by Calculated Risk on 4/01/2014 09:09:00 AM

Tuesday, April 01, 2014

Reis: Office Vacancy Rate declined slightly in Q1 to 16.8%

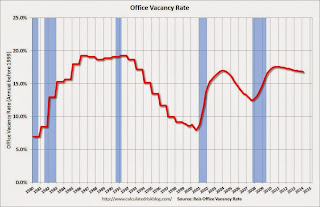

Reis released their Q1 2014 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.8% in Q1. This is down from 16.9% in Q4 2013, and down from the cycle peak of 17.6%.

From Reis Senior Economist Ryan Severino:

The national vacancy rate was down 10 basis points during the fourth quarter to 16.8%. This is a very marginal improvement from last quarter, but completely in line with the tepid recovery in the office sector since it commenced in early 2011. Since that, time declines in vacancy have been no greater than 10 basis points per quarter; the vacancy rate has been unchanged in numerous quarters during the recovery. Over the last twelve months, the vacancy rate is down just 20 basis points, on par with last quarter. National vacancies remain elevated at 430 basis points above the sector's cyclical low of 12.5% recorded during the third quarter of 2007.On absorption and new construction:

emphasis added

Net absorption increased by 9.8 million square feet during the quarter. This is the highest quarterly figure since before the recession. Net absorption averaged roughly 7.1 million square feet per quarter during 2013 so this represents an optimistic start to the year. Construction increased by 6.3 million square feet during the first quarter. This is roughly on par with the quarterly average of 6.5 million square feet during 2013. Therefore, net absorption outpaced completions by approximately 3.5 million square feet during the first quarter. This is heartening because in recent quarters increases in net absorption have been largely tied to increases in construction activity. This is a more organic increase, tied to increasing demand for existing inventory as well as newly completed space.On rents:

Asking and effective rents grew by 0.7% and 0.8%, respectively, during the first quarter. These figures are all little changed from last quarter, owing to the similar tepid pace of improvement in vacancy. Nevertheless, asking and effective rents have now risen for fourteen consecutive quarters, albeit modestly. Asking rent growth was 1.6% during 2011, 1.8% during 2012, and 2.1% in 2013. Given the still‐elevated national vacancy rate, rent growth is struggling to grow faster than inflation because landlords have little leverage over tenants.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was unchanged at 16.8% in Q1, and was down from 17.0% in Q1 2013. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

Office vacancy data courtesy of Reis.

Monday, March 31, 2014

Tuesday: Auto Sales, ISM Mfg Index, Construction Spending, Q1 Office Vacancy Survey

by Calculated Risk on 3/31/2014 09:16:00 PM

Oh no, not April 1st! From the NY Times: Beware the April Fools’ Jokes Coming From Madison Avenue

In the last three or four years, the ranks of pranksters seem to have grown, partly because of the ability of social media to rapidly communicate and amplify messages. For instance, a trick pulled off for April Fools’ Day last year by FreshDirect — the introduction of a blueberry and banana hybrid called a “bluenana” — was “a hit with our customers, garnering lots of buzz across social media,” said Jodi Kahn, chief consumer officer at FreshDirect.Tuesday:

...

Time will tell whether any of the jokes for 2014 will rank among the funniest — and most successful in fooling consumers — of previous April Fools’ Days. Among those was a “left-handed” Whopper from Burger King in 1998 and an announcement in 1996 that Taco Bell had bought the Liberty Bell and renamed it the Taco Liberty Bell.

• Early: Reis Q1 2014 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.

• At 9:00 AM ET, the Markit US PMI Manufacturing Index for March.

• At 10:00 AM, the ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for a 0.1% increase in construction spending.

Fannie Mae: Mortgage Serious Delinquency rate declined in February, Lowest since November 2008

by Calculated Risk on 3/31/2014 05:40:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in February to 2.27% from 2.33% in January. The serious delinquency rate is down from 3.13% in February 2013, and this is the lowest level since November 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 2.29% from 2.34% in January. Freddie's rate is down from 3.15% in February 2013, and is at the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.86 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in late 2015.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Weekly Update: Housing Tracker Existing Home Inventory up 6.7% year-over-year on March 31st

by Calculated Risk on 3/31/2014 03:51:00 PM

Here is another weekly update on housing inventory ...

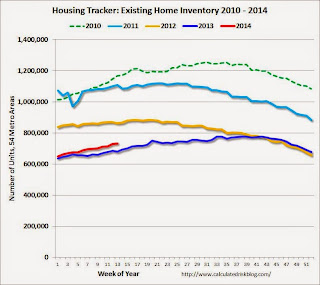

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year, and finished up about 2.7% YoY.

Inventory in 2014 (Red) is now 6.7% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Restaurant Performance Index indicates expansion in February

by Calculated Risk on 3/31/2014 01:51:00 PM

From the National Restaurant Association: Restaurant Performance Index Remained Above 100 in February Despite Continued Dampened Customer Traffic Levels

Although challenging weather conditions in many parts of the country continued to impact customer traffic in February, the National Restaurant Association’s Restaurant Performance Index (RPI) remained above 100 for the 12th consecutive month. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.5 in February, down 0.2 percent from January’s level of 100.7. Despite the modest decline, the fact that the overall RPI remains above 100 continues to signify expansion in the index of key industry indicators.

“Restaurant operators continued to report net positive same-store sales results in February, despite customer traffic levels that were challenged by the weather,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Looking forward, operators are generally optimistic about sales gains in the months ahead, although they aren’t as bullish about the overall economy.””

...

Although results were mixed in February, restaurant operators reported net positive same-store sales for the 12th consecutive month. ... In contrast, restaurant operators reported a net decline in customer traffic for the third consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.5 in February, down from 100.7 in January. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and this is fairly positive considering the terrible weather in February.