by Calculated Risk on 10/25/2014 08:11:00 AM

Saturday, October 25, 2014

Goldman Sachs: FOMC Preview

Excerpts from a research piece by economist Kris Dawsey at Goldman Sachs:

US data have generally been solid since the last FOMC meeting, with a few exceptions. However, concern about downside risks to global growth increased—echoed by Fed communications—while financial market volatility rose considerably. The market-implied date of the first rate hike shifted out by roughly a quarter to 2015 Q4.

Our analysis suggests that recent developments should have a limited effect on the Fed’s baseline expectation for growth in the near-term, although downside risks to inflation are more pronounced. The FOMC will probably acknowledge recent foreign developments in the October statement, but an explicit shift in the balance of risks for the US outlook to the downside would be a dovish surprise. Other changes to the statement will likely include a slight upgrade to the language on the labor market.

St. Louis Fed President Bullard’s suggestion that QE could be extended past the October meeting garnered a lot of attention, but this seems unlikely to us. ...

We think the “considerable time” forward guidance will only be adjusted slightly at the October meeting, removing the reference to the end of asset purchases. The September meeting minutes suggested that any major changes are most likely at a meeting with a press conference, such as December. ...

emphasis added

Friday, October 24, 2014

Merrill Lynch: FOMC Preview

by Calculated Risk on 10/24/2014 08:50:00 PM

From Merrill Lynch:

The October FOMC meeting is likely to see the end of QE3 buying, as the Fed tapers the final $15bn in asset purchases. ... Tapering has been largely contingent on an improving labor market, and that has generally continued. The FOMC also has indicated multiple times that they are likely to end QE3 in October. Thus, it would take a significant adverse shock to change that plan, in our view.I'll post a preview this weekend, but it seems QE3 will end ... and the FOMC statement will be shorter!

As for the statement language, we expect the “significant underutilization” language to once again remain in place — although we see a modest chance that is downgraded, say to “elevated underutilization.” Meanwhile, the likelihood of changing the “considerable time” language is much more evenly split. Our base case remains no change in October, largely because there is no urgent need to revise, especially with the increase in downside risks to the outlook and heightened market volatility since the last meeting. However, there is general dissatisfaction on the FOMC with this phrase, and Fed officials have had another month and a half to consider alternatives. With no press conference scheduled after this meeting, the Committee may opt for re-examining the forward guidance language more comprehensively at their December meeting.

Perhaps most notable at this meeting may be the number and nature of dissents. We see a high probability of hawkish dissents from Dallas’s Fisher and Philadelphia’s Plosser. In our view, there is some chance the FOMC statement will note a bit more concern about downside risks to inflation — a reflection of recent data, the drop in breakevens, the strong US dollar, and disinflationary forces abroad. Should the Committee opt not to add such language, a dovish dissent from Minneapolis’s Kocherlakota becomes a risk. ... We continue to recommend focusing on the statement language and prepared remarks from Chair Yellen and other key Fed officials to understand the views of the majority of voters, who favor a patient and gradual exit process.

Bank Failure #16 in 2014: National Republic Bank of Chicago

by Calculated Risk on 10/24/2014 06:41:00 PM

From the FDIC: State Bank of Texas, Dallas, Texas, Assumes All of the Deposits of the National Republic Bank of Chicago, Chicago, Illinois

As of June 30, 2014, The National Republic Bank of Chicago had approximately $954.4 million in total assets and $915.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $111.6 million. ... The National Republic Bank of Chicago is the 16th FDIC-insured institution to fail in the nation this year, and the fifth in Illinois.Bank failure friday two weeks in a row!

Lawler on New Home Sales: Silly-Looking August Guess Revised Down Sharply in the West – As Expected

by Calculated Risk on 10/24/2014 03:30:00 PM

From housing economist Tom Lawler:

Census “guesstimated” that new SF home sales ran at a seasonally adjusted annual rate of 467,000 in September, up 0.2% from August’s downwardly-revised (by 7.5% to 466,000) pace. Sales estimates for June and July were also revised downward (by 2.4% and 5.4%, respectively). Not surprisingly (see LEHC, 9/24/2014), the biggest downward revision in sales for August was in the West region, where sales were revised downward by almost 20%.

Census also estimated that the inventory of new SF homes for sale at the end of September was 207,000 on a seasonally adjusted basis, up 1.5% from August’s upwardly revised (to 204,000 from 203,000) level and up 13.1% from a year ago. Census estimated that the median new SF home sales price last month was $259,000, down 4% from last September.

| Census Estimates of New SF Home Sales in August (SAAR) | |||

|---|---|---|---|

| Preliminary | First Revision | % Difference | |

| US | 504,000 | 466,000 | -7.5% |

| Northeast | 31,000 | 30,000 | -3.2% |

| Midwest | 58,000 | 57,000 | -1.7% |

| South | 262,000 | 256,000 | -2.3% |

| West | 153,000 | 123,000 | -19.6% |

Here are Census’ estimates of new SF home sales for the first nine months of 2014 compared to the first nine months of 2013 (not seasonally adjusted).

| Census Estimates of New SF Home Sales, Jan - Sep (NSA) | |||

|---|---|---|---|

| 2014 | 2013 | % Change* | |

| US | 337,000 | 331,000 | 1.7% |

| Northeast | 21,000 | 24,000 | -12.5% |

| Midwest | 47,000 | 47,000 | -1.2% |

| South | 187,000 | 175,000 | 6.8% |

| West | 82,000 | 85,000 | -3.2% |

| *Note: Census only shows home sales rounded to the nearest thousand, but % changes are reported based on unrounded estimates | |||

New SF home sales so far this year have fallen well short of consensus industry expectations at the beginning of the year. A major reason appears to be weakness sales to first-time home buyers, partly because of tight credit, partly because of financial “issues” for many younger adults, but also partly because many builders have trouble meeting their high return targets for communities with smaller, lower-price homes that would normally be targeted for first-time buyers.

As an example, home builder Pulte noted this morning that given its return targets “most” of its current land development was going to communities focused on the move-up and active adult markets, as in many areas there is not enough “pricing power” in the first-time buyer market for the company to meet its return targets.

Comments on September New Home Sales

by Calculated Risk on 10/24/2014 12:31:00 PM

The new home sales report for September was slightly above expectations at 467 thousand on a seasonally adjusted annual rate basis (SAAR). With the downward revision to August sales, sales for September were at the the highest sales rate since July 2008.

Sales for the previous three months (June, July and August) were revised down.

Earlier: New Home Sales increased slightly to 467,000 Annual Rate in September

The Census Bureau reported that new home sales this year, through September, were 338,000, Not seasonally adjusted (NSA). That is up 2.4% from 330,000 during the same period of 2013 (NSA). Not much of a gain from last year. Right now it looks like sales will barely be up this year (maybe 3% or so for the year).

Sales were up 17.0% year-over-year in September - however sales declined sharply in Q3 2013 as mortgage rates increased - so this was an easy comparison. The comparisons for Q4 will be more difficult.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will probably be smaller in Q4, but I expect sales to be up for the quarter and for the year.

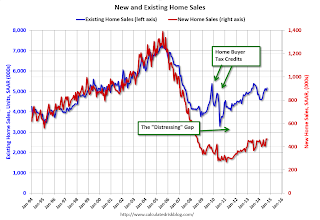

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be somewhat offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.