by Calculated Risk on 10/16/2014 08:30:00 AM

Thursday, October 16, 2014

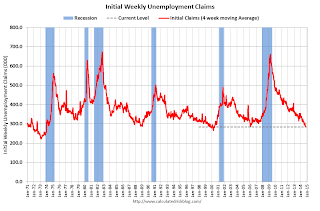

Weekly Initial Unemployment Claims decrease to 264,000, 4-Week Average lowest since 2000

The DOL reports:

In the week ending October 11, the advance figure for seasonally adjusted initial claims was 264,000, a decrease of 23,000 from the previous week's unrevised level of 287,000. This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The 4-week moving average was 283,500, a decrease of 4,250 from the previous week's unrevised average of 287,750. This is the lowest level for this average since June 10, 2000 when it was 283,500.The previous week was unrevised at 287,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 283,500.

This was below the consensus forecast of 290,000 and suggests few layoffs.

Wednesday, October 15, 2014

Thursday: Industrial Production, Unemployment Claims, Homebuilder Survey, Philly Fed Mfg Survey

by Calculated Risk on 10/15/2014 07:27:00 PM

Just a highlight of a few prices ...

Brent oil futures are down to $83.78 per barrel, down from $110 a year ago.

National gasoline prices are down to $3.18 per gallon and under $3.00 in many states. This is down from $3.35 per gallon a year ago. If oil prices stay at this level, national gasoline prices will probably fall under $3.00.

30 year fixed mortgage rates are down to 3.90% down from 4.38% a year ago. Loan officer Logan Mohtashami notes:

Right now, people who bought their homes in late 2013 and early 2014 may be good candidates to refinance their mortgages. Having said that, refinance activity is down 72% from the peak in May of 2013 because many already have lower rates and this recent move down won’t mean much to them. Therefore, people who can take advantage of these lower rates will only be a small pool of home owners. For those with the sufficient equity to eliminate their private mortgage insurance due to recent home prices gains, could benefit by refinancing. Others may benefit by combining their first and second loans into one at a new loan as well.As I noted earlier, we will not see a significant increase in refinance activity at these rates, because so many people refinanced in 2012 and early 2013 at even lower rates. Still - for some people as Logan notes - refinancing now makes sense.

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 287 thousand.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.0%.

• At 10:00 AM, the October NAHB homebuilder survey. The consensus is for a reading of 59, unchanged from 59 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, the the Philly Fed manufacturing survey for October. The consensus is for a reading of 20.0, down from 22.5 last month (above zero indicates expansion).

Fed's Beige Book: Economic Activity Expanded "modest to moderate" pace

by Calculated Risk on 10/15/2014 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Minneapolis and based on information collected before October 6, 2014."

Reports from the twelve Federal Reserve Districts generally described modest to moderate economic growth at a pace similar to that noted in the previous Beige Book. Moderate growth was reported by the Cleveland, Chicago, St. Louis, Minneapolis, Dallas, and San Francisco Districts, while modest growth was reported by the New York, Philadelphia, Richmond, Atlanta, and Kansas City Districts. In the Boston District, reports from business contacts painted a mixed picture of economic conditions. In addition, several Districts noted that contacts were generally optimistic about future activity.And on real estate:

Reports on residential construction and real estate activity were mixed. New York noted that single-family construction was sluggish in some areas, but that multifamily construction increased. Philadelphia reported only slight growth in home construction. In August, single-family construction starts in the Cleveland District reached their highest level so far this year, though the number of starts year-to-date remained slightly lower than last year. Richmond noted that residential construction across the District increased slightly for custom homes. Atlanta reported that multifamily construction continued to increase across much of the District, while Chicago indicated that both single- and multi-family construction continued to expand. Residential real estate contacts in the Atlanta District indicated that existing home sales and prices remained ahead of last year's levels and inventory levels were down from a year ago. Chicago noted that home sales were somewhat lower, and growth in home prices and residential rents slowed. San Francisco reported that sales of single-family homes were stable since the previous report.Residential real estate is "mixed', although nonresidential is seeing some growth.

Commercial construction and real estate activity grew in most Districts. Richmond, St. Louis, and San Francisco reported increased commercial construction, industrial construction, or both. Cleveland noted that a majority of commercial contractors saw increased construction activity relative to a year ago. Commercial contractors in the Atlanta District saw an increase in construction activity across many property types. In Minneapolis, however, commercial construction activity declined. Richmond reported that commercial real estate activity improved modestly over the past several weeks. The New York District noted that the New York City office market continued to strengthen. Atlanta noted that many commercial brokers saw growth in activity. Chicago noted that commercial real estate activity continued to expand. Kansas City indicated that commercial vacancy rates declined and absorption and sales increased. Boston noted that commercial real estate fundamentals are either holding steady or improving.

emphasis added

NY Fed: Empire State Manufacturing Survey indicates "business activity grew modestly" in October

by Calculated Risk on 10/15/2014 10:33:00 AM

Earlier from the NY Fed: Empire State Manufacturing Survey

The October 2014 Empire State Manufacturing Survey indicates that business activity grew modestly for New York manufacturers. The headline general business conditions index fell twenty-one points to 6.2, signaling that the pace of growth slowed significantly from last month. The new orders index dropped nineteen points to -1.7, indicating a slight decline in orders, and the shipments index fell twenty-six points to 1.1, indicating that shipments were flat. The employment index rose seven points to 10.2, pointing to an increase in employment levels, while the average workweek index fell to a level just below zero, suggesting that hours worked held steady ...This is the first of the regional surveys for October. The general business conditions index was well below the consensus forecast of a reading of 20.0, and indicates significantly slower expansion (above zero suggests expansion).

Most of the indexes assessing the future outlook were down from last month. Nevertheless, they remained fairly high by historical standards, and conveyed an expectation that activity would continue to grow in the months ahead. The index for future general business conditions fell five points to 41.7.

emphasis added

Retail Sales decreased 0.3% in September

by Calculated Risk on 10/15/2014 08:59:00 AM

On a monthly basis, retail sales decreased 0.3% from August to September (seasonally adjusted), and sales were up 4.3% from September 2013. Sales in August were unrevised at a 0.6% increase.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $442.7 billion, a decrease of 0.3 percent from the previous month, but 4.3 percent (±0.9%) above September 2013. ... The July to August 2014 percent change was unrevised from 0.6% (±0.2%).

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were down 0.2%.

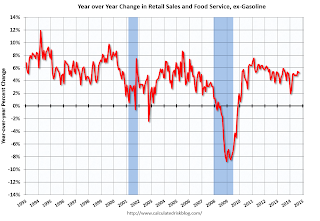

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.2% on a YoY basis (4.3% for all retail sales).

Retail sales ex-gasoline increased by 5.2% on a YoY basis (4.3% for all retail sales).The decrease in September was above consensus expectations of a 0.1% decrease.

This was a weak report.