by Calculated Risk on 7/23/2014 06:00:00 PM

Wednesday, July 23, 2014

Inflation: Another "False Alarm"?

From Gavyn Davies at the Financial Times: Another false alarm on US inflation?

There have been a few false alarms about a possible upsurge in inflation in the US in the past few years, even as core inflation on most measures has remained extremely subdued. ... Another such scare has been brewing recently.From Ron Insana at CNBC: Inflation is about to fall—and fall hard

...

It now seems probable that part of the recent jump in core inflation was just a random fluctuation in the data. ... But the main reason for the lack of concern is that wage pressures in the economy have remained stable, on virtually all the relevant measures. ... there has been yet another false alarm on US inflation.

I will make a bet with this country's leading inflationistas, who continue to warn that inflation is about to surge, that they are dead wrong. ...My view is inflation is not a concern this year.

Agricultural commodity prices, excluding meats, have crashed. Corn, wheat and soybean prices have plummeted on expectations of bumper crops around the world — particularly in the United States. ...

...

Likewise, despite geopolitical hot spots around the world, energy prices have also dropped from recent highs. While oil remains stubbornly above $100 a barrel, both at home and abroad. Were it not for recent events in Ukraine and the Middle East, oil prices may have continued their recent dip below that century mark. ...

With respect to raging wage inflation, that argument is also a non-starter. Wages are rising at a 2 percent to 2.5 percent annual rate, hardly the stuff of wage-price spirals....

For years, and on all counts, inflation hawks have been, let's say, premature in calling for a rapid acceleration in inflation.

Housing Inventory: NAR and Housing Tracker

by Calculated Risk on 7/23/2014 01:41:00 PM

I've been using weekly inventory numbers from Housing Tracker ("DeptofNumbers") to track changes in listed inventory and it might be useful to compared the Housing Tracker numbers to the Realtor (NAR) numbers for inventory.

According to Housing Tracker for (54 metro areas), inventory is up 15.0% compared to the same week last year.

However the NAR reported yesterday that inventory in June was only up 6.5% year-over-year. Some of the difference could be because of coverage (Housing Tracker is only for the largest 54 metro areas), and some of the difference could be because of timing and methodology.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through June (left axis) and the HousingTracker data for the 54 metro areas through July.

In general - over time - Housing Tracker and the NAR reports of inventory move together.

Both reports suggest inventory is increasing, and that overall inventory is still fairly low.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

This year-over-year increase in inventory is a significant story. This increase should slow house price increases (maybe even lead to price declines in some areas).

This year-over-year increase in inventory is a significant story. This increase should slow house price increases (maybe even lead to price declines in some areas).

Note: I use the NAR data as the "standard", but I think the Housing Tracker data is useful (since it is reported weekly without a significant lag). My guess is the NAR will continue to report increases in inventory, and that inventory will be up 10% to 15% year-over-year at the end of 2014 based on the NAR report (maybe even more).

AIA: Architecture Billings Index increased in June

by Calculated Risk on 7/23/2014 10:35:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Momentum Increasing for Architecture Billings Index

The Architecture Billings Index (ABI) is signaling improving conditions for the overall design and construction industry. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 53.5, up from a mark of 52.6 in May. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 66.4, up noticeably from the reading of 63.2 the previous month and its highest level in a calendar year.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in June was 55.7 – the highest mark since that indicator starting being measured in October 2010.

“The recent surge in both design contracts and general inquiries for new projects by prospective clients is indicative of a sustainable strengthening across the construction marketplace,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “With the first positive reading since last summer in billings at institutional firms, it appears that design activity for all major segments of the building industry is growing. The challenge now for architecture firms seems to be finding the right balance for staffing needs to meet increasing demand.”

• Regional averages: Midwest (56.3), South (53.9), Northeast 51.1) , West (48.7) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.5 in June, up from 52.6 in May. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion during 18 of the last 23 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the readings over the last year suggest some increase in CRE investment this year and in 2015.

Black Knight: Mortgage Loans in Foreclosure Process Lowest since May 2008

by Calculated Risk on 7/23/2014 09:16:00 AM

According to Black Knight's First Look report for June, the percent of loans delinquent increased slightly in June compared to May, and declined by 15.0% year-over-year.

Also the percent of loans in the foreclosure process declined further in June and were down 36% over the last year. Foreclosure inventory was at the lowest level since May 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.70% in June, up seasonally from 5.62% in May. The normal rate for delinquencies is around 4.5% to 5%. The increase in delinquencies was in the 'less than 90 days' bucket.

The percent of loans in the foreclosure process declined to 1.88% in June from 1.91% in May.

The number of delinquent properties, but not in foreclosure, is down 445,000 properties year-over-year, and the number of properties in the foreclosure process is down 507,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for June in early August.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| June 2014 | May 2014 | June 2013 | |

| Delinquent | 5.70% | 5.62% | 6.68% |

| In Foreclosure | 1.88% | 1.91% | 2.93% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,728,000 | 1,670,000 | 1,983,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,155,000 | 1,169,000 | 1,345,000 |

| Number of properties in foreclosure pre-sale inventory: | 951,000 | 966,000 | 1,458,000 |

| Total Properties | 3,834,000 | 3,805,000 | 4,785,000 |

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 7/23/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 18, 2014. ...

The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.33 percent, with points increasing to 0.23 from 0.20 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 74% from the levels in May 2013.

As expected, refinance activity is very low this year.

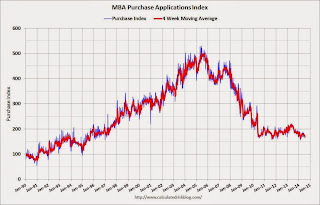

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 15% from a year ago.