by Calculated Risk on 3/22/2014 08:15:00 AM

Saturday, March 22, 2014

Unofficial Problem Bank list declines to 552 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 21, 2014.

Changes and comments from surferdude808:

The OCC provided an update on its enforcement action activities today as anticipated. The release contributed to the majority of the seven removals this week, with six being action terminations. After the removals, the Unofficial Problem Bank List includes 552 institutions with assets of $176.4 billion. A year ago, the list held 797 institutions with $294.3 billion in assets.

The Bank of the Lakes, National Association, Owasso, OK ($169 million) found its way off the list through an unassisted acquisition. Actions were terminated by the OCC against Putnam Bank, Putnam, CT ($453 million Ticker: PSBH); The First National Bank of Ottawa, Ottawa, IL ($271 million Ticker: FOTB); First National Bank of Central Alabama, Aliceville, AL ($230 million); The Oculina Bank, Fort Pierce, FL ($162 million); First National Bank of Pasco, Dade City, FL ($145 million); and First National Bank of Southern California, Riverside, CA ($141 million).

Next week, the FDIC should provide an update in its enforcement action activity through the end of February 2014. With also being the calendar quarter-end, we will update the transition matrix. Enjoy the weekend and hopefully your bracket is still intact for the $1 billion grand prize.

Friday, March 21, 2014

DOT: Vehicle Miles Driven decreased 1.3% year-over-year in January

by Calculated Risk on 3/21/2014 06:04:00 PM

This monthly decline appears weather related since miles driven were down 4.6% in the Northeast, and 4.0% in the Northwest. Miles driven were up 2.9% in the West.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -1.3% (-2.9 billion vehicle miles) for January 2014 as compared with January 2013.The following graph shows the rolling 12 month total vehicle miles driven.

...

Travel for the month is estimated to be 224.0 billion vehicle miles.

The rolling 12 month total is still mostly moving sideways but has started to increase a little recently.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 74 months - 6+ years - and still counting. Currently miles driven (rolling 12 months) are about 2.3% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In January 2014, gasoline averaged of $3.39 per gallon according to the EIA. that was unchanged from January 2013 when prices also averaged $3.39 per gallon.

In January 2014, gasoline averaged of $3.39 per gallon according to the EIA. that was unchanged from January 2013 when prices also averaged $3.39 per gallon.As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 6 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it appears miles driven might be gradually increasing again.

Lawler on Lennar: Orders up 10.1% YoY; Prices, Margins Up Sharply; Saw “Volumes Returning,” But Not from First-Time Buyers

by Calculated Risk on 3/21/2014 03:01:00 PM

From housing economist Tom Lawler:

Lennar Corporation, the third largest US home builder, reported that net home orders in the quarter ended February 28, 2014 totaled 4,465, up 10.1% from the comparable quarter of 2013. The company’s community count was up 13% YOY. Home deliveries last quarter totaled 3,609, up 13.3% from the comparable quarter of 2013, at an average sales price of $316,000, up 17.5% from a year ago. The company’s order backlog at the end of February was 5,662, up 15.0% from last February.

In its conference call, a Lennar official noted that while in the previous quarter the company had seen evidence of weaker sales, more recently there were “clear signs that volume is returning to the market.” The official said that net orders “improved sequentially” during the quarter, but when asked for more information the official said that this “sequential increase” was “normal” for the time of year. An official said that the company had seen a “bit of a slowdown” in home price increases in “most” (though not all) markets. In response to a question on competitors, an official said that competition “has heated up a bit” and some competitors have been a bit more aggressive in offering sales incentives to increase sales, but that so far such competitive pressure was “not significant.”

In a Q&A on first-time buyers, an official said that the company’s land/lot acquisitions had prepared the company to meet increased first-time buyer demand “should that market return,” implying that demand from first-time buyers remained very weak.

Lennar was extremely aggressively acquiring land/lots over the last two years – Lennar owned or controlled 153,776 lots at the end of last November, up about 20% from November 2012 and up 38% from November 2011. An official said that the company’s land/lot inventory was sufficient to meet planned home deliveries in both 2014 and 2015.

Here is a summary of net home orders for the three-month period ending in February for three large home builders.

| Net Home Orders | |||

|---|---|---|---|

| 3-mo period ending: | 2/28/2014 | 2/28/2013 | % Change |

| Lennar | 4,465 | 4,055 | 10.1% |

| KB Home | 1,765 | 1,671 | 5.6% |

| Hovnanian | 1,402 | 1,581 | -11.3% |

| Total | 7,632 | 7,307 | 4.4% |

So far builder results have been “mixed,” and while most are optimistic, most also say it is too early to gauge the “success” of the “spring” home selling season (which actually begins well before spring.) There appears to be a consensus, however, that demand from first-time buyers remains very low.

Update: Predicting the Next Recession

by Calculated Risk on 3/21/2014 11:11:00 AM

The following is a repeat of a post I wrote in January 2013. This still seems correct - and I've added a few updates in italics.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR Update: this was written over a year ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

[CR Update: 2013 was a little better than I expect, but still sluggish. Even with the weak start, I think growth in 2014 will be better than in 2013.]

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR Update: Most of the poor policy choices in the U.S. are behind us. Austerity hurt the recovery, but austerity appears over at the state and local level and diminished at the Federal level.]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR Update: This still seems correct - no recession this year or next from Fed tightening.]

ATA Trucking Index increased in February

by Calculated Risk on 3/21/2014 09:24:00 AM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Jumped 2.8% in February

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 2.8% in February, after plunging 4.5% the previous month. January’s drop was slightly more than the 4.3% reported on February 19, 2014. In February, the index equaled 127.6 (2000=100) versus 124.1 in January. The all-time high was in November 2013 (131.0).

Compared with February 2013, the SA index increased 3.6%.

...

“It is pretty clear that winter weather had a negative impact on truck tonnage during February,” said ATA Chief Economist Bob Costello. “However, the impact wasn’t as bad as in January because of the backlog in freight due to the number of storms that hit over the January and February period.”

“The fundamentals for truck freight continue to look good,” he said. “Several other economic indicators also snapped back in February. We have a hole to dig out of from such a bad January, but I feel like we are moving in the right direction again. I remain optimistic for 2014.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index rebounded in February after the sharp decline in January.

Thursday, March 20, 2014

Fed: Large Banks "collectively better positioned" to cope with "an extremely severe economic downturn"

by Calculated Risk on 3/20/2014 09:04:00 PM

Note: I was strong early supporter of bank stress tests, and I'm glad the Fed has continued testing banks on an annual basis. Hopefully this will continue ...

From the Federal Reserve: Press Release

According to the summary results of bank stress tests announced by the Federal Reserve on Thursday, the largest banking institutions in the United States are collectively better positioned to continue to lend to households and businesses and to meet their financial commitments in an extremely severe economic downturn than they were five years ago. This result reflects continued broad improvement in their capital positions since the financial crisis.From the WSJ: Fed 'Stress Test' Results: 29 of 30 Big Banks Could Weather Big Shock

Reflecting the severity of the most extreme stress scenario--which features a deep recession with a sharp rise in the unemployment rate, a drop in equity prices of nearly 50 percent, and a decline in house prices to levels last seen in 2001--projected loan losses at the 30 bank holding companies in the latest stress tests would total $366 billion during the nine quarters of the hypothetical stress scenario. The aggregate tier 1 common capital ratio, which compares high-quality capital to risk-weighted assets, would fall from an actual 11.5 percent in the third quarter of 2013 to the minimum level of 7.6 percent in the hypothetical stress scenario. That minimum post-stress number is significantly higher than the 30 firms' actual tier 1 common ratio of 5.5 percent measured in the beginning of 2009.

The Fed said 29 of the 30 largest institutions have enough capital to continue lending even when faced with a hypothetical jolt to the U.S. economy lasting into 2015, including a severe drop in housing prices and a spike in the unemployment rate.

The results will factor into the Fed's decision next week to approve or deny individual banks' plans for returning billions of dollars to shareholders through dividends or share buybacks. The Fed's annual "stress tests" are designed to ensure large banks can withstand severe losses without needing a government rescue.

Fed: Q4 Household Debt Service Ratio near 30 year low

by Calculated Risk on 3/20/2014 04:51:00 PM

Here is an update of the Fed's Household Debt Service ratio through Q4 2013 Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio increased slightly in Q4, and is near a record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) are near the low for the last 30 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape than a few years ago.

Earlier: Philly Fed Manufacturing Survey indicated Expansion in March

by Calculated Risk on 3/20/2014 02:27:00 PM

From the Philly Fed: March Manufacturing Survey

Manufacturing activity rebounded in March, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, and shipments increased and recorded positive readings this month, suggesting a return to growth following weather‐related weakness in February. Firms’ employment levels were reported near steady, but responses reflected optimism about adding to payrolls over the next six months. The surveyʹs indicators of future activity reflected optimism about continued growth over the next six months.This was above the consensus forecast of a reading of 4.0 for March.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of ‐6.3 in February to 9.0 this month, nearing its reading in January.

The employment index remained positive for the ninth consecutive month but edged 3 points lower, suggesting near‐steady employment.

emphasis added

Click on graph for larger image.

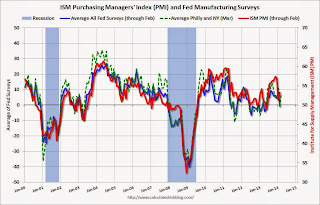

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys was negative in February (probably weather related), and turned positive again in March. This suggests stronger expansion in the ISM report for March.

Comments on Existing Home Sales

by Calculated Risk on 3/20/2014 11:59:00 AM

The NAR reported this morning that inventory was up 5.3% year-over-year in February.

A few points:

• Inventory is the KEY number in the NAR release.

• The NAR inventory data is "noisy" (and difficult to forecast based on other data), however it appears inventory bottomed in early 2013.

• The headline NAR inventory number is NOT seasonally adjusted (and there is a clear seasonal pattern).

• Inventory is still very low, and with the low level of inventory, there is still upward pressure on prices.

• I expect inventory to increase in 2014, and I expect the year-over-year increase to be in the 10% to 15% range by the end of 2014.

• However, if inventory doesn't increase, prices will probably increase a little faster than expected (a key reason to watch inventory right now).

Click on graph for larger image.

Click on graph for larger image.

The NAR does not seasonally adjust inventory, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory (see graph of NAR reported and seasonally adjusted).

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 6.8% from the bottom. On a seasonally adjusted basis, inventory was mostly unchanged in February compared to January.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 7.1% from February 2013, but normal equity sales were probably up from February 2013, and distressed sales down. The NAR reported that 16% of sales were distressed in February (from a survey that isn't perfect):

Distressed homes – foreclosures and short sales – accounted for 16 percent of February sales, compared with 15 percent in January and 25 percent in February 2013.Last year the NAR reported that 25% of sales were distressed sales.

A rough estimate: Sales in February 2013 were reported at 4.95 million SAAR with 25% distressed. That gives 1.24 million distressed (annual rate), and 3.71 million conventional. In February 2014, sales were 4.60 million SAAR, with 16% distressed. That gives 0.74 million distressed, and 3.86 million conventional. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up. A positive sign!

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in February (red column) were above the sales for 2008 through 2011, and below sales for the last two year.

Overall this report was as expected (fewer distressed sales pulling down overall sales), and inventory needs to be watched closely.

Earlier:

• Existing Home Sales in February: 4.60 million SAAR, Inventory up 5.3% Year-over-year

Existing Home Sales in February: 4.60 million SAAR, Inventory up 5.3% Year-over-year

by Calculated Risk on 3/20/2014 10:00:00 AM

The NAR reports: February Existing-Home Sales Remain Subdued

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 0.4 percent to a seasonally adjusted annual rate of 4.60 million in February from 4.62 million in January, and 7.1 percent below the 4.95 million-unit level in February 2013. February’s pace of sales was the lowest since July 2012, when it stood at 4.59 million.

...

Total housing inventory at the end of February rose 6.4 percent to 2.00 million existing homes available for sale, which represents a 5.2-month supply at the current sales pace, up from 4.9 months in January. Unsold inventory is 5.3 percent above a year ago, when there was a 4.6-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (4.60 million SAAR) were slightly lower than last month, and were 7.1% below the February 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.00 million in February from 1.88 million in January. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.00 million in February from 1.88 million in January. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 5.3% year-over-year in February compared to February 2013. This year-over-year increase in inventory suggests inventory bottomed early last year.

Inventory increased 5.3% year-over-year in February compared to February 2013. This year-over-year increase in inventory suggests inventory bottomed early last year.Months of supply was at 5.2 months in February.

This was slightly below expectations of sales of 4.64 million. For existing home sales, the key number is inventory - and the key story is inventory is still low, but up year-over-year. I'll have more later ...