by Calculated Risk on 3/28/2014 09:55:00 AM

Friday, March 28, 2014

Final March Consumer Sentiment at 80.0

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for March decreased to 80.0 from the February reading of 81.6, and was up slightly from the preliminary March reading of 79.9.

This was below the consensus forecast of 80.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Personal Income increased 0.3% in February, Spending increased 0.3%

by Calculated Risk on 3/28/2014 08:44:00 AM

The BEA released the Personal Income and Outlays report for February:

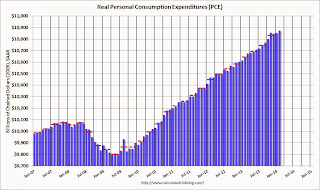

Personal income increased $47.7 billion, or 0.3 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $30.8 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in February, compared with an increase of 0.1 percent in January. ... The price index for PCE increased 0.1 percent in February, the same increase as in January. The PCE price index, excluding food and energy, increased 0.1 percent in February, the same increase as in January.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q1 PCE growth (first two months of the quarter), PCE was increasing at a 1.3% annual rate in Q1 2014 (using mid-month method, PCE was increasing less than 1.0%). This suggests weak PCE growth in Q1, but I expect PCE to increase faster in March.

Thursday, March 27, 2014

Friday: February Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 3/27/2014 07:27:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 80.5, up from the preliminary reading of 79.9, but down from the February reading of 81.6.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for February 2014.

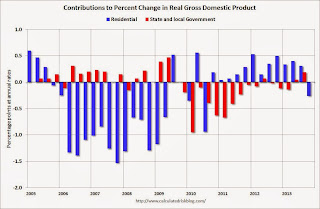

Here is an update based on the third estimate of Q4 GDP release today. The following graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments (red) appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local government contribution was zero in Q4 after revisions.

I expect state and local governments to make a small positive contribution to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.

House Prices and Lagged Data

by Calculated Risk on 3/27/2014 02:55:00 PM

Two years ago I wrote a post titled House Prices and Lagged Data. In early 2012, I had just called the bottom for house prices (see: The Housing Bottom is Here), and in the "lagged data" post I was pointing out that the Case-Shiller house price index has a serious data lag - and that we had to wait several months to see if prices had actually bottomed (the call was correct).

Now I'm looking for price increases to slow, and once again we have to remember that the Case-Shiller data has a serious lag. (Note: the following is updated from the post two years ago)

All data is lagged, but some data is lagged more than others.

In times of economic stress, I tend to watch the high frequency data closely: initial weekly unemployment claims, monthly manufacturing surveys, and consumer sentiment. The “high frequency” data is lagged, but the lag is usually just a week or two.

Most of the time I focus on the monthly employment report, quarterly GDP, housing starts, new home sales and retail sales. The lag for most of this data is several weeks. As an example, the BLS reference period contains the 12th of the month, so the report is lagged a few weeks by the time it is released. The housing starts and new home sales data released recently were for February, so the lag is also a few weeks after the end of the month. The advance estimate of quarterly GDP is released several weeks after the end of the quarter.

But sometimes the lag can be much longer. Two days ago, the January Case-Shiller house price index was released. This is actually a three month average for house sales closed in November, December and January.

But remember that the purchase agreement for a house that closed in November was probably signed in September or early October. So some portion of the Case-Shiller index will be for contract prices 6 to 7 months ago!

Other house price indexes have less of a lag. CoreLogic uses a weighted 3 month average with the most recent month weighted the most, the Black Knight house price index is for just one month (not an average).

But, if price increases have slowed - as Jed Kolko argues using asking prices - then the key point is that the Case-Shiller index will not show the slowdown for some time. Just something to remember ...

Kansas City Fed: Regional Manufacturing increased in March

by Calculated Risk on 3/27/2014 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Increased

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity increased, and producers’ expectations were mostly stable at solid levels.The last regional Fed manufacturing survey for March will be released on Monday, March 31st (Dallas Fed). In general - with the exception of the Richmond survey - the regional surveys have been positive in March and suggest improvement in the ISM manufacturing index.

“We saw acceleration in regional factory activity in March, to the fastest pace in over two years”, said Wilkerson. “However, several respondents noted the stronger growth was in part making up for weather-related softness in previous months.”

The month-over-month composite index was 10 in March, up from 4 in February and 5 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity increased at both durable and non-durable goods-producing plants, particularly for plastic and machinery products. Other month-over-month indexes also improved. The production index jumped from 3 to 22, its highest level in 3 years, and the shipments and new orders indexes also climbed higher. The order backlog index edged up from -4 to -1, and the new orders for exports index also increased slightly. The employment index moderated from 3 to 0, and both inventory indexes eased somewhat.

emphasis added