by Calculated Risk on 11/30/2014 08:27:00 PM

Sunday, November 30, 2014

Monday: ISM Manufacturing

From Professor Hamilton at Econbrowser: A glut of oil?

The world is awash in oil, I’m hearing. The problem is, it’s fairly expensive oil.Monday:

...

[C]onsider the United States, where production has grown 2 mb/d since 2004. More than 3 mb/d of that growth has come from fracking of oil trapped in tight geologic formations. Without tight oil, U.S. production would be down more than a million barrels a day over the last ten years and down 5-1/2 mb/d from its peak in 1970.

...

So here’s the basic picture. The current surplus of oil was brought about primarily by the success of unconventional oil production in North America, most new investments in which are not sustainable at current prices. Without that production, the price of oil could not remain at current levels. It’s just a matter of how long it takes for the high-cost North American producers to cut back in response to current incentives. And when they do, the price has to go back up.

• At 10:00 AM ET, the ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October. The ISM manufacturing index indicated solid expansion in October at 59.0%. The employment index was at 55.5%, and the new orders index was at 65.8%.

Weekend:

• Schedule for Week of November 30th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down 4 and DOW futures are down 25 (fair value).

Oil prices were down sharply over the last week with WTI futures at $64.37 per barrel and Brent at $68.50 per barrel. A year ago, WTI was at $93 and Brent was at $111 per barrel - so prices are down more 30% to 40% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.77 per gallon (down about 50 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

WSJ: "Mortgage Lenders Set to Relax Standards"

by Calculated Risk on 11/30/2014 10:16:00 AM

These are the changes (mostly to reps and warrants) that FHFA Director Melvin Watt discussed in October: Prepared Remarks of Melvin L. Watt, Director, FHFA, At the Mortgage Bankers Association Annual Convention

From Joe Light at the WSJ: Mortgage Lenders Set to Relax Standards

Some of the largest U.S. mortgage lenders are preparing to further ease standards for borrowers after the release of new guidelines this month from mortgage giants Fannie Mae and Freddie Mac.This should make mortgages available to more people, but I expect the overall impact will be small.

...

Some lenders, including Wells Fargo & Co. and SunTrust Banks Inc., said borrowers should begin to see initial changes in a few weeks, including faster turnaround times for mortgage applications to be processed.

...

After the financial crisis, Fannie and Freddie made banks repurchase tens of billions of dollars in loans that the companies said didn’t meet their standards. In turn, many lenders stopped making loans to all but the most pristine of borrowers.

In many cases, they required borrowers to have substantially higher credit scores and put in place other measures—so-called credit overlays—that were more stringent than what Fannie and Freddie required.

With the new agreement, “I’ve been told with absolute confidence that some lenders are lifting almost all of their overlays,” said David Stevens, president of the Mortgage Bankers Association.

Saturday, November 29, 2014

Schedule for Week of November 30th

by Calculated Risk on 11/29/2014 01:21:00 PM

The key report this week is the November employment report on Friday.

Other key reports include the November ISM manufacturing index on Monday, November vehicle sales on Tuesday, the November ISM non-manufacturing index on Wednesday, and the October Trade Deficit on Friday.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.

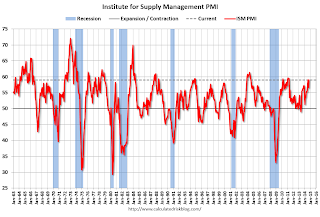

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated solid expansion in October at 59.0%. The employment index was at 55.5%, and the new orders index was at 65.8%.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

8:30 AM: Employment Report for November. The consensus is for an increase of 225,000 non-farm payroll jobs added in November, up from the 214,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to decline to 5.7% in November.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.64 million jobs, and it appears the pace of hiring is increasing. Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.5 billion in October from $43.0 billion in September.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1 decrease in October orders.

3:00 PM: Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $16.3 billion.

Unofficial Problem Bank list declines to 408 Institutions

by Calculated Risk on 11/29/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 28, 2014.

Changes and comments from surferdude808:

This week, the FDIC provided an update on its latest enforcement action activity and updated aggregate figures for their official problem banks. After four additions and seven removals, the Unofficial Problem Bank List holds 408 institutions with assets of $124.7 billion. A year ago, the list held 645 institutions with assets of $221.2 billion. During November, the list count dropped by 14 institutions after four additions, 13 action terminations, four mergers, and one failure. It was the most institutions added in a month since five were added back in October 2013.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 408. Almost a round trip ...

The FDIC terminated actions against CNLBank, Orlando, FL ($1.3 billion); Chambers Bank, Danville, AR ($773 million); Pine River Valley Bank, Bayfield, CO ($142 million); Hanover Community Bank, Garden City Park, NY ($142 million); Heritage Bank & Trust, Columbia, TN ($102 million); Thayer County Bank, Hebron, NE ($55 million); and Riverland Bank, Jordan, MN ($44 million).

The FDIC issued actions against Noah Bank, Elkins Park, PA ($317 million); Pacific Valley Bank, Salinas, CA ($231 million Ticker: PVBK); Lafayette State Bank, Mayo, FL ($93 million); and Bison State Bank, Bison, KS ($9 million).

The FDIC reported its number of problem banks had fallen for 14 consecutive quarters to 329 institutions with assets of $102 billion. So the difference between the FDIC numbers and the Unofficial number is 79 institutions and $22.7 billion in assets, which is down from a difference of 85 institutions and $30 billion in assets last quarter.

Friday, November 28, 2014

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/28/2014 09:11:00 PM

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change.

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller National index since 1987 (both through September). The seasonal pattern was smaller back in the '90s and early '00s, and increased since the bubble burst.

Both indexes were negative seasonally (NSA) in September and will probably stay slightly negative for a few months.

It appears the seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.