by Calculated Risk on 3/24/2014 09:45:00 AM

Monday, March 24, 2014

Black Knight on Mortgages: "Nearly 1 million fewer loans in U.S. non-current population since last February"

According to Black Knight (formerly LPS) First Look report for February, the percent of loans delinquent decreased in February compared to January, and declined by more than 12% year-over-year.

Also the percent of loans in the foreclosure process declined further in January and were down 34% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 5.97% from 6.27% in January. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.22% in February from 2.48% in January.

The number of delinquent properties, but not in foreclosure, is down 419,000 properties year-over-year, and the number of properties in the foreclosure process is down 579,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for February in early April.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| February 2014 | January 2014 | February 2013 | |

| Delinquent | 5.97% | 6.27% | 6.80% |

| In Foreclosure | 2.22% | 2.35% | 3.38% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,749,000 | 1,851,000 | 1,927,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,242,000 | 1,289,000 | 1,483,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,115,000 | 1,175,000 | 1,694,000 |

| Total Properties | 4,106,000 | 4,315,000 | 5,104,000 |

Chicago Fed: "Economic activity increased in February"

by Calculated Risk on 3/24/2014 08:42:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth increased in February

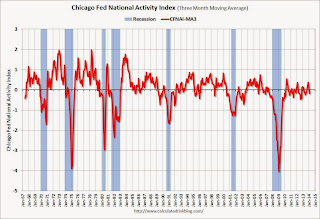

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.14 in February from –0.45 in January. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.18 in February from +0.02 in January, marking its first reading below zero in six months. February’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in February (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, March 23, 2014

Sunday Night Futures

by Calculated Risk on 3/23/2014 08:33:00 PM

Jon Hilesenrath at the WSJ points out that even if the Fed starts raising rates a little earlier than expected, rates are expected to be below normal for a long time: Inside Fed Statement Lurks Hint on Rates

The Fed, in its official policy statement, said it planned to keep short-term rates below what it sees as appropriate for a normal economy even after the unemployment rate and inflation revert to typical levels.Monday:

In 2016, for example, the Fed projects the jobless rate will reach 5.4%, economic output will be growing at a rate near 3% and inflation will be just below 2%. That level of unemployment would be lower than the average over the past 50 years.

Yet officials see the Fed's target short-term interest rate at just over 2% at the end of 2016, well below the 4% they consider appropriate for an economy running on all cylinders.

• At 8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

• Early, Black Knight (formerly LPS) will release their monthly "First Look" at February mortgage performance data.

Weekend:

• Schedule for Week of March 23rd

• The Favorable Demographics for Apartments

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices are mixed with WTI futures at $99.21 per barrel and Brent at $106.92 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.51 per gallon (up sharply over the last month, but still down from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

The Favorable Demographics for Apartments

by Calculated Risk on 3/23/2014 02:57:00 PM

For several years I've been pointing out that demographics are favorable for apartments. This is because a large cohort has been moving into the 20 to 34 year old age group (a key age group for renters).

Also ... in 2015, based on Census Bureau projections, the two largest 5 year cohorts will be 20 to 24 years old, and 25 to 29 years old (the largest cohorts will no longer be the "boomers").

Here are two graphs showing the population in the 25 to 34 year age group, and the 20 to 34 year old age group from 1985 to 2035 (1990 was the previous peak for 25 to 34, 1985 was the previous peak for 20 to 34).

This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

Click on graph for larger image.

Click on graph for larger image.

For the 25 to 34 year old age group, the population is just getting back to the previous peak, and will continue to increase significantly over the next 5 years.

After 2020, the increase in population for this key age group will slow.

The second graph is for the 20 to 34 year old age group.

The second graph is for the 20 to 34 year old age group.

This favorable demographics is a key reason I've been positive on the apartment sector for the last several years - and I expect new apartment construction to stay strong for several more years.

Hamilton: Graphs of key economic trends

by Calculated Risk on 3/23/2014 10:36:00 AM

Professor Hamilton discusses several interesting graphs at econbrowser: Graphs of key economic trends.

As an example, Hamilton (via Martin Neil Baily and Barry Bosworth) presents a graph that shows while "U.S. manufacturing output has grown at the same pace as the rest of the economy, U.S. manufacturing employment has not."

And there are couple of interesting graphs on oil. Enjoy!