by Calculated Risk on 9/03/2014 06:01:00 PM

Wednesday, September 03, 2014

Lawler on Toll Brothers: Net Home Orders Down, Price Gains Slow; Some “Lessening” in Pricing Power

From housing economist Tom Lawler: Toll Brothers: Net Home Orders Down, Price Gains on Orders Slows; Some “Lessening” in Pricing Power but No “Need” to Increase Incentives Much -- Yet

Toll Brothers, the self-described “nation’s leading builder of luxury homes,” reported that net home orders in the quarter ended July 31, 2014 totaled 1,324, down 5.8% from the comparable quarter of 2013. Net orders per community last quarter were down 15.9% from the comparable quarter of 2013. The company average net order price last quarter was $717,000, up 1.4% from a year ago. Toll’s sales cancellation rate, expressed as a % of gross orders, was 6.6% last quarter, up from 4.6% in the comparable quarter of 2013. Home deliveries last quarter totaled 1,364, up 36.8% from the comparable quarter of 2013, at an average sales price of $732,000, up 12.4% from a year ago. The company’s order backlog at the end of July was 4,204, up 5.1% from last July, at an average order price of $737,300, up 4.1% from a year ago. The company controlled 49,037 home sites at the end of July, up 3.9% from last July and up 25.1% from two years ago.

For its “traditional” home building business (i.e., ex city living), net home orders totaled 1,281 last quarter, down 5.0% from the comparable quarter of 2014, at an average net order price of $700,500, up 3.4% from a year ago.

Here are a few excerpts from the company’s press release.

Douglas C. Yearley, Toll Brothers' chief executive officer:

"Although we have seen some lessening of pricing power in the past year, we have not felt the need to incentivize to spur home sales. Because we generally do not build 'spec' homes, we are not under pressure to move standing inventory. We are driven by bottom-line growth and are pleased with our continued margin expansion through what we still believe is a recovering, albeit bumpy, housing cycle. We have been particularly pleased with our performance in a number of the markets we have targeted for growth, especially Coastal California, Texas, and the urban New York City area.Robert I. Toll, executive chairman

"With pent-up demand still yet to be unleashed, we are growing community count in attractive locations.”

"The national housing data has been somewhat volatile in recent months. Without real urgency pushing buyers to make a decision, general industry demand continues to be impacted by uncertainty about the economy and world events, improving but fragile consumer confidence and reduced affordability due to rising prices and limited personal income growth. One data point we do have confidence in is the low level of production compared to historic norms. Population grew during the recession and has continued to increase since then. Based on trends over more than forty years, the industry should be building 50% more homes this year than its current pace to meet the increased population demographics.”As with many other builders, last year Toll raised prices aggressively based on stronger-than-expected demand as well as longer-than-expected development timelines that limited supply. Toll and many other builders are now increasing active communities at a double-digit pace, but are having trouble generating double-digit sales growth because prices were increased at too rapid a pace last year.

Toll’s net orders were significantly below consensus.

U.S. Light Vehicle Sales increase to 17.45 million annual rate in August, Highest since Jan 2006

by Calculated Risk on 9/03/2014 02:51:00 PM

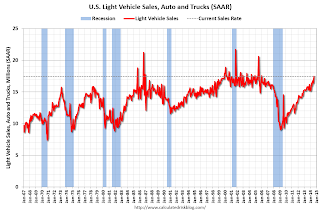

Based on an WardsAuto estimate, light vehicle sales were at a 17.45 million SAAR in August. That is up 10% from August 2013, and up 6.4% from the 16.4 million annual sales rate last month.

This was well above the consensus forecast of 16.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for August (red, light vehicle sales of 17.45 million SAAR from WardsAuto).

From WardsAuto:

August's 17.45 million-unit seasonally adjusted annual rate of sales is the industry's highest monthly SAAR since January 2006.

The 103-month high was set as rising automaker incentives intersected with a strengthening economy and growing consumer confidence to boost deliveries well past 1.5 million units, for an industry wide 9.3% rise in daily sales.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

This is the highest sales rate since January 2006.

Fed's Beige Book: Economic Activity Expanded, No "distinct shift in the overall pace of growth"

by Calculated Risk on 9/03/2014 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Philadelphia and based on information collected on or before August 22, 2014."

Reports from the twelve Federal Reserve Districts indicated that economic activity has expanded since the previous Beige Book report; however, none of the Districts pointed to a distinct shift in the overall pace of growth. The New York, Cleveland, Chicago, Minneapolis, Dallas, and San Francisco Districts characterized their growth rates as moderate; Philadelphia, Atlanta, St. Louis, and Kansas City reported modest growth. Boston reported that business activity appeared to be improving, and Richmond reported further strengthening. Philadelphia, Atlanta, Chicago, Kansas City, and Dallas explicitly reported that contacts in their Districts generally remained optimistic about future growth; most of the other Districts cited various examples of ongoing optimism from specific sectors.And on real estate:

Barely half of the Districts reported stable or growing residential real estate activity related to the construction of new homes and sales of existing houses. New construction and existing home sales generally grew modestly; market conditions tended to vary by metropolitan area and by neighborhood within metropolitan areas. Boston, New York, and Dallas reported high levels of ongoing multifamily construction projects; Chicago reported a moderate pace of growth, and San Francisco noted a pickup in activity.Very cautious comments on residential real estate, although nonresidential is seeing some growth.

A little over half of the Districts reported some degree of growth in nonresidential real estate activity, with increased construction, leasing, or both tied to steady or falling vacancy rates and to rent increases. None of the Districts reported a decline in overall activity, although New York and St. Louis described activity as mixed. In addition to traditional office space, certain Districts reported increased demand for specific projects: Boston noted demand for construction in the hospitality sector, Philadelphia cited industrial and warehouse projects, Richmond noted distribution centers, and St. Louis reported new retail and mixed-use projects as well as new industrial facility construction.

emphasis added

Early: August Vehicle Sales may be over 17 Million SAAR, Highest Sales Rate since July 2006

by Calculated Risk on 9/03/2014 11:50:00 AM

From John Sousanis at WardsAuto Counting Cars: Summer Sales Heat Up

SUMMARY: With a few exceptions, automakers are reporting higher than expected August sales, pointing to the possibility that the forecasted July 17-million SAAR, which failed to materialize, just may have been a month late coming.WardsAuto is currently projecting sales in August at 17.06 million seasonally adjusted annual rate (SAAR). This would be the highest sales rate since July 2006.

A few excerpts:

Toyota beat WardsAuto expections by nearly 9%, delivering 246,100 LVs in August. The automaker's daily sales rose 10.2% from same-month year-ago ...

[Ford] daily deliveries up just 3.9% over same-month year-ago, on total LV sales of 217,040.

...

General Motors poored a little cold water on August sales reports, recording a 2.4% DSR gain on year-ago, with LV deliveries of 272,243 units - 3% below WardsAuto's expectations for the company ...

Nissan is reporting August sales of almost 135,000 LVs, a 15.7% rise in DSR compared with same-month 2013. Volkswagen brand daily sales fell 9.6%, but the result was better than expected, with VW moving 35,181 units during the month.

Fiat-Chrysler reports over 197,000 LV deliveries in August, a massive 24.2% leap over year-ago sales

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 9/03/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 29, 2014. ...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.25 percent, the lowest level since June 2013, from 4.28 percent, with points decreasing to 0.24 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.