom Perez to jump-start stalled contract talks between the employer group, Pacific Maritime Assn., and the International Longshore and Warehouse Union. Perez is scheduled to meet with both sides Tuesday, according to a Department of Labor spokeswoman.