by Calculated Risk on 8/15/2014 02:47:00 PM

Friday, August 15, 2014

Lawler: Early Read on Existing Home Sales in July

From housing economist Tom Lawler:

Based on reports released so far by local realtor associations/boards/MLS, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.09 million in July, up 0.6% from June’s estimate but down 5.4% from last July’s estimate.CR Note: The NAR is scheduled to release July existing home sales on Thursday, August 21st. The consensus is for sales at a 5.00 million pace (SAAR).

Last July, of course, was the peak month for home sales in 2013. Based on a combination of local realtor/MLS reports and real-estate listings trackers, I project that the NAR’s estimate of the number of existing homes for sale at the end of July will be up about 3.0% from the end of June. Barring revisions, such a gain would imply a YOY inventory increase of 5.8%, compared to the YOY gain of 6.5% in June.

Finally, based on local realtor/MLS reports I project that the NAR’s estimate of the median existing SF home sales price in July will be 3.7% higher than last July. The estimated YOY gain in June was 4.5%.

On inventory, if Lawler is correct, this would put inventory in July at close to the same level as two years ago - in July 2012 -when prices started increasing faster. Now, with rising inventory, this should mean slower price increases.

Preliminary August Consumer Sentiment decreases to 79.2

by Calculated Risk on 8/15/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for August was at 79.2, down from 81.8 in July.

This was the lowest reading since last November and below the consensus forecast of 82.3. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Fed: Industrial Production increased 0.4% in July

by Calculated Risk on 8/15/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.4 percent in July for its sixth consecutive monthly gain. Manufacturing output advanced 1.0 percent in July, its largest increase since February. The production of motor vehicles and parts jumped 10.1 percent, while output in the rest of the manufacturing sector rose 0.4 percent. The production at mines moved up 0.3 percent, its ninth consecutive monthly increase. The output of utilities dropped 3.4 percent, as weather that was milder than usual for July reduced demand for air conditioning. At 104.4 percent of its 2007 average, total industrial production in July was 5.0 percent above its year-earlier level. Capacity utilization for total industry edged up 0.1 percentage point to 79.2 percent in July, a rate 1.7 percentage points above its level of a year earlier and 0.9 percentage point below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

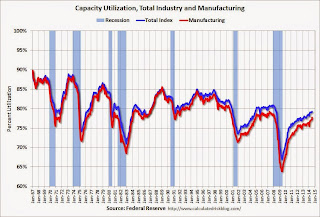

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is 0.9 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.4% in July to 104.4. This is 24.7% above the recession low, and 3.6% above the pre-recession peak.

The monthly change for Industrial Production was slightly above expectations.

NY Fed: Empire State Manufacturing Survey indicates "business conditions continued to improve" in August

by Calculated Risk on 8/15/2014 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The August 2014 Empire State Manufacturing Survey indicates that business conditions continued to improve for New York manufacturers, but the improvement was less wide-spread than in the previous month. The headline general business conditions index retreated eleven points to 14.7, after reaching a four-year high in July. The new orders index slipped almost five points to 14.1, while the shipments index edged up a point to 24.6—a multiyear high. ...This is the first of the regional surveys for August. The general business conditions index was below the consensus forecast of a reading of 20.0, but still indicates solid expansion (above zero suggests expansion). However this is slower expansion in August than in July (the index was at a four-year high in July).

Labor market conditions were mixed but continued to improve overall. The index for number of employees slipped three points to 13.6, suggesting a slight pullback in the pace of hiring. However, the average workweek index rose six points to 8.0, signaling a slight increase in hours worked.

Despite the pullback in most of the survey’s indexes for current conditions, optimism about the near-term outlook grew increasingly widespread. The index for future general business conditions climbed eighteen points to 46.8—its highest level in two-and-a-half years.

emphasis added

Thursday, August 14, 2014

Friday: Industrial Production, NY Fed Mfg Survey, PPI, Consumer Sentiment

by Calculated Risk on 8/14/2014 08:15:00 PM

First from the WSJ: New Rules Near on Credit-Ratings Firms

The rules, expected to be somewhat tougher than those proposed more than three years ago, will take additional steps to ensure that the firms' interest in winning business doesn't affect ratings analysis, said the people familiar with the process.The downgrades might have triggered the crisis, but the key problem wasn't the downgrade - it was that the bonds were rated too high when first rated. I'll review why this happened (ratings too high) again soon.

Credit raters have been lambasted by critics and lawmakers over their actions in the run-up to the 2008 financial crisis. A 2011 U.S. congressional report cited widespread and sudden downgrades of mortgage-related bonds as being perhaps "more than any other single event ... the immediate trigger for the financial crisis." The bonds had previously been given top-notch ratings by the firms.

Friday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 20.0, down from 25.6 in July (above zero is expansion).

• Also at 8:30 AM, the Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 82.3, up from 81.8 in July.