by Calculated Risk on 11/27/2014 08:02:00 PM

Thursday, November 27, 2014

Vehicle Sales Forecast: "Strongest November since 2001"

The automakers will report November vehicle sales on Tuesday, December 2nd. Sales in October were at 16.35 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in November might be at or above 17 million SAAR.

Note: There were 25 selling days in November this year compared to 26 last year.

Here are a few forecasts:

From WardsAuto: Forecast: SAAR Could Reach 17 Million for Second Time in Four Months

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 17 million-unit seasonally adjusted annual rate for just the second time since 2006, after crossing that threshold most recently in August, when deliveries equated to a 17.4 million SAAR. The WardsAuto report is calling for 1.29 million light vehicles to be delivered over 25 selling days. The resulting daily sales rate of 51,461 units represents an 8.1% improvement over same-month year-ago (over 26 days) and a 9.1% month-to-month gain on October (27 days), slightly ahead of an average 6% October-November gain over the past three years. The 17 million-unit SAAR would be significantly higher than the 16.3 million recorded year-to-date through October, and would help bring 2014 sales in line with WardsAuto’s full year forecast of 16.4 million units.From J.D. Power: New-Vehicle Retail Sales On Pace for 1.1 Million, the Strongest November Since 2001

New-vehicle retail sales in November 2014 are projected to come in at 1.1 million units, a 5.5 percent increase on a selling-day adjusted basis, compared with November 2013 (November 2014 has one fewer selling day than November 2013).From Kelley Blue Book: New-Vehicle Sales To Rise 2.2 Percent In November On Black Friday Deals, According To Kelley Blue Book

...

“The industry continues to demonstrate strong sales growth, which is exceptional considering that November is currently on pace to record the highest average customer-facing transaction prices ever,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. [Total forecast 16.5 million SAAR]

In November 2014, new light-vehicle sales, including fleet, are expected to hit 1,270,000 units, up 2.2 percent from November 2013, and down 0.6 percent from October 2014. The seasonally adjusted annual rate (SAAR) for November 2014 is estimated to be 16.8 million, up from 16.2 million in November 2013, and up from 16.3 million in October 2014.From TrueCar: TrueCar Forecasts 17 Million SAAR in November as Early Black Friday Events Prime the Market

TrueCar, Inc. ... forecasts the pace of auto sales in November accelerated to a seasonally adjusted annualized rate ("SAAR") of 17 million new units with the early launch of Black Friday sales campaigns.Another strong month for auto sales, and 2014 should be the best year since 2006.

New light vehicle sales in the U.S. (including fleet) are expected to reach 1,296,700 units for the month, up 4.1 percent from a year ago. On a daily selling rate (DSR) basis, with one less selling day this November, deliveries are expected to rise 8.2 percent. ... Best November since 2001

WTI Crude Oil Falls Below $70

by Calculated Risk on 11/27/2014 12:48:00 PM

From the WSJ: OPEC Leaves Production Target Unchanged

The Organization of the Petroleum Exporting Countries said its 12 members, who collectively pump around one-third of the world’s oil, would comply with its current production ceiling of 30 million barrels a day. That would involve a supply cut of around 300,000 barrels a day based on the cartel’s output in October, according to the group’s own data.

...

The oil producer group’s decision led to a further sharp selloff in major global oil benchmarks, with U.S. markets closed for the Thanksgiving holiday. Brent crude fell about 6% to below $73, a four-year low, while the West Texas Intermediate benchmark was down 3.2% to $71.36 a barrel.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI has fallen over 4% today to $69.40 per barrel, and Brent to $72.97.

Prices are off over 35% from the peak for the year, and if this price decline holds, there should be further declines in gasoline prices over the next couple of weeks. Gasoline futures are down about 10 cents per gallon.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.80 per gallon (down about 45 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Word of the Year

by Calculated Risk on 11/27/2014 11:16:00 AM

Each year since 2003, Merriam-Webster has listed the Words of the Year mostly based on the frequency that each word was looked up that year.

Some years the "words of the year" have been relevant to Calculated Risk, as an example, in 2004 the word of the year was "blog" (CR was started in January 2005 partly because I was wondering what a "blog" was). In 2008, the word of the year was "bailout", and in 2010 the word was "austerity".

For fun, here are a few suggestions for "word of the year" related to the blog since 2004 (I'm sure others will have better suggestions):

2004: Blog (Merriam-Webster)

2005: Bubble. This was the peak year for the housing bubble (activity peaked in 2005, although prices peaked in early 2006). Writing about the housing bubble was the main topic on the blog in 2005.

2006: Bust. This was when the housing bust started.

2007: Subprime or Recession. It was 2007 that "subprime" started to be used by the general public. An alternative would be "recession" since the Great Recession started in December 2007, and a key topic on the blog all year was when the recession would start. Other words could be: delinquency, Alt-A, and NINJA (No income, jobs or asset loans).

2008: Bailout (Merriam-Webster). Three alternatives could be "Financial Crisis", "TARP" and "foreclosure".

2009: Stimulus. An alternative could be "deflation".

2010: Austerity (Merriam-Webster). Unfortunately austerity could be the "word of the year" for several years.

2011: Default. This was the year Congress threatened to default on paying the bills.

2012: Short Sale. This was probably the year that short sales peaked. This was the year house prices bottomed (but I couldn't think of a "word")

2013: Shutdown. In 2013, Congress shut down the government.

2014: Employment. In May 2014, employment surpassed the pre-recession peak, and 2014 will be the best year for employment since the '90s.

2015: Wages (Just being hopeful - maybe 2015 will be the year that real wages start to increase)

Happy Thanksgiving to all!

Wednesday, November 26, 2014

Fannie Mae: Mortgage Serious Delinquency rate declined in October, Lowest since October 2008

by Calculated Risk on 11/26/2014 08:21:00 PM

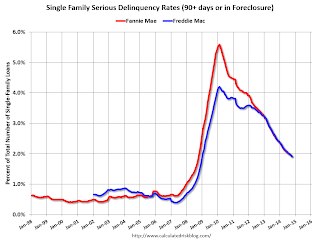

Fannie Mae reported yesterday that the Single-Family Serious Delinquency rate declined in October to 1.92% from 1.96% in September. The serious delinquency rate is down from 2.48% in October 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 1.91% from 1.96% in September. Freddie's rate is down from 2.48% in September 2013, and is at the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.56 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in 2016 - although the rate of decline has slowed recently.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be close to normal in late 2016.

Zillow: Case-Shiller House Price Index year-over-year change expected to slow further in October

by Calculated Risk on 11/26/2014 03:47:00 PM

The Case-Shiller house price indexes for September were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Oct. 2014 Case-Shiller Prediction: Expect the Slowdown to Continue

The September S&P/Case-Shiller (SPCS) data out [yesterday] showed more slowing in the housing market, with annual growth in the 20-city index falling 0.7 percentage points from August’s pace to 4.9 percent in September. This is the first time annual appreciation for the 20-city index has been below 5 percent since October 2012. The national index was up 4.8 percent on an annual basis in September.So the Case-Shiller index will probably show a lower year-over-year gain in October than in September (4.9% year-over-year for the Composite 20 in September, 4.8% year-over-year for the National Index).

Our current forecast for October SPCS data indicates further slowing, with the annual increase in the 20-City Composite Home Price Index falling to 4.3 percent.

The non-seasonally adjusted (NSA) 20-City index was flat from August to September, and we expect it to decrease 0.4 percent in October. We also expect a monthly decline for the 10-City Composite Index, which is projected to fall 0.4 percent from September to October (NSA).

All forecasts are shown in the table below. These forecasts are based on the September SPCS data release and the October 2014 Zillow Home Value Index (ZHVI), released Nov. 20. Officially, the SPCS Composite Home Price Indices for October will not be released until Tuesday, Dec. 30.

| Zillow October 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | October 2013 | 180.29 | 178.20 | 165.90 | 164.01 |

| Case-Shiller (last month) | September 2014 | 188.68 | 184.84 | 173.72 | 170.19 |

| Zillow Forecast | YoY | 4.2% | 4.2% | 4.3% | 4.3% |

| MoM | -0.4% | 0.2% | -0.4% | 0.2% | |

| Zillow Forecasts1 | 187.9 | 185.4 | 173.0 | 170.8 | |

| Current Post Bubble Low | 146.45 | 149.87 | 134.07 | 137.05 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 28.3% | 23.7% | 29.1% | 24.6% | |

| Bubble Peak | 226.29 | 226.87 | 206.52 | 206.61 | |

| Date of Bubble Peak | Jun-06 | Apr-06 | Jul-06 | Apr-06 | |

| Below Bubble Peak | 17.0% | 18.3% | 16.2% | 17.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||