by Calculated Risk on 9/11/2014 01:55:00 PM

Thursday, September 11, 2014

Hotels: Occupancy up 4.5%, RevPAR up 10.6% Year-over-Year

From HotelNewsNow.com: STR: US results for week ending 6 September

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 31 August through 6 September 2014, according to data from STR.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rate rose 4.5 percent to 59.0 percent. Average daily rate increased 5.9 percent to finish the week at US$108.87. Revenue per available room for the week was up 10.6 percent to finish at US$64.20.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

There is always a dip in occupancy after the summer (less leisure travel), and business travel should pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at about the level as for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels. Since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy. Note: Smith Travel analysts say that supply growth will pickup next year, but remain relatively slow, "hotel supply growth in the United States is forecast to be 1% this year and 1.3% in 2015".

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Goldman Sachs Revises Q2 GDP estimate to 4.7%

by Calculated Risk on 9/11/2014 12:05:00 PM

From Brett LoGiurato at Business Insider: Goldman Is Now Saying That Q2 GDP Growth Was Absolutely Massive

Goldman Sachs revised its estimate of second-quarter GDP growth to 4.7% on Thursday, based on new data from the Census Bureau's Quarterly Services Survey (QSS).Here is the Q2 Quarterly Services Press Release

Stronger-than-expected healthcare spending growth led to the revised Goldman estimate of 4.7%, which was up 0.5% from the Bureau of Economic Analysis' second advance-estimate of 4.2%.

Health care and social assistance The estimate of U.S. health care and social assistance revenue for the second quarter of 2014, not adjusted for seasonal variation, or price changes, was $565.6 billion, an increase of 3.0 percent (± 0.9%) from the first quarter of 2014 and up 3.7 percent (± 0.9%) from the second quarter of 2013. The fourth quarter of 2013 to first quarter of 2014 percent change was not revised from -2.0 percent (± 0.8%).The third estimate of Q2 GDP will be released on Friday, September 26th. Some of the Q2 GDP increase was a bounce back from the weather impacted Q1.

Weekly Initial Unemployment Claims increase to 315,000

by Calculated Risk on 9/11/2014 08:35:00 AM

The DOL reports:

In the week ending September 6, the advance figure for seasonally adjusted initial claims was 315,000, an increase of 11,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 302,000 to 304,000. The 4-week moving average was 304,000, an increase of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 302,750 to 303,250.The previous week was revised up to 304,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 304,000.

This was above the consensus forecast of 300,000 and in the normal range for an economic expansion.

Wednesday, September 10, 2014

Thursday: Unemployment Claims, Quarterly Services Report

by Calculated Risk on 9/10/2014 07:01:00 PM

This is an important change ... from the WSJ: Cost of Employer Health Coverage Shows Muted Growth

The cost of employer health coverage continued its muted growth this year with a 3% increase that pushed the average annual premium for a family plan to $16,834, according to a major survey.Thursday:

The increase was slightly less than the 4% seen last year, according to the annual poll of employers performed by the nonprofit Kaiser Family Foundation along with the Health Research & Educational Trust, a nonprofit affiliated with the American Hospital Association. The share of the family-plan premium borne by employees was $4,823, or 29% of the total, the same percentage as last year.

The total annual cost of employer coverage for an individual was $6,025 in the 2014 survey, up 2%, a difference that wasn't statistically significant.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 302 thousand.

• At 10:00 AM, the Q2 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for August.

Vehicle Sales: Fleet Turnover Ratio

by Calculated Risk on 9/10/2014 02:29:00 PM

Back in early 2009, I wrote a couple of posts arguing there would be an increase in auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). This was an out-of-the-consensus call and helped me call the bottom for the US economy in mid-2009.

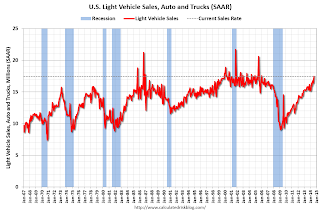

Here is an update to the U.S. fleet turnover graph.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through August 2014 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet). Note: the number of registered vehicles is estimated for 2012 through 2014.

The wild swings in 2009 were due to the "cash for clunkers" program.

The estimated ratio for August was just over 14 years - back to a more normal level.

Note: I argued the turnover ratio would "probably decline to 15 or so eventually" and that has happened.

The current sales rate is now near the top (excluding one month spikes) of the '98/'06 auto boom.

Light vehicle sales were at a 17.45 million seasonally adjusted annual rate (SAAR) in August.

I now expect vehicle sales to mostly move sideways over the next few years.