by Calculated Risk on 11/25/2014 08:36:00 AM

Tuesday, November 25, 2014

Q3 GDP Revised Up to 3.9% Annual Rate

From the BEA: Gross Domestic Product: Third Quarter 2014 (Second Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 3.9 percent in the third quarter of 2014, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.6 percent.Here is a Comparison of Second and Advance Estimates. PCE was revised up from 1.8% to 2.2%, and private investment was revised up. A solid report.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 3.5 percent. With the second estimate for the third quarter, private inventory investment decreased less than previously estimated, and both personal consumption expenditures (PCE) and nonresidential fixed investment increased more. In contrast, exports increased less than previously estimated.

The increase in real GDP in the third quarter reflected positive contributions from PCE, nonresidential fixed investment, federal government spending, exports, residential fixed investment, and state and local government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Monday, November 24, 2014

Tuesday: GDP, Case-Shiller House Prices, Q3 Household Debt and Credit Report and much more

by Calculated Risk on 11/24/2014 08:11:00 PM

There has been little precipitation in California so far this year - following three years of drought - from the NY Times: As Snow Fades, California Ski Resorts Are Left High and Very Dry

The season is just starting, and snow may yet pile high, but the harvest in California the last three years was bleak, and the globe’s long-range forecast is grim.The article is about ski resorts, but the main impact of another year of drought will be on agriculture and food prices (California is by far the largest agricultural producing State).

Last year’s snow pack at the University of California, Berkeley’s Central Sierra Snow Lab, in the heart of California ski country near Lake Tahoe, topped out at a depth of 133 centimeters (about 52 inches), the second lowest of the last 90 years. With most of the snow arriving late in the season, skier and snowboarder visits in this area were down by 25 percent from the season before, according to the National Ski Area Association.

Similarly meager snow packs in 2012 and 2013 have exacerbated the statewide drought, with ramifications far beyond the ski industry. A fourth lackluster season would be unprecedented, according to snow records kept since 1879.

Tuesday:

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2014 (second estimate); Corporate Profits, 3rd quarter 2014 (preliminary estimate). The consensus is that real GDP increased 3.3% annualized in Q3, revised down from the advance estimate of 3.5%.

• At 9:00 AM, the FHFA House Price Index for September 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

• Also at 9:00 AM, the S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices. The consensus is for a 4.5% year-over-year increase in the National Index for September, down from 5.1% in August (consensus 4.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 4.7% year-over-year in September, and for prices to increase 0.1% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed surveys for November.

• Also at 10:00 AM, the Conference Board's consumer confidence index for November. The consensus is for the index to increase to 95.7 from 94.5.

• At 11:00 AM, the NY Fed Q3 2014 Household Debt and Credit Report. The New York Fed will also release an accompanying blog, which will analyze household deleveraging.

Mortgage News Daily: Mortgage Rates below 4%, Lowest in 1-Month

by Calculated Risk on 11/24/2014 05:35:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Now at 1-Month Lows

Mortgage rates continue making improvements so small and so steady that they're barely noticeable, but they're improvements just the same. That's recently left us in the best territory in nearly a month. Today extends those slow and steady gains just enough to technically claim the "1-month low" designation, despite the fact that rates aren't materially different than they have been. The most prevalently-quoted conforming 30yr fixed rate remains 4.0% for top tier borrowers, but each day of modest improvement brings us closer to 3.875% and puts 4.125% farther in the rearviewHere is a table from Mortgage News Daily:

Black Knight: House Price Index down slightly in September, Up 4.6% year-over-year

by Calculated Risk on 11/24/2014 01:14:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). The timing of different house prices indexes; Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Down Slightly for the Month; Up 4.6 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on September 2014 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI declined 0.01% percent in September, and is off 10.2% from the peak in June 2006 (not adjusted for inflation).

The year-over-year increases have been getting steadily smaller for the last year - as shown in the table below:

| Month | YoY House Price Increase |

|---|---|

| Jan-13 | 6.7% |

| Feb-13 | 7.3% |

| Mar-13 | 7.6% |

| Apr-13 | 8.1% |

| May-13 | 7.9% |

| Jun-13 | 8.4% |

| Jul-13 | 8.7% |

| Aug-13 | 9.0% |

| Sep-13 | 9.0% |

| Oct-13 | 8.8% |

| Nov-13 | 8.5% |

| Dec-13 | 8.4% |

| Jan-14 | 8.0% |

| Feb-14 | 7.6% |

| Mar-14 | 7.0% |

| Apr-14 | 6.4% |

| May-14 | 5.9% |

| June-14 | 5.5% |

| July-14 | 5.1% |

| Aug-14 | 4.9% |

| Sep-14 | 4.6% |

The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 41.0% from the peak in Las Vegas, off 34.3% in Orlando, and 31.7% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston and San Antonio metros). Prices are also at new highs in Honolulu, HI, Nashville, TN and San Jose, CA.

Note: Case-Shiller for September will be released tomorrow.

Dallas Fed: Texas Manufacturing "Posts Slower Growth" in November

by Calculated Risk on 11/24/2014 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Activity Posts Slower Growth

Texas factory activity increased again in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 13.7 to 6, indicating output growth slowed in November.The last of the regional Fed surveys (Richmond) will be released tomorrow. So far the surveys have been solid in November.

Other measures of current manufacturing activity also reflected slower growth during the month. The capacity utilization index fell sharply from 18.1 to 9.8. The new orders index also declined notably from 14.2 to 5.6, although more than a quarter of firms continued to note increases in new orders over October levels. The shipments index was 12.1, nearly unchanged from its October reading.

Perceptions of broader business conditions remained positive this month, while outlooks were less optimistic. The general business activity index held steady at a solid reading of 10.5. The company outlook index dropped from 18.2 to 8.8, due to a smaller share of firms noting an improved outlook in November than in October.

Labor market indicators reflected continued employment growth and longer workweeks. The November employment index posted a sixth robust reading, coming in at 9.6.

emphasis added

Chicago Fed: Index shows "economic activity was near its historical trend" in October

by Calculated Risk on 11/24/2014 08:41:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth decelerated in August

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to +0.14 in October from +0.29 in September. Two of the four broad categories of indicators that make up the index decreased from September, and two of the four categories made negative contributions to the index in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, declined to –0.01 in October from +0.12 in September. October’s CFNAI-MA3 suggests that growth in national economic activity was near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in October (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, November 23, 2014

Sunday Night Futures

by Calculated Risk on 11/23/2014 07:30:00 PM

From Professor Hamilton at Econbrowser: Lower oil prices and the U.S. economy

Last year Americans consumed 135 billion gallons of gasoline. That means that if prices stay where they are, consumers will have an extra $108 billion each year to spend on other things. And if the historical pattern holds, spend it they will.Overall a nice boost for the U.S. economy.

...

[A]nother thing that’s changed is that much more of the oil we consume is now being produced right here at home. While lower prices are a boon for consumers, they pose a potential threat to producers ... Nevertheless, there should be no question that at this point this is a favorable development on-balance for the U.S. economy. We’re still importing 5 million more barrels each day of petroleum and products than we are exporting. Importing fewer barrels, and paying less for the barrels we do import, is a good thing.

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for October. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for November.

Weekend:

• Schedule for Week of November 16th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are up slightly and DOW futures are also up slightly (fair value).

Oil prices were up a little over the last week with WTI futures at $76.58 per barrel and Brent at $80.04 per barrel. A year ago, WTI was at $94, and Brent was at $108 - so prices are down more than 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.82 per gallon (down about 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Business Cycles and Markets

by Calculated Risk on 11/23/2014 11:47:00 AM

For fun ... recently we've seen another recession call for 2015, this time from the Jerome Levy Forecasting Center (following their an incorrect recession call in 2011). Over the last few years, there were several incorrect recession calls from ECRI and others. I disagreed with all of them, and I wrote I wasn't even on recession watch then, and I'm not on recession watch now!

But why do we care? Here is a repeat of a post I wrote in early 2011 (with updated tables and charts):

From 2011 [updates in brackets]: Here is something very different. This is NOT intended as investment advice.

Why is there so much focus on the business cycle? For companies, especially cyclical companies, the reason is obvious – it helps with planning, staffing and investment.

But why are investors so focused on the business cycle? Obviously earnings decline in a recession, and stock prices fall too. The following graph shows the year-over-year (YoY) change in the S&P 500 (using average monthly prices) since 1970. Notice that the market usually declines YoY in a recession.

Note: Because this is “year-over-year” there is a lag to the S&P 500 data. [Graph updated to November 2014]

So calling a recession isn’t just an academic exercise, there is some opportunity to preserve capital.

Not all downturns in the stock market are associated with recessions. As an example, the 1987 market crash was during an economic expansion. And the stock bubble collapse lasted from March 2000 through early 2003 – and the only official economic recession during that period was 7 months in 2001.

Although I don’t give investment advice, I think investors should measure their performance with some index. Warren Buffett likes to use the S&P 500 index, so I also used the S&P 500 for this exercise.

Imagine if we could call recessions in real time, and if we could predict recoveries in advance. The following table shows the performance of a buy-and-hold strategy (with dividend reinvestment), compared to a strategy of market timing based on 1) selling when a recession starts, and 2) buying 6 months before a recession ends.

For the buy and sell prices, I averaged the S&P 500 closing price for the entire month (no cherry picking price – just cherry picking the timing with 20/20 hindsight).

I assumed an investor started at four different times, in January of 1970, 1980, 1990, and 2000 [UPDATE: added 2010 start].

Note: Table columns for sensitivity corrected (ht YT)

| Return from Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | 9.3% | 12.7% | 11.8% | 12.4% | 12.6% | 12.1% |

| Jan-80 | 10.4% | 13.0% | 12.9% | 12.9% | 13.2% | 12.5% |

| Jan-90 | 8.6% | 11.8% | 11.5% | 11.7% | 11.7% | 11.2% |

| Jan-00 | 3.4% | 7.4% | 7.9% | 7.6% | 7.5% | 7.6% |

| Jan-10 | 14.4% | 14.4% | -- | -- | -- | -- |

The “recession timing” column gives the annualized return for each of the starting dates. Timing the recession correctly always outperforms buy-and-hold. The last four columns show the performance if the investor is two months early (both in and out), one month early, one month late, and two months late. The investor doesn’t have to be perfect!

Note: This includes dividends, but not taxes. Also I assumed no interest earned when the investor is out of the market (money in the mattress).

The second table provides the same information, but this time in dollars (assuming a $10,000 initial investment). Notice that someone could have bought the S&P 500 index in January 2000, and they’d be up about $150 [November 2014 Update: Up $16,410] now using buy-and-hold even though the market is still below the January 2000 average price of 1425 [Update: Now well above January 2000].

| Value based on Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | $532,650 | $2,113,480 | $1,497,100 | $1,905,810 | $2,053,620 | $1,678,730 |

| Jan-80 | $310,120 | $706,780 | $678,110 | $679,200 | $745,040 | $607,400 |

| Jan-90 | $77,950 | $159,530 | $148,160 | $156,400 | $157,430 | $140,910 |

| Jan-00 | $16,410 | $28,810 | $30,690 | $29,830 | $29,220 | $29,680 |

| Jan-10 | $19,150 | $19,150 | -- | -- | -- | -- |

Unfortunately forecasters have a terrible record of predicting downturns. The running joke is that forecasters have predicted 9 of the last 5 recessions! Although a forecaster doesn’t have to be perfect, they still have to be right. And that is very rare.

As economist Victor Zarnowitz said way back in 1960: “The record of predicting turning points — changes in the direction of economic activity — is on the whole poor." Forecasting hasn't improved much since then.

As an example, here are some comments from then Fed Chairman Alan Greenspan in 1990 (a recession began in July 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].”I'd say he missed that downturn. Of course Wall Street and Fed Chairmen are notoriously bad at calling downturns.

Chairman Greenspan, July 1990

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.”

Greenspan, August 1990

“... the economy has not yet slipped into recession.”

Greenspan, October 1990

But the track record for calling recoveries isn’t much better. ... Calling recessions is a mug’s game, but I like to play. I was very lucky with the [2007] recession, but the key wasn’t calling the end in June 2009 (I thought it ended in July), but looking for the bottom in early 2009 (that is why I posted several times in early 2009 that I was looking for the sun).

This is NOT intended as investment advice. I am NOT an investment advisor. Just some (hopefully) fun musing ...

[Final Update: If investors sold when ECRI first made their recession call in Sept 2011, they would have a missed around a 75% increase in the market This shows why trying to add recession timing is difficult; investors have to be correct on the business cycle - and most forecasters and investors are wrong].

Saturday, November 22, 2014

Update: More 2015 Housing Forecasts

by Calculated Risk on 11/22/2014 06:05:00 PM

Update 11/26/2014 for Merrill Lynch (minor downward revisions) and Fannie Mae (no changes)

Update 11/24/2014: I've added Metrostudy's forecast.

Update: I've added the MBA and Goldman Sachs forecasts. Also Wells Fargo updated their forecast (slight changes).

Towards the end of each year I collect some housing forecasts for the following year, and it looks like most analysts are optimistic for 2015.

Here is a summary of forecasts for 2014. In 2014, new home sales will be around 440 thousand, and total housing starts will be close to 1 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high).

In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Note: Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays were the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2015.

From Fannie Mae: Housing Forecast: November 2014

From NAHB: Single-Family Production Poised to Take Off in 2015

I don't have Moody's Analytics' forecast, but Mark Zandi, chief economist at Moody's Analytics said today "that single-family starts could be closing in on 1 million units by the end of 2015 and multifamily production could go as high as 500,000 units." That seems too high.

I haven't worked up a forecast yet for 2015.

| Housing Forecasts for 2015 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 523 | 783 | 1,170 | 4.9%2 |

| Goldman Sachs | 521 | 1,166 | 3.1% | |

| Merrill Lynch | 530 | 1,175 | 3.7% | |

| Metrostudy | 515 | 730 | 1,100 | 3.9%4 |

| MBA | 503 | 728 | 1,108 | 3.0%2 |

| NAHB | 547 | 802 | 1,158 | |

| NAR | 620 | 1,300 | 4%3 | |

| Wells Fargo | 530 | 770 | 1,160 | 3.3% |

| Zillow | 2.4%4 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Home price 4Zillow Home Value Index, Oct 2014 to Oct 2015 | ||||

Schedule for Week of November 23rd

by Calculated Risk on 11/22/2014 11:56:00 AM

This will be a short, but busy holiday week. The key reports this week are the second estimate of Q3 GDP, October New Home sales, October personal income and outlays, and September Case-Shiller house prices.

For manufacturing, the November Dallas and Richmond Fed surveys will be released this week.

Also, the NY Fed Q3 Report on Household Debt and Credit will be released on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for November.

8:30 AM: Gross Domestic Product, 3rd quarter 2014 (second estimate); Corporate Profits, 3rd quarter 2014 (preliminary estimate). The consensus is that real GDP increased 3.3% annualized in Q3, revised down from the advance estimate of 3.5%..

9:00 AM: FHFA House Price Index for September 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.

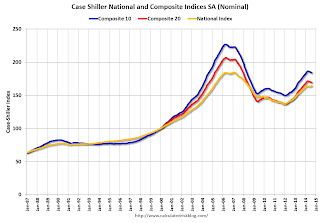

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.5% year-over-year increase in the National Index for September, down from 5.1% in August (consensus 4.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 4.7% year-over-year in September, and for prices to increase 0.1% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for the index to increase to 95.7 from 94.5.

11:00 AM: NY Fed Q3 2014 Household Debt and Credit Report. The New York Fed will also release an accompanying blog, which will analyze household deleveraging.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 288 thousand from 291 thousand last week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 63.2, down from 66.2 in October.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 90.0, up from the preliminary reading of 89.4, and up from the October reading of 86.9.

10:00 AM: New Home Sales for October from the Census Bureau.

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an increase in sales to 470 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 467 thousand in September.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 0.6% increase in the index.

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close at 1:00 PM ET.