by Calculated Risk on 7/03/2014 09:42:00 PM

Thursday, July 03, 2014

Correcting WSJ Graph Error on Wages

For fun, here is an incorrect graph on wages from the WSJ today: U.S. Jobs Report: 288,000 Positions Added

Click on graph for larger image.

This graph just looked wrong (one on the right). If wages had to increase from $22.15 per hour to $26.99 per hour to track inflation over the last 5 years, then inflation must of been 4% per year! That isn't correct.

So I pulled up the actual wage and CPI data.

| Month | Total Private Average Hourly Earnings of All Employees | CPI | Inflation Adjusted |

|---|---|---|---|

| June 2009 | $22.15 | 214.79 | |

| June 2014 | $24.45 | 237.0831 | $24.45 |

| 1CPI is for May 2014 (per WSJ). | |||

The wage data is from the BLS and is correct on the graph. But instead of multiplying $22.15 times the increase in inflation, they must have multiplied the June 2014 wages times inflation. Oops!

The correct story is that real wages have gone nowhere for 5 years (the BLS has a series on real hourly wages, and of course the series shows essentially no change from June 2009 to May 2014). The article actually had the story correct: "The average hourly wage for private-sector workers rose six cents to $24.45. That's up just 2% from a year earlier, basically in line with consumer-price inflation."

Black Knight releases Mortgage Monitor for May

by Calculated Risk on 7/03/2014 05:54:00 PM

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for May today. According to BKFS, 5.62% of mortgages were delinquent in May, unchanged from April. BKFS reports that 1.91% of mortgages were in the foreclosure process, down from 3.05% in May 2013.

This gives a total of 7.53% delinquent or in foreclosure. It breaks down as:

• 1,670,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,169,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 966,000 loans in foreclosure process.

For a total of 3,805,000 loans delinquent or in foreclosure in May. This is down from 4,569,000 in May 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

From Black Knight:

Though refinance activity is still down significantly from the levels seen in 2012 and early last year, it has increased 21 percent since January 2014. Black Knight also found that seasonal purchase activity has picked up, with approximately 897,000 purchase originations through April, a level on par with 2013 (898,000 over the same period), and better than 2012 (847,000). Overall, credit standards do not seem to be easing, as both average loan-to-value (LTV) ratios and credit scores on both purchase and refinance originations remain relatively strict and essentially unchanged.This fits with the NAR data showing standard equity purchases up slightly this year even as distressed sales decline sharply (many distressed sales are cash buyers). However this doesn't fit with the MBA purchase index.

emphasis added

There is much more in the mortgage monitor.

Trade Deficit decreased in May to $44.4 Billion

by Calculated Risk on 7/03/2014 03:35:00 PM

Catching up ... the Department of Commerce reported this morning:

[T]otal May exports of $195.5 billion and imports of $239.8 billion resulted in a goods and services deficit of $44.4 billion, down from $47.0 billion in April, revised. May exports were $2.0 billion more than April exports of $193.5 billion. May imports were $0.7 billion less than April imports of $240.5 billion.The trade deficit was smaller than the consensus forecast of $45.1 billion.

The first graph shows the monthly U.S. exports and imports in dollars through April 2014.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in May.

Exports are 18% above the pre-recession peak and up 4% compared to May 2013; imports are about 4% above the pre-recession peak, and up about 3% compared to May 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $96.12 in May, up from $95.48 in April, and down from $96.74 in May 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $28.8 billion in May, from $27.9 billion in May 2013.

Reis: Strip Mall Vacancy Rate declined slightly in Q2, Regional Malls Unchanged

by Calculated Risk on 7/03/2014 01:03:00 PM

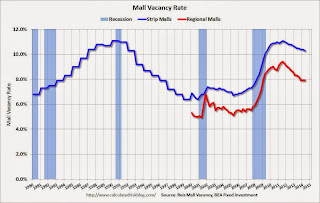

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q2 2014. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined slightly to 10.3% from 10.4% in Q1. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] The national vacancy rate for neighborhood and community shopping centers declined by 10 basis points to 10.3% during the second quarter. This was a marginal improvement over the first quarter when the national vacancy rate did not change. The national vacancy is now down 80 basis points from its historical peak during the third quarter of 2011. However, that translates into a less than 10 basis points per quarter compression in the vacancy rate.

...

[Regional] Vacancy during the second quarter was 7.9%, unchanged from the first quarter and down 40 basis points from the second quarter of 2013. Vacancy is also down 150 basis points from the historical‐high level of 9.4% reached during the third quarter of 2011. Asking rents grew by 0.4% in the second quarter and 1.8% during the last twelve months. This is the thirteenth consecutive quarter of rent increases at the national level for regional malls. While the mood surrounding malls at industry events continues to brighten, the data in recent quarters has become a bit less optimistic. The vacancy rate for malls has been unchanged over the last three quarters, although rent growth continues to accelerate. Even though the economy is recovering, the mall sector is grappling with the fallout surrounding store closures and retailers going out of business. This is putting upward pressure on vacancy at a time when improvement in the economy and labor market is gradually translating into slow increases in demand and net absorption.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

Comments on Employment Report

by Calculated Risk on 7/03/2014 10:46:00 AM

Earlier: June Employment Report: 288,000 Jobs, 6.1% Unemployment Rate

Total employment increased 288,000 from May to June, and is now 415,000 above the previous peak. Private payroll employment increased 262,000 from May to June, and private employment is now 895,000 above the previous peak (the unprecedented large number of government layoffs has held back total employment).

Through the first half of 2014, the economy has added 1,385,000 payroll jobs - up from 1,221,000 added during the same period in 2013 - even with the severe weather early this year. My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year, and that still looks about right.

Hopefully - now that the unemployment rate has fallen to 6.1% - wage growth will start to pick up.

Overall this was another solid employment report.

Employment-Population Ratio, 25 to 54 years old

Since the overall participation rate declined recently due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate declined recently due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate has mostly moved sideways (with a downward drift started around '00) - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in June to 80.9%, and the 25 to 54 employment population ratio increased to 76.7% from 76.4%. As the recovery continues, I expect the participation rate for this group to increase.

Year-over-year Change in Employment

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.

In June, the year-over-year change was 2.495 million jobs, and it appears the pace of hiring is increasing.

Right now it looks possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

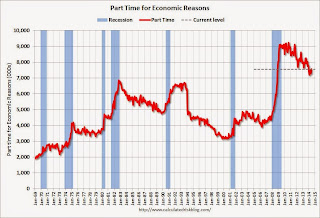

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by 275,000 in June to 7.5 million. The number of involuntary part-time workers is down over the year but has shown no clear trend in recent months. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons increased in June to 7.544 million from 7.269 million in May. This suggests significantly slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 12.1% in June from 12.2% in May. This is the lowest level for U-6 since October 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.081 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 3.374 in May. This is trending down, but is still very high. This is the lowest level for long term unemployed since February 2009.

Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In June 2014, state and local governments added 24,000 jobs. State and local government employment is now up 138,000 from the bottom, but still 606,000 below the peak.

It is pretty clear that state and local employment is now increasing. Federal government layoffs have slowed (actually added 2,000 in June), but Federal employment is still down 23,000 for the year.

ISM Non-Manufacturing Index declines to 56.0%

by Calculated Risk on 7/03/2014 10:00:00 AM

The June ISM Non-manufacturing index was at 56.0%, down from 56.3% in May. The employment index increased in June to 54.4%, up from 52.4% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 53rd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56 percent in June, 0.3 percentage point lower than the May reading of 56.3 percent. This represents continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased to 57.5 percent, which is 4.6 percentage points lower than the May reading of 62.1 percent, reflecting growth for the 59th consecutive month at a slower rate. The New Orders Index registered 61.2 percent, 0.7 percentage point higher than the reading of 60.5 percent registered in May. The Employment Index increased 2 percentage points to 54.4 percent from the May reading of 52.4 percent and indicates growth for the fourth consecutive month and at a faster rate. The Prices Index decreased 0.2 percentage point from the May reading of 61.4 percent to 61.2 percent, indicating prices increased at a slightly slower rate in June when compared to May. According to the NMI®, 14 non-manufacturing industries reported growth in June. Respondents' comments vary by industry and company; however, the majority indicate that steady economic growth is continuing."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.2% and suggests slightly slower expansion in June than in May.

June Employment Report: 288,000 Jobs, 6.1% Unemployment Rate

by Calculated Risk on 7/03/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 288,000 in June, and the unemployment rate declined to 6.1 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for April was revised from +282,000 to +304,000, and the change for May was revised from +217,000 to +224,000. With these revisions, employment gains in April and May were 29,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

This was the fifth month in a row with more than 200 thousand jobs added, and employment is now up 2.495 million year-over-year.

Total employment is now 415 thousand above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was unchanged in June at 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio increased in June to 59.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

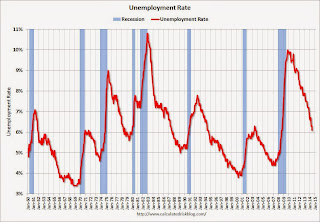

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate declined in June to 6.1%.

This was another solid employment report, and 2014 is on pace to be the best year for employment gains since 1999.

I'll have much more later ...

Wednesday, July 02, 2014

Thursday: Employment Report, Trade Deficit, Unemployment Claims, ISM Service

by Calculated Risk on 7/02/2014 07:35:00 PM

Thursday will feel like a Friday - all day!

Thursday:

• Early, Reis Q2 2014 Mall Survey of rents and vacancy rates.

• At 8:30 AM ET, the Employment Report for June. The consensus is for an increase of 211,000 non-farm payroll jobs added in June, down from the 217,000 non-farm payroll jobs added in May. The consensus is for the unemployment rate to be unchanged at 6.3% in May.

• Also at 8:30 AM, the Trade Balance report for May from the Census Bureau. The consensus is for the U.S. trade deficit to be at $45.1 billion in May from $47.2 billion in April.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 314 thousand from 312 thousand.

• At 10:00 AM, ISM non-Manufacturing Index for June. The consensus is for a reading of 56.2, down from 56.3 in May. Note: Above 50 indicates expansion.

Here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

Note: "2014" shows the annualized pace through May.

It is possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,177 | 2,716 |

| 2000 | 1,946 | 1,682 |

| 2001 | -1,735 | -2,286 |

| 2002 | -508 | -741 |

| 2003 | 105 | 147 |

| 2004 | 2,033 | 1,886 |

| 2005 | 2,506 | 2,320 |

| 2006 | 2,085 | 1,876 |

| 2007 | 1,140 | 852 |

| 2008 | -3,576 | -3,756 |

| 2009 | -5,087 | -5,013 |

| 2010 | 1,058 | 1,277 |

| 2011 | 2,083 | 2,400 |

| 2012 | 2,236 | 2,294 |

| 2013 | 2,331 | 2,365 |

| 20141 | 2,563 | 2,527 |

| 1 2014 is the hiring pace through May. | ||

Preview: Employment Report for June

by Calculated Risk on 7/02/2014 02:01:00 PM

Thursday at 8:30 AM ET, the BLS will release the employment report for June. The consensus, according to Bloomberg, is for an increase of 211,000 non-farm payroll jobs in June (range of estimates between 199,000 and 290,000), and for the unemployment rate to be unchanged at 6.3%.

Note: The BLS reported 217,000 payroll jobs added in May with the unemployment rate at 6.3%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 281,000 private sector payroll jobs in June. This was above expectations of 210,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index was unchanged in June at 52.8%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 5,000 in June. The ADP report indicated a 12,000 increase for manufacturing jobs in June.

The ISM non-manufacturing employment index for June will be released tomorrow (after the employment report is released).

• Initial weekly unemployment claims averaged close to 314,000 in June, up slightly from May. For the BLS reference week (includes the 12th of the month), initial claims were at 314,000; this was down from 327,000 during the reference week in May.

The lower reference week reading suggests some upside to the consensus forecast.

• The final June Reuters / University of Michigan consumer sentiment index increased slightly to 82.5 from the May reading of 81.9. This is frequently coincident with changes in the labor market, but there are other factors too.

• On small business hiring: The small business index from Intuit showed a 20,000 increase in small business employment in June. From Intuit:

U.S. small business employment grew for the fourth consecutive month in June, adding 20,000 jobs. While the labor market continues to show signs of revival, small business employment remains 900,000 workers shy of the peak reached in March of 2007.• A few comments from Goldman Sachs economist Kris Dawsey:

...

"This month's employment data makes for the fourth consecutive month of small business job growth after a flat job market early in 2014. While employment growth continued this month, changes for compensation and hours worked were mixed but very small. This indicates that while the employment picture has improved, there is little pressure on wages or hours," said Susan Woodward, the economist who works with Intuit to create the indexes.

"The revenue figures for small businesses are better than they have been in some years – they were up in April, and are up even more in May. The rise in revenues for all businesses is about three-fourths of one percent, which is a lot, and if it continued for a year, would give us an increase of 10 percent."

We forecast a 210k increase in June payroll employment, just a bit less than the consensus expectation of 215k. On the one hand, ADP, initial claims, the labor differential, and the employment components of service sector surveys argue for a stronger report. On the other hand, consensus tends to be a bit too optimistic on June payrolls, and the "weather bounce-back" in employment after this winter's slowdown could be losing some steam.• Conclusion: Most of the data was fairly positive in June with the exception of small business hiring. The ADP report was higher in June than in May, and well above forecasts, and weekly unemployment claims were lower during the reference period. However the Intuit small business index showed somewhat less hiring in June.

...

Labor differential heading north. The Conference Board's labor differential―the net percent of respondents in the consumer confidence survey describing jobs as plentiful vs. hard to get―improved by 0.9pt in June to -17.1.

Last year the consensus was for 161,000 payroll jobs added in June, and the BLS reported 195,000 jobs added (since revised up to 201,000). In June 2012, the consensus was for 90,000 payroll jobs added, and the BLS reported 80,000 jobs added (revised up to 88,000).

There is always some randomness to the employment report, but the I'll take the over on the consensus forecast of 211,000 nonfarm payrolls jobs added in June. Note: This might be "wishcasting" (as opposed to forecasting) because 222,000 would put the year-over-year increase at a nice round 2.4 million or 200,000 per month.

Fed Chair Yellen: "Pockets of increased risk-taking"

by Calculated Risk on 7/02/2014 11:13:00 AM

From Fed Chair Janet Yellen: Monetary Policy and Financial Stability. A few excerpts:

I am also mindful of the potential for low interest rates to heighten the incentives of financial market participants to reach for yield and take on risk, and of the limits of macroprudential measures to address these and other financial stability concerns. Accordingly, there may be times when an adjustment in monetary policy may be appropriate to ameliorate emerging risks to financial stability.

...

[M]onetary policy has powerful effects on risk taking. Indeed, the accommodative policy stance of recent years has supported the recovery, in part, by providing increased incentives for households and businesses to take on the risk of potentially productive investments. But such risk-taking can go too far, thereby contributing to fragility in the financial system. This possibility does not obviate the need for monetary policy to focus primarily on price stability and full employment--the costs to society in terms of deviations from price stability and full employment that would arise would likely be significant.

...

In recent years, accommodative monetary policy has contributed to low interest rates, a flat yield curve, improved financial conditions more broadly, and a stronger labor market. These effects have contributed to balance sheet repair among households, improved financial conditions among businesses, and hence a strengthening in the health of the financial sector. Moreover, the improvements in household and business balance sheets have been accompanied by the increased safety of the financial sector associated with the macroprudential efforts I have outlined. Overall, nonfinancial credit growth remains moderate, while leverage in the financial system, on balance, is much reduced. Reliance on short-term wholesale funding is also significantly lower than immediately before the crisis, although important structural vulnerabilities remain in short-term funding markets.

Taking all of these factors into consideration, I do not presently see a need for monetary policy to deviate from a primary focus on attaining price stability and maximum employment, in order to address financial stability concerns. That said, I do see pockets of increased risk-taking across the financial system, and an acceleration or broadening of these concerns could necessitate a more robust macroprudential approach. For example, corporate bond spreads, as well as indicators of expected volatility in some asset markets, have fallen to low levels, suggesting that some investors may underappreciate the potential for losses and volatility going forward. In addition, terms and conditions in the leveraged-loan market, which provides credit to lower-rated companies, have eased significantly, reportedly as a result of a "reach for yield" in the face of persistently low interest rates. The Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation issued guidance regarding leveraged lending practices in early 2013 and followed up on this guidance late last year. To date, we do not see a systemic threat from leveraged lending, since broad measures of credit outstanding do not suggest that nonfinancial borrowers, in the aggregate, are taking on excessive debt and the improved capital and liquidity positions at lending institutions should ensure resilience against potential losses due to their exposures. But we are mindful of the possibility that credit provision could accelerate, borrower losses could rise unexpectedly sharply, and that leverage and liquidity in the financial system could deteriorate. It is therefore important that we monitor the degree to which the macroprudential steps we have taken have built sufficient resilience, and that we consider the deployment of other tools, including adjustments to the stance of monetary policy, as conditions change in potentially unexpected ways.

emphasis added