by Calculated Risk on 7/24/2014 10:00:00 AM

Thursday, July 24, 2014

New Home Sales decrease to 406,000 Annual Rate in June

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 406 thousand.

May sales were revised down from 504 thousand to 442 thousand, and April sales were revised down from 425 thousand to 408 thousand.

Sales of new single-family houses in June 2014 were at a seasonally adjusted annual rate of 406,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.1 percent below the revised May rate of 442,000 and is 11.5 percent below the June 2013 estimate of 459,000.

Click on graph for larger image.

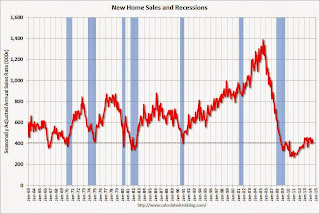

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in June to 5.8 months from 5.2 months in May.

The months of supply increased in June to 5.8 months from 5.2 months in May. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of June was 197,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

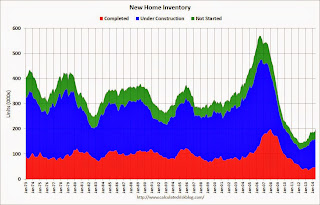

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

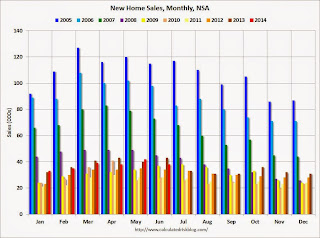

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2014 (red column), 38 thousand new homes were sold (NSA). Last year 43 thousand homes were also sold in June. The high for June was 115 thousand in 2005, and the low for June was 28 thousand in 2010 and 2011.

This was well below expectations of 475,000 sales in June, and sales were down 11.5% year-over-year.

I'll have more later today .

Weekly Initial Unemployment Claims decrease to 284,000, 4-Week Average Lowest since May 2007

by Calculated Risk on 7/24/2014 08:30:00 AM

The DOL reports:

In the week ending July 19, the advance figure for seasonally adjusted initial claims was 284,000, a decrease of 19,000 from the previous week's revised level. This is the lowest level for initial claims since February 18, 2006 when they were 283,000. The previous week's level was revised up by 1,000 from 302,000 to 303,000. The 4-week moving average was 302,000, a decrease of 7,250 from the previous week's revised average. This is the lowest level for this average since May 19, 2007 when it was 302,000. The previous week's average was revised up by 250 from 309,000 to 309,250.The previous week was revised up to 303,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 302,000.

This was lower than the consensus forecast of 310,000. The 4-week average is now at normal levels for an expansion.

Wednesday, July 23, 2014

Thursday: New Home Sales, Unemployment Claims and More

by Calculated Risk on 7/23/2014 08:16:00 PM

The scams never end, and this one was really disgusting (ripping off people in financial trouble) ... from the LA Times: Authorities crack down on mortgage-relief scams nationwide

Federal and state officials filed lawsuits accusing dozens of companies of ripping off struggling homeowners by falsely promising help in avoiding foreclosures or lowering mortgage payments while collecting millions of dollars in illegal upfront fees.Thursday:

...

The Consumer Financial Protection Bureau said three suits it filed against eight companies and their owners involved scams that cost homeowners more than $25 million in illegal upfront fees for services such as renegotiating mortgages or preventing foreclosures.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 302 thousand.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for a decrease in sales to 475 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 504 thousand in May.

• At 11:00 AM, the Kansas City Fed manufacturing survey for July.

• During the day, the NMHC Quarterly Survey of Apartment Conditions.

Inflation: Another "False Alarm"?

by Calculated Risk on 7/23/2014 06:00:00 PM

From Gavyn Davies at the Financial Times: Another false alarm on US inflation?

There have been a few false alarms about a possible upsurge in inflation in the US in the past few years, even as core inflation on most measures has remained extremely subdued. ... Another such scare has been brewing recently.From Ron Insana at CNBC: Inflation is about to fall—and fall hard

...

It now seems probable that part of the recent jump in core inflation was just a random fluctuation in the data. ... But the main reason for the lack of concern is that wage pressures in the economy have remained stable, on virtually all the relevant measures. ... there has been yet another false alarm on US inflation.

I will make a bet with this country's leading inflationistas, who continue to warn that inflation is about to surge, that they are dead wrong. ...My view is inflation is not a concern this year.

Agricultural commodity prices, excluding meats, have crashed. Corn, wheat and soybean prices have plummeted on expectations of bumper crops around the world — particularly in the United States. ...

...

Likewise, despite geopolitical hot spots around the world, energy prices have also dropped from recent highs. While oil remains stubbornly above $100 a barrel, both at home and abroad. Were it not for recent events in Ukraine and the Middle East, oil prices may have continued their recent dip below that century mark. ...

With respect to raging wage inflation, that argument is also a non-starter. Wages are rising at a 2 percent to 2.5 percent annual rate, hardly the stuff of wage-price spirals....

For years, and on all counts, inflation hawks have been, let's say, premature in calling for a rapid acceleration in inflation.

Housing Inventory: NAR and Housing Tracker

by Calculated Risk on 7/23/2014 01:41:00 PM

I've been using weekly inventory numbers from Housing Tracker ("DeptofNumbers") to track changes in listed inventory and it might be useful to compared the Housing Tracker numbers to the Realtor (NAR) numbers for inventory.

According to Housing Tracker for (54 metro areas), inventory is up 15.0% compared to the same week last year.

However the NAR reported yesterday that inventory in June was only up 6.5% year-over-year. Some of the difference could be because of coverage (Housing Tracker is only for the largest 54 metro areas), and some of the difference could be because of timing and methodology.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through June (left axis) and the HousingTracker data for the 54 metro areas through July.

In general - over time - Housing Tracker and the NAR reports of inventory move together.

Both reports suggest inventory is increasing, and that overall inventory is still fairly low.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

This year-over-year increase in inventory is a significant story. This increase should slow house price increases (maybe even lead to price declines in some areas).

This year-over-year increase in inventory is a significant story. This increase should slow house price increases (maybe even lead to price declines in some areas).

Note: I use the NAR data as the "standard", but I think the Housing Tracker data is useful (since it is reported weekly without a significant lag). My guess is the NAR will continue to report increases in inventory, and that inventory will be up 10% to 15% year-over-year at the end of 2014 based on the NAR report (maybe even more).