by Calculated Risk on 4/30/2014 08:53:00 PM

Wednesday, April 30, 2014

Thursday: ISM Mfg Survey, Unemployment Claims, Personal Income and Outlays, Construction Spending, and Yellen

A very busy day ...

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 320 thousand from 329 thousand.

• Also at 8:30 AM, Personal Income and Outlays for March. The consensus is for a 0.4% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• Also at 8:30 AM, Speech by Fed Chair Janet Yellen, Community Bank Supervision, At the Independent Community Bankers of America 2014 Washington Policy Summit, Washington, D.C.

• At 9:00 AM, the Markit US PMI Manufacturing Index for April.

• At 10:00 AM, the ISM Manufacturing Index for April. The consensus is for an increase to 54.2 from 53.7 in March. The ISM employment index was at 51.1% in March, and the new orders index was at 55.1%.

• At 10:00 AM, Construction Spending for March. The consensus is for a 0.6% increase in construction spending.

Fannie Mae and Freddie Mac: Mortgage Serious Delinquency rate declined in March

by Calculated Risk on 4/30/2014 05:43:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in March to 2.19% from 2.27% in February. The serious delinquency rate is down from 3.02% in March 2013, and this is the lowest level since November 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier Freddie Mac reported that the Single-Family serious delinquency rate declined in March to 2.20% from 2.29% in February. Freddie's rate is down from 3.03% in March 2013, and is at the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Both Fannie Mae and Freddie Mac serious delinquency rates have fallen 0.83 percentage points over the last year, and at that pace the serious delinquency rates will probably be below 2% mid-year 2014 - and will be under 1% in late 2015.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

FOMC Statement: More Taper, Economic Growth "picked up recently"

by Calculated Risk on 4/30/2014 02:00:00 PM

Information received since the Federal Open Market Committee met in March indicates that growth in economic activity has picked up recently, after having slowed sharply during the winter in part because of adverse weather conditions. Labor market indicators were mixed but on balance showed further improvement. The unemployment rate, however, remains elevated. Household spending appears to be rising more quickly. Business fixed investment edged down, while the recovery in the housing sector remained slow. Fiscal policy is restraining economic growth, although the extent of restraint is diminishing. Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace and labor market conditions will continue to improve gradually, moving toward those the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for the economy and the labor market as nearly balanced. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

The Committee currently judges that there is sufficient underlying strength in the broader economy to support ongoing improvement in labor market conditions. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions since the inception of the current asset purchase program, the Committee decided to make a further measured reduction in the pace of its asset purchases. Beginning in May, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $20 billion per month rather than $25 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $25 billion per month rather than $30 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy remains appropriate. In determining how long to maintain the current 0 to 1/4 percent target range for the federal funds rate, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Richard W. Fisher; Narayana Kocherlakota; Sandra Pianalto; Charles I. Plosser; Jerome H. Powell; Jeremy C. Stein; and Daniel K. Tarullo.

emphasis added

Q1 GDP: Investment Contributions

by Calculated Risk on 4/30/2014 11:41:00 AM

Private investment in Q1 was very weak.

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a negative contribution to GDP in Q1 for the second consecutive quarter (red).

Residential investment is so low - as a percent of the economy - that this 2 quarter decline is not much of a concern. However, for the rate of economic growth to increase, RI will probably have to make positive contributions.

Equipment and software investment also made a negative contribution in Q1, and the three quarter average is barely positive.

The contribution from nonresidential investment in structures was zero in Q1. Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in the recovery.

I expect to see investment to increase over the next few quarters - and that is key for stronger GDP growth.

BEA: Real GDP increased at 0.1% Annualized Rate in Q1

by Calculated Risk on 4/30/2014 08:30:00 AM

From the BEA: Gross Domestic Product: First Quarter 2014 (advance estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 0.1 percent in the first quarter (that is, from the fourth quarter of 2013 to the first quarter of 2014), according to the "advance" estimate released by the Bureau of Economic Analysis.The advance Q1 GDP report, with 0.1% annualized growth, was below expectations of a 1.1% increase. Personal consumption expenditures (PCE) increased at a 3.0% annualized rate - a solid pace.

...

The increase in real GDP in the first quarter primarily reflected a positive contribution from personal consumption expenditures (PCE) that was partly offset by negative contributions from exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

However the the change in inventories subtracted 0.57 percentage points from growth in Q1, exports subtracted 0.83 percentage points, and both non-residential and residential investment were negative.

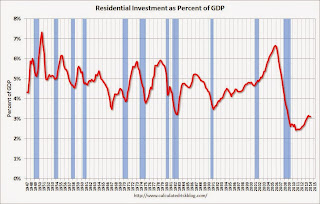

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The drag from state and local governments (red) appeared to have ended last year after an unprecedented period of state and local austerity (not seen since the Depression). However State and local governments subtracted from GDP in Q1.

Overall I expect state and local governments to continue to make a small positive contributions to GDP in 2014.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4 2013 and Q1 2014. However since RI is still very low, I expect RI to make a positive contribution to GDP in 2014.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".I'll add details for investment in offices, malls and hotels next week.

Overall this was a weak report, although PCE growth was decent. Private investment (even excluding the change in inventories) was negative, and that is the key to more growth going forward.

ADP: Private Employment increased 220,000 in April

by Calculated Risk on 4/30/2014 08:19:00 AM

Private sector employment increased by 220,000 jobs from March to April according to the April ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market is gaining strength. After a tough winter employers are expanding payrolls across nearly all industries and company sizes. The recent pickup in job growth at mid-sized companies may signal better business confidence. Job market prospects are steadily improving.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for April will be released on Friday.

MBA: Mortgage Applications Decrease in Latest Survey, Refinance Activity Lowest Since 2008

by Calculated Risk on 4/30/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 25, 2014. ...

The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. ...

“Both purchase and refinance application activity fell last week, and the market composite index is at its lowest level since December 2000,” said Mike Fratantoni, MBA’s Chief Economist. “Purchase applications decreased 4 percent over the week, and were 21 percent lower than a year ago. Refinance activity also continued to slide despite a 30-year fixed rate that was unchanged from the previous week. The refinance index dropped 7 percent to the lowest level since 2008, continuing the declining trend that we have seen since May 2013.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.49 percent, with points decreasing to 0.38 from 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 76% from the levels in May 2013 (almost one year ago).

With the mortgage rate increases, refinance activity will be very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, April 29, 2014

Wednesday: FOMC Announcement, Q1 GDP and more

by Calculated Risk on 4/29/2014 06:54:00 PM

From Goldman Sachs economist Kris Dawsey: FOMC Preview: A Bit Brighter

The April FOMC meeting will probably be a quiet one compared with the March meeting, with no press conference or Summary of Economic Projections (SEP) to be released. We anticipate that the Fed will want to make relatively few changes to the statement, especially in the monetary policy paragraphs. The largest changes will probably occur in the first paragraph on economic activity, reflecting the passing drag from adverse weather.Wednesday:

...

Regarding the FOMC's policy decision, a further $10bn/month tapering of asset purchases is almost a foregone conclusion, split equally between Treasuries and MBS. This would bring the monthly purchase amount down to $45bn ($25bn Treasuries and $20bn MBS), to take effect in May. ...

It appears likely that Minneapolis Fed President Kocherlakota—who lodged a dovish dissent at the March meeting—will not dissent to the April statement, based on a recent interview.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in April, up from 191,000 in March.

• At 8:30 AM, Q1 GDP (advance estimate). This is the advance estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 1.1% annualized in Q1.

• At 9:45 AM, the Chicago Purchasing Managers Index for April. The consensus is for an increase to 56.9, up from 55.9 in March.

• At 2:00 PM, the FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

An exciting time for the Data Tribe

by Calculated Risk on 4/29/2014 03:12:00 PM

This is an exciting time to be a member of the "data tribe" (those who follow data closely and are willing to change their views based on the data). There are two new internet sites worth following: The Upshot at the NY Times, and Vox (both feeds added to right sidebar).

Here is fun piece from Neil Irwin at The Upshot: No One Cares About Economic Data Anymore. That’s Good News.

If people in your office seem to be tingling with excitement this week, it is probably because of all the big economic news on the way. The two biggest regular United States economic reports are scheduled to come out, with first-quarter gross domestic product on tap for Wednesday and April jobs numbers out on Friday. Federal Reserve policy makers are meeting Tuesday and Wednesday for one of their regular sessions to set the nation’s monetary policy. And a variety of other important data releases are coming, including personal income and spending, manufacturing and home prices.Personally I'm excited about all the data to be released this week, but Irwin makes an excellent point. Most people don't feel the need to pay close attention any more.

What, no tingling? You’re not alone. Because as important as all that stuff is, it is substantially less important, and less interesting, than it has been any time in the last seven years. The economy has gotten boring, and that’s fantastic news — even if it would be even better news if that underlying growth path were a bit stronger.

P.S. A suggestion for The Upshot - drop the "The", just Upshot, it is cleaner.

NMHC Survey: Apartment Market Conditions Tighter in April 2014

by Calculated Risk on 4/29/2014 12:04:00 PM

From the National Multi Housing Council (NMHC): Overbuilding Overblown? Apartment Markets Expand in April NMHC Quarterly Survey

Apartment markets rebounded from a soft January, with all four indexes above the breakeven level of 50 in the latest National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. Last year’s concerns of overbuilding or lack of capital have largely eased, reflected in market tightness (56), sales volume (52), equity financing (53) and debt financing (63) all above 50 for the first time since April 2013.

“Supply appears to have ramped up enough to meet approximate ongoing demand with few, if any, signs of irrational exuberance,” said NMHC Senior Vice President of Research and Chief Economist Mark Obrinsky. “A handful of submarkets are facing a temporary surge in new deliveries that may put downward pressure on occupancy rates or rent growth. However, increased development costs could well keep a lid on new supply.”

...

The Market Tightness Index rose from 41 to 56. Almost half (47 percent) of respondents reported unchanged conditions, and approximately one-third (32 percent) saw conditions as tighter than three months ago, in contrast with January’s survey, where almost one-third saw conditions as looser than three months ago. This is the first time the index has indicated overall improving conditions since July 2013.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. The quarterly increase was small, but indicates tighter market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey has been bouncing around 50 - and now suggests vacancy rates might be close to a bottom.