by Calculated Risk on 11/29/2014 01:21:00 PM

Saturday, November 29, 2014

Schedule for Week of November 30th

The key report this week is the November employment report on Friday.

Other key reports include the November ISM manufacturing index on Monday, November vehicle sales on Tuesday, the November ISM non-manufacturing index on Wednesday, and the October Trade Deficit on Friday.

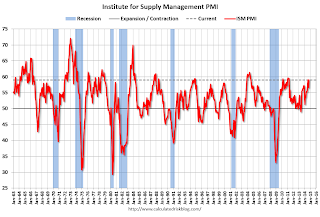

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated solid expansion in October at 59.0%. The employment index was at 55.5%, and the new orders index was at 65.8%.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

8:30 AM: Employment Report for November. The consensus is for an increase of 225,000 non-farm payroll jobs added in November, up from the 214,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to decline to 5.7% in November.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.64 million jobs, and it appears the pace of hiring is increasing. Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.5 billion in October from $43.0 billion in September.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1 decrease in October orders.

3:00 PM: Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $16.3 billion.

Unofficial Problem Bank list declines to 408 Institutions

by Calculated Risk on 11/29/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 28, 2014.

Changes and comments from surferdude808:

This week, the FDIC provided an update on its latest enforcement action activity and updated aggregate figures for their official problem banks. After four additions and seven removals, the Unofficial Problem Bank List holds 408 institutions with assets of $124.7 billion. A year ago, the list held 645 institutions with assets of $221.2 billion. During November, the list count dropped by 14 institutions after four additions, 13 action terminations, four mergers, and one failure. It was the most institutions added in a month since five were added back in October 2013.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 408. Almost a round trip ...

The FDIC terminated actions against CNLBank, Orlando, FL ($1.3 billion); Chambers Bank, Danville, AR ($773 million); Pine River Valley Bank, Bayfield, CO ($142 million); Hanover Community Bank, Garden City Park, NY ($142 million); Heritage Bank & Trust, Columbia, TN ($102 million); Thayer County Bank, Hebron, NE ($55 million); and Riverland Bank, Jordan, MN ($44 million).

The FDIC issued actions against Noah Bank, Elkins Park, PA ($317 million); Pacific Valley Bank, Salinas, CA ($231 million Ticker: PVBK); Lafayette State Bank, Mayo, FL ($93 million); and Bison State Bank, Bison, KS ($9 million).

The FDIC reported its number of problem banks had fallen for 14 consecutive quarters to 329 institutions with assets of $102 billion. So the difference between the FDIC numbers and the Unofficial number is 79 institutions and $22.7 billion in assets, which is down from a difference of 85 institutions and $30 billion in assets last quarter.

Friday, November 28, 2014

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/28/2014 09:11:00 PM

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change.

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller National index since 1987 (both through September). The seasonal pattern was smaller back in the '90s and early '00s, and increased since the bubble burst.

Both indexes were negative seasonally (NSA) in September and will probably stay slightly negative for a few months.

It appears the seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Possible Headline for Next Friday: "Best Year for Employment since the '90s"

by Calculated Risk on 11/28/2014 03:05:00 PM

As of the October BLS report, the economy has added 2.225 million private sector jobs, and 2.285 million total jobs in 2014.

The consensus is the economy will add another 220 thousand jobs in November (215 thousand private sector jobs). If that happens, 2014 will be the best year for private employment since 1999.

Here is a table showing the best years for nonfarm employment growth since 1995. To be the best year since the '90s, the economy needs to add an additional 222 thousand total nonfarm jobs. This could happen in the November report to be released next Friday, December 5th or in the December employment report to be released in early January.

This is happening with only 60 thousand public sector jobs added so far this year. For comparison, there were 186 thousand public sector jobs added in 2005

| Top Years Since 1995 Change in Nonfarm Payrolls per Year (000s) | ||

|---|---|---|

| Year | Total Nonfarm Employment | |

| 1997 | 3,408 | |

| 1999 | 3,177 | |

| 1998 | 3,047 | |

| 1996 | 2,825 | |

| 2005 | 2,506 | |

| 2013 | 2,331 | |

| 20141 | 2,285 | |

| 2012 | 2,236 | |

| 1995 | 2,159 | |

| 1 2014 is through October. | ||

For private employment, to be the best year since the '90s, the economy needs to add an additional 176 thousand private sector jobs (probably happen in the November report).

There is a small chance that 2014 will be the best year since 1998 for private employment. However it would take an additional 491 thousand private sector jobs added in November and December (it would take 505 thousand additional jobs to be the best since 1997). That would be a very strong finish to the year - unlikely, but not impossible.

| Top Years Since 1995 Change in Private Payrolls per Year (000s) | ||

|---|---|---|

| Year | Private Employment | |

| 1997 | 3,213 | |

| 1998 | 2,734 | |

| 1996 | 2,720 | |

| 1999 | 2,716 | |

| 2011 | 2,400 | |

| 2013 | 2,365 | |

| 2005 | 2,320 | |

| 2012 | 2,294 | |

| 20141 | 2,225 | |

| 1995 | 2,081 | |

| 1 2014 is through October. | ||

Right now it seems very likely that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

Hotels: Occupancy Rate Finishing 2014 Strong, Best Year since 2000

by Calculated Risk on 11/28/2014 10:41:00 AM

From HotelNewsNow.com: US hotel results for week ending 22 November

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 16-22 November 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 5.5 percent to 60.7 percent. Average daily rate increased 4.1 percent to finish the week at US$112.52. Revenue per available room for the week was up 9.8 percent to finish at US$68.34.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now heading into the slow period of the year.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and since mid-June, the 4-week average of the occupancy rate has been a little higher than for the same week in 2000.

Right now it looks like 2014 will be the best year since 2000 for hotels. And since it takes some time to plan and build hotels, I expect 2015 will be even better for hotel occupancy.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com